This version of the form is not currently in use and is provided for reference only. Download this version of

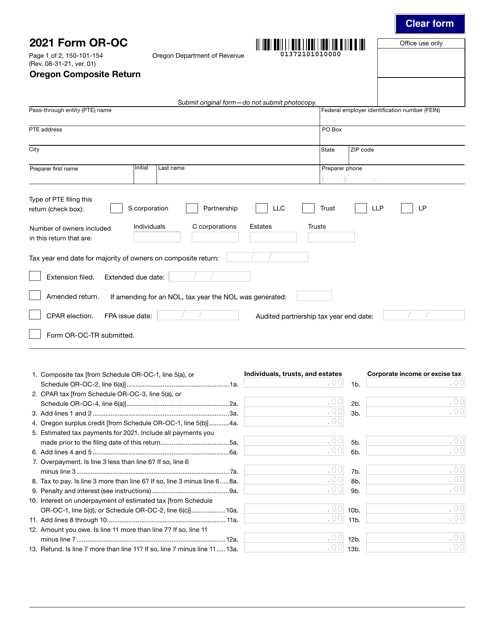

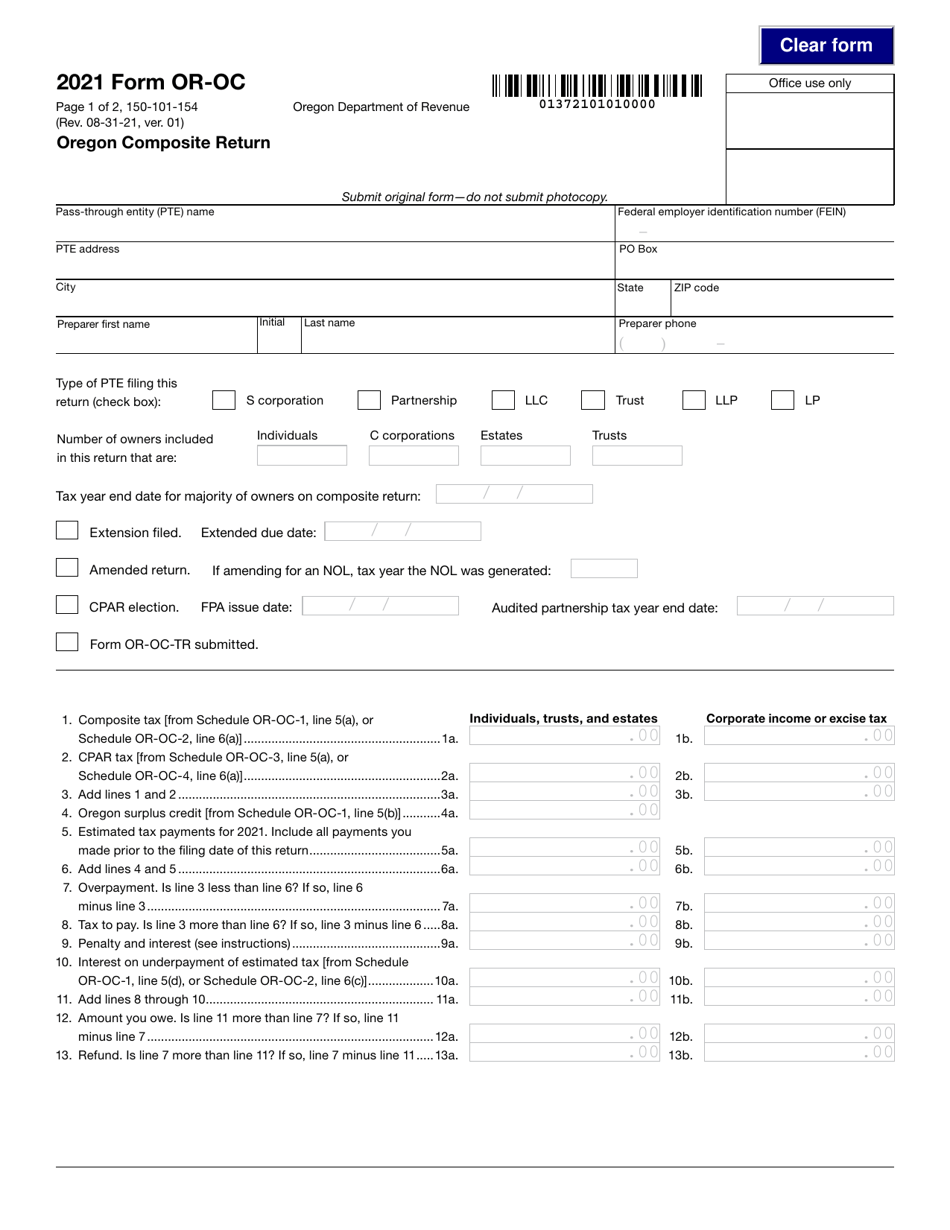

Form OR-OC (150-101-154)

for the current year.

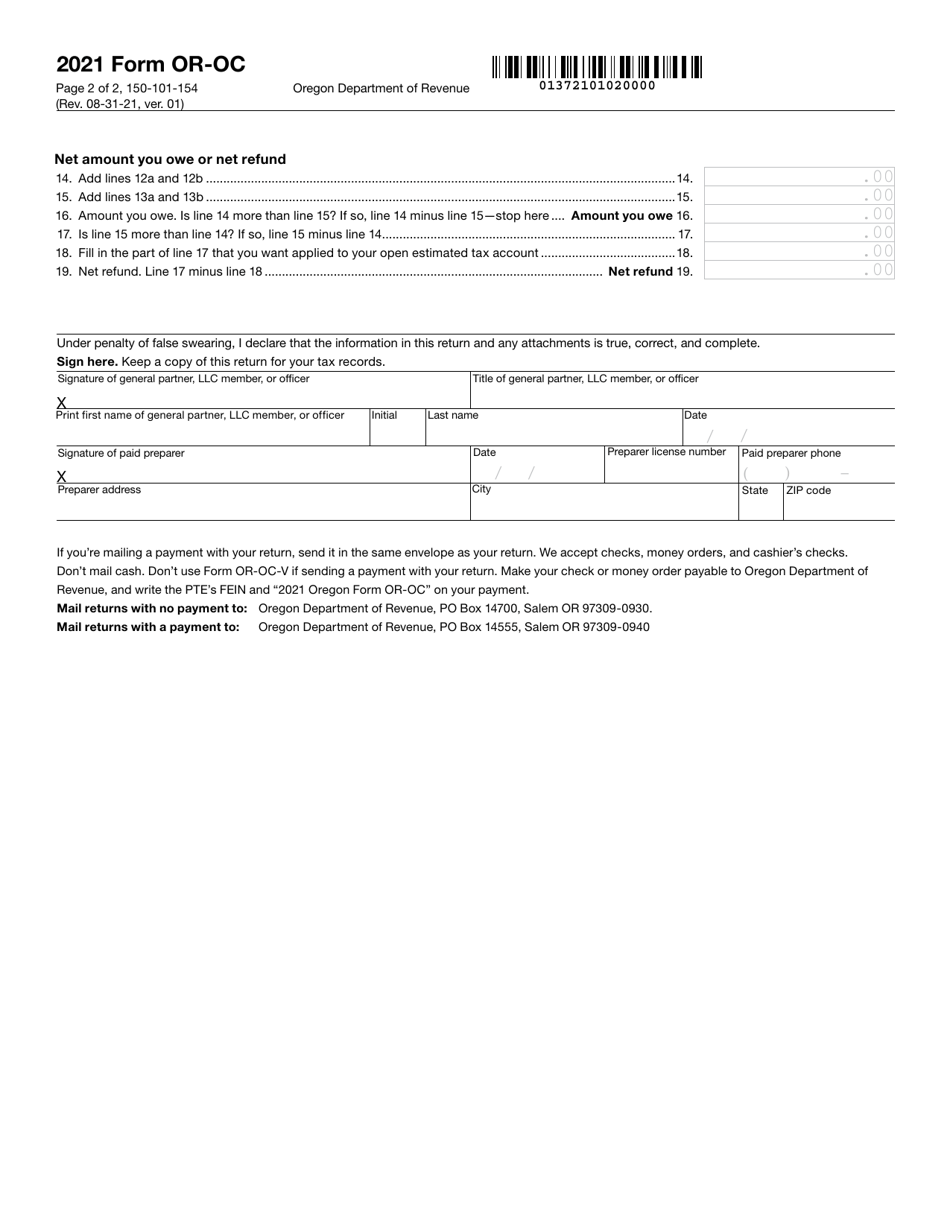

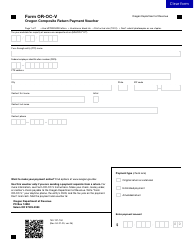

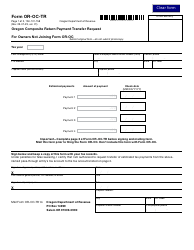

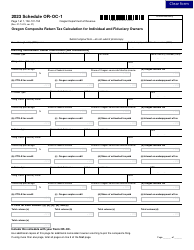

Form OR-OC (150-101-154) Oregon Composite Return - Oregon

What Is Form OR-OC (150-101-154)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-OC?

A: Form OR-OC is the Oregon Composite Return for partnerships, S corporations, and composite income tax returns.

Q: Who needs to file Form OR-OC?

A: Partnerships, S corporations, and taxpayers who elect to file a composite return for nonresident owners need to file Form OR-OC.

Q: What is the purpose of Form OR-OC?

A: The purpose of Form OR-OC is to report income, deductions, credits, and taxes for partnerships and S corporations that have income from Oregon sources.

Q: When is the due date for Form OR-OC?

A: Form OR-OC is due on the 15th day of the third month following the close of the tax year.

Q: Are there any penalties for late filing of Form OR-OC?

A: Yes, there are penalties for late filing of Form OR-OC. It is important to file the return on time to avoid penalties and interest.

Q: What supporting documents do I need to attach to Form OR-OC?

A: Partnerships and S corporations generally do not need to attach supporting documents to Form OR-OC. However, it is important to keep records and documents for possible future review by the Oregon Department of Revenue.

Q: Can I amend a filed Form OR-OC?

A: Yes, you can amend a filed Form OR-OC by filing an amended return using Form OR-OC-Amended.

Form Details:

- Released on August 31, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-OC (150-101-154) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.