This version of the form is not currently in use and is provided for reference only. Download this version of

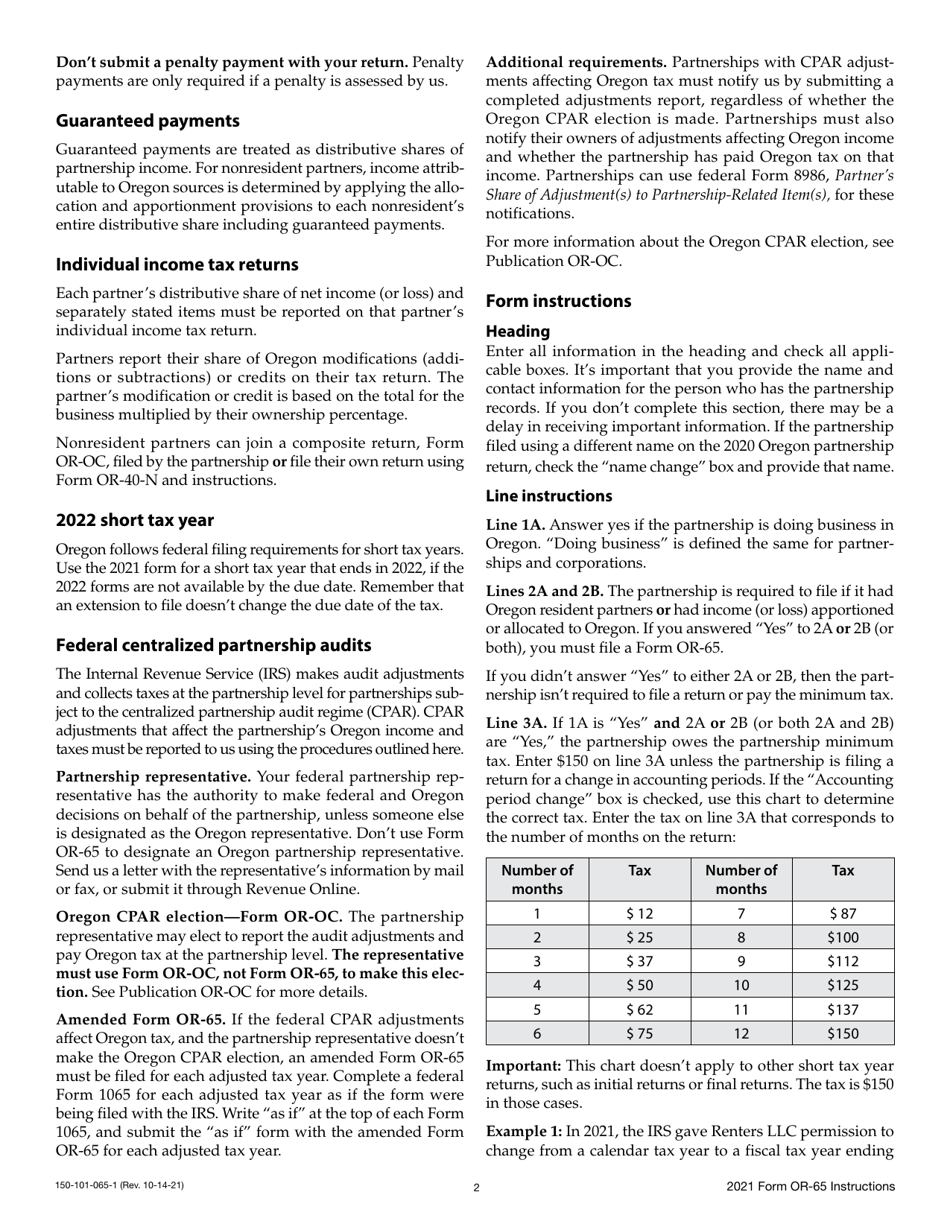

Instructions for Form OR-65, 150-101-065

for the current year.

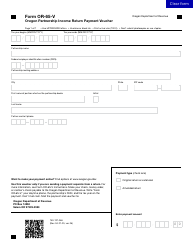

Instructions for Form OR-65, 150-101-065 Oregon Partnership Return of Income - Oregon

This document contains official instructions for Form OR-65 , and Form 150-101-065 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-65 (150-101-065) is available for download through this link.

FAQ

Q: What is Form OR-65?

A: Form OR-65 is the Oregon Partnership Return of Income form.

Q: Who needs to file Form OR-65?

A: Partnerships doing business in Oregon need to file Form OR-65.

Q: What is the purpose of Form OR-65?

A: Form OR-65 is used to report partnership income and deductions for Oregon tax purposes.

Q: When is the deadline for filing Form OR-65?

A: The deadline for filing Form OR-65 is the same as the federal partnership return, usually March 15th.

Q: Are there any specific instructions for completing Form OR-65?

A: Yes, the Oregon Department of Revenue provides detailed instructions for completing Form OR-65.

Q: Is there a separate fee for filing Form OR-65?

A: No, there is no separate fee for filing Form OR-65.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.