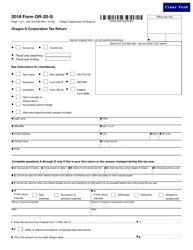

This version of the form is not currently in use and is provided for reference only. Download this version of

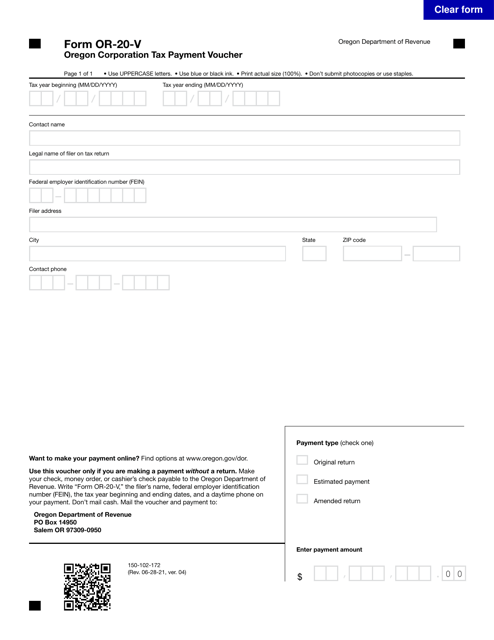

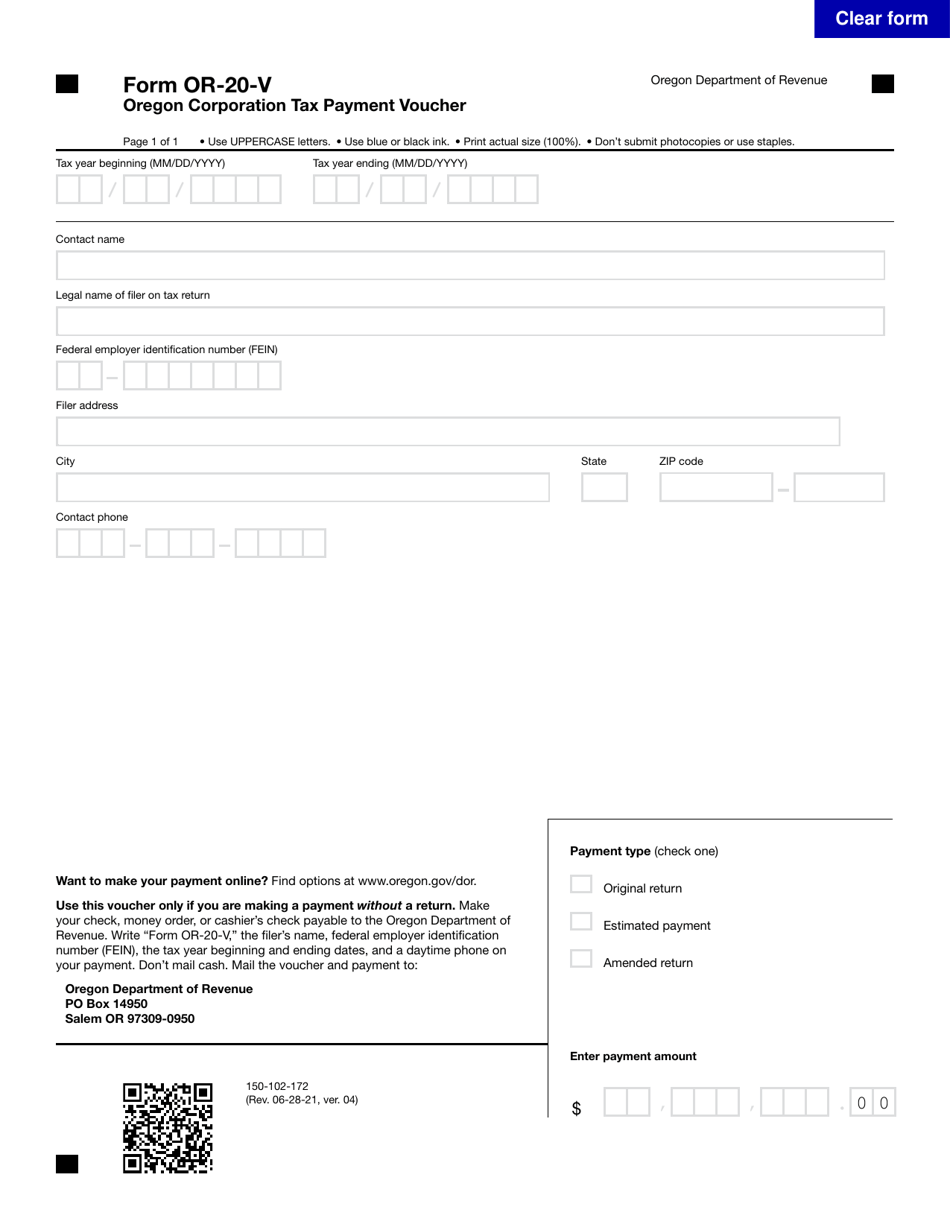

Form OR-20-V (150-102-172)

for the current year.

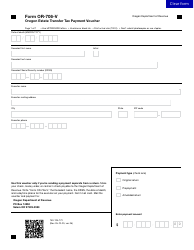

Form OR-20-V (150-102-172) Oregon Corporation Tax Payment Voucher - Oregon

What Is Form OR-20-V (150-102-172)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

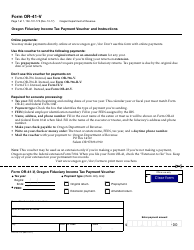

Q: What is Form OR-20-V?

A: Form OR-20-V is the Oregon Corporation Tax Payment Voucher.

Q: What is the purpose of Form OR-20-V?

A: Form OR-20-V is used to remit payments for Oregon Corporation Taxes.

Q: What is the form number for Form OR-20-V?

A: The form number for Form OR-20-V is 150-102-172.

Q: Who needs to file Form OR-20-V?

A: Corporations in Oregon who owe taxes need to file Form OR-20-V.

Q: When is Form OR-20-V due?

A: Form OR-20-V is typically due on the same day as the corporation's annual tax return, which is the 15th day of the month following the close of the tax year.

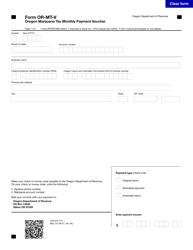

Form Details:

- Released on June 28, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-20-V (150-102-172) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.