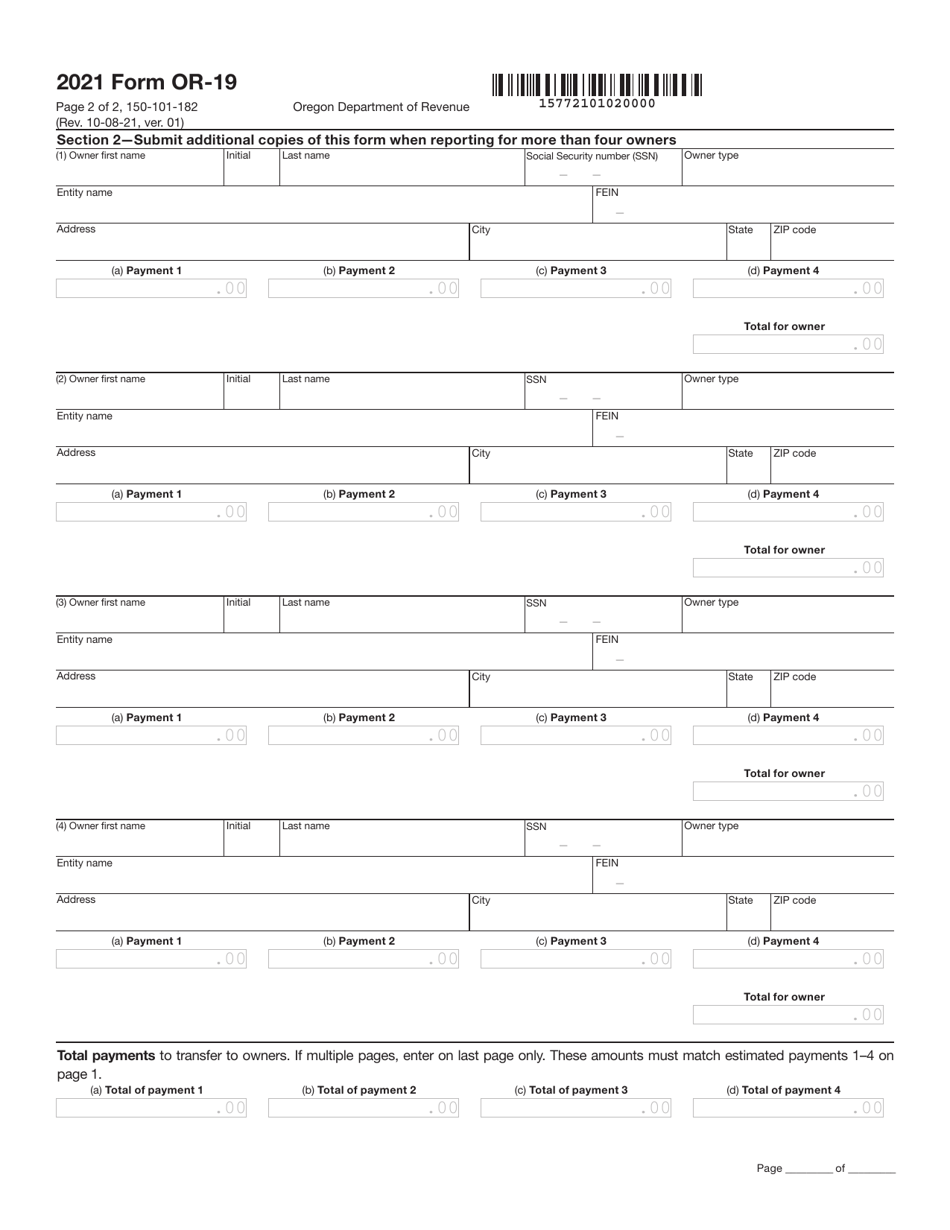

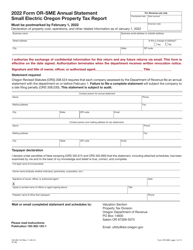

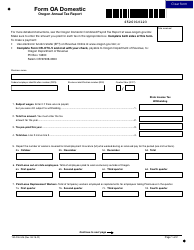

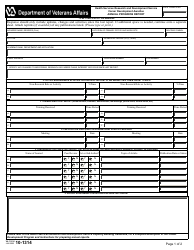

This version of the form is not currently in use and is provided for reference only. Download this version of

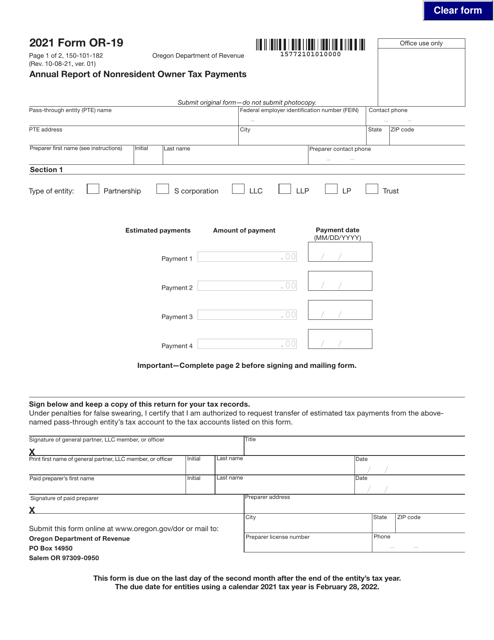

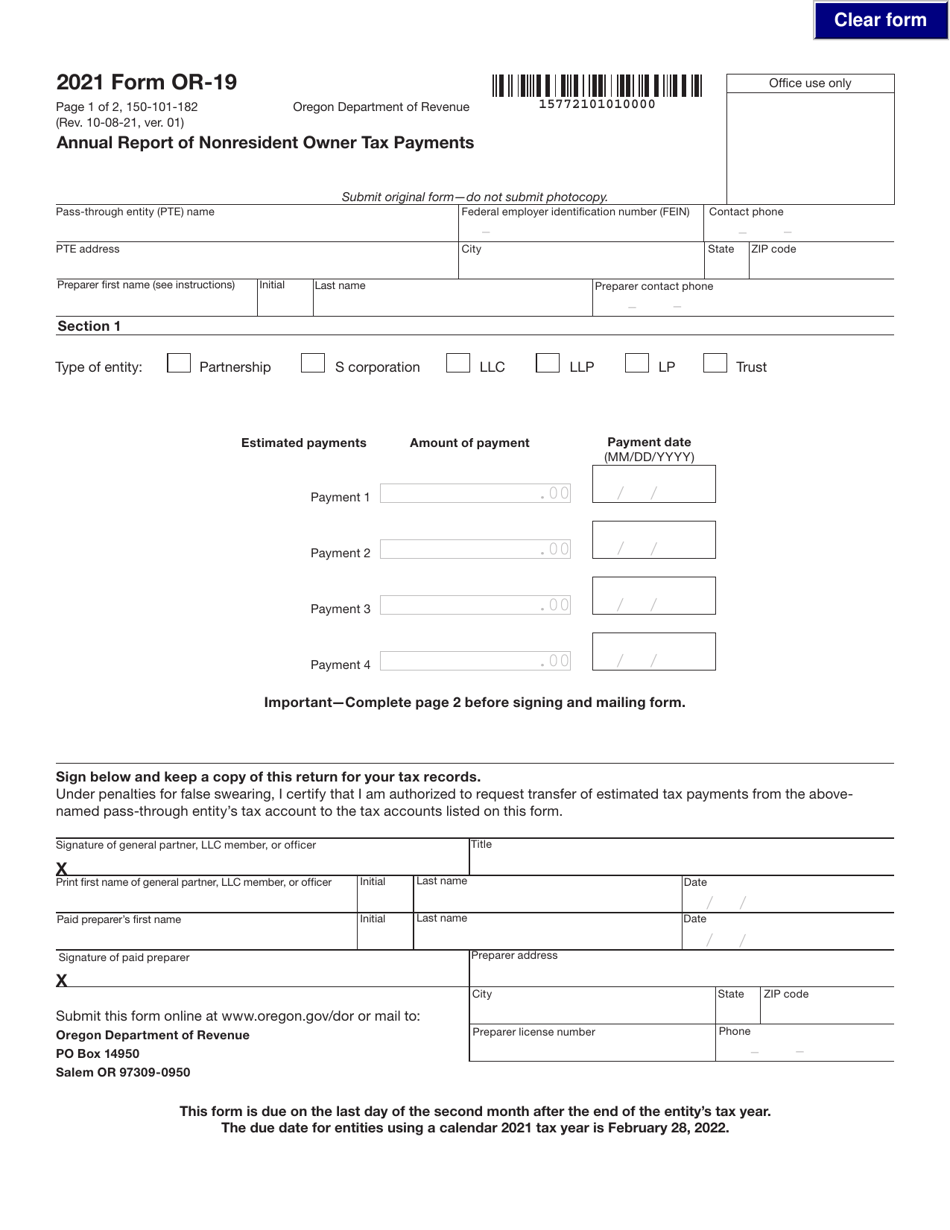

Form OR-19 (150-101-182)

for the current year.

Form OR-19 (150-101-182) Annual Report of Nonresident Owner Tax Payments - Oregon

What Is Form OR-19 (150-101-182)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

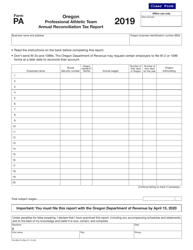

Q: What is Form OR-19?

A: Form OR-19 is the Annual Report of Nonresident Owner Tax Payments in Oregon.

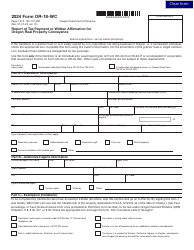

Q: Who needs to file Form OR-19?

A: Nonresident owners who have rental properties in Oregon need to file Form OR-19.

Q: What information is required on Form OR-19?

A: Form OR-19 requires the nonresident owner's contact information, property details, and tax payment information.

Q: When is Form OR-19 due?

A: Form OR-19 is due on or before April 15th of each year for the previous calendar year.

Q: Are there any penalties for not filing Form OR-19?

A: Yes, there are penalties for not filing Form OR-19, including late filing fees and interest on unpaid taxes.

Form Details:

- Released on October 8, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-19 (150-101-182) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.