This version of the form is not currently in use and is provided for reference only. Download this version of

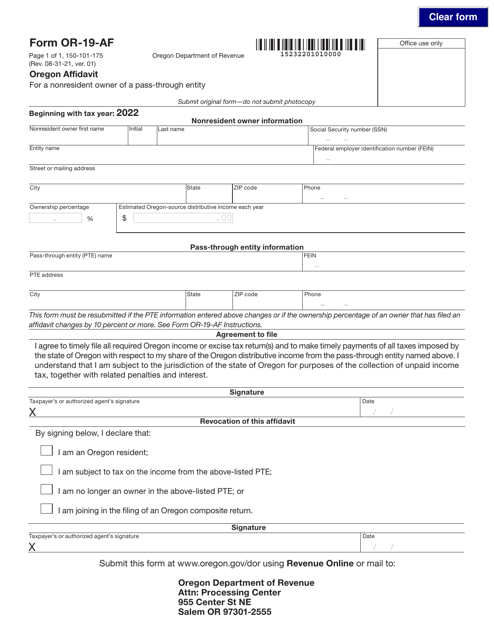

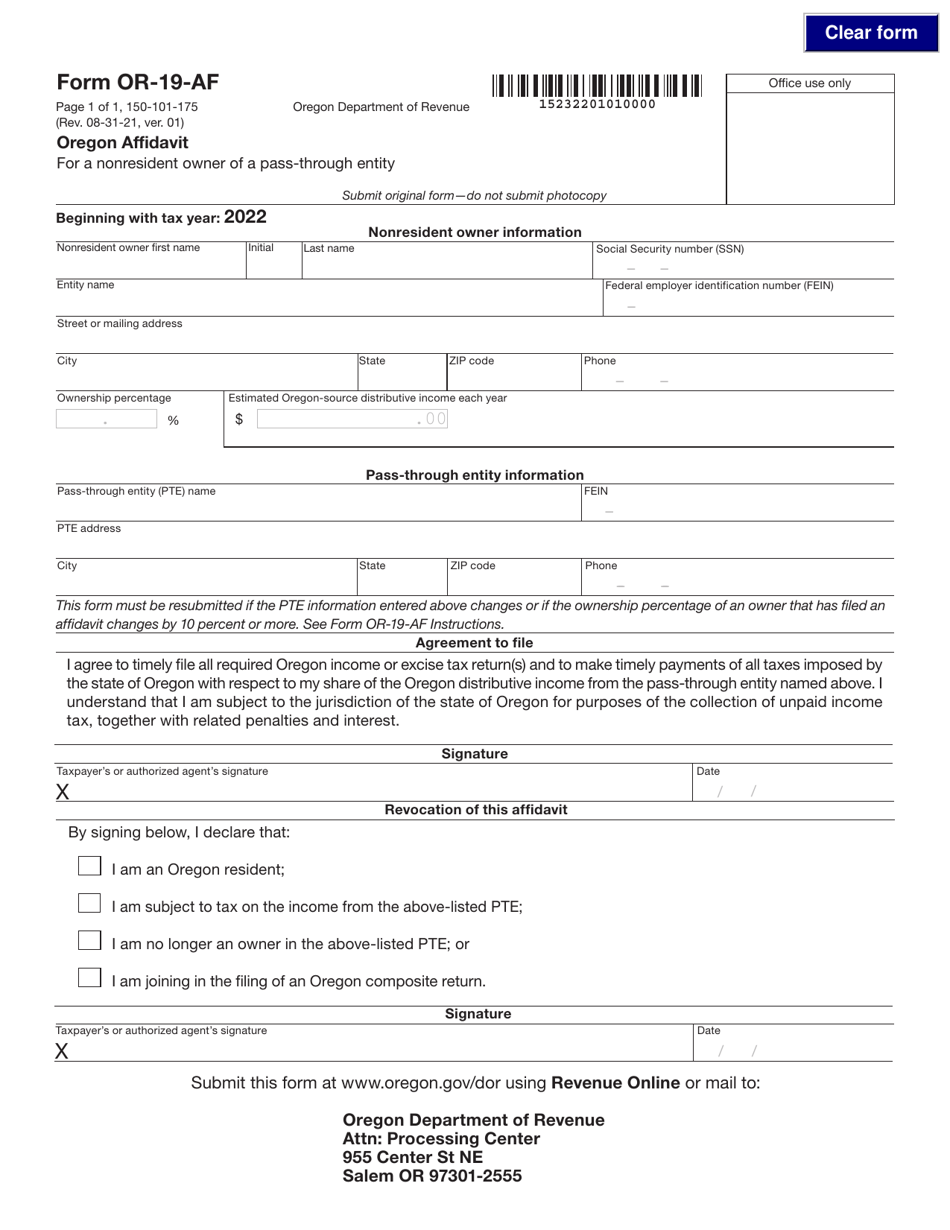

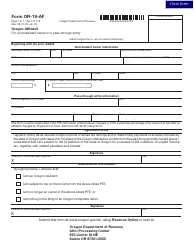

Form OR-19-AF (150-101-175)

for the current year.

Form OR-19-AF (150-101-175) Oregon Affidavit - Oregon

What Is Form OR-19-AF (150-101-175)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-19-AF for?

A: Form OR-19-AF, also known as the Oregon Affidavit, is used to declare the value of a decedent's real property in Oregon.

Q: Who needs to fill out Form OR-19-AF?

A: Executors or personal representatives of an estate need to fill out Form OR-19-AF if the decedent owned real property in Oregon.

Q: What information is required on Form OR-19-AF?

A: Form OR-19-AF requires information such as the decedent's name, property description, value of the property, and the signature of the executor or personal representative.

Q: Is there a deadline to submit Form OR-19-AF?

A: Yes, Form OR-19-AF must be filed within nine months from the date of the decedent's death, unless an extension is granted.

Q: Are there any fees associated with filing Form OR-19-AF?

A: There is no fee to file Form OR-19-AF with the Oregon Department of Revenue.

Q: Can I submit Form OR-19-AF electronically?

A: No, currently the Oregon Department of Revenue only accepts paper copies of Form OR-19-AF, which must be mailed to their office.

Form Details:

- Released on August 31, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-19-AF (150-101-175) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.