This version of the form is not currently in use and is provided for reference only. Download this version of

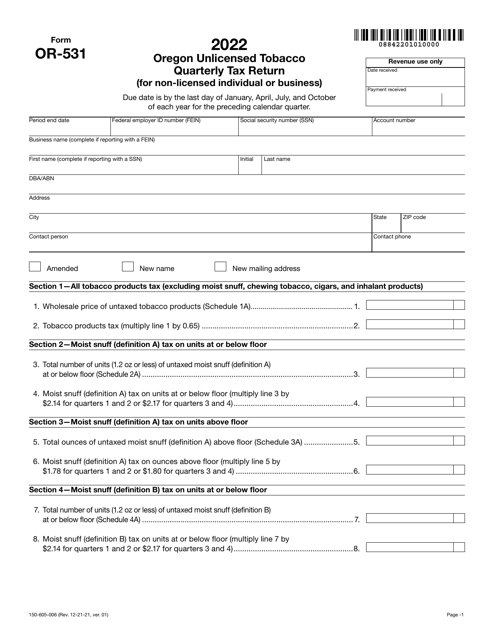

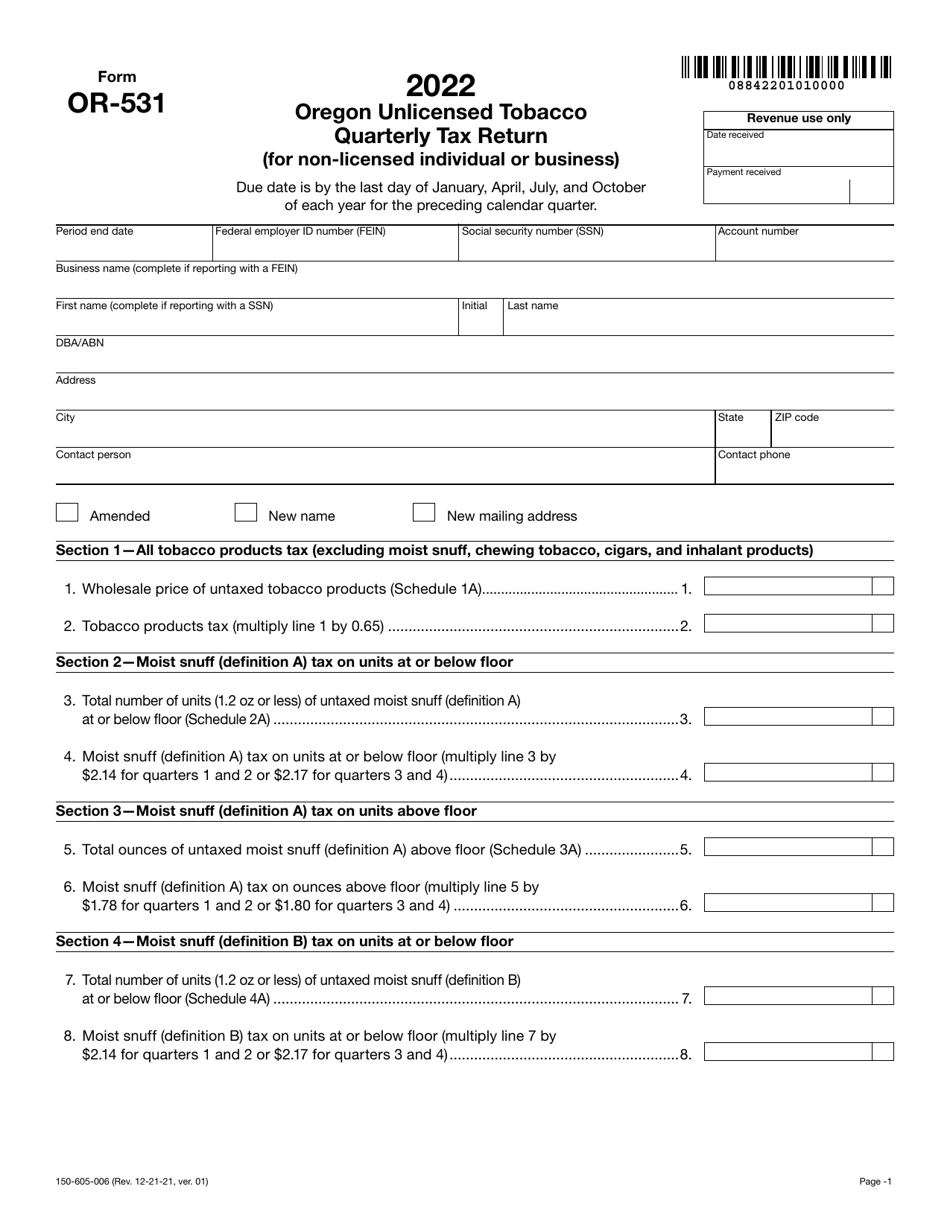

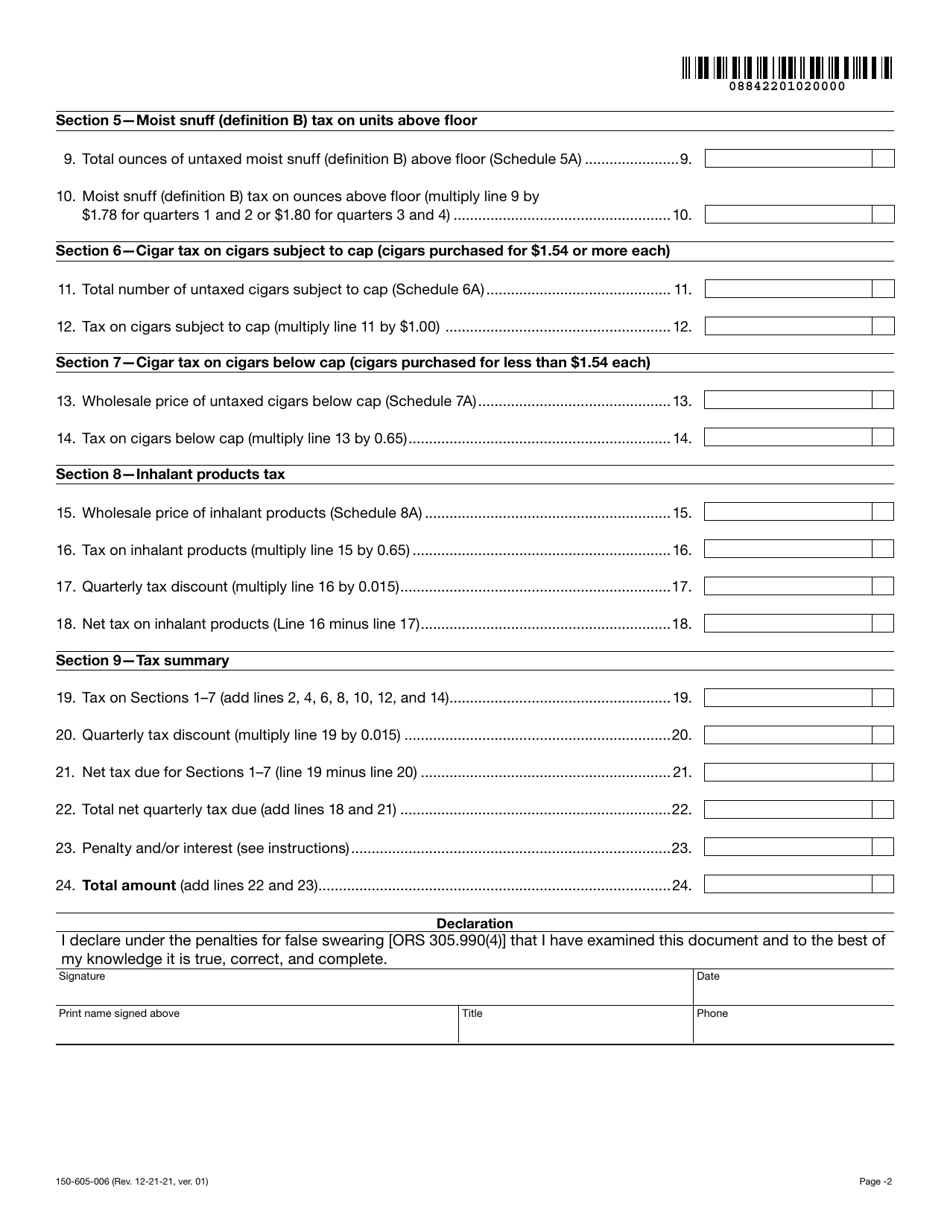

Form OR-531 (150-605-006)

for the current year.

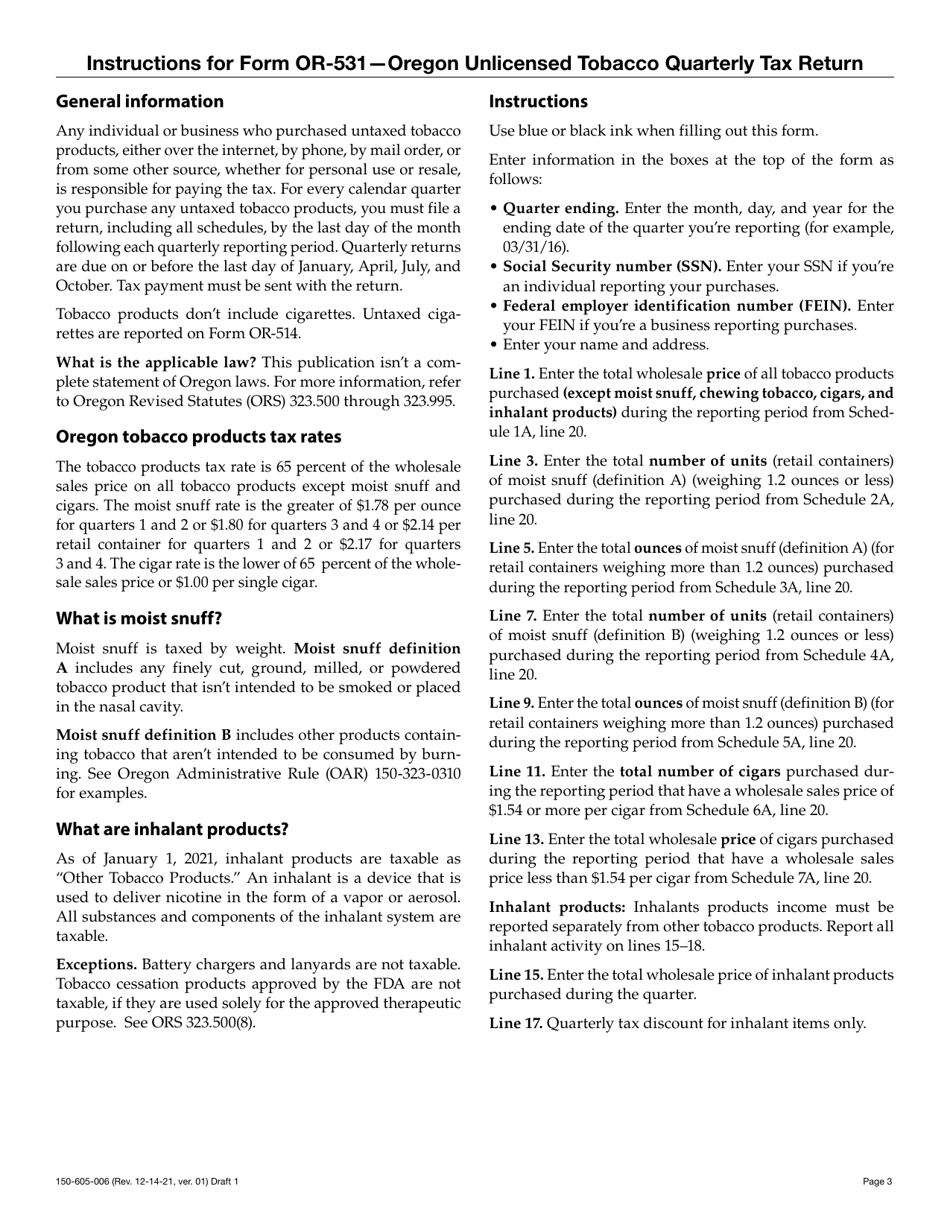

Form OR-531 (150-605-006) Oregon Unlicensed Tobacco Quarterly Tax Return (For Non-licensed Individual or Business) - Oregon

What Is Form OR-531 (150-605-006)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OR-531?

A: OR-531 is the Oregon Unlicensed Tobacco Quarterly Tax Return form.

Q: Who needs to file OR-531?

A: Non-licensed individuals or businesses in Oregon who sell tobacco products need to file OR-531.

Q: What is the purpose of OR-531?

A: OR-531 is used to report and pay quarterly taxes on tobacco products sold in Oregon.

Q: When is OR-531 due?

A: OR-531 is due on a quarterly basis, with specific due dates provided on the form.

Q: How do I submit OR-531?

A: You can submit OR-531 electronically or by mail using the instructions provided on the form.

Q: Are there any penalties for not filing OR-531?

A: Yes, failure to file OR-531 or pay the required taxes may result in penalties and interest.

Q: Is OR-531 only for businesses in Oregon?

A: No, OR-531 is also applicable to non-licensed individuals selling tobacco in Oregon.

Q: Can I file OR-531 if I am licensed to sell tobacco?

A: No, if you are licensed to sell tobacco in Oregon, you need to use a different form to report and pay your taxes.

Form Details:

- Released on December 21, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OR-531 (150-605-006) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.