This version of the form is not currently in use and is provided for reference only. Download this version of

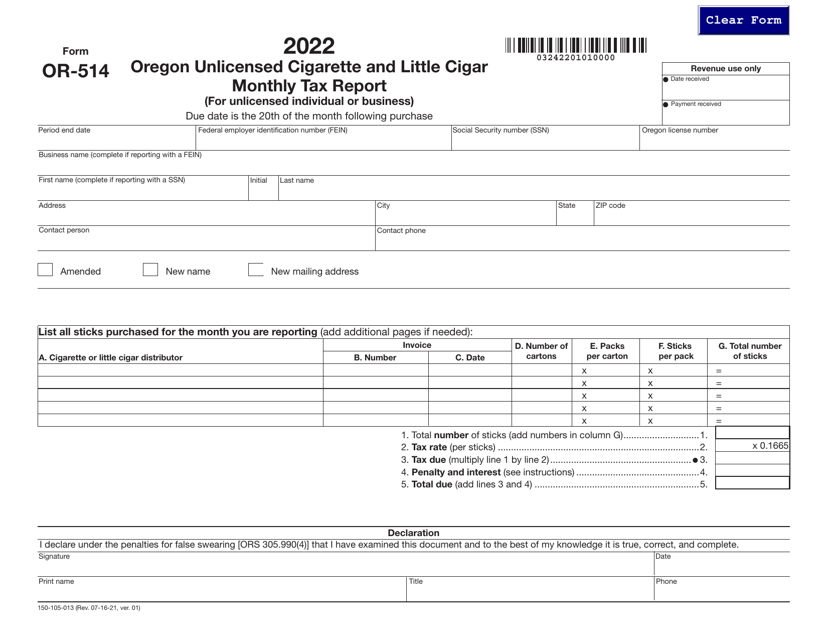

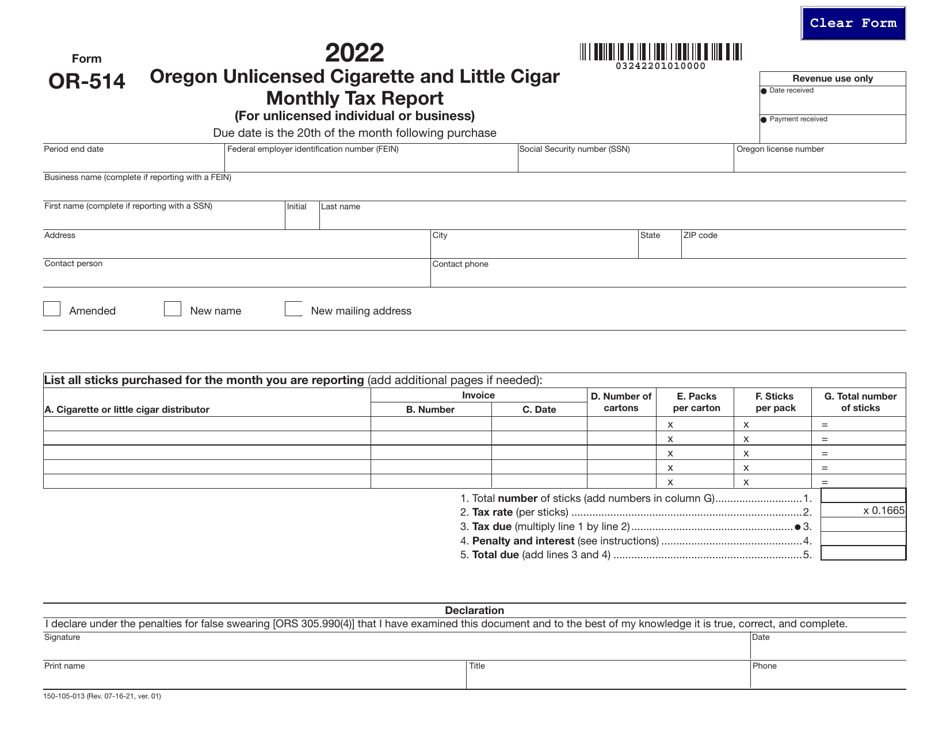

Form OR-514 (150-105-013)

for the current year.

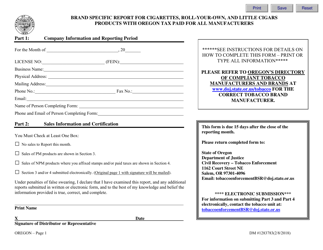

Form OR-514 (150-105-013) Oregon Unlicensed Cigarette and Little Cigar Monthly Tax Report (For Unlicensed Individual or Business) - Oregon

What Is Form OR-514 (150-105-013)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-514?

A: Form OR-514 is the Oregon Unlicensed Cigarette and Little Cigar Monthly Tax Report.

Q: Who is required to file Form OR-514?

A: Unlicensed Individuals or businesses that sell cigarettes or little cigars in Oregon are required to file Form OR-514.

Q: What is the purpose of Form OR-514?

A: The purpose of Form OR-514 is to report and pay the monthly tax on cigarettes and little cigars sold in Oregon by unlicensed individuals or businesses.

Q: How often is Form OR-514 filed?

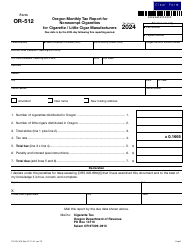

A: Form OR-514 is filed on a monthly basis.

Q: What information is needed to complete Form OR-514?

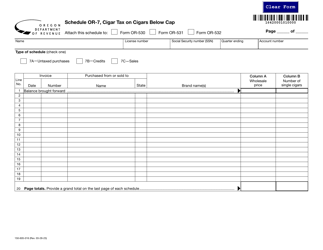

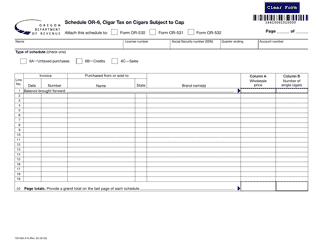

A: Some of the information needed to complete Form OR-514 includes the number of cigarettes and little cigars sold, the total tax due, and the payment information.

Q: When is Form OR-514 due?

A: Form OR-514 is due on the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing Form OR-514?

A: Yes, failure to file Form OR-514 or late filing may result in penalties and interest.

Q: Are there any exceptions to filing Form OR-514?

A: Yes, licensed retailers and wholesalers are not required to file Form OR-514. Only unlicensed individuals or businesses need to file this form.

Form Details:

- Released on July 16, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-514 (150-105-013) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.