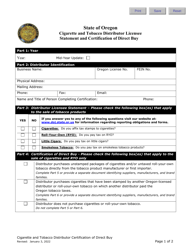

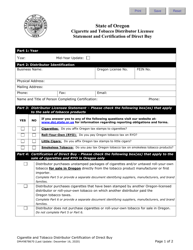

This version of the form is not currently in use and is provided for reference only. Download this version of

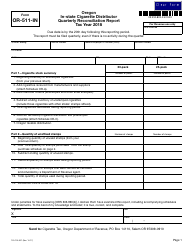

Form OR-511-IN (150-105-051)

for the current year.

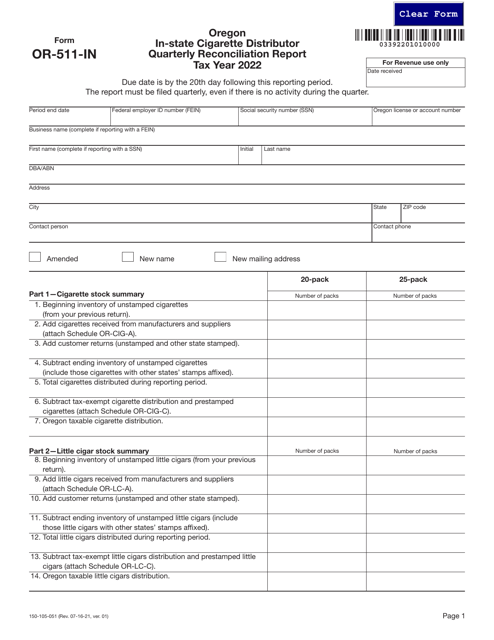

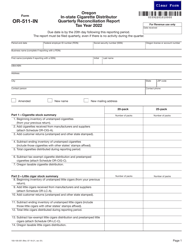

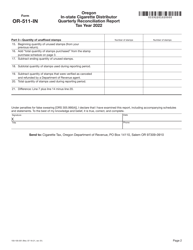

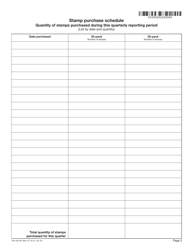

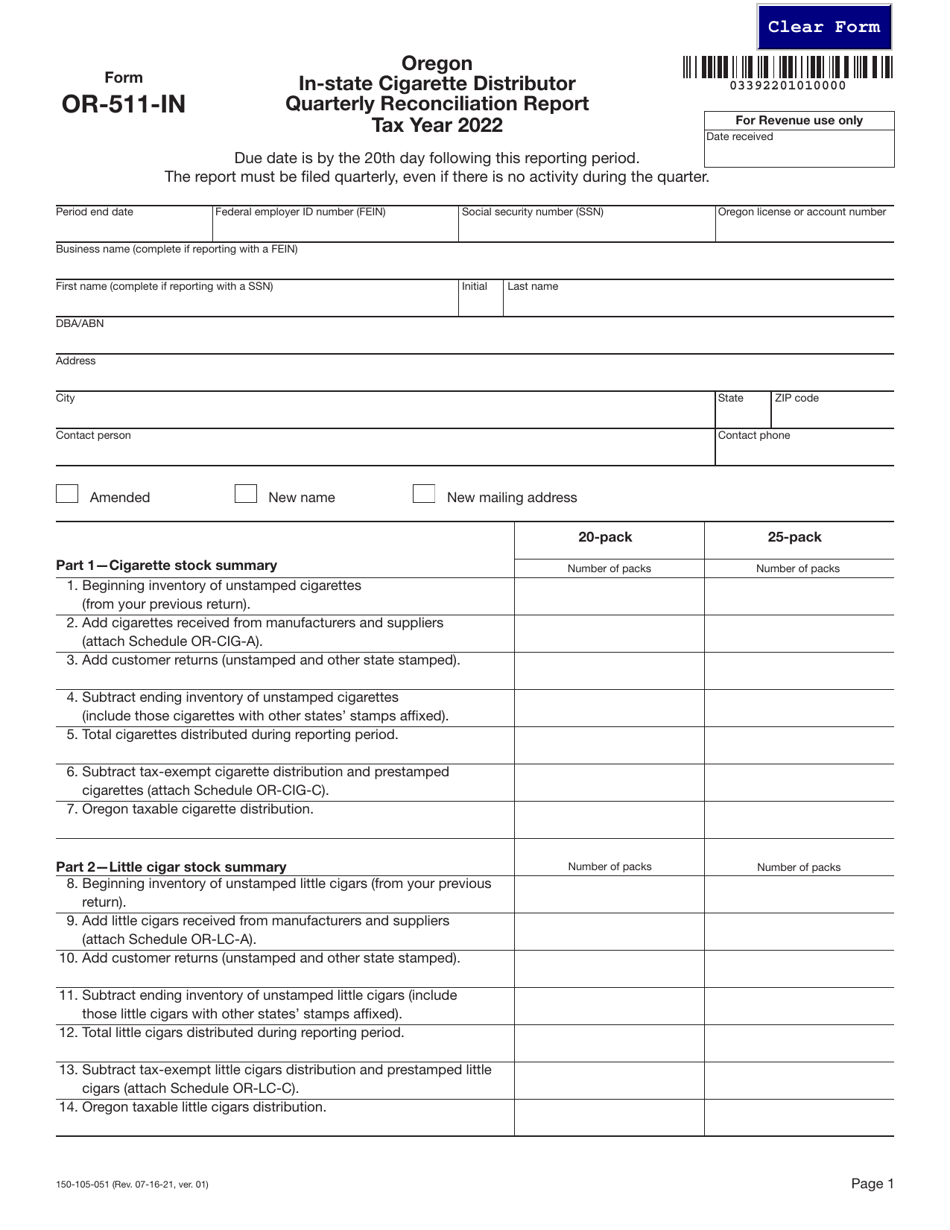

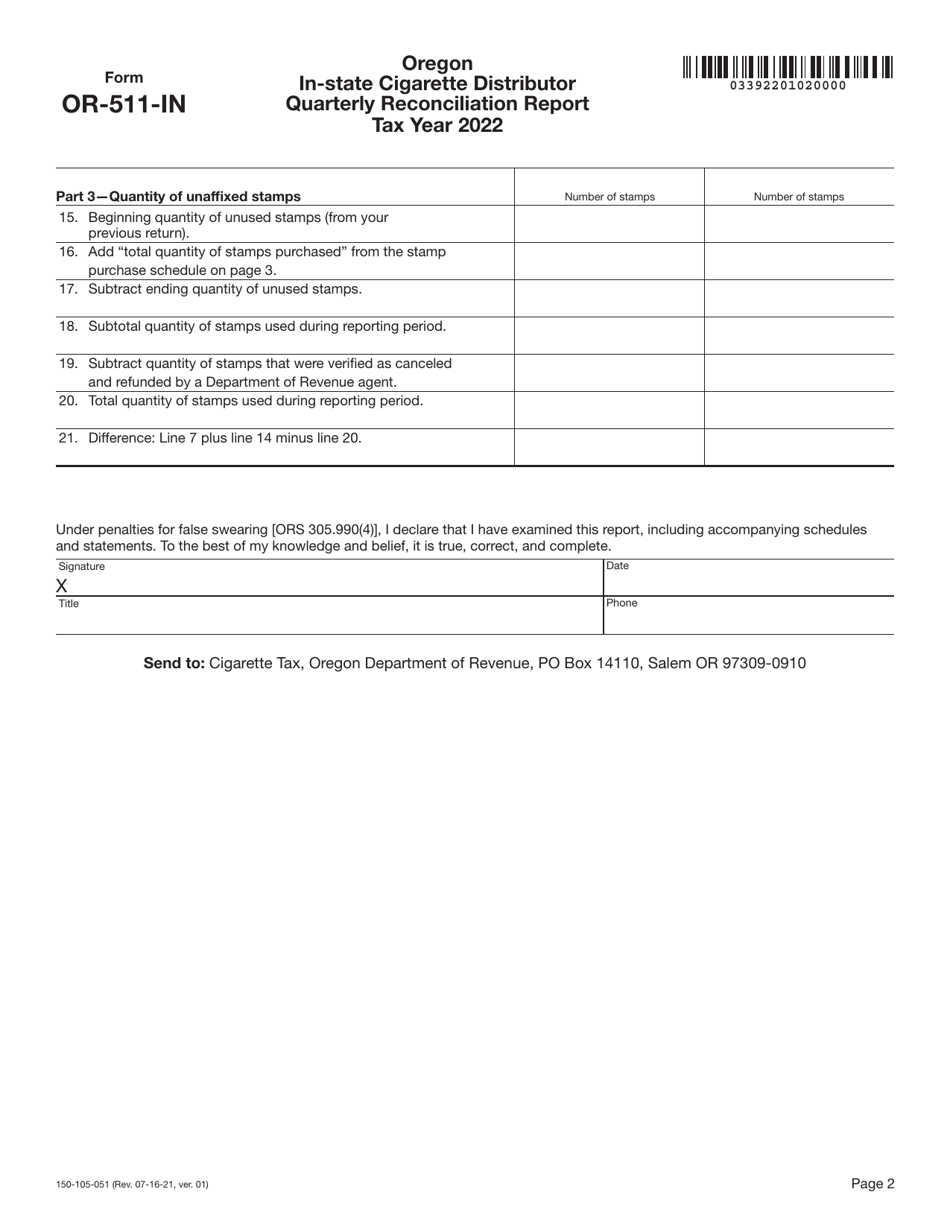

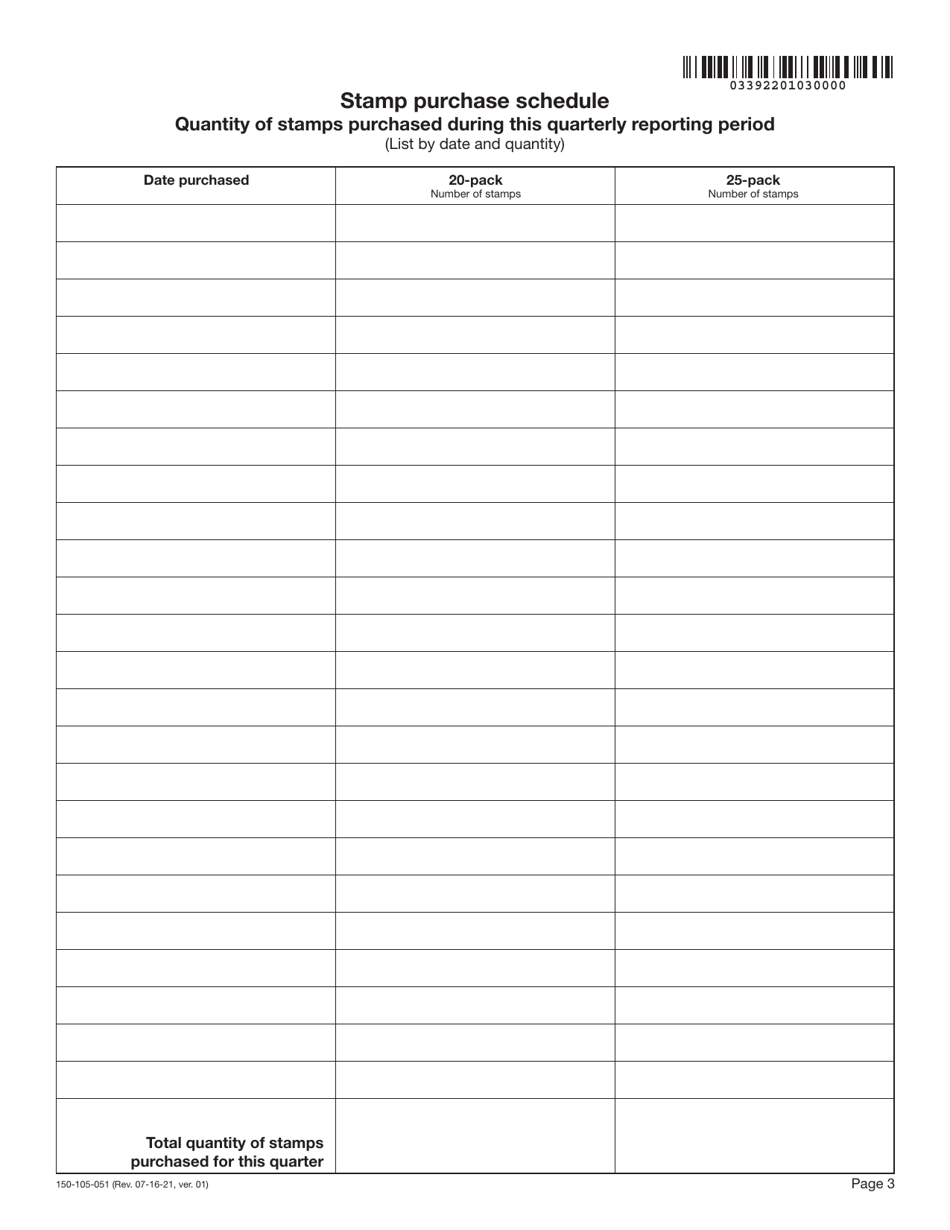

Form OR-511-IN (150-105-051) Oregon in-State Cigarette Distributor Quarterly Reconciliation Report - Oregon

What Is Form OR-511-IN (150-105-051)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

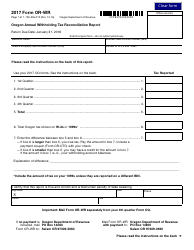

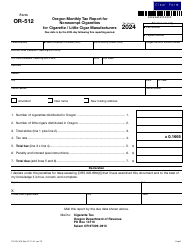

Q: What is Form OR-511-IN?

A: Form OR-511-IN is the Oregon in-State Cigarette Distributor Quarterly Reconciliation Report.

Q: Who needs to file Form OR-511-IN?

A: Oregon in-state cigarette distributors need to file Form OR-511-IN.

Q: What is the purpose of Form OR-511-IN?

A: The purpose of Form OR-511-IN is to reconcile the quantity of Oregon-stamped cigarettes sold in the state with the amount of tax paid.

Q: When is Form OR-511-IN due?

A: Form OR-511-IN is due quarterly, with the following due dates: April 30, July 31, October 31, and January 31.

Q: Is there a penalty for not filing Form OR-511-IN on time?

A: Yes, there is a penalty for not filing Form OR-511-IN on time. The penalty amount is based on the number of delinquent reports.

Form Details:

- Released on July 16, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-511-IN (150-105-051) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.