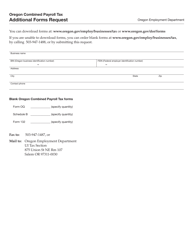

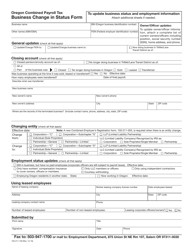

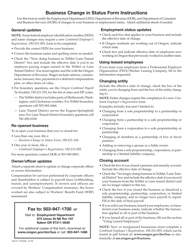

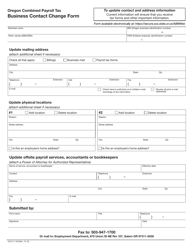

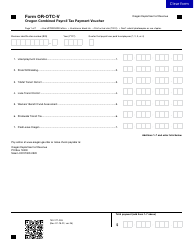

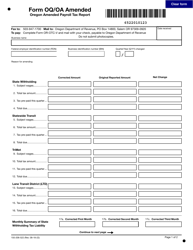

Form 150-211-155 Oregon Combined Payroll Tax Report Instructions for Oregon Employers - Oregon

What Is Form 150-211-155?

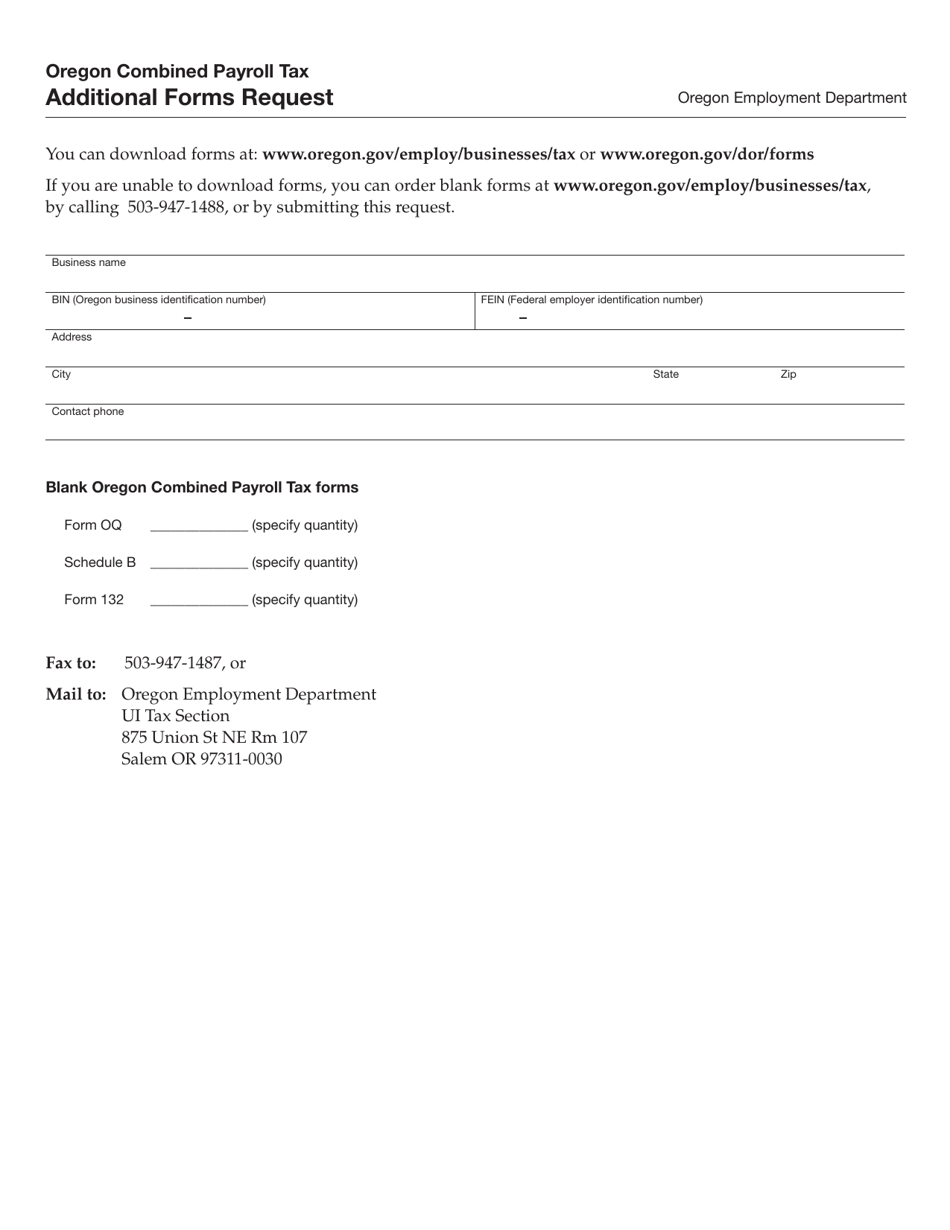

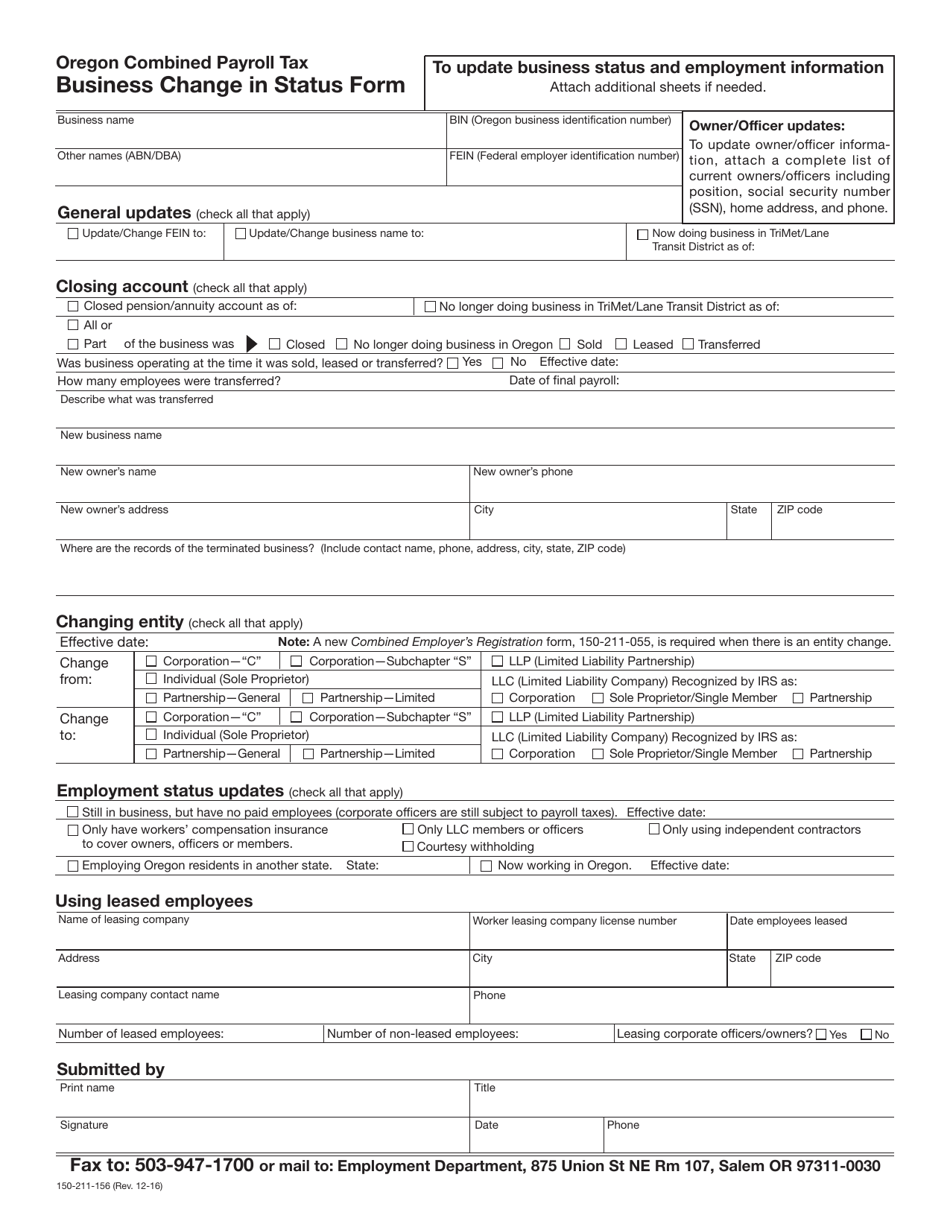

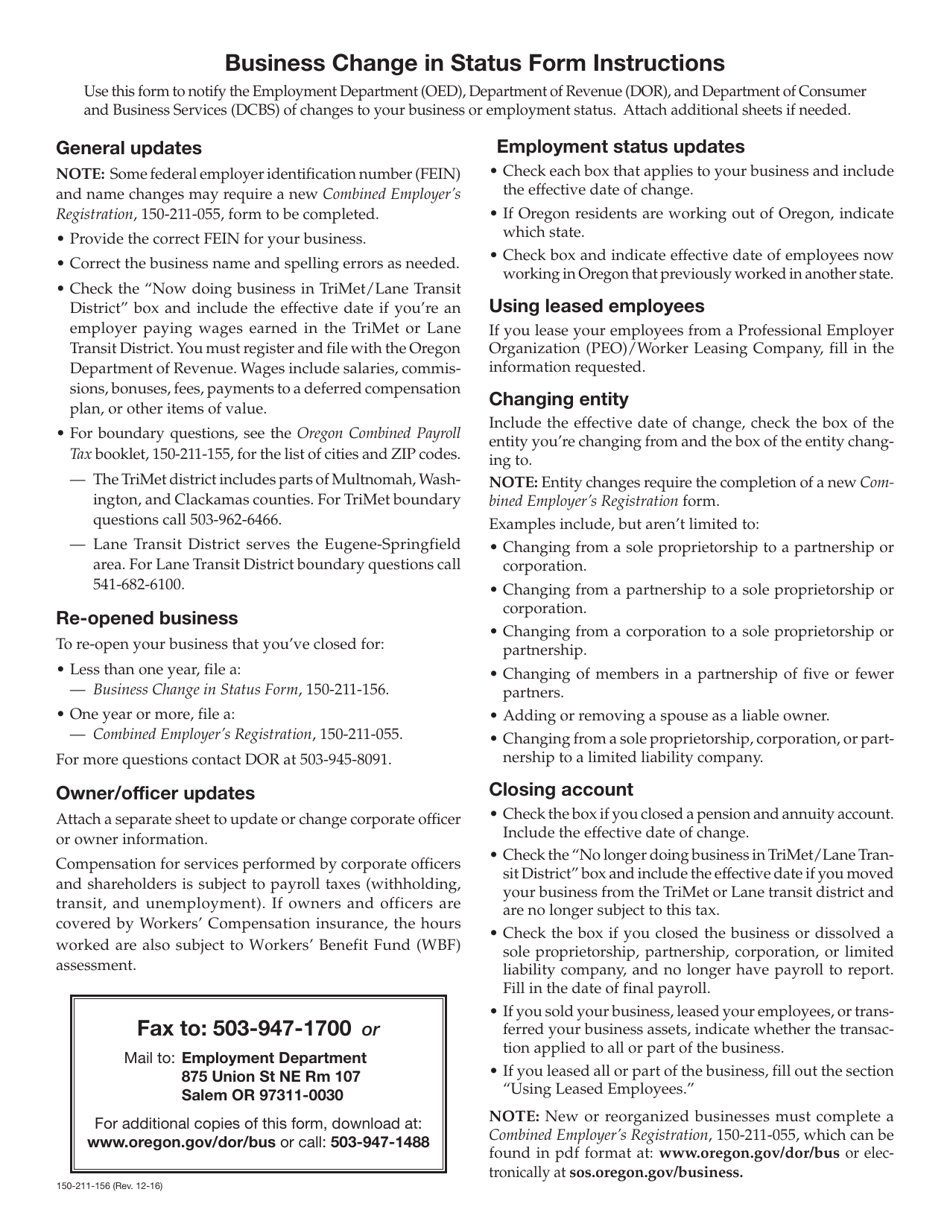

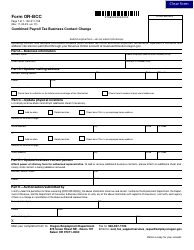

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-211-155?

A: Form 150-211-155 is the Oregon Combined Payroll Tax ReportInstructions for Oregon Employers.

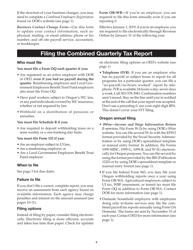

Q: Who needs to file Form 150-211-155?

A: Oregon employers need to file Form 150-211-155.

Q: What is the purpose of Form 150-211-155?

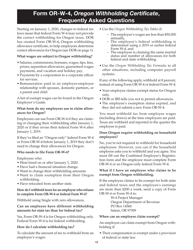

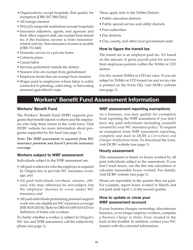

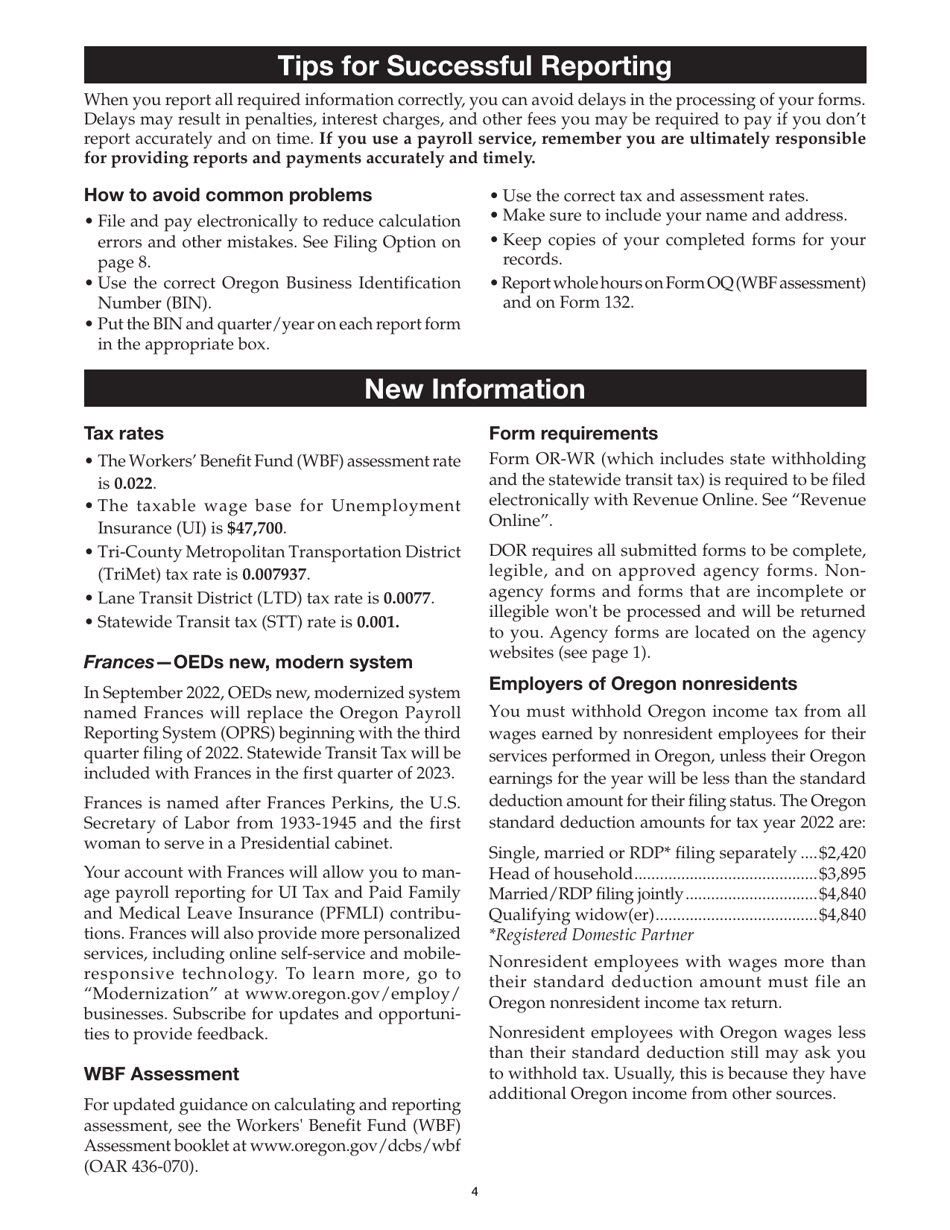

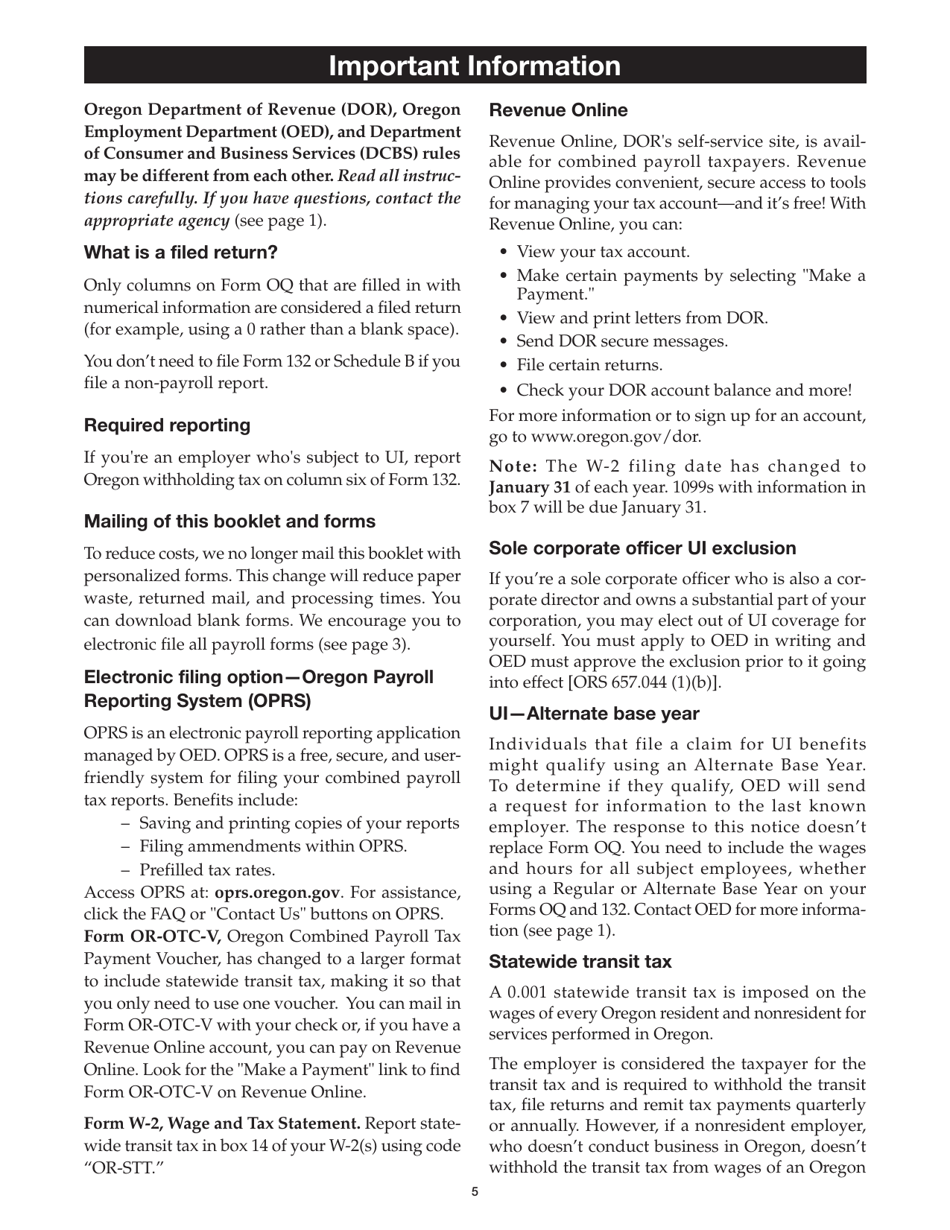

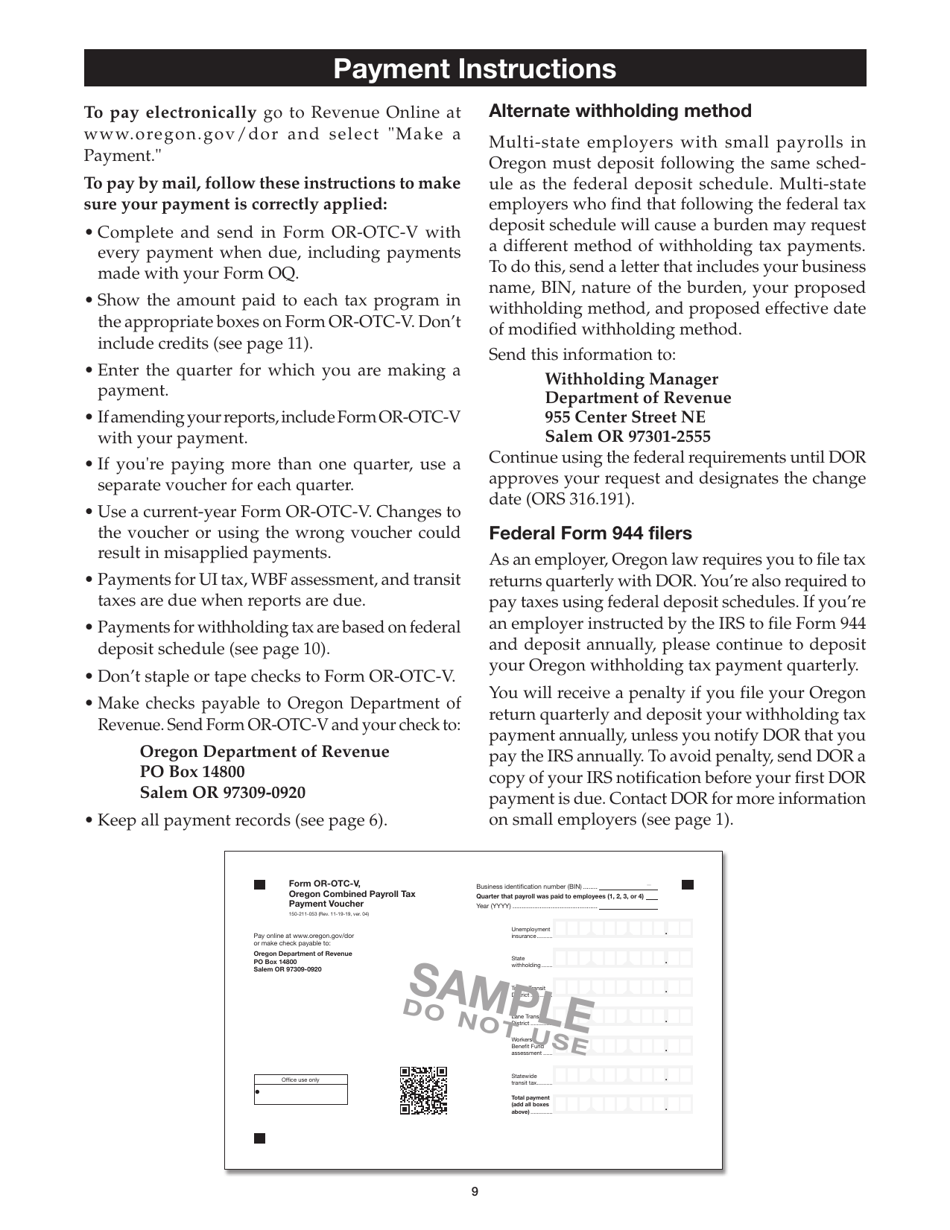

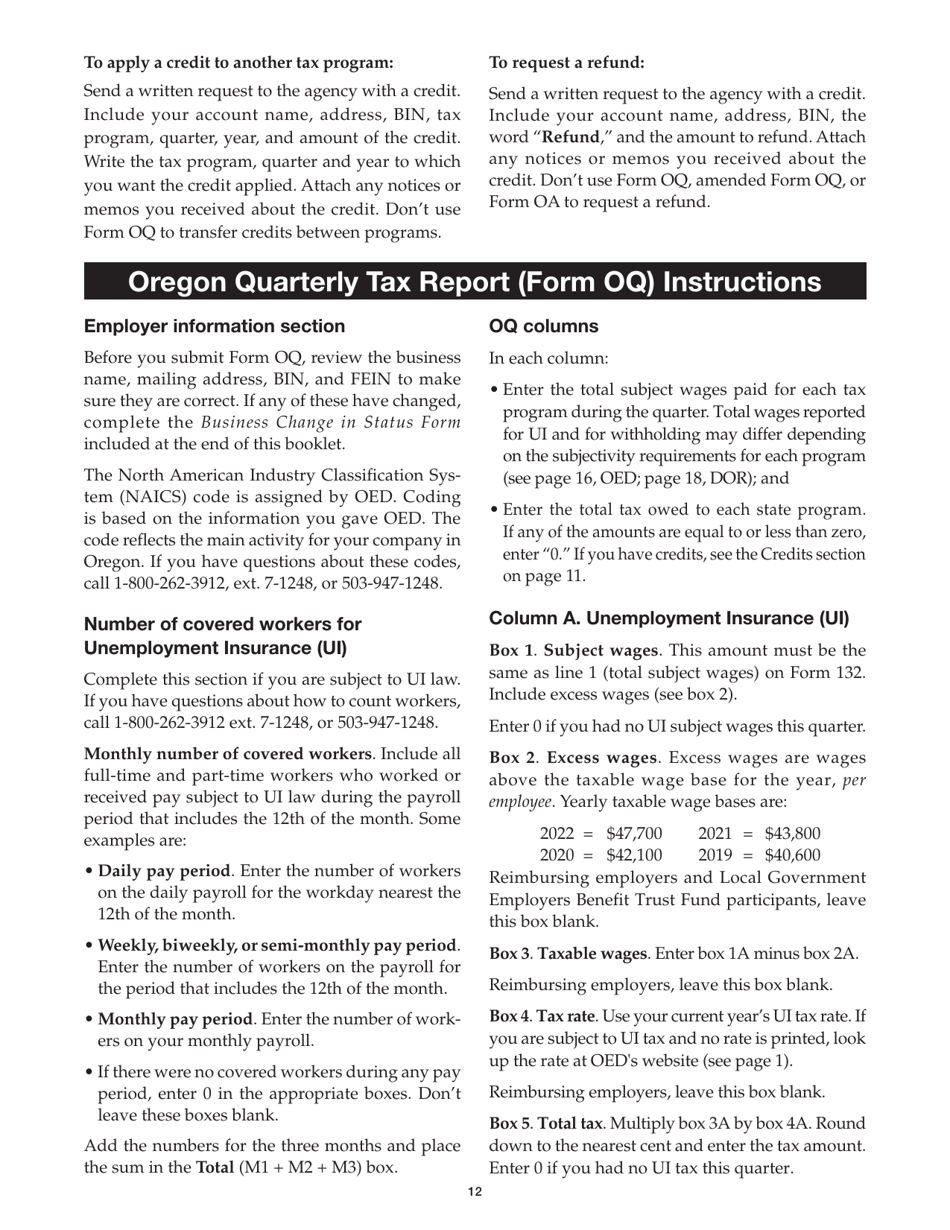

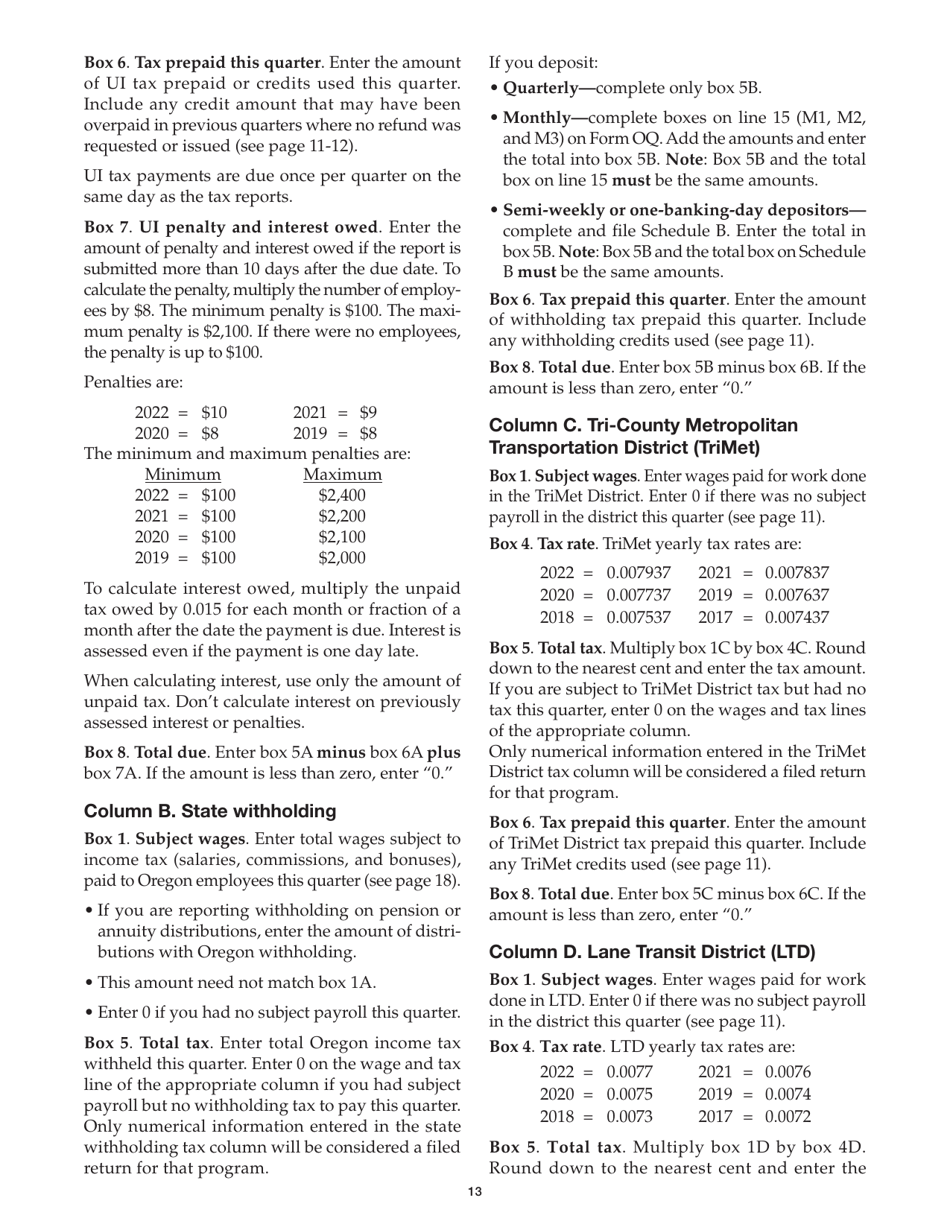

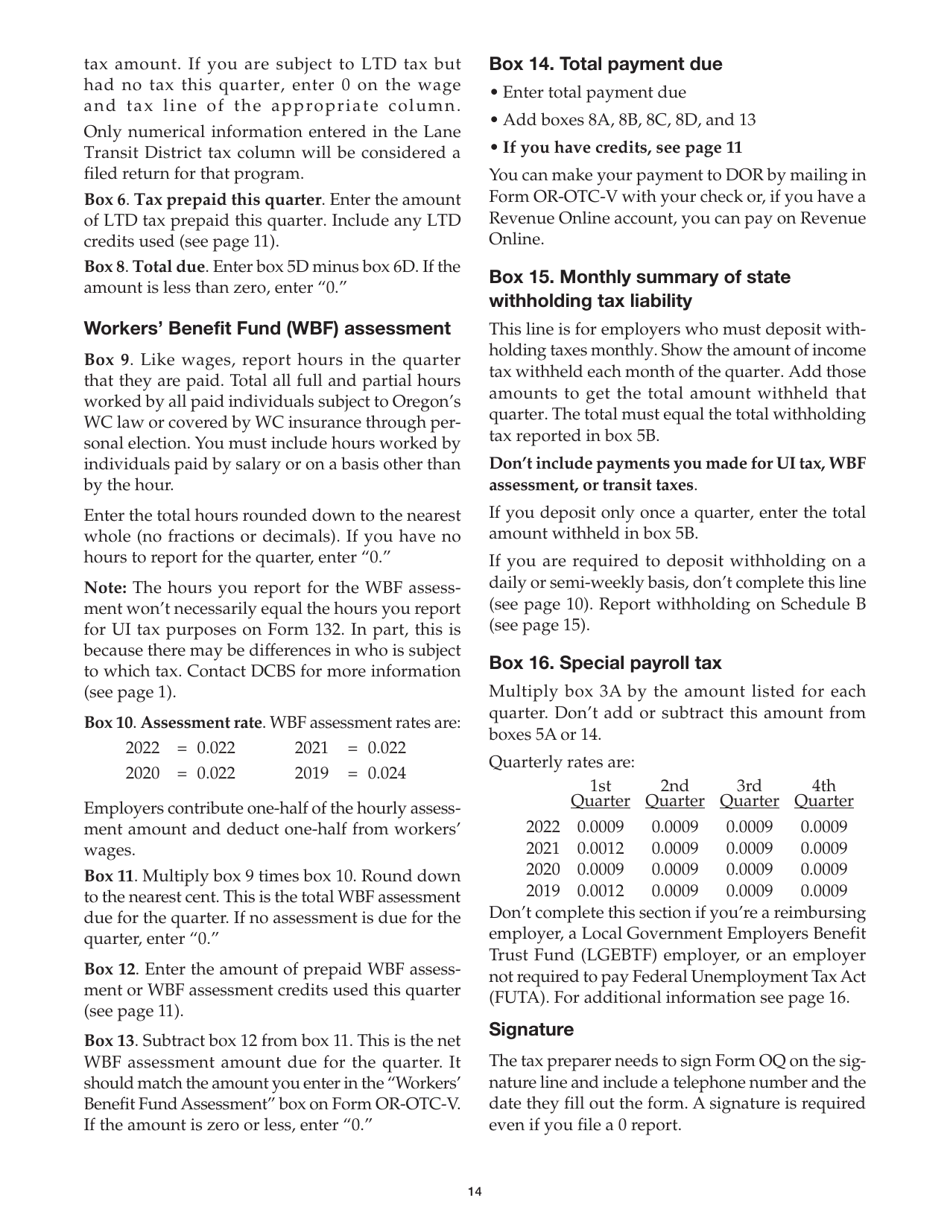

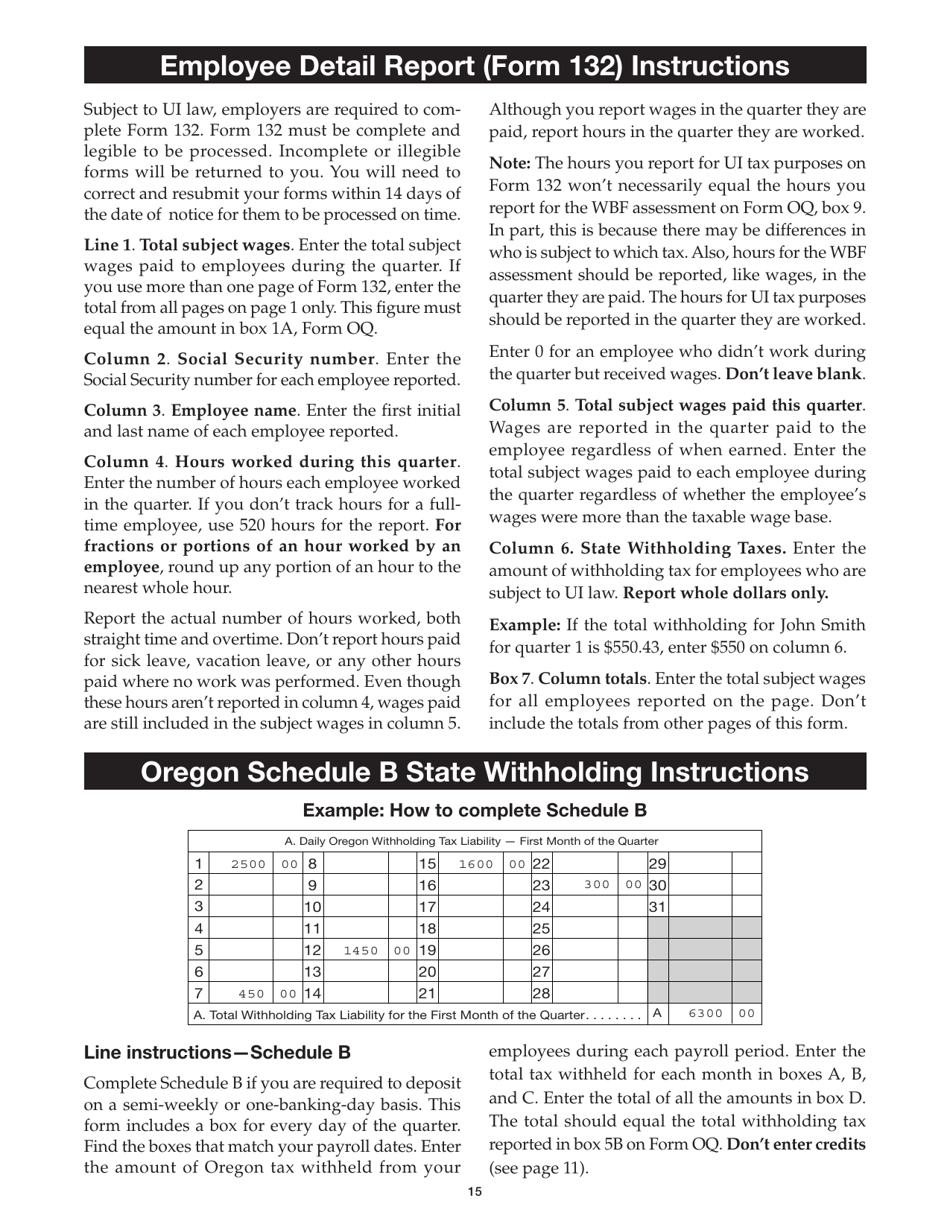

A: Form 150-211-155 is used to report payroll taxes for Oregon employers.

Q: What information is required on Form 150-211-155?

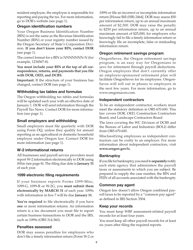

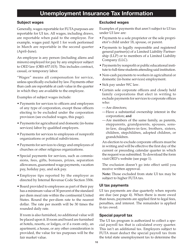

A: Form 150-211-155 requires information about wages paid, taxes withheld, and other payroll-related details.

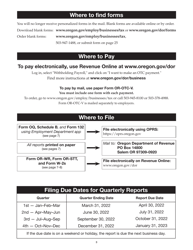

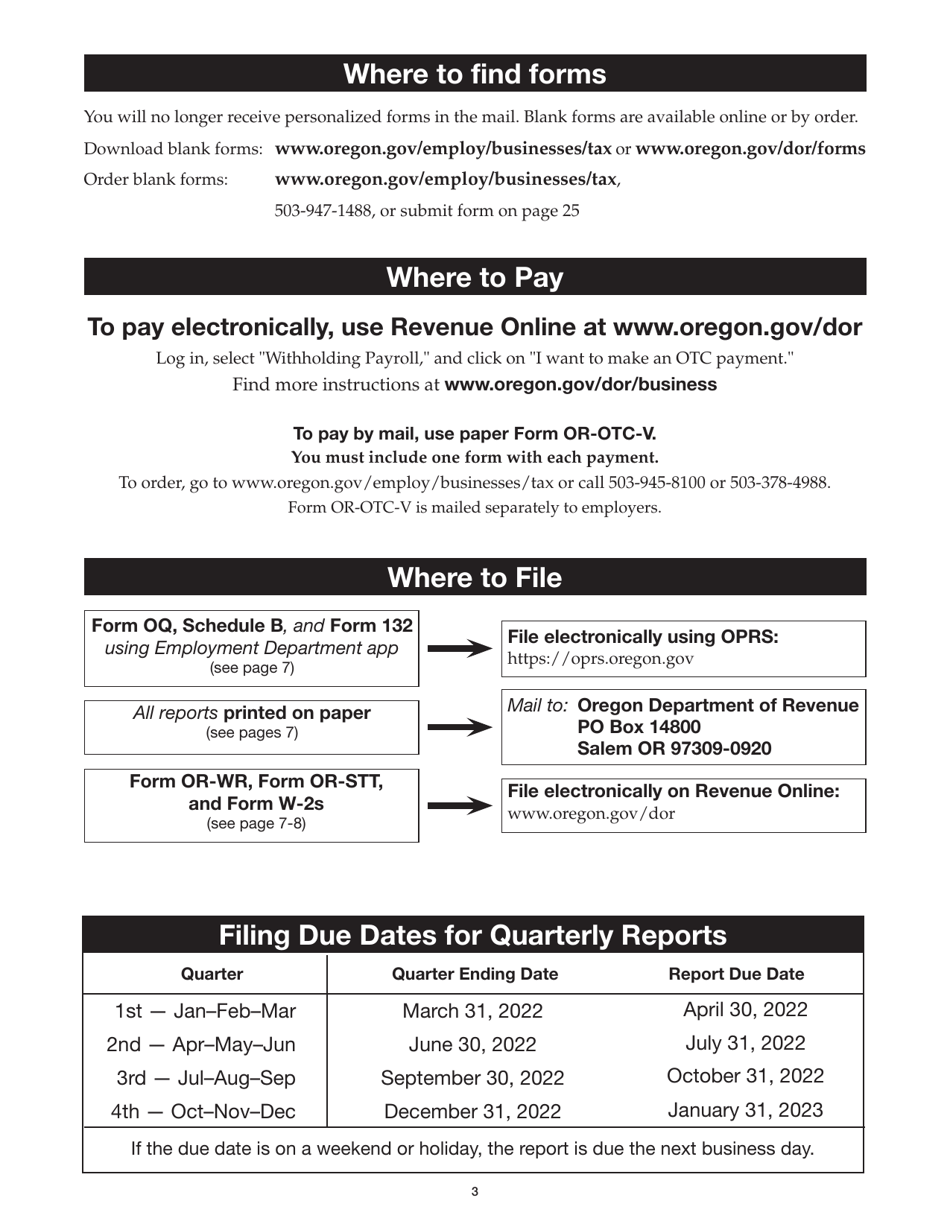

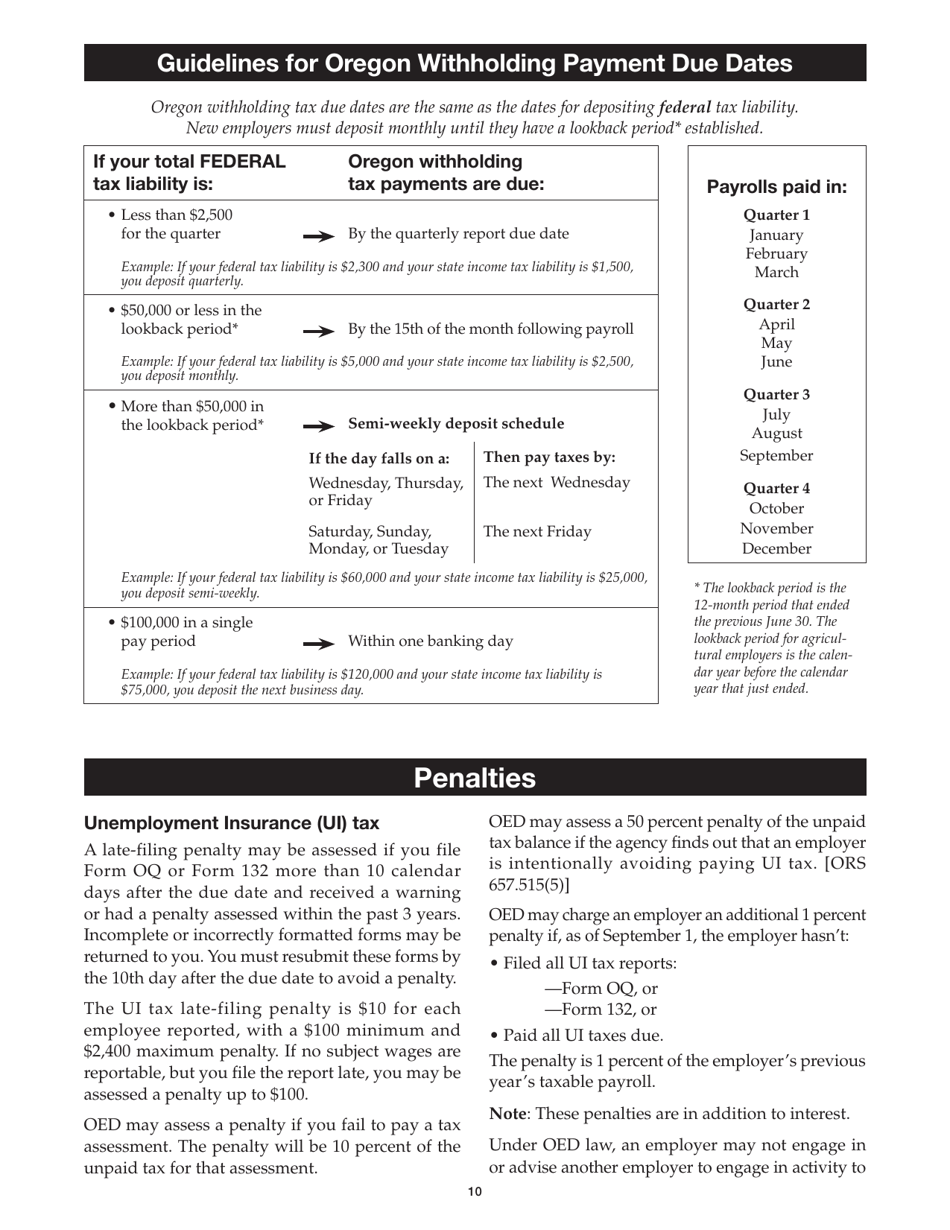

Q: When is Form 150-211-155 due?

A: Form 150-211-155 is due on the last day of the month following the end of each calendar quarter.

Q: Are there any penalties for late filing of Form 150-211-155?

A: Yes, there may be penalties for late filing of Form 150-211-155. It is important to submit the form on time to avoid penalties.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 150-211-155 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.