This version of the form is not currently in use and is provided for reference only. Download this version of

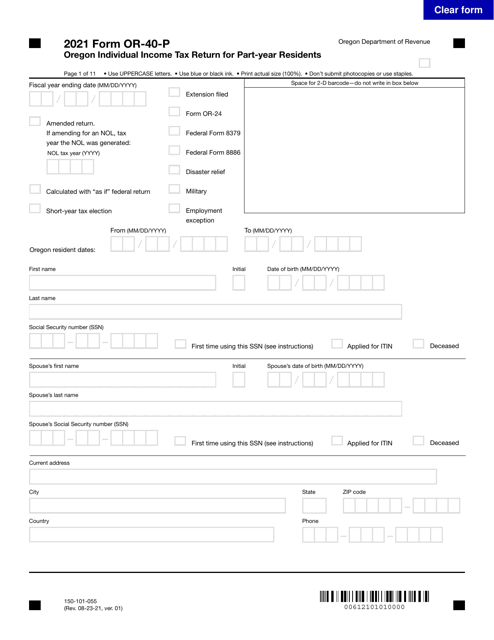

Form OR-40-P (150-101-055)

for the current year.

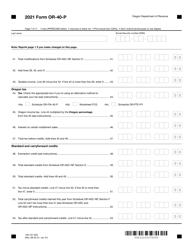

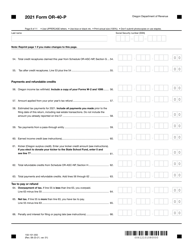

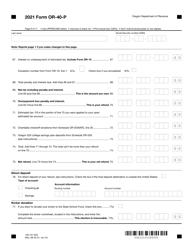

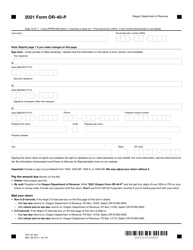

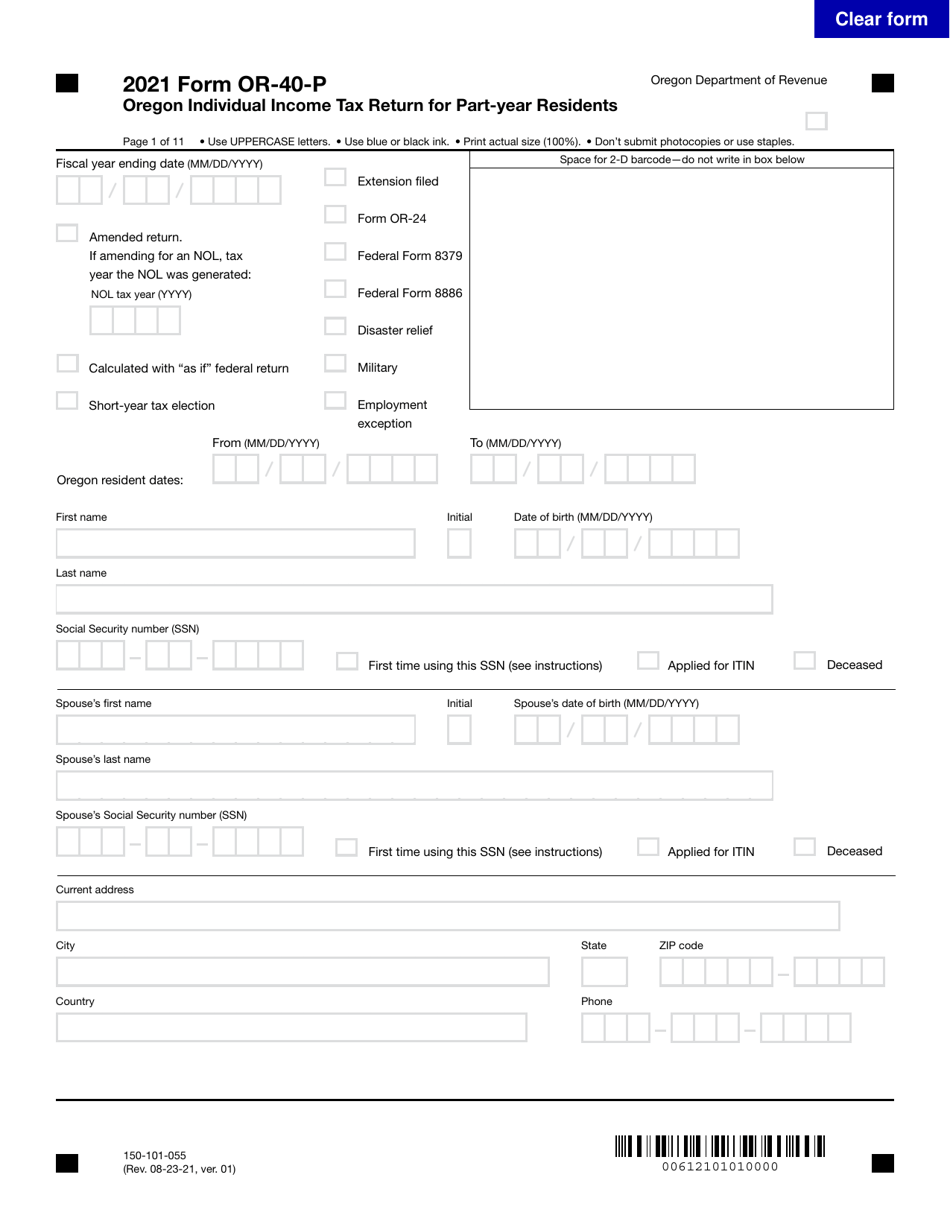

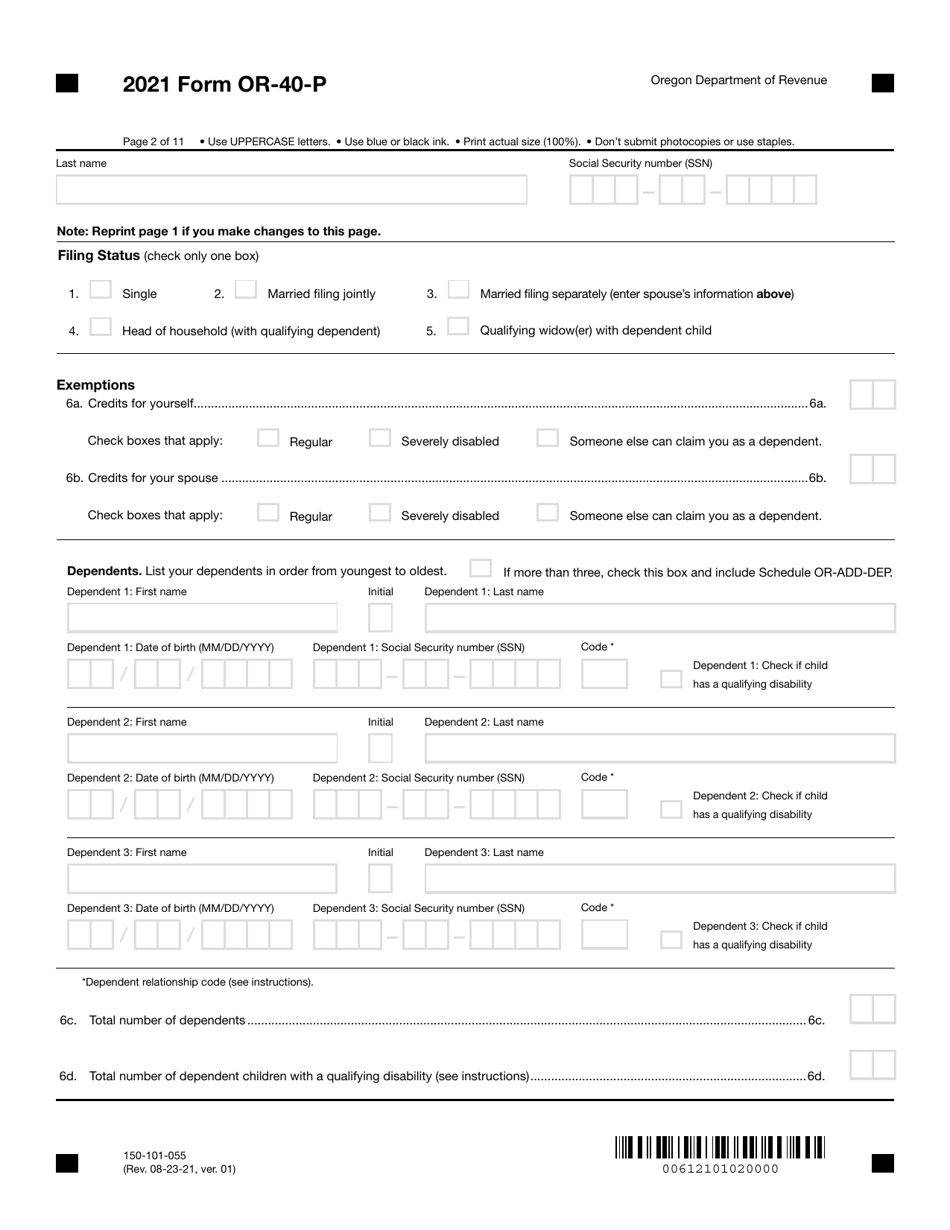

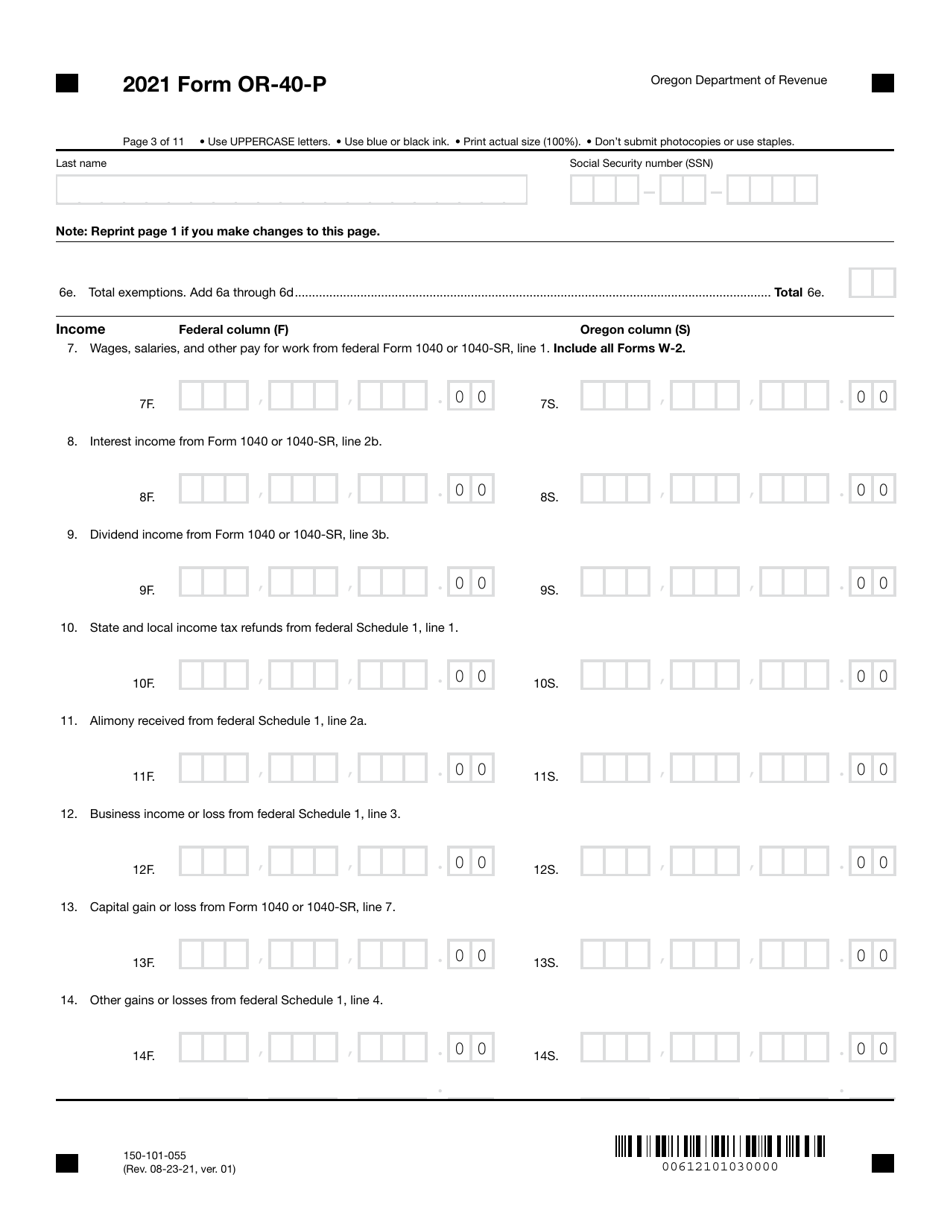

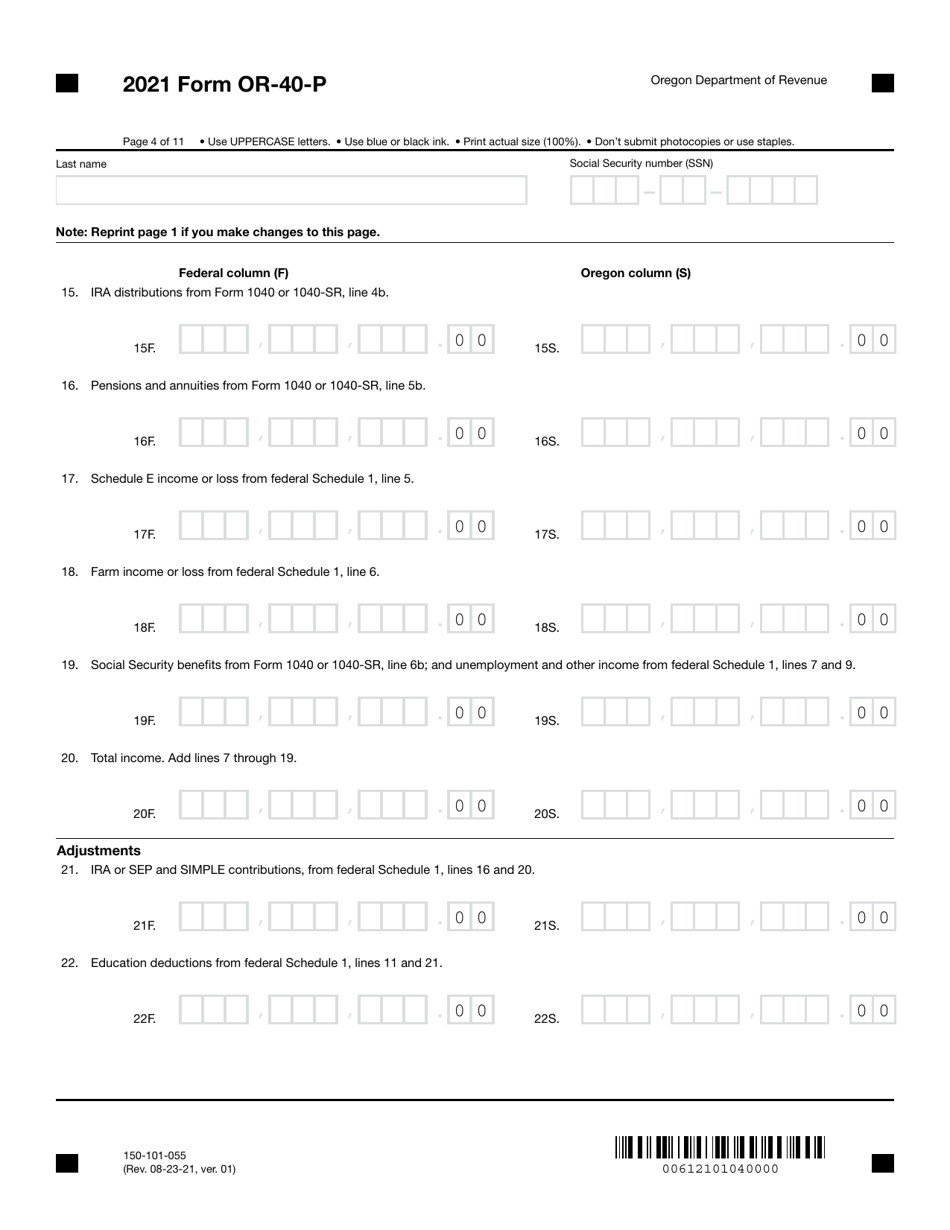

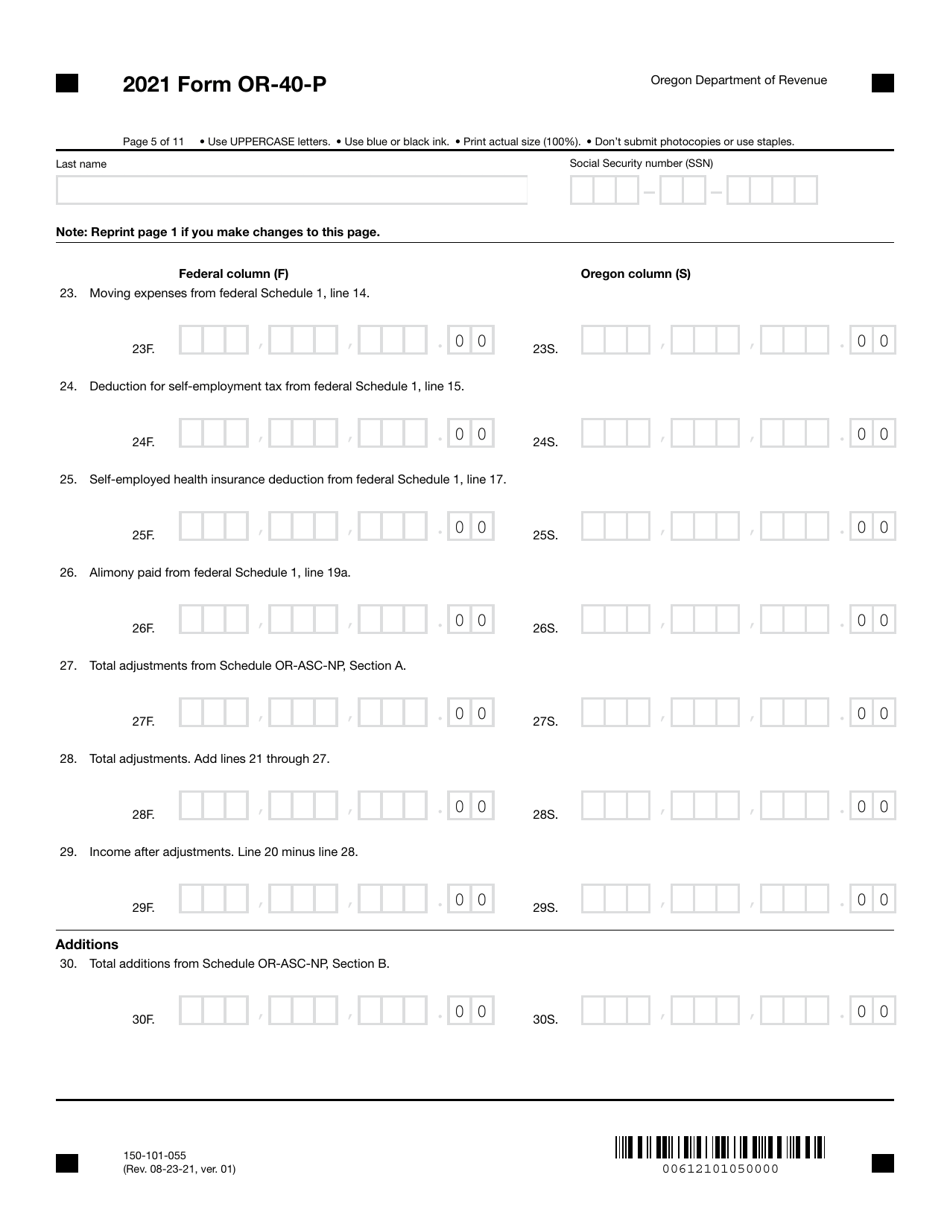

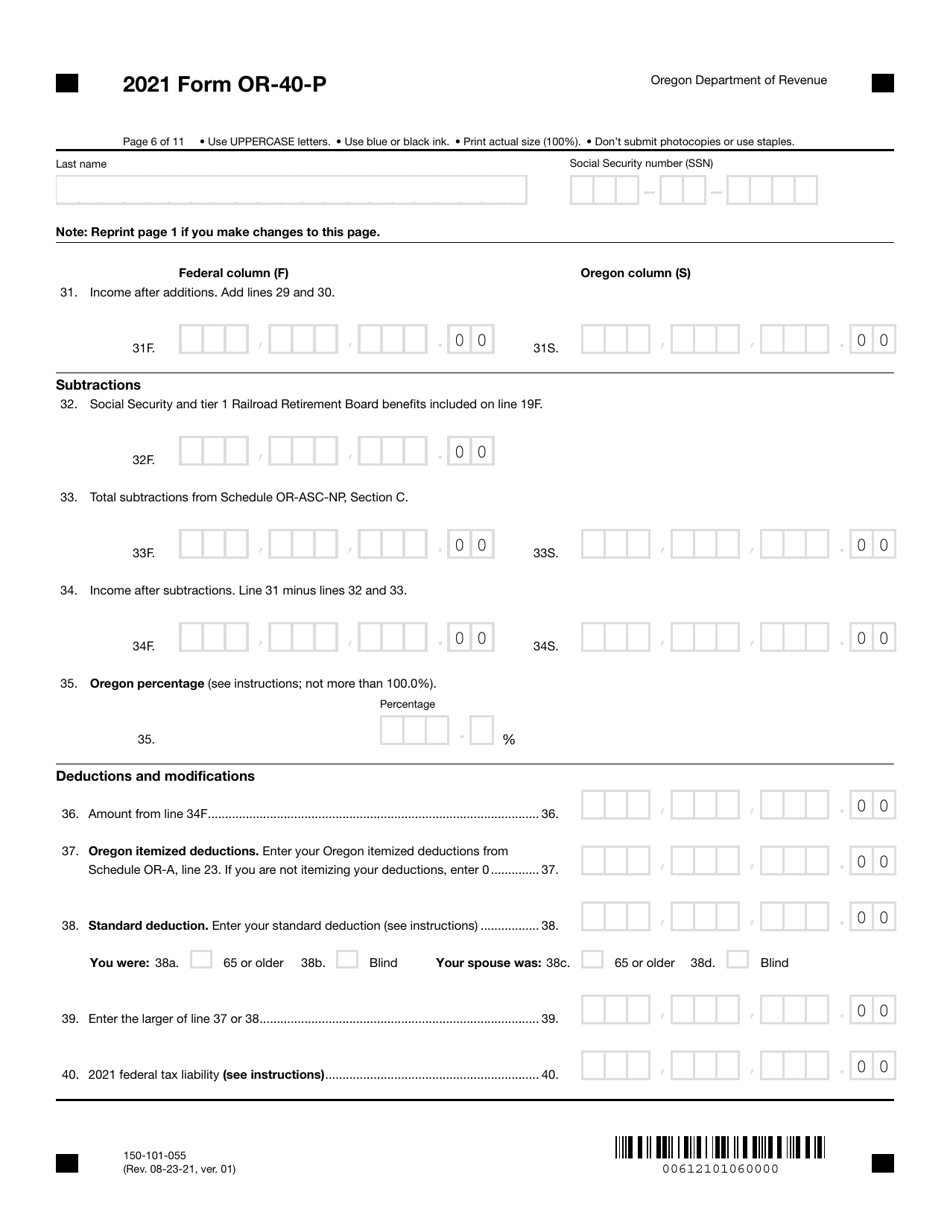

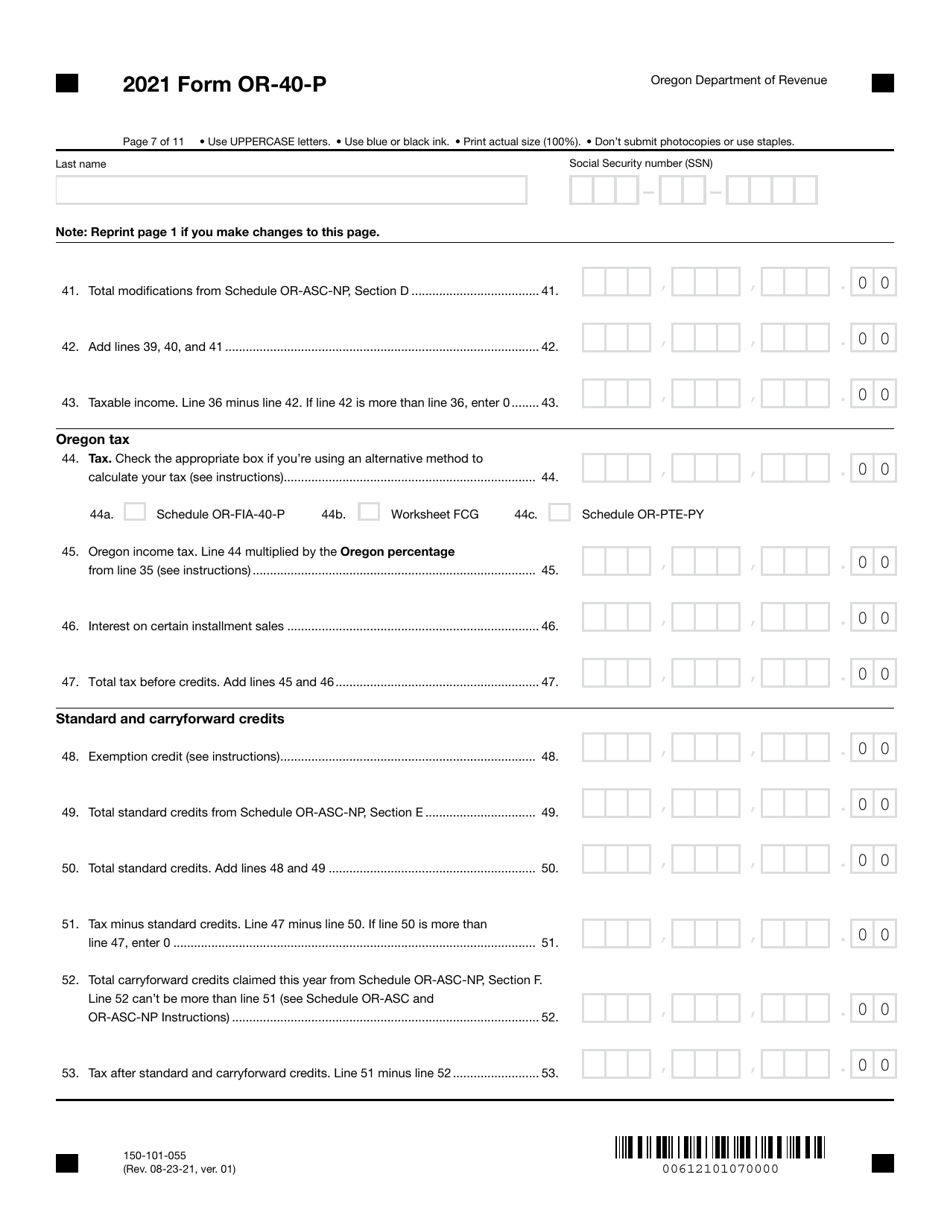

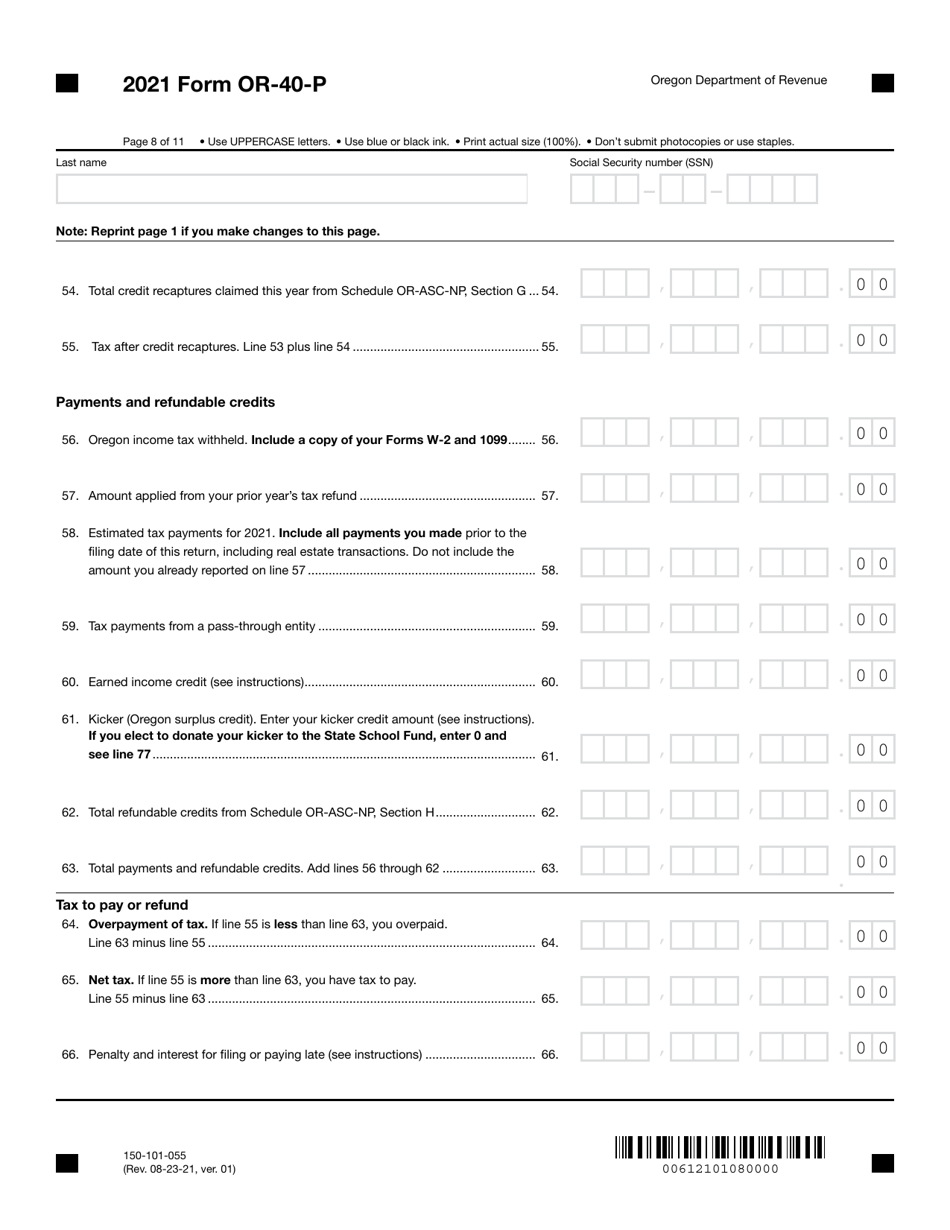

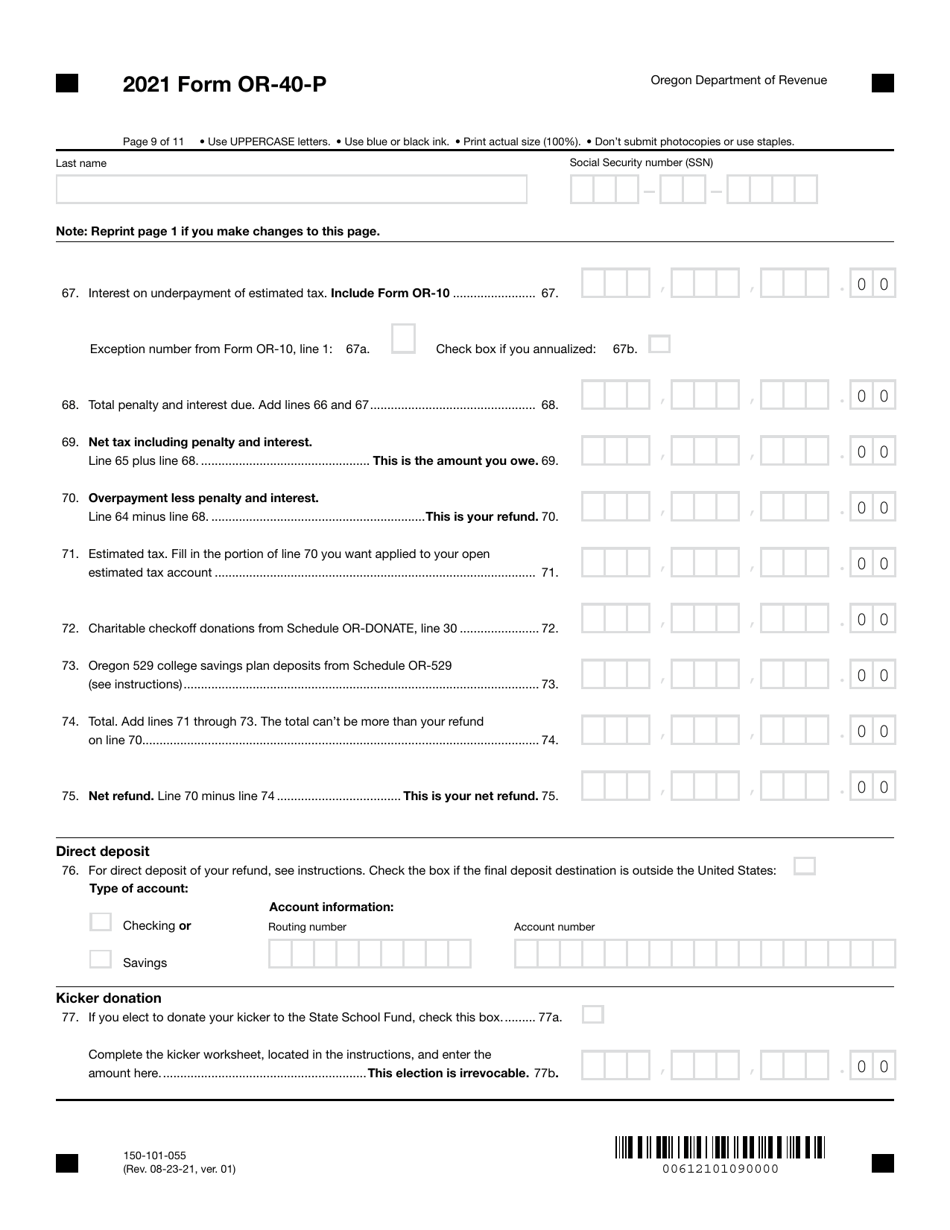

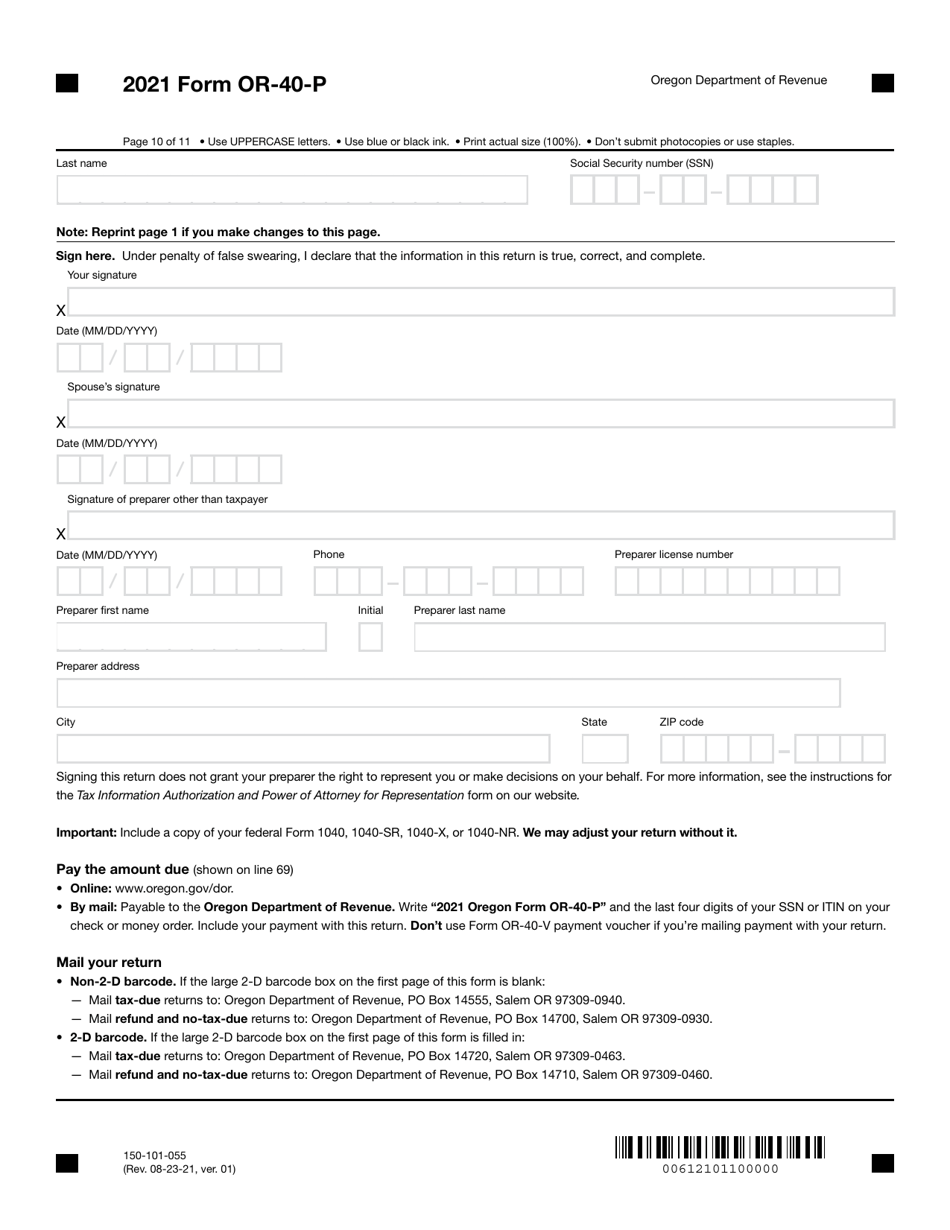

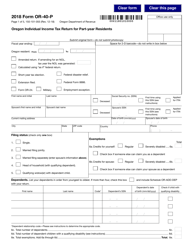

Form OR-40-P (150-101-055) Oregon Individual Income Tax Return for Part-Year Residents - Oregon

What Is Form OR-40-P (150-101-055)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-40-P?

A: Form OR-40-P is the Oregon Individual Income Tax Return for Part-Year Residents.

Q: Who needs to file Form OR-40-P?

A: Part-year residents of Oregon who had income during the year need to file Form OR-40-P.

Q: When is the deadline to file Form OR-40-P?

A: The deadline to file Form OR-40-P is generally April 15th, the same as the federal tax deadline.

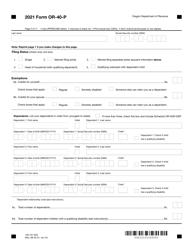

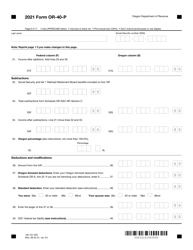

Q: What information do I need to complete Form OR-40-P?

A: You will need information about your income, deductions, and credits for the part-year you were a resident of Oregon.

Q: Can I file Form OR-40-P if I was a full-year resident of Oregon?

A: No, if you were a full-year resident of Oregon, you should file Form OR-40 instead.

Q: What if I need help completing Form OR-40-P?

A: If you need help completing Form OR-40-P, you can seek assistance from a tax professional or refer to the instructions provided with the form.

Form Details:

- Released on August 23, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-40-P (150-101-055) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.