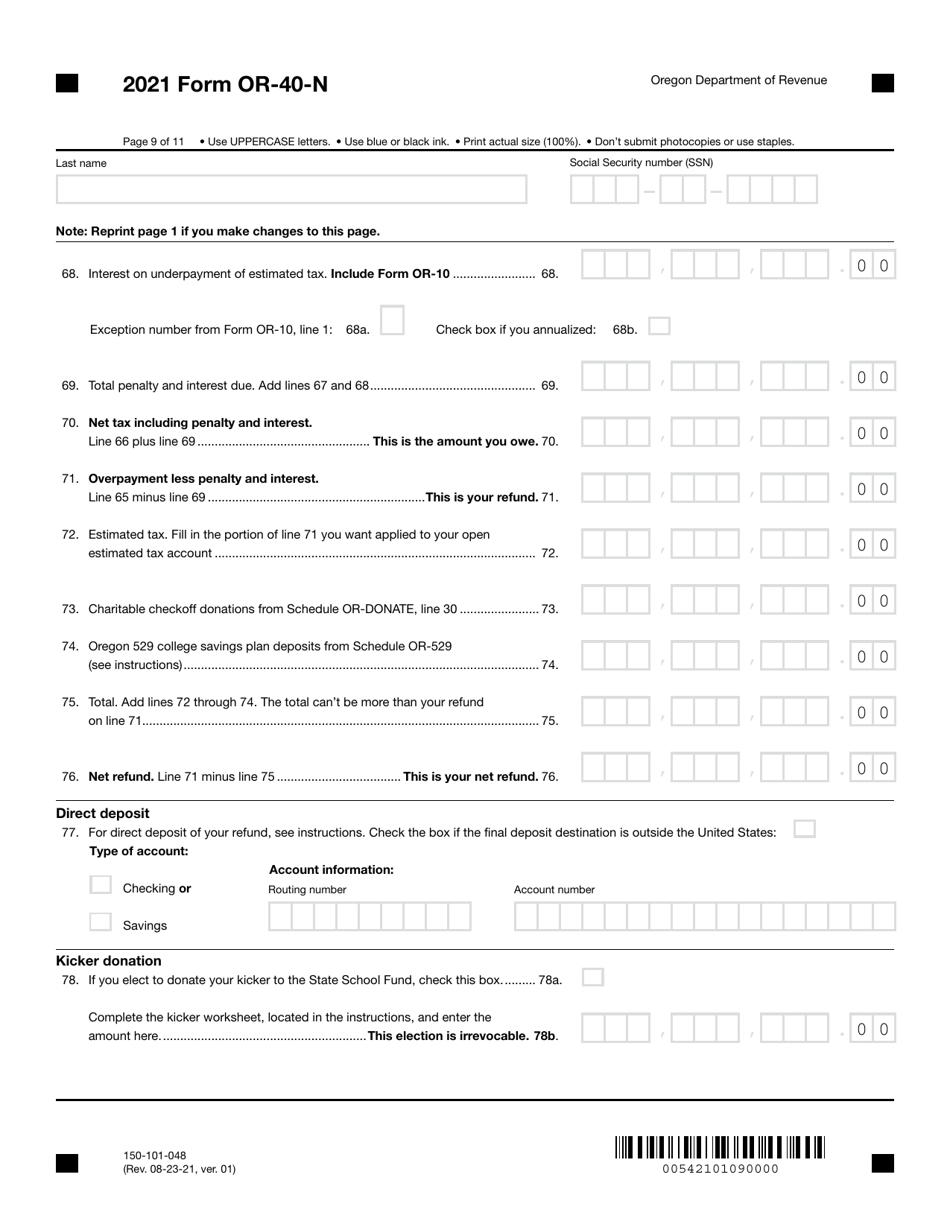

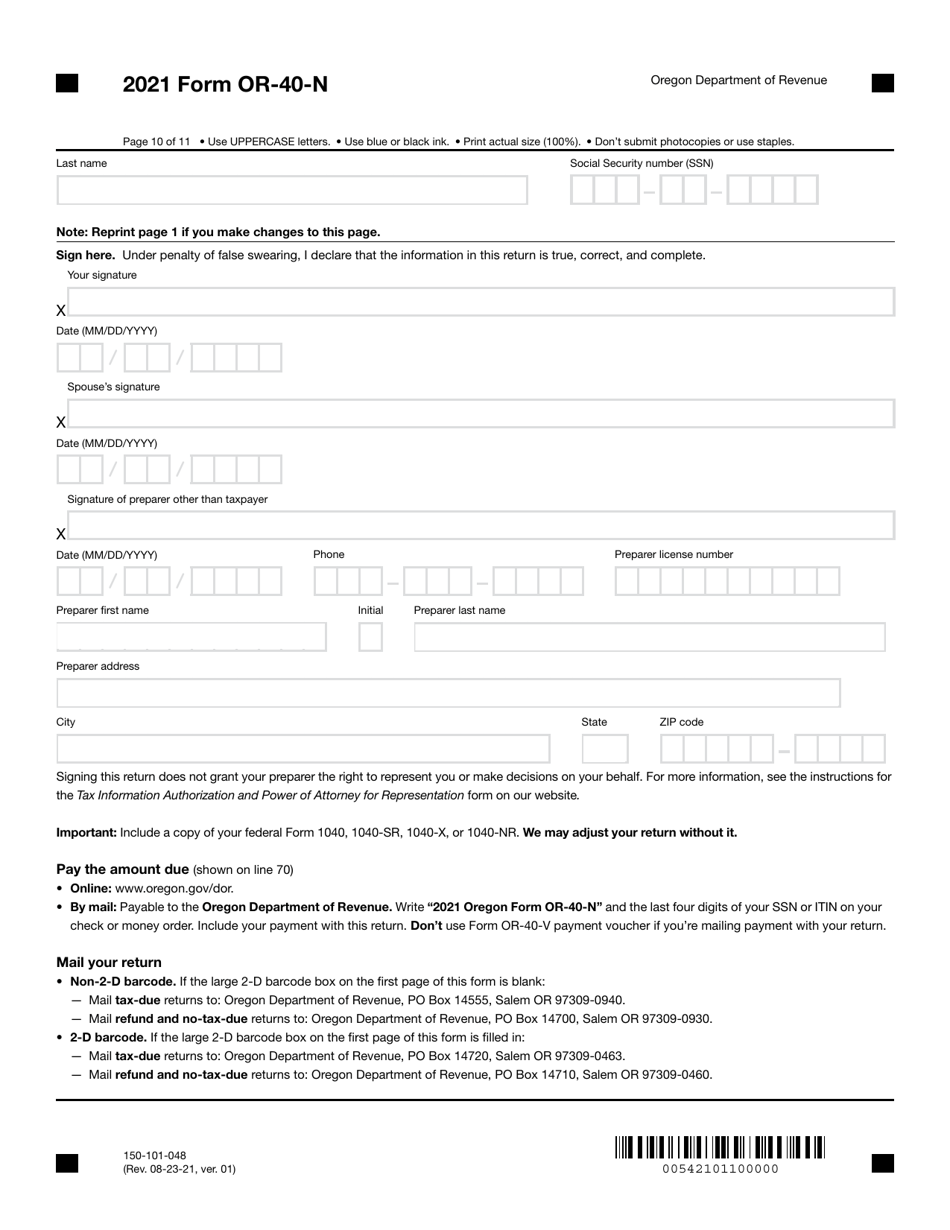

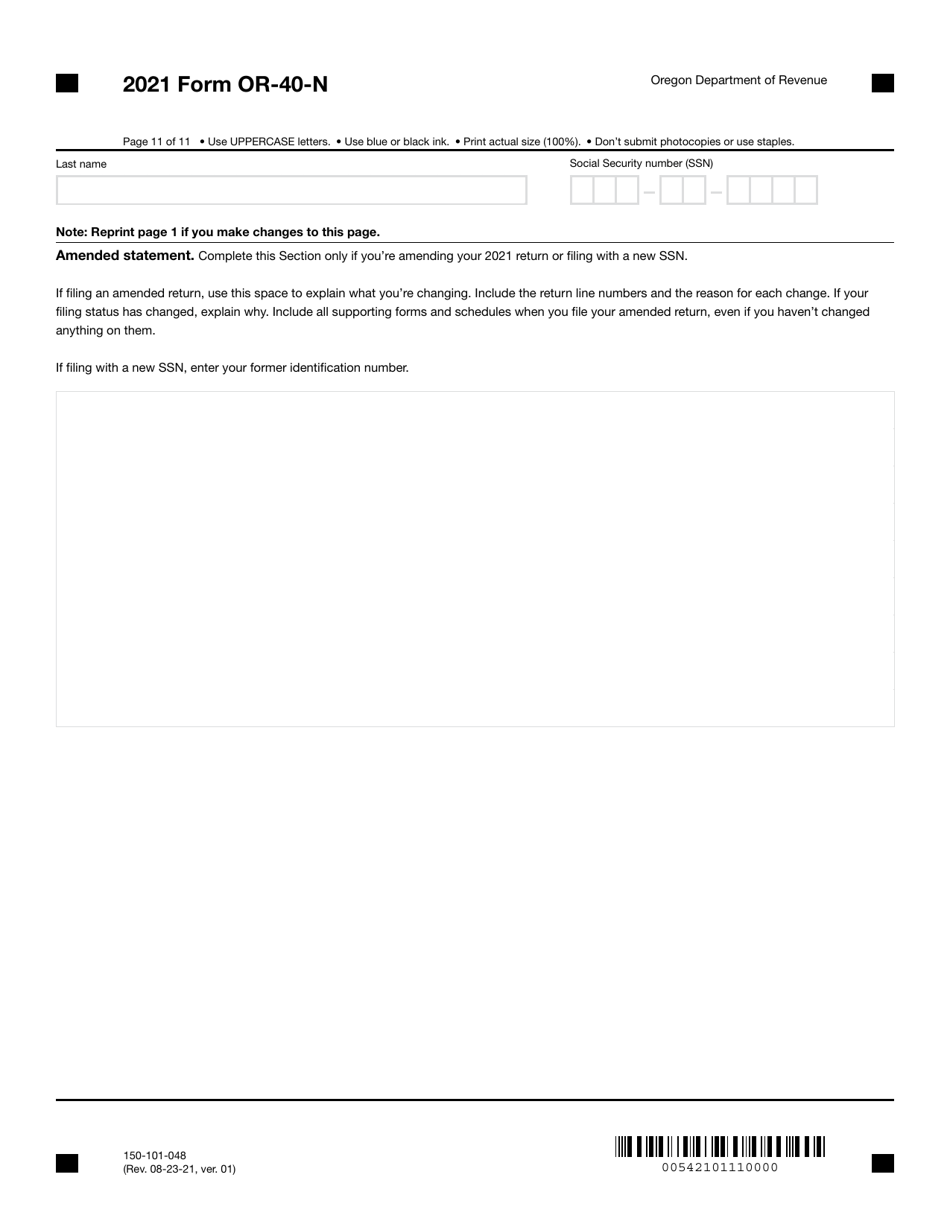

This version of the form is not currently in use and is provided for reference only. Download this version of

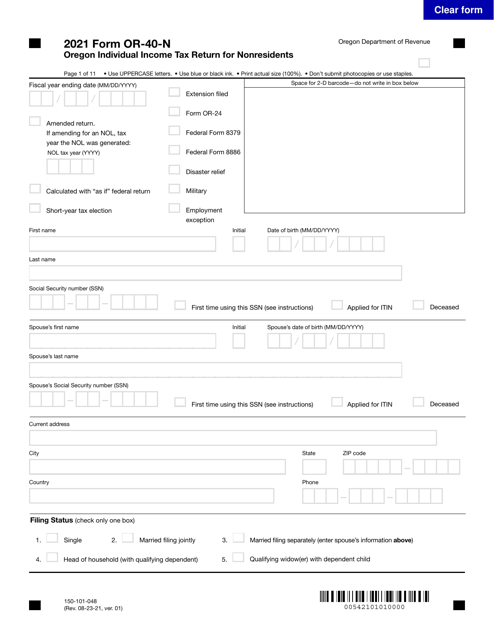

Form OR-40-N (150-101-048)

for the current year.

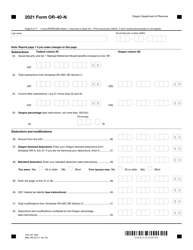

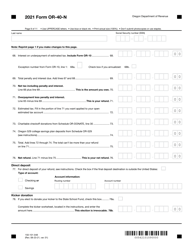

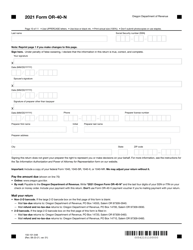

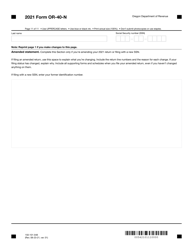

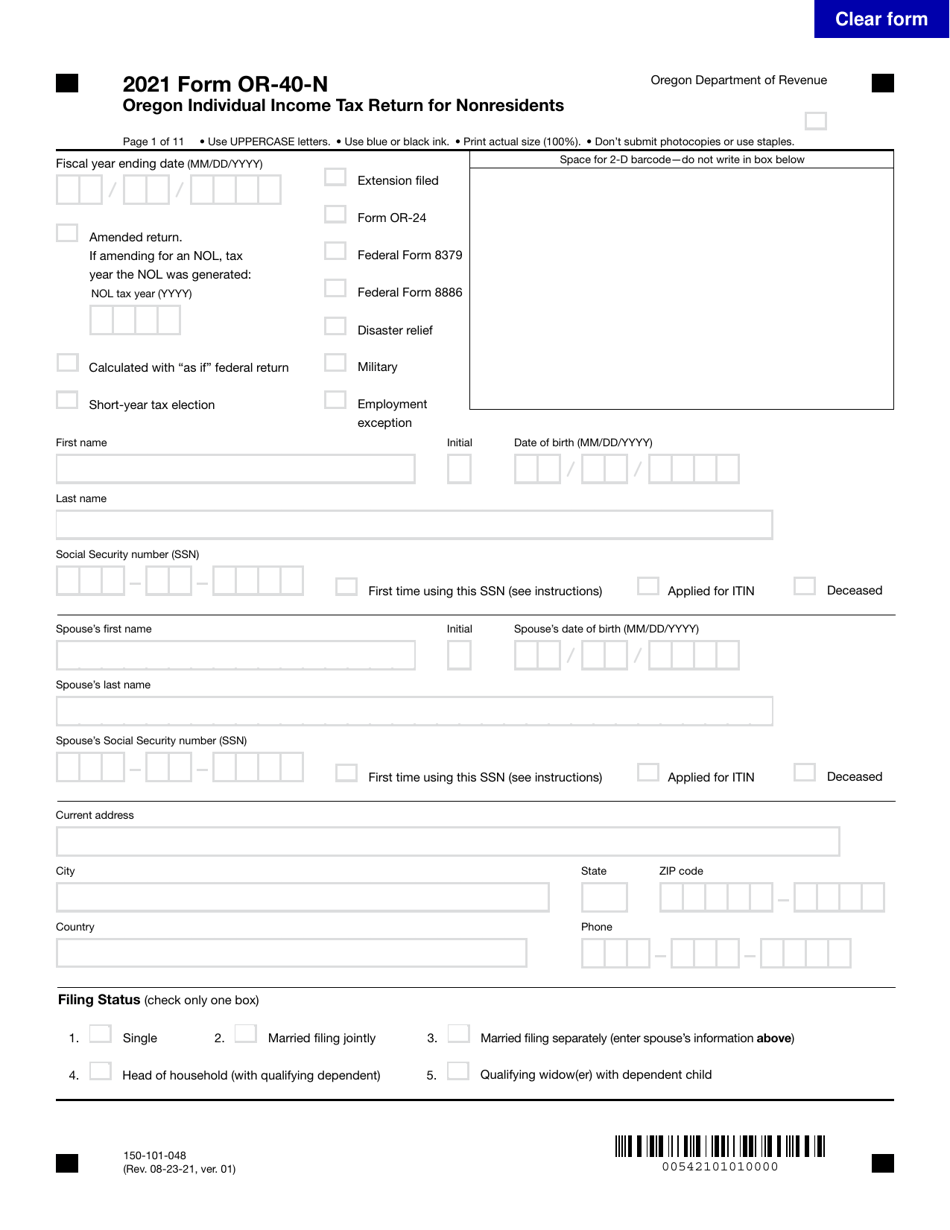

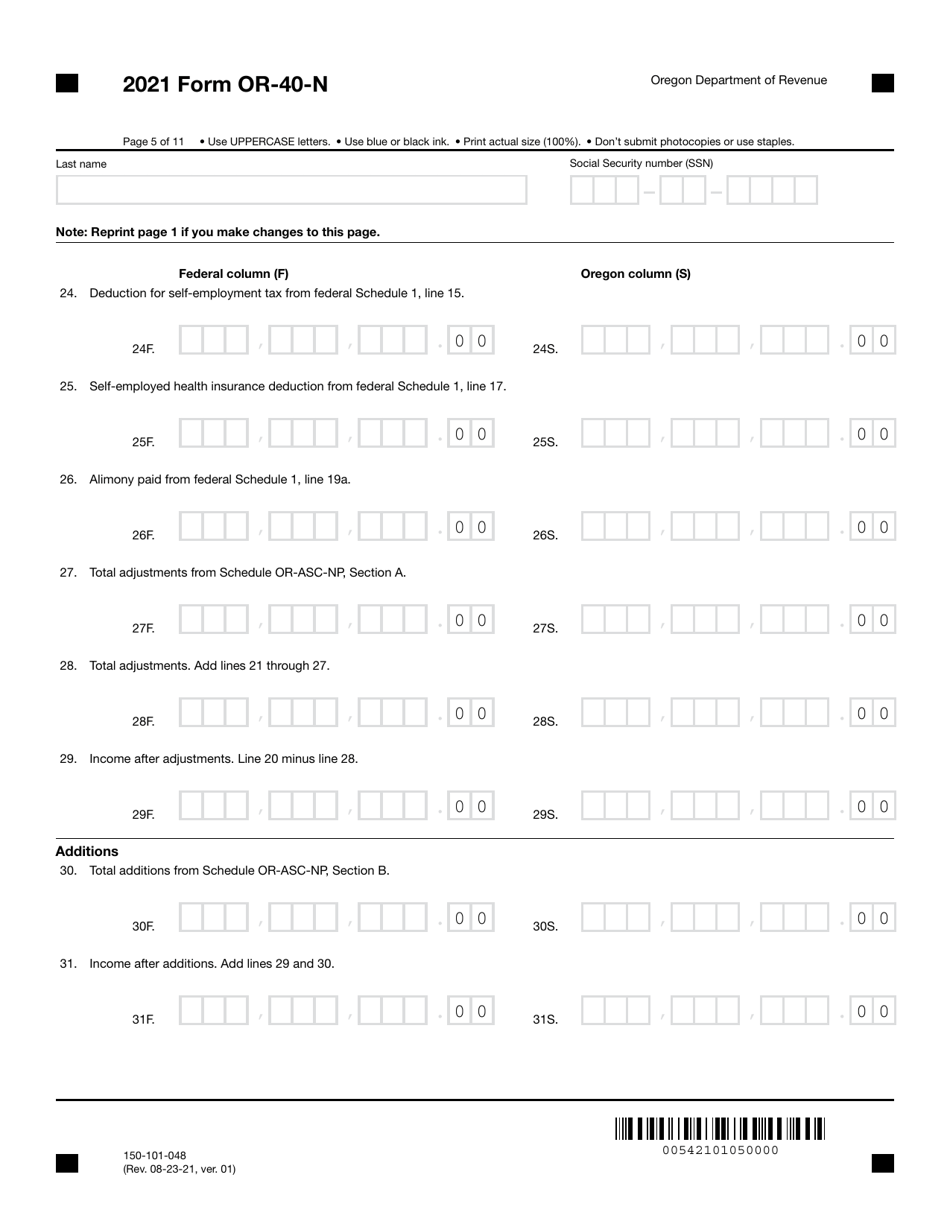

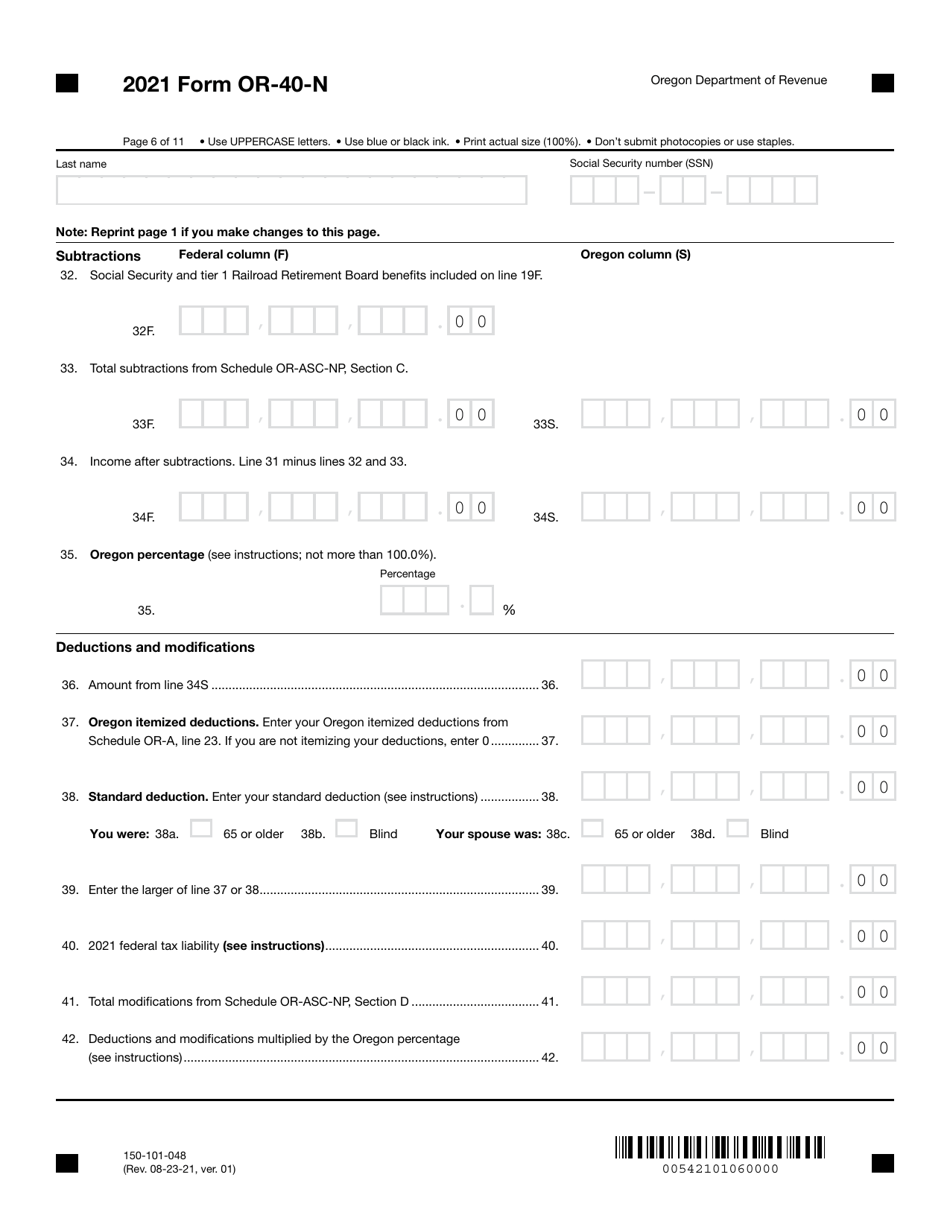

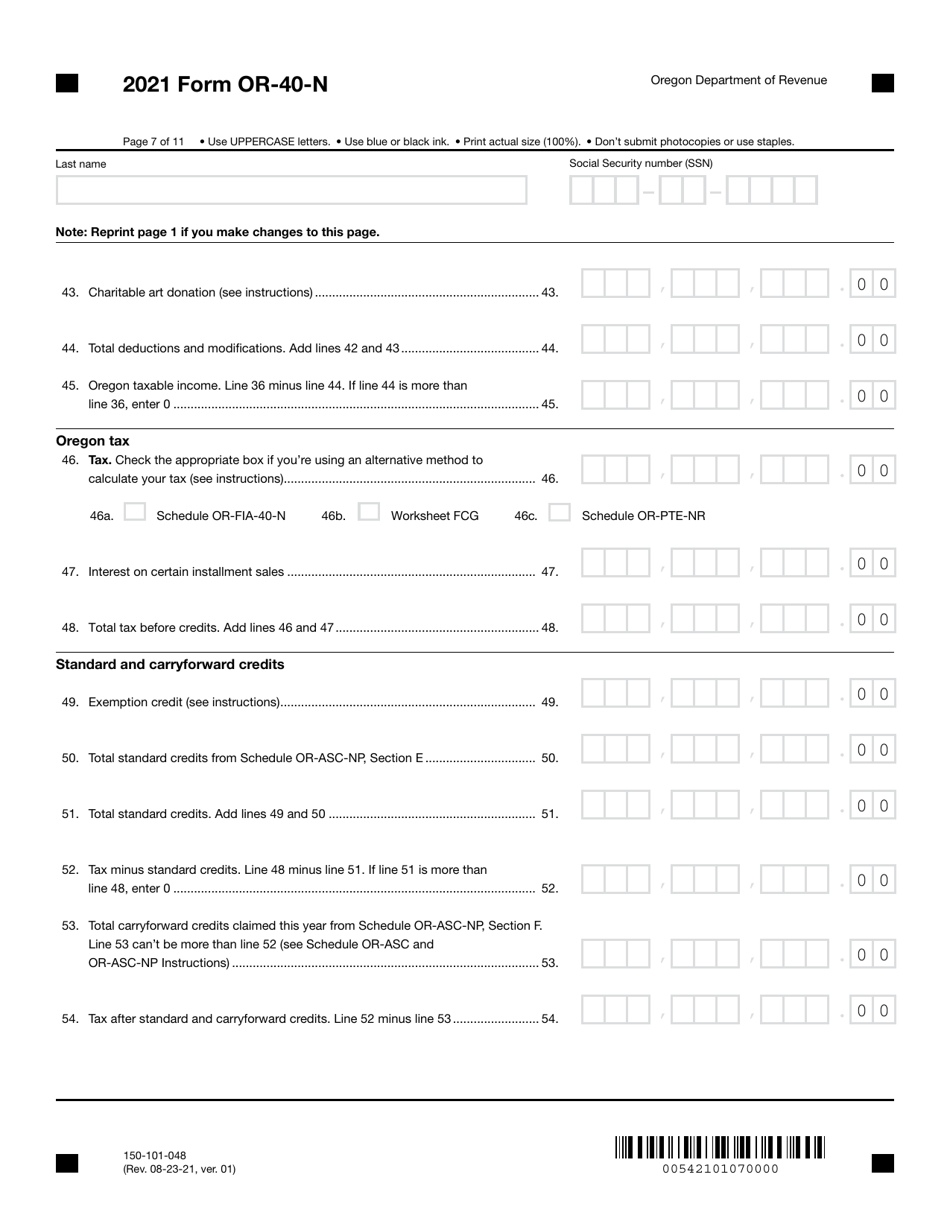

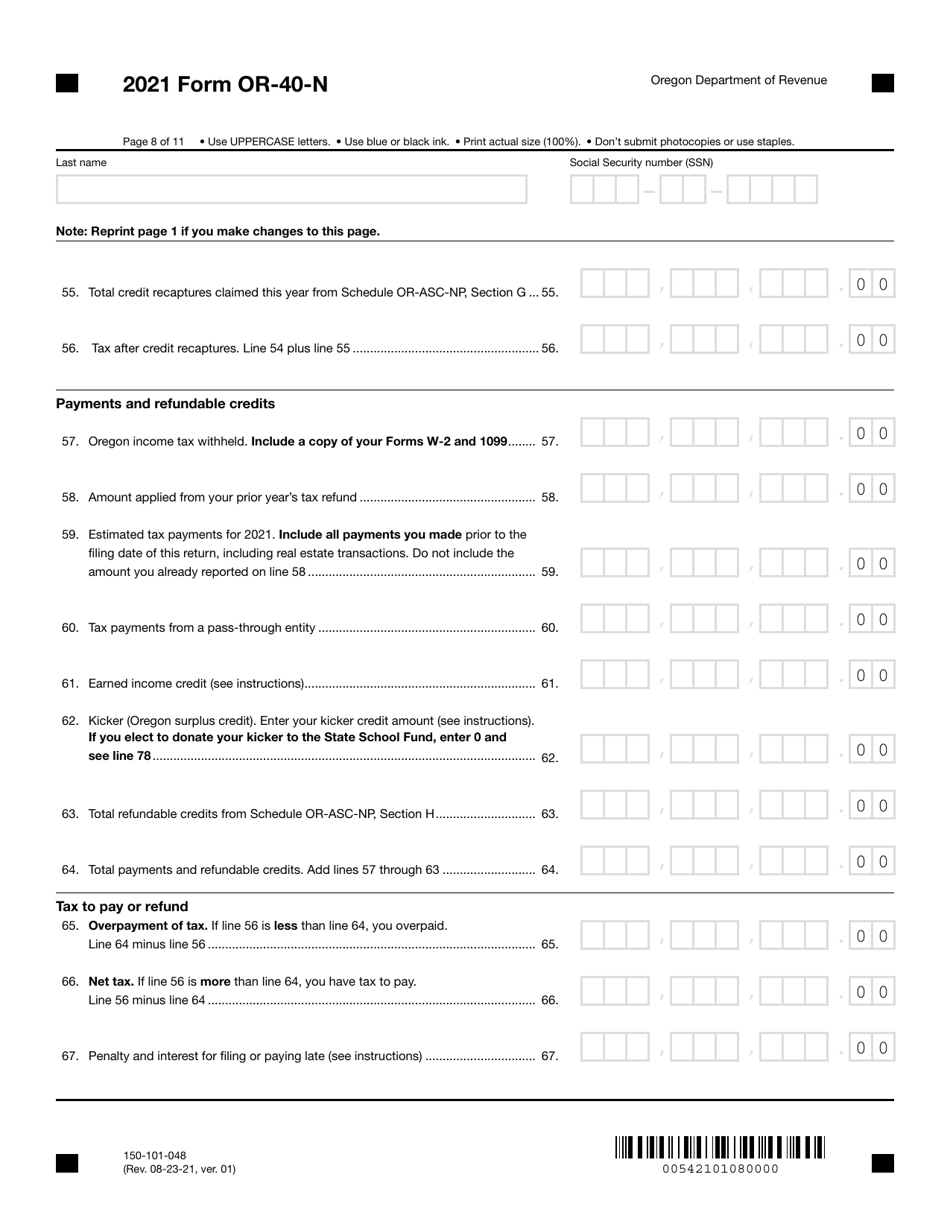

Form OR-40-N (150-101-048) Oregon Individual Income Tax Return for Nonresidents - Oregon

What Is Form OR-40-N (150-101-048)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file a Form OR-40-N?

A: Nonresidents who earned income in Oregon and need to pay state income tax.

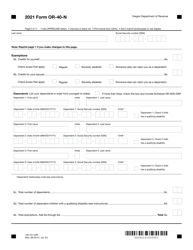

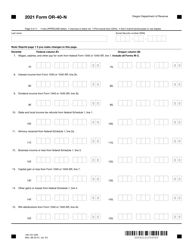

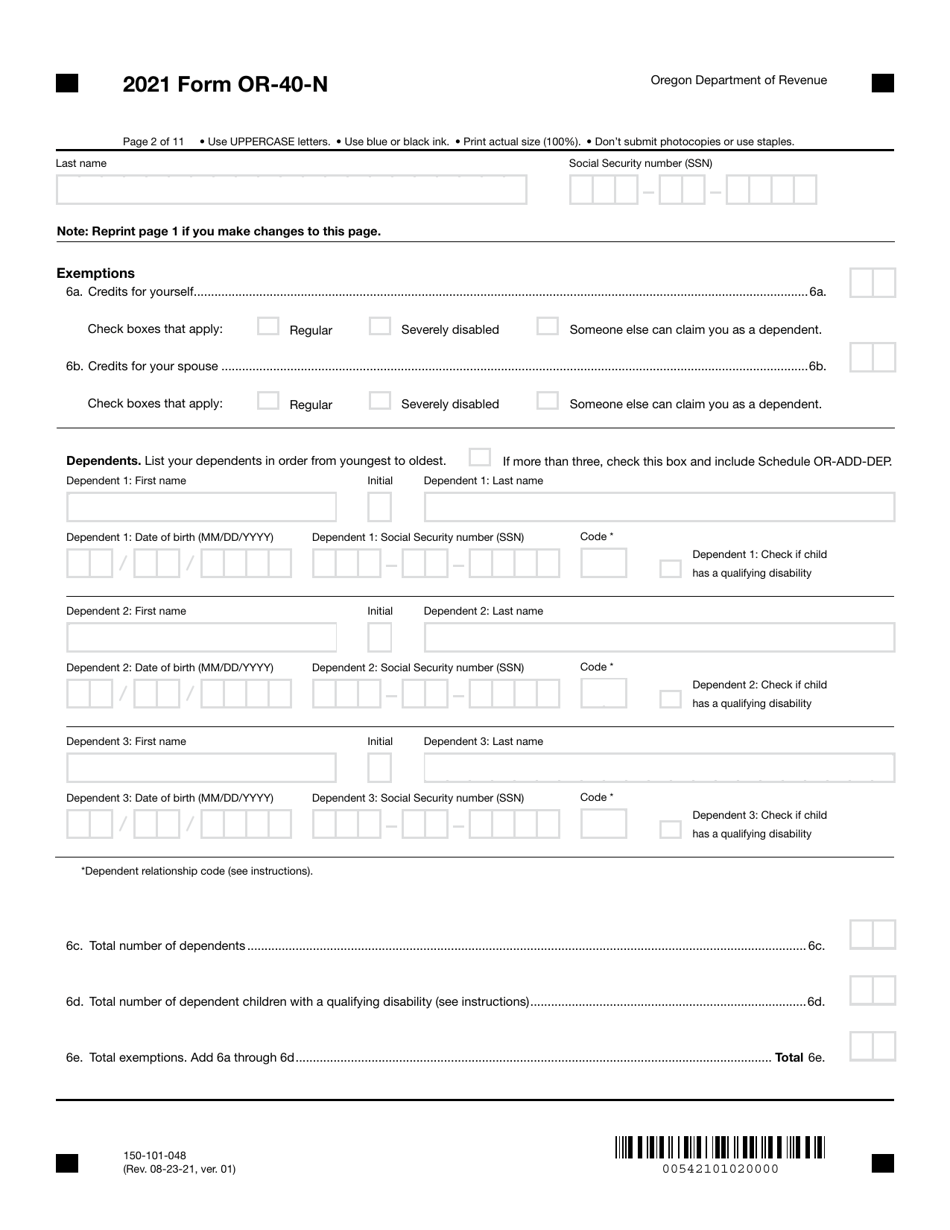

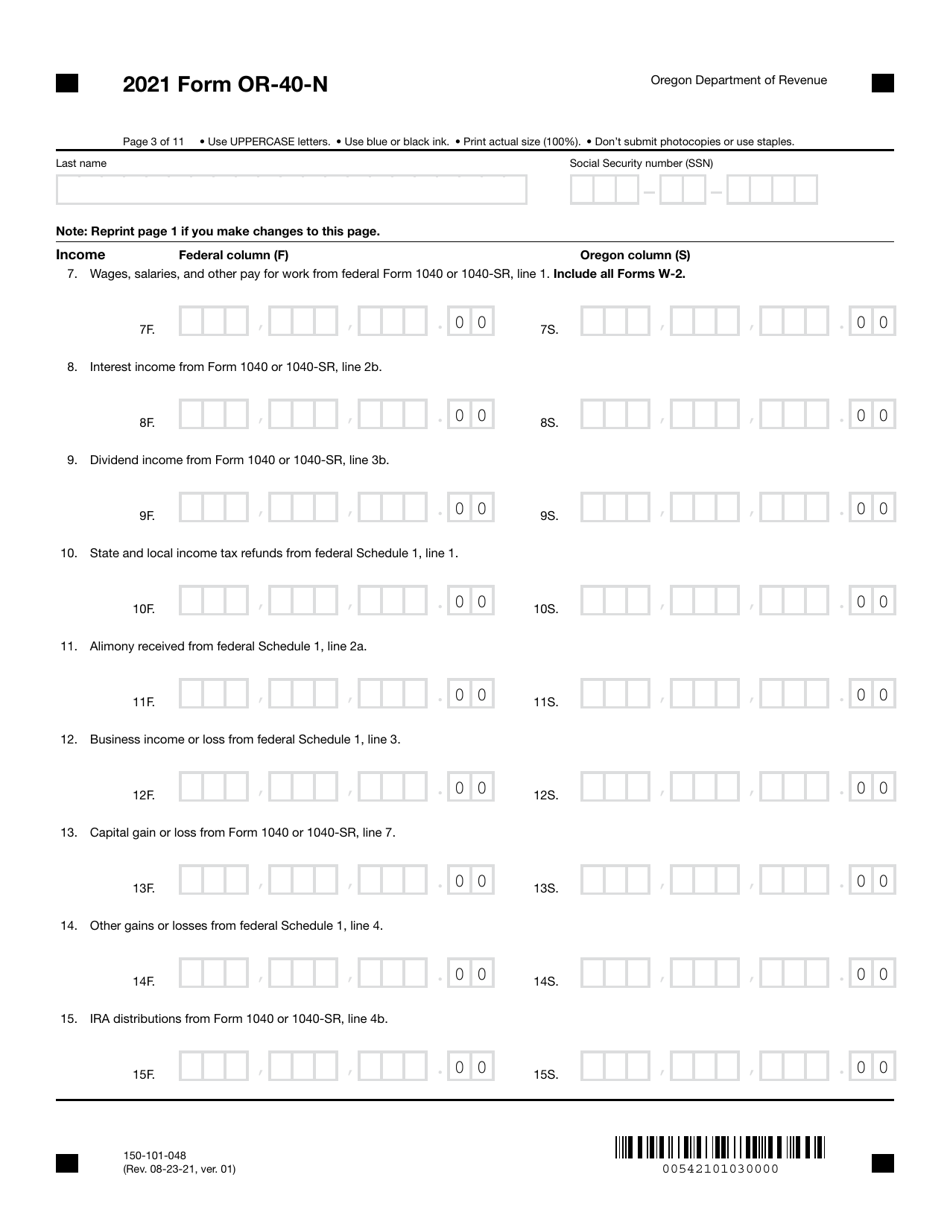

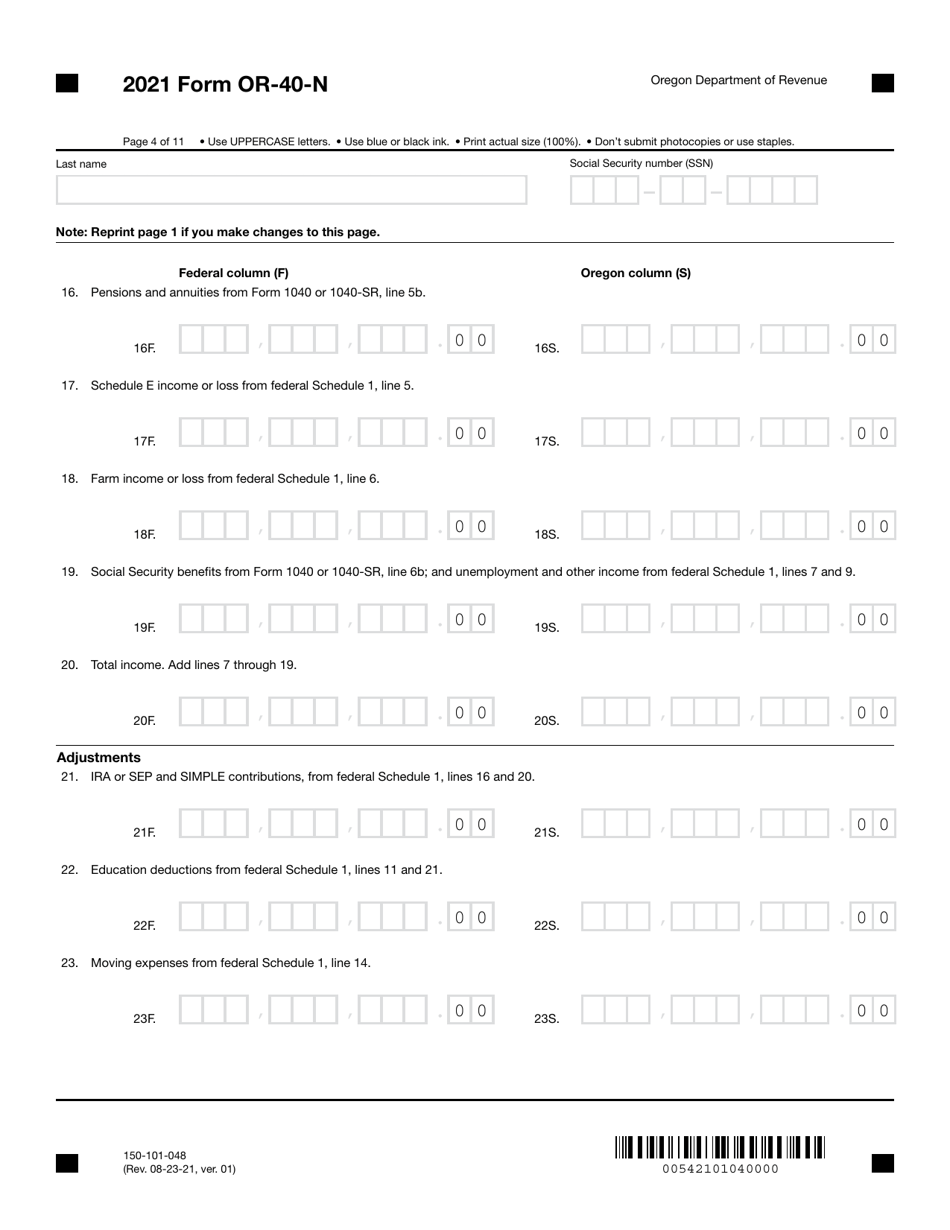

Q: What information is needed to complete Form OR-40-N?

A: You will need to provide your personal information, income details, and any applicable deductions or credits.

Q: When is the deadline to file Form OR-40-N?

A: The deadline to file the Form OR-40-N is typically April 15th, the same as the federal tax deadline.

Q: Can I e-file the Form OR-40-N?

A: Yes, Oregon accepts electronic filing for the Form OR-40-N. You can use approved software or an authorized tax preparer to e-file.

Q: Do I need to include a copy of my federal tax return with Form OR-40-N?

A: No, you do not need to include a copy of your federal tax return with Form OR-40-N. However, you may need to reference information from your federal return when completing the Oregon return.

Form Details:

- Released on August 23, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-40-N (150-101-048) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.