This version of the form is not currently in use and is provided for reference only. Download this version of

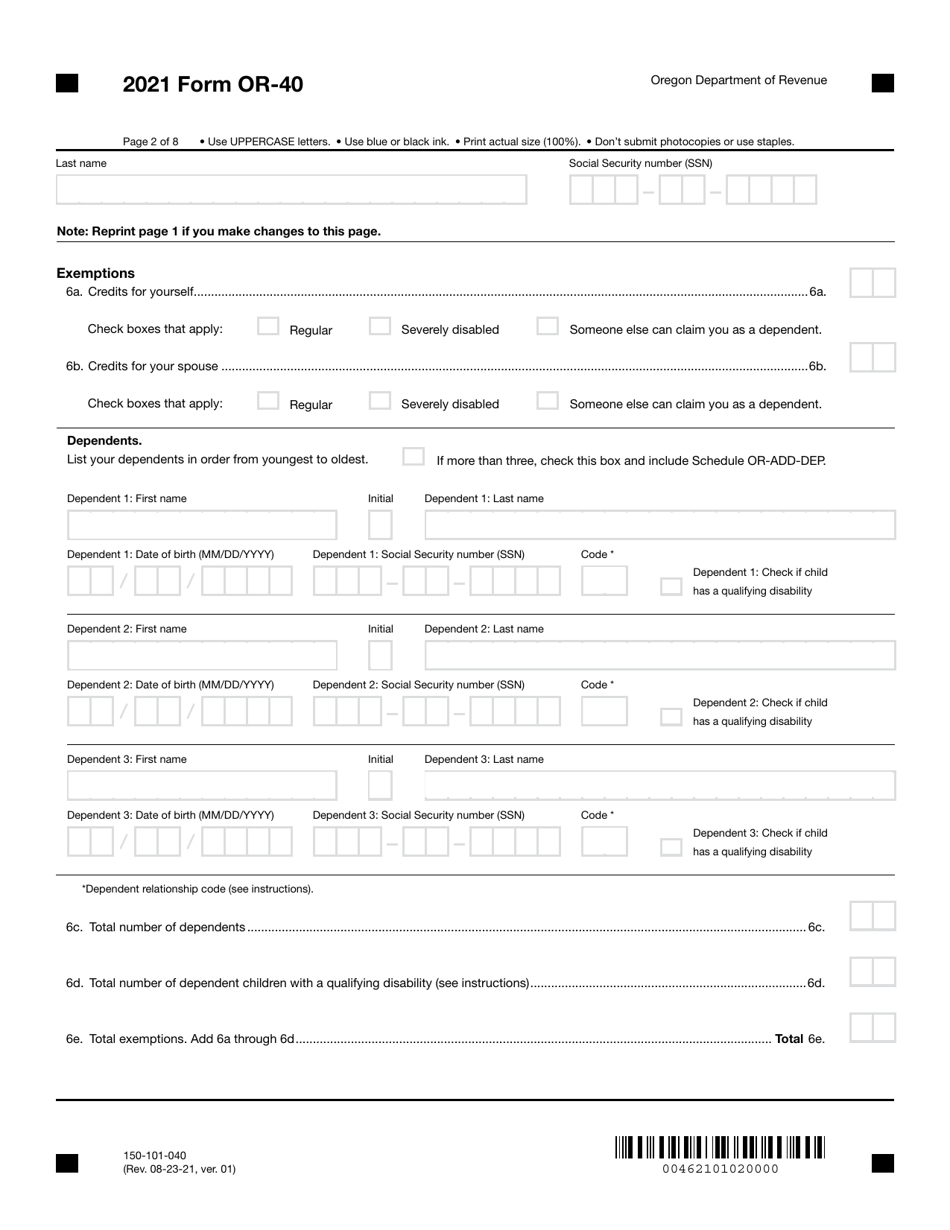

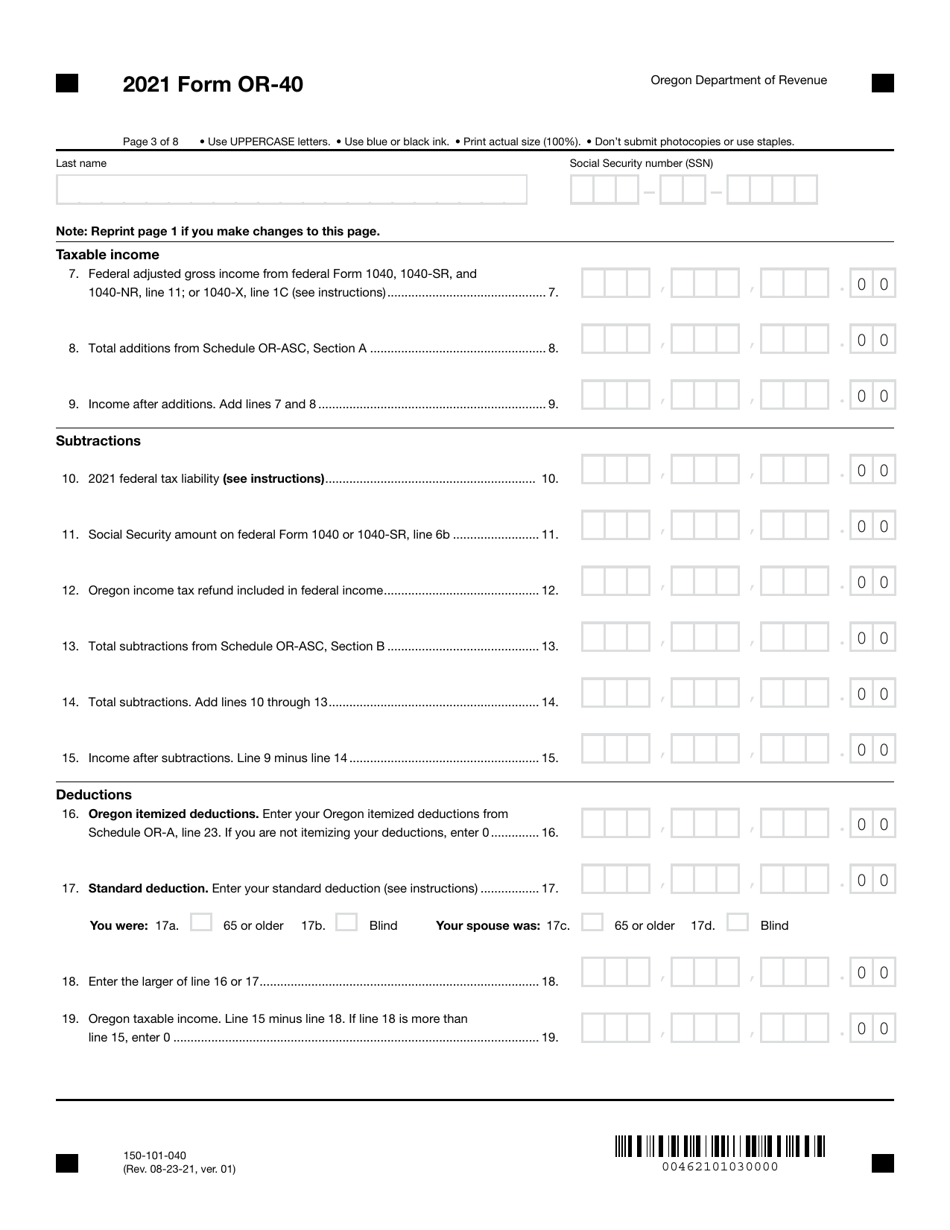

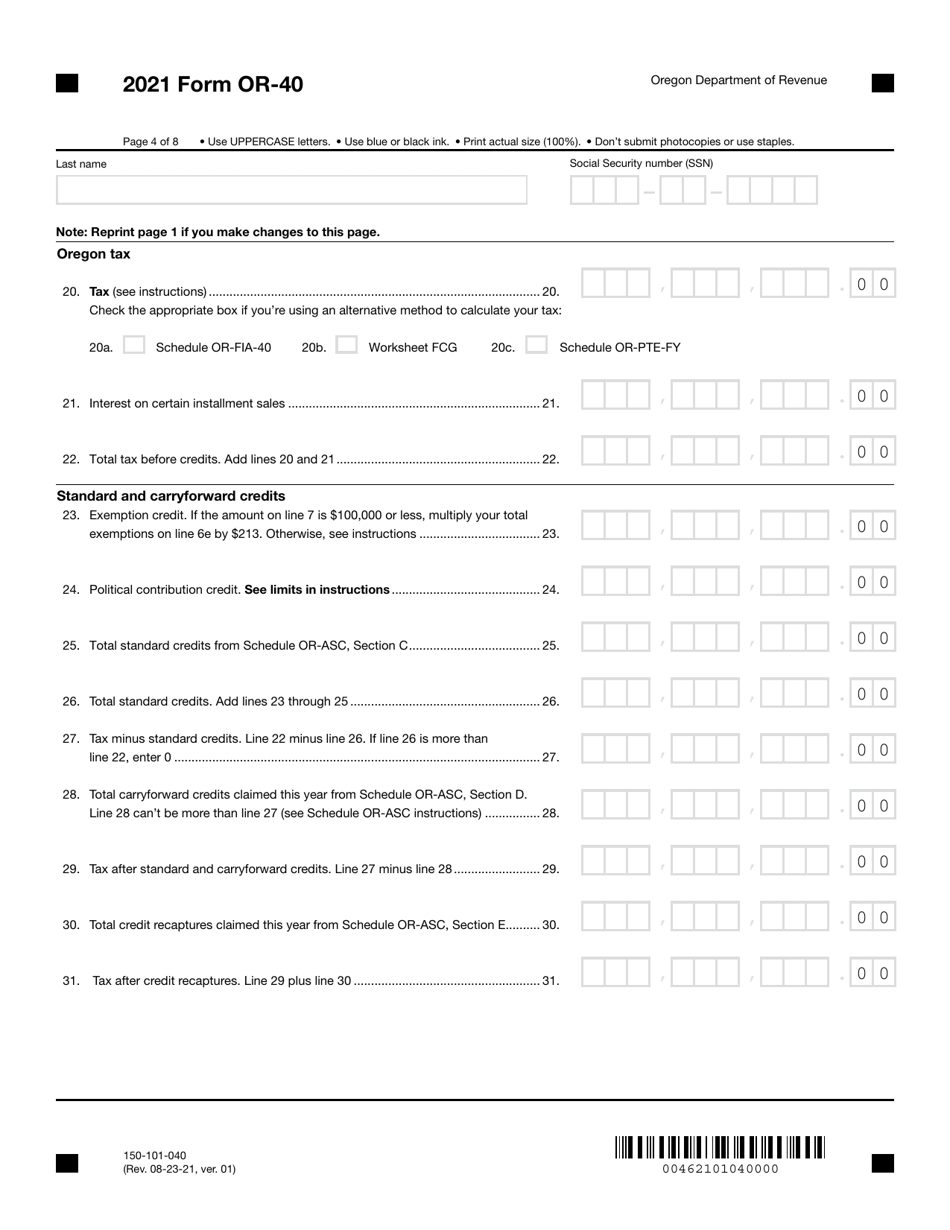

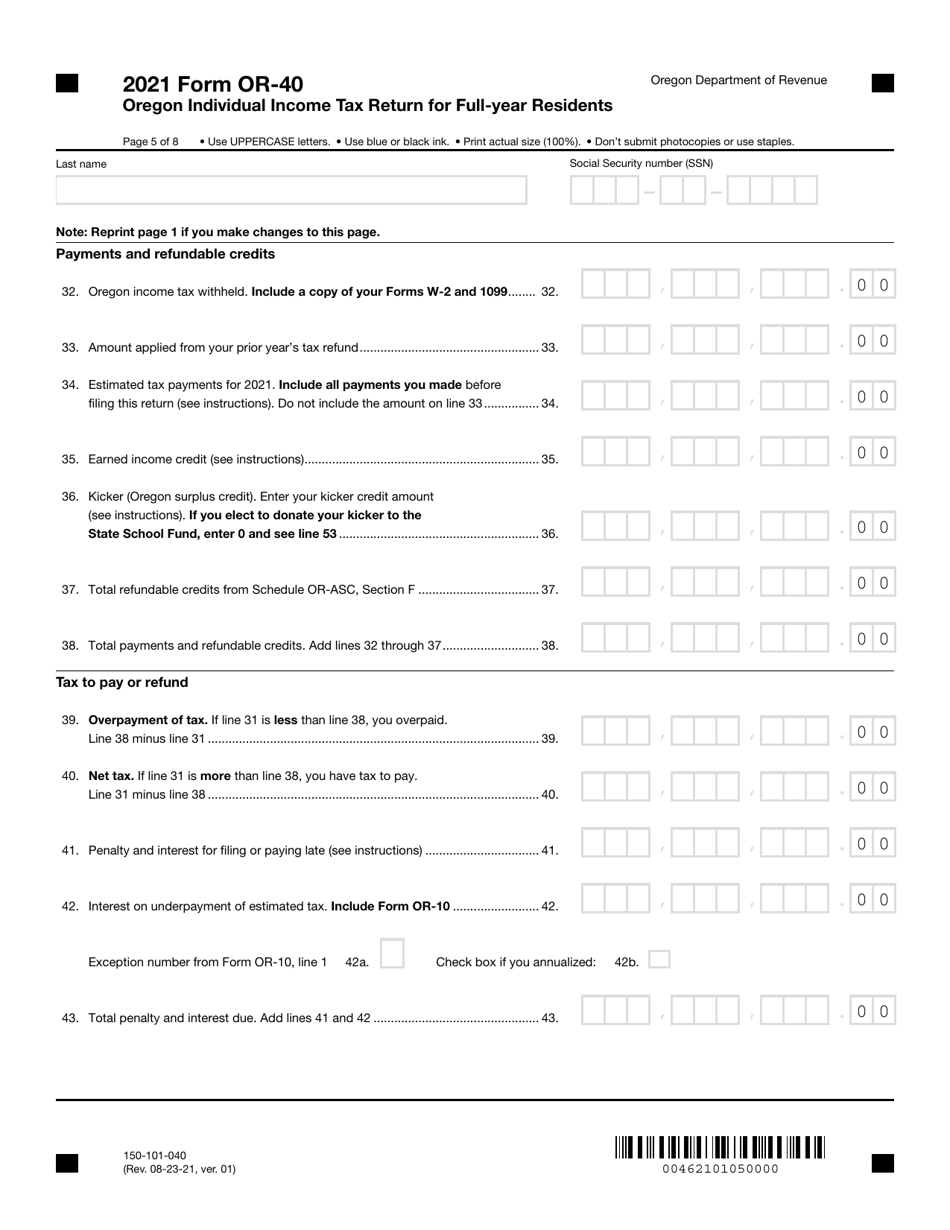

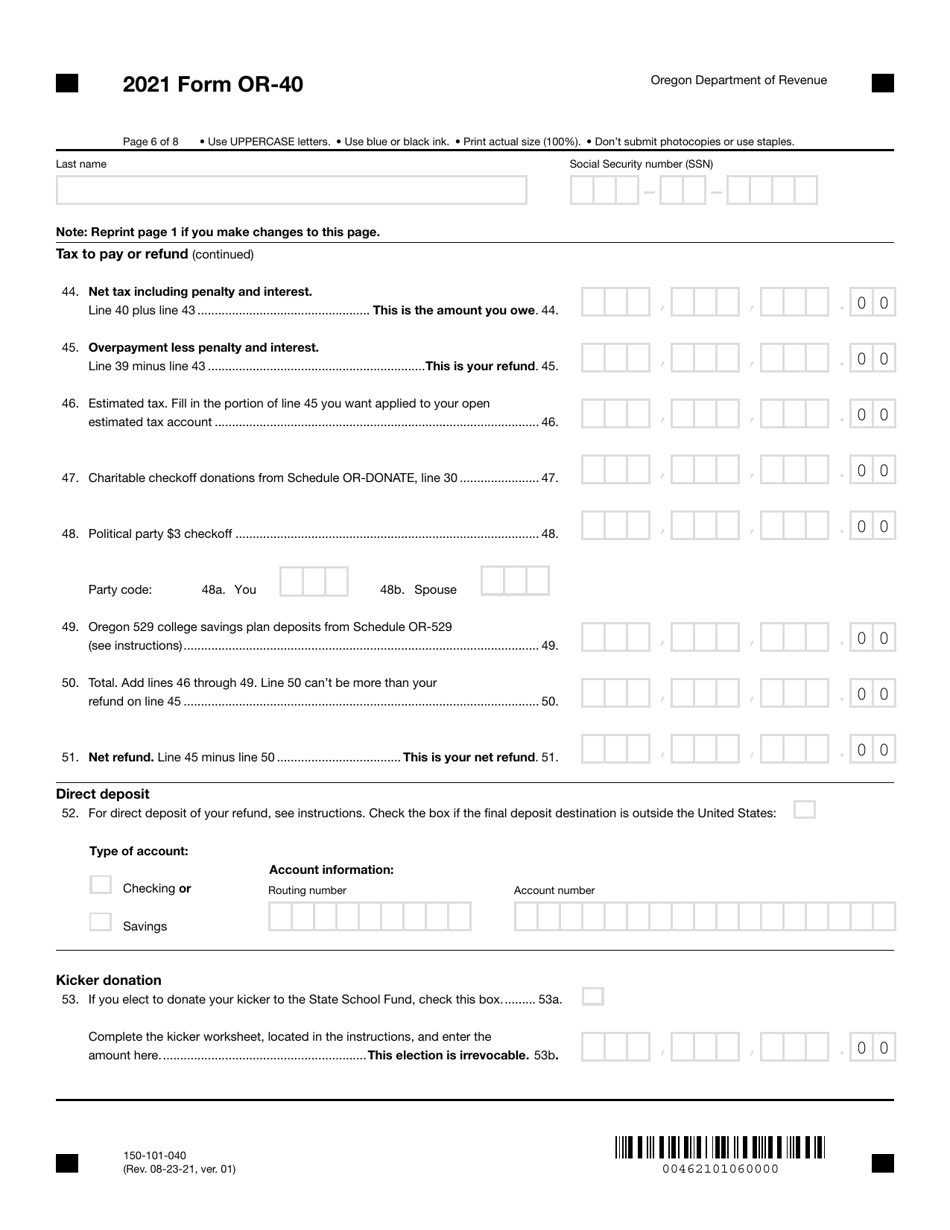

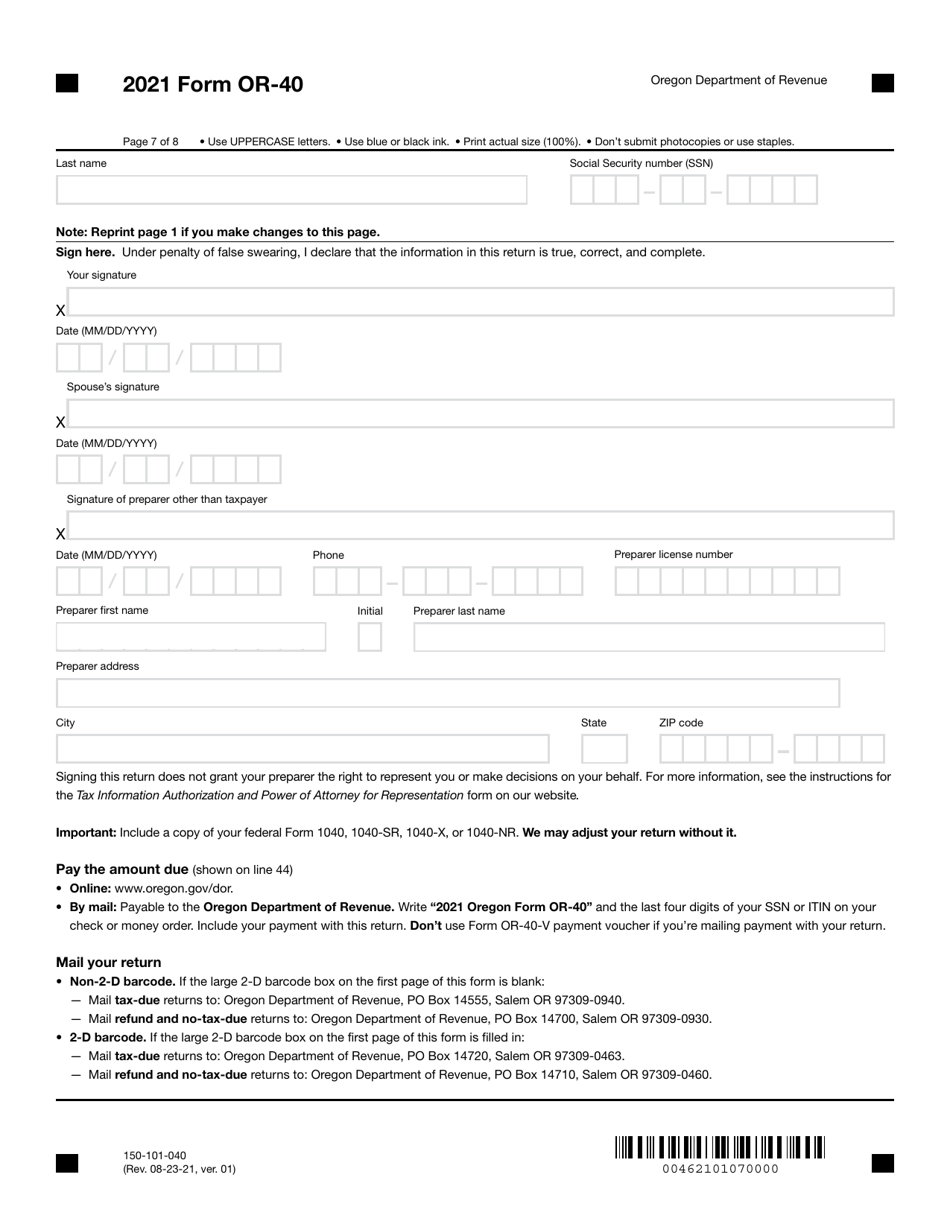

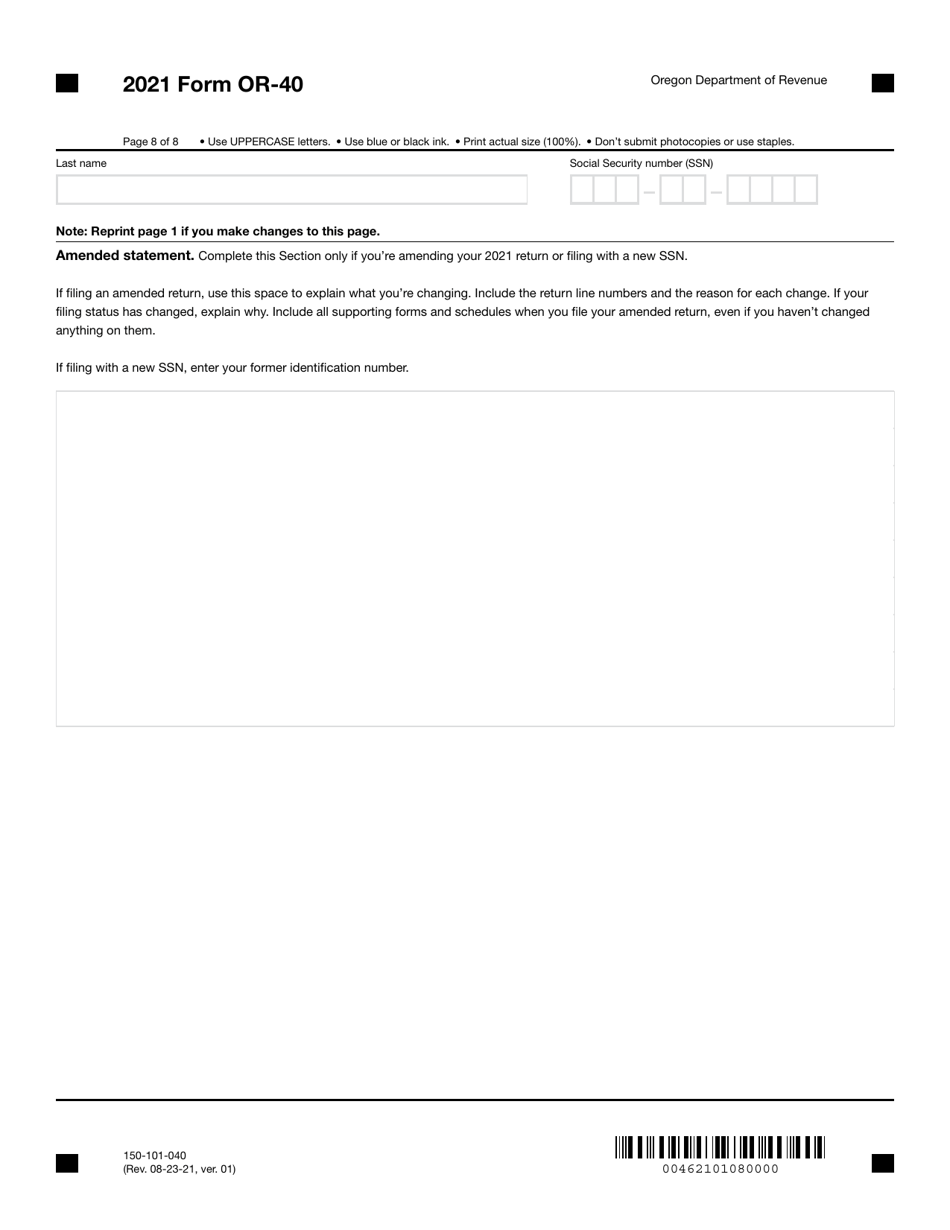

Form OR-40 (150-101-040)

for the current year.

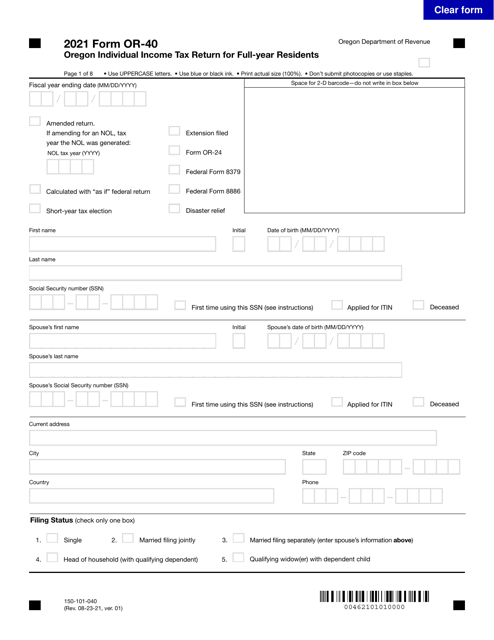

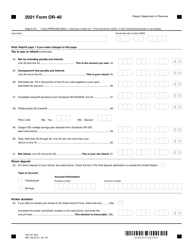

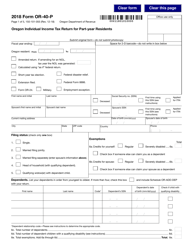

Form OR-40 (150-101-040) Oregon Individual Income Tax Return for Full-Year Residents - Oregon

What Is Form OR-40 (150-101-040)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-40?

A: Form OR-40 is the Oregon Individual Income Tax Return for Full-Year Residents.

Q: Who should use Form OR-40?

A: Oregon residents who need to file their individual income tax return should use Form OR-40.

Q: When is Form OR-40 due?

A: Form OR-40 is generally due on April 15th of each year, unless that date falls on a weekend or holiday.

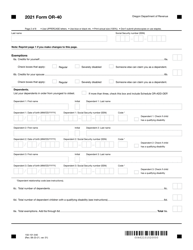

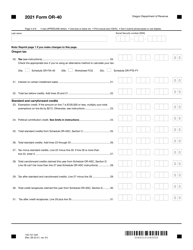

Q: What information do I need to complete Form OR-40?

A: To complete Form OR-40, you will need information about your income, deductions, credits, and other relevant tax information.

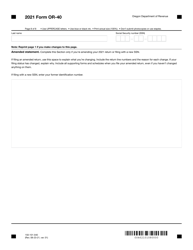

Q: Is there a penalty for filing Form OR-40 late?

A: Yes, if you file Form OR-40 after the due date, you may be subject to penalties and interest on any unpaid tax balance.

Form Details:

- Released on August 23, 2021;

- The latest edition provided by the Oregon Department of Revenue;

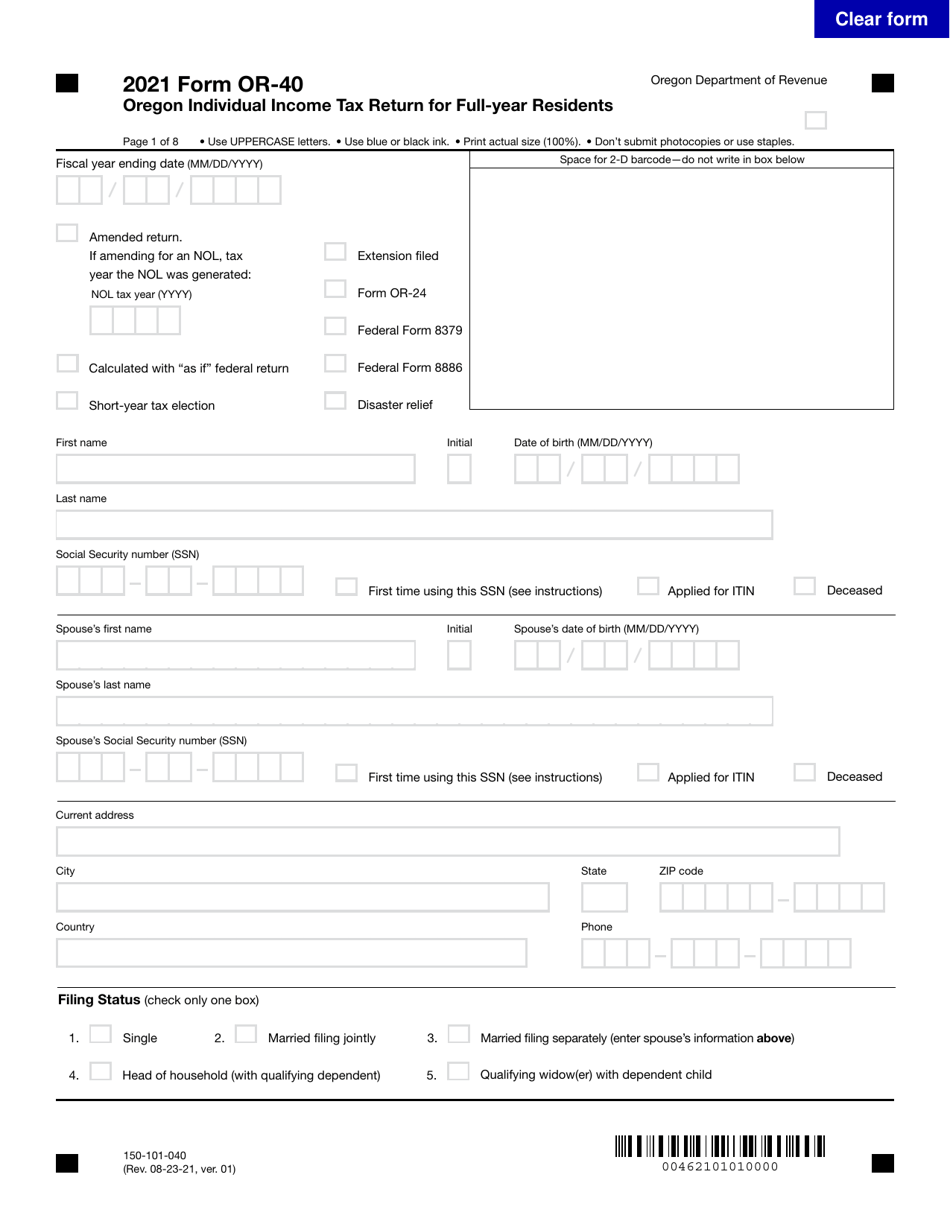

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-40 (150-101-040) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.