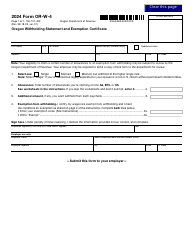

This version of the form is not currently in use and is provided for reference only. Download this version of

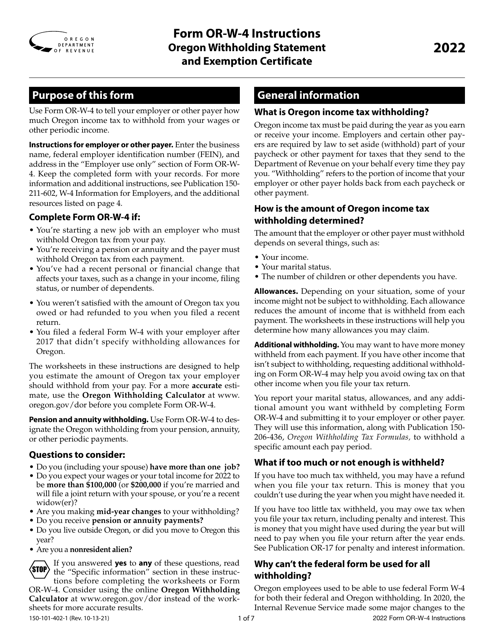

Instructions for Form OR-W-4, 150-101-402

for the current year.

Instructions for Form OR-W-4, 150-101-402 Oregon Withholding Statement and Exemption Certificate - Oregon

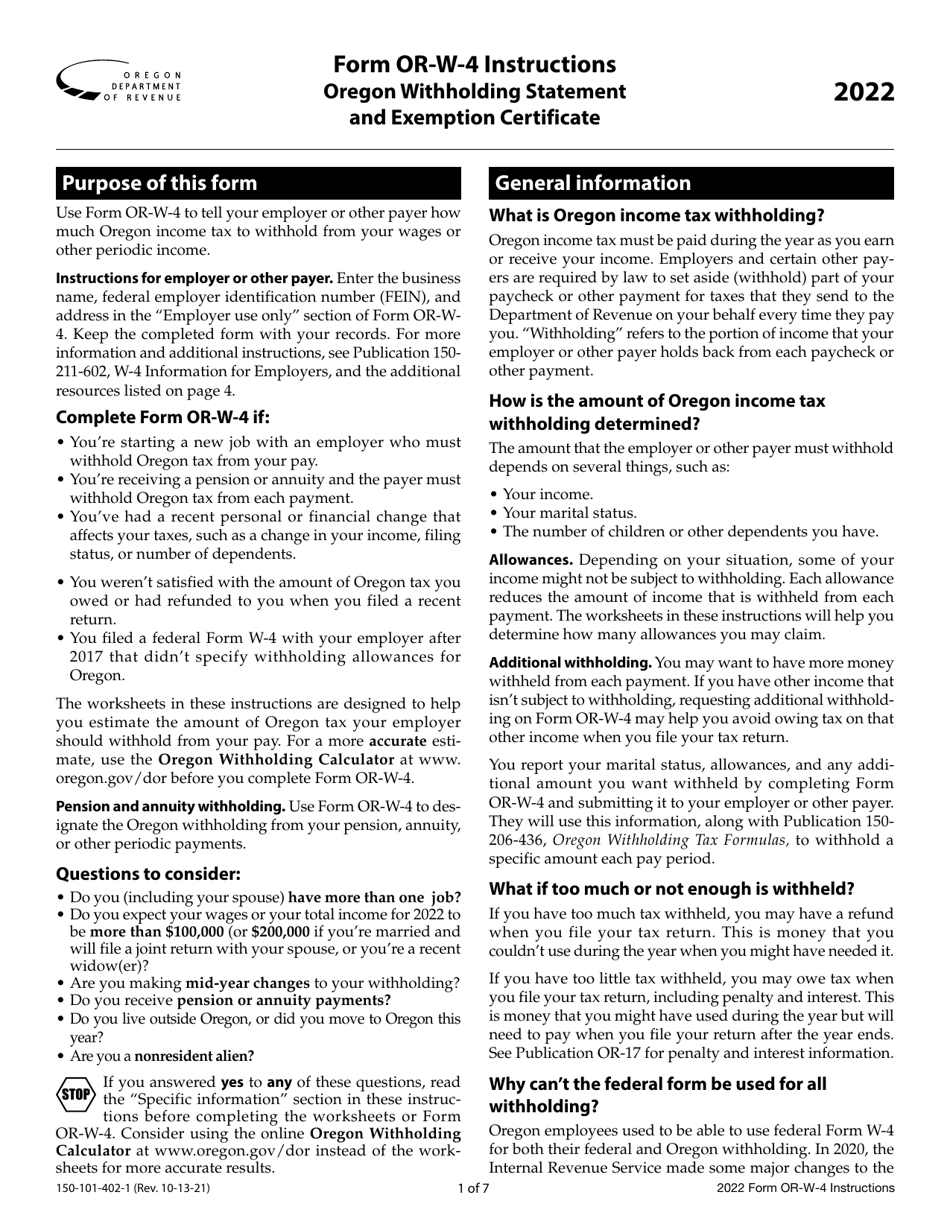

This document contains official instructions for Form OR-W-4 , and Form 150-101-402 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-W-4 (150-101-402) is available for download through this link.

FAQ

Q: What is Form OR-W-4?

A: Form OR-W-4 is the Oregon Withholding Statement and Exemption Certificate.

Q: What is the purpose of Form OR-W-4?

A: The purpose of Form OR-W-4 is to determine the amount of income tax that should be withheld from your wages in the state of Oregon.

Q: Who needs to fill out Form OR-W-4?

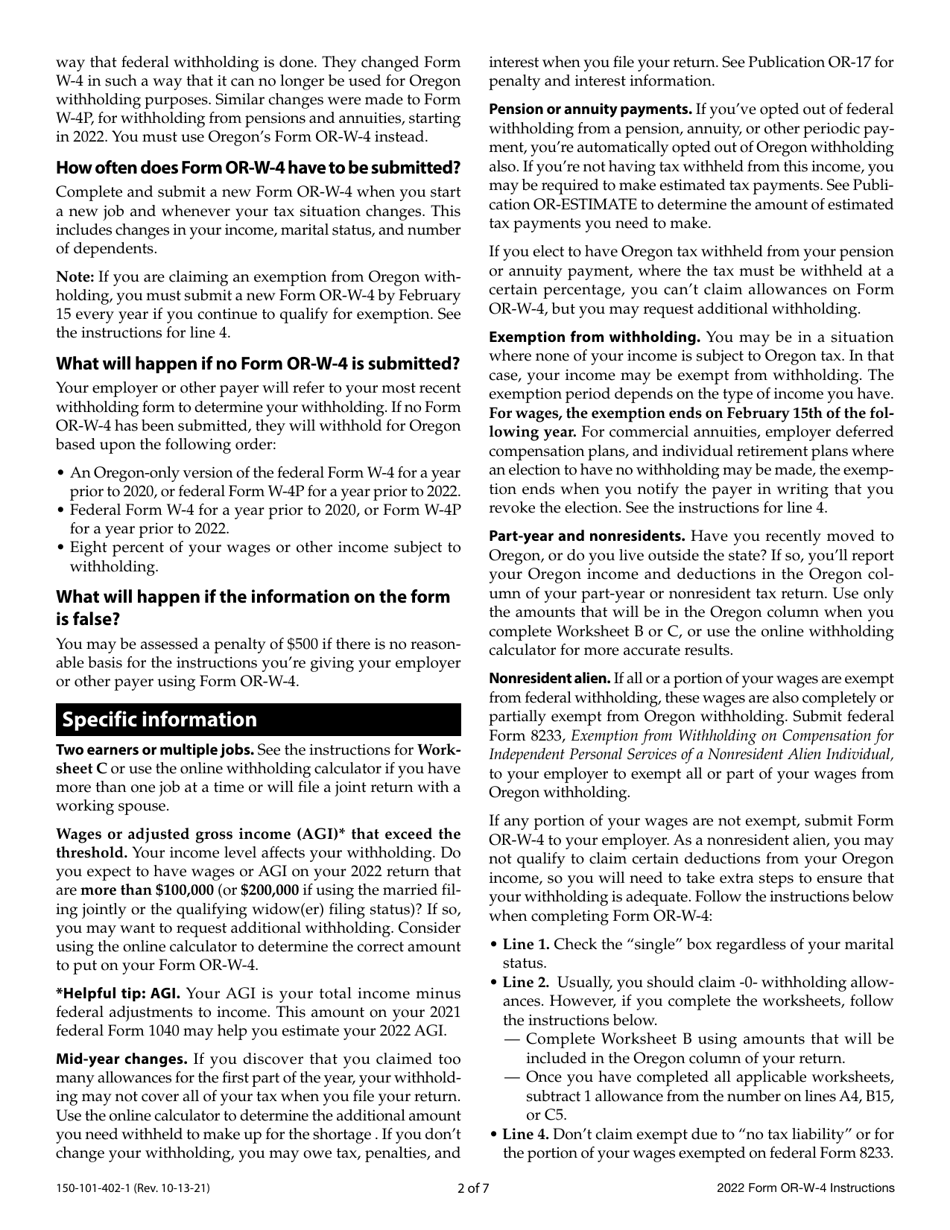

A: Employees who work in the state of Oregon and want to adjust their Oregon state income tax withholding need to fill out Form OR-W-4.

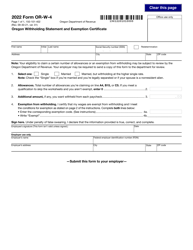

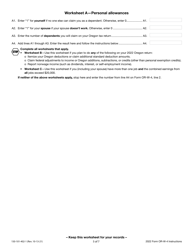

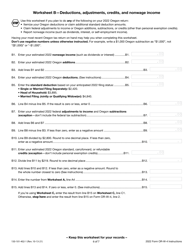

Q: What information do I need to provide on Form OR-W-4?

A: You need to provide your personal information, your filing status, number of exemptions, and any additional withholding amounts.

Q: Can I claim exempt from Oregon state income tax withholding?

A: Yes, you can claim exempt from Oregon state income tax withholding if you meet certain conditions.

Q: How often do I need to fill out Form OR-W-4?

A: You need to fill out Form OR-W-4 whenever your tax situation changes, or at least once a year.

Q: What if I don't fill out Form OR-W-4?

A: If you don't fill out Form OR-W-4, your employer will withhold Oregon state income tax based on the default withholding rates.

Q: Can I update my Form OR-W-4 at any time?

A: Yes, you can update your Form OR-W-4 at any time by submitting a new form to your employer.

Q: Do I need to submit Form OR-W-4 to the Oregon Department of Revenue?

A: No, you do not need to submit Form OR-W-4 to the Oregon Department of Revenue. You only need to provide it to your employer.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.