This version of the form is not currently in use and is provided for reference only. Download this version of

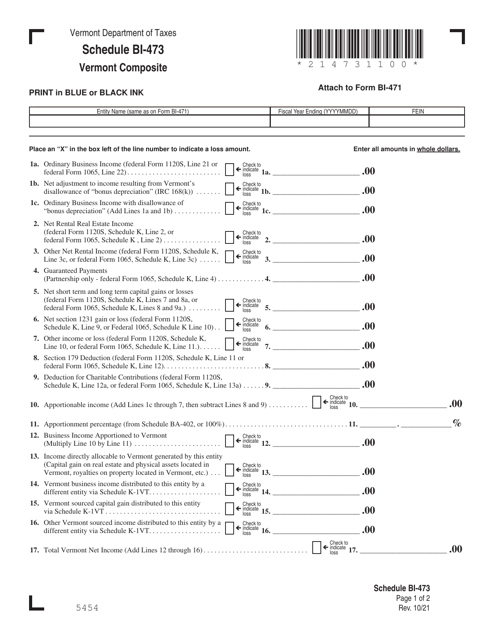

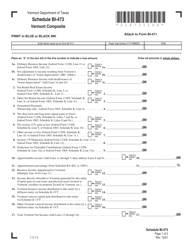

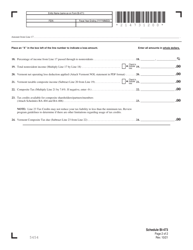

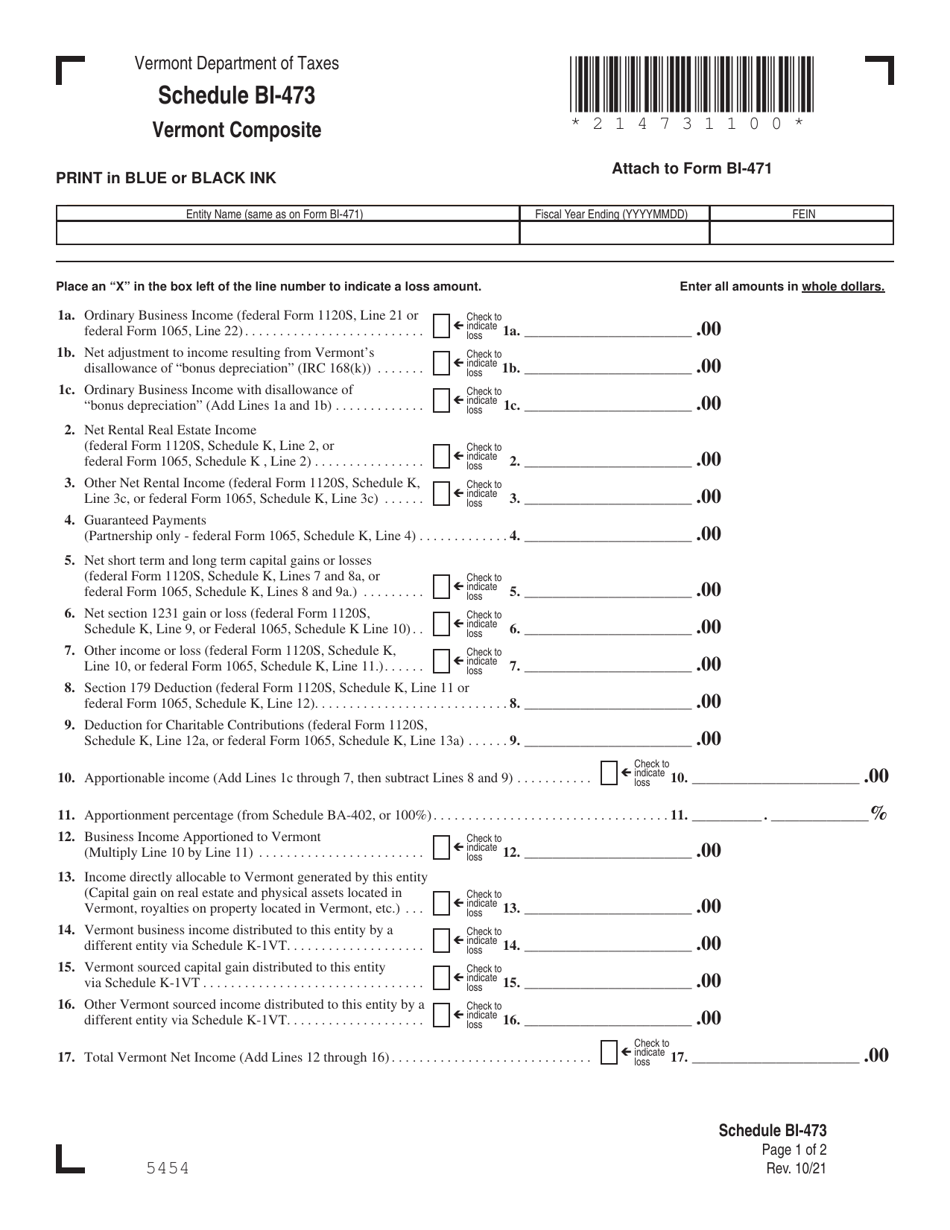

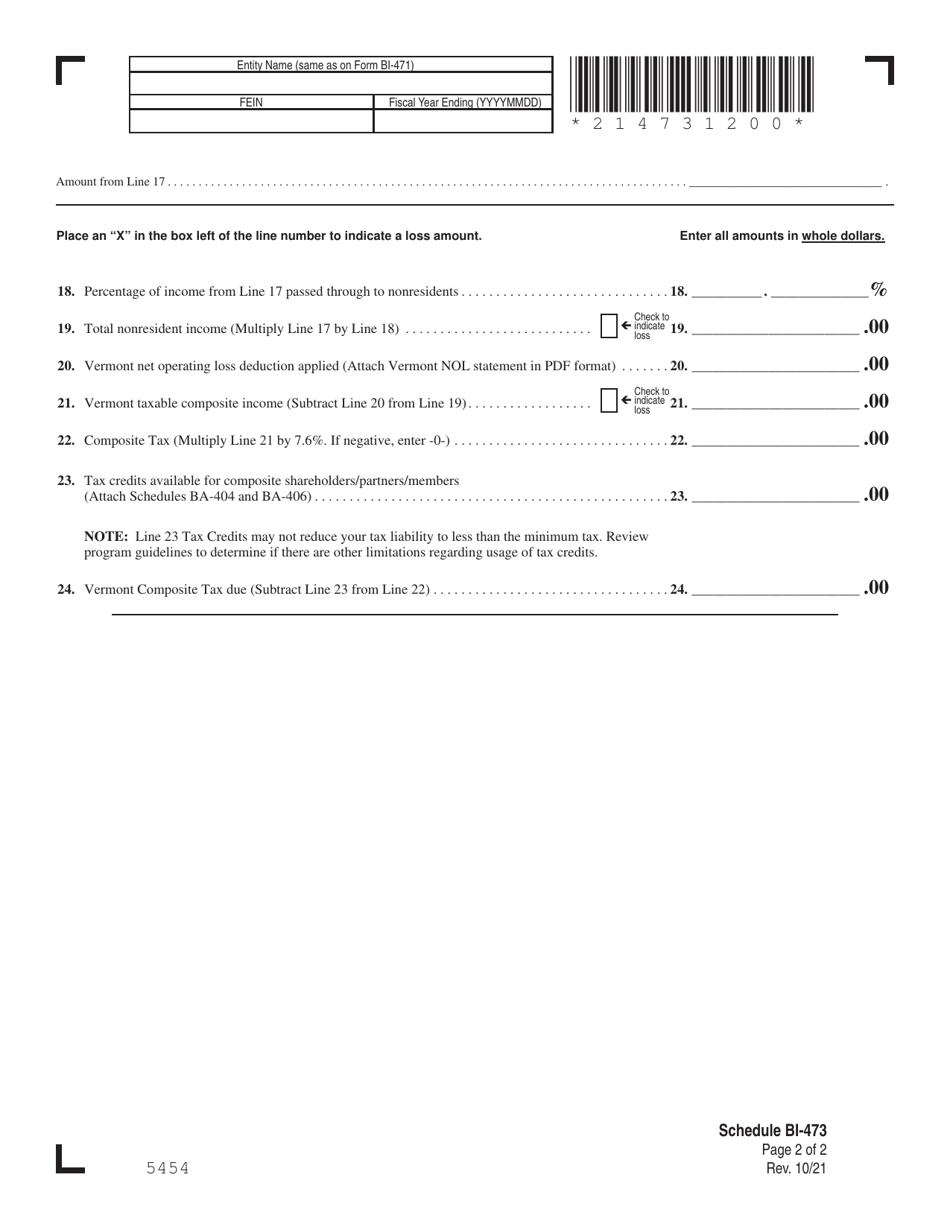

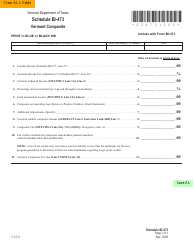

Schedule BI-473

for the current year.

Schedule BI-473 Vermont Composite - Vermont

What Is Schedule BI-473?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule BI-473?

A: Schedule BI-473 is a form used for reporting composite income in the state of Vermont.

Q: What is composite income?

A: Composite income is the combined income of all nonresident partners or shareholders in a pass-through entity.

Q: Who needs to file Schedule BI-473?

A: Pass-through entities with nonresident partners or shareholders who earned income in Vermont need to file Schedule BI-473.

Q: What information is required on Schedule BI-473?

A: Schedule BI-473 requires information about the income earned by nonresident partners or shareholders, including their names, addresses, and income amounts.

Q: When is the deadline to file Schedule BI-473?

A: The deadline to file Schedule BI-473 is the same as the deadline for filing the Vermont Composite Return, which is typically April 15th.

Q: What are the consequences of failing to file Schedule BI-473?

A: Failing to file Schedule BI-473 may result in penalties and interest charges.

Q: Is there a fee for filing Schedule BI-473?

A: There is no fee for filing Schedule BI-473.

Q: Are there any special instructions for completing Schedule BI-473?

A: Yes, the Vermont Department of Taxes provides instructions on how to complete Schedule BI-473. It is important to carefully follow these instructions when filling out the form.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BI-473 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.