This version of the form is not currently in use and is provided for reference only. Download this version of

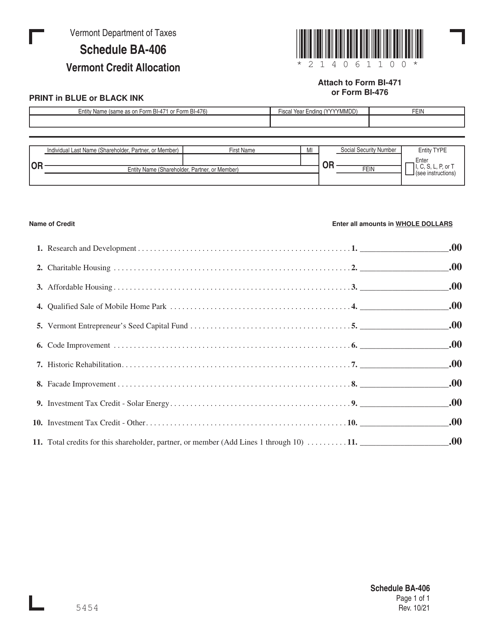

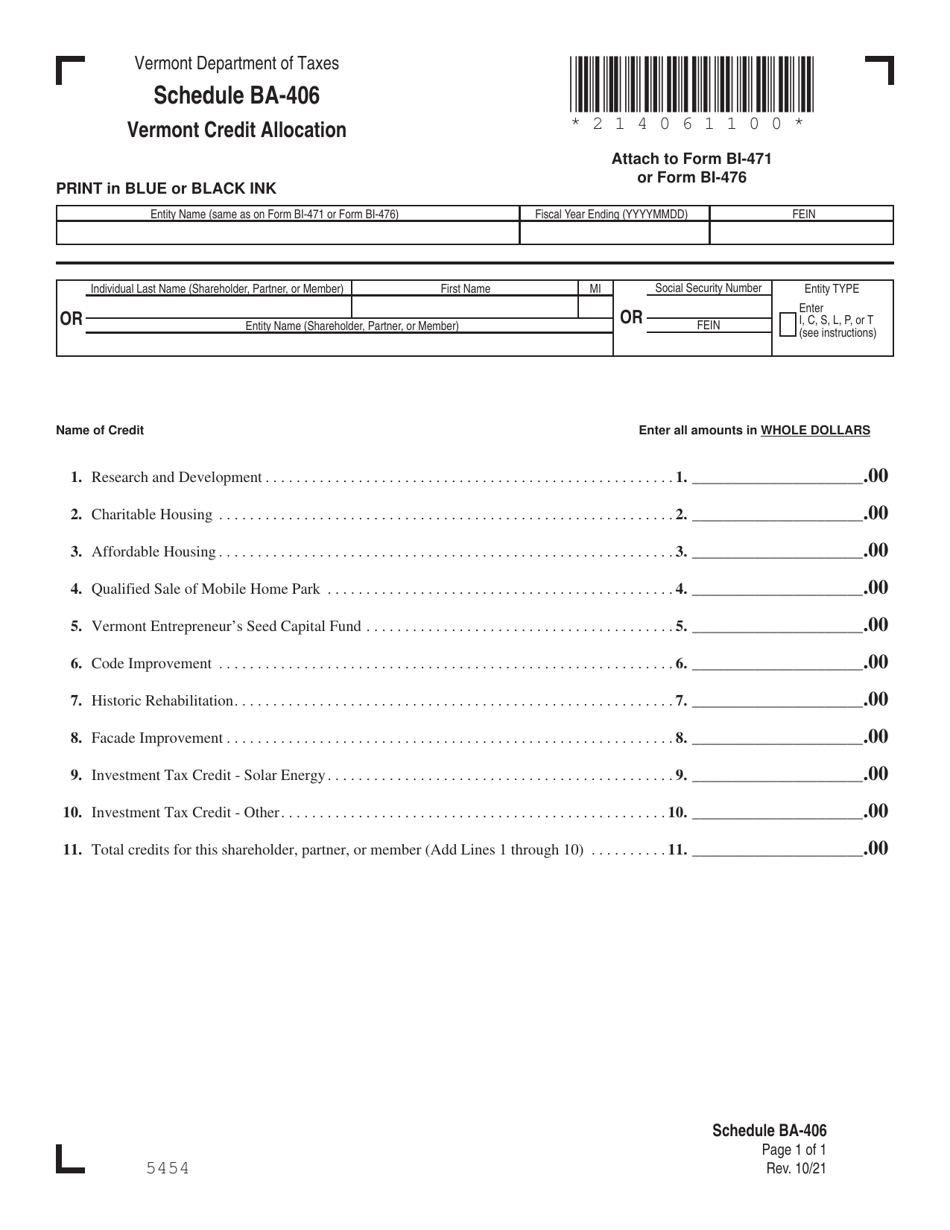

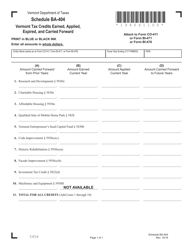

Schedule BA-406

for the current year.

Schedule BA-406 Vermont Credit Allocation - Vermont

What Is Schedule BA-406?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule BA-406 Vermont Credit Allocation?

A: Schedule BA-406 Vermont Credit Allocation is a form used in Vermont to allocate credits among partners, members, or shareholders of a pass-through entity.

Q: Who uses Schedule BA-406 Vermont Credit Allocation?

A: Partnerships, Limited Liability Companies (LLCs), and S Corporations in Vermont use Schedule BA-406 to allocate credits to their partners, members, or shareholders.

Q: What credits can be allocated using Schedule BA-406 Vermont Credit Allocation?

A: Schedule BA-406 can be used to allocate various credits, such as the Affordable Housing Credit, Brownfields Credit, and the Vermont Research and Development Credit, among others.

Q: How is the credit allocation determined?

A: The credit allocation is determined based on the ownership or membership interests of the partners, members, or shareholders in the pass-through entity.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BA-406 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.