This version of the form is not currently in use and is provided for reference only. Download this version of

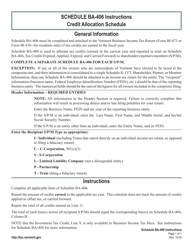

Instructions for Schedule BA-402

for the current year.

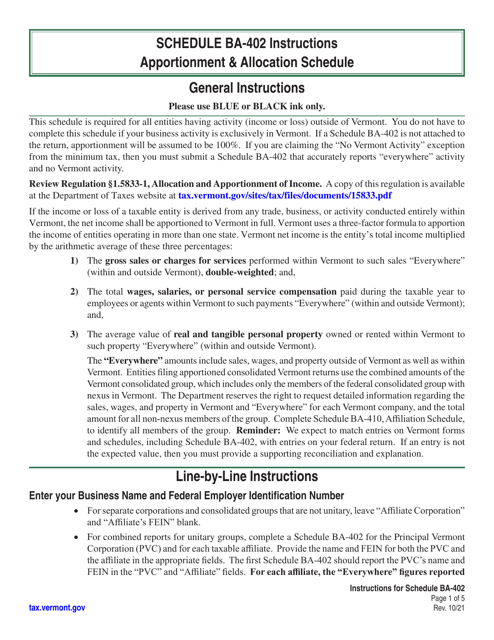

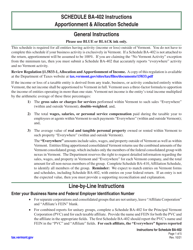

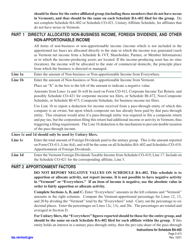

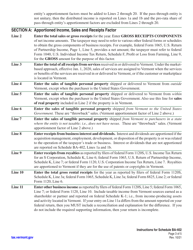

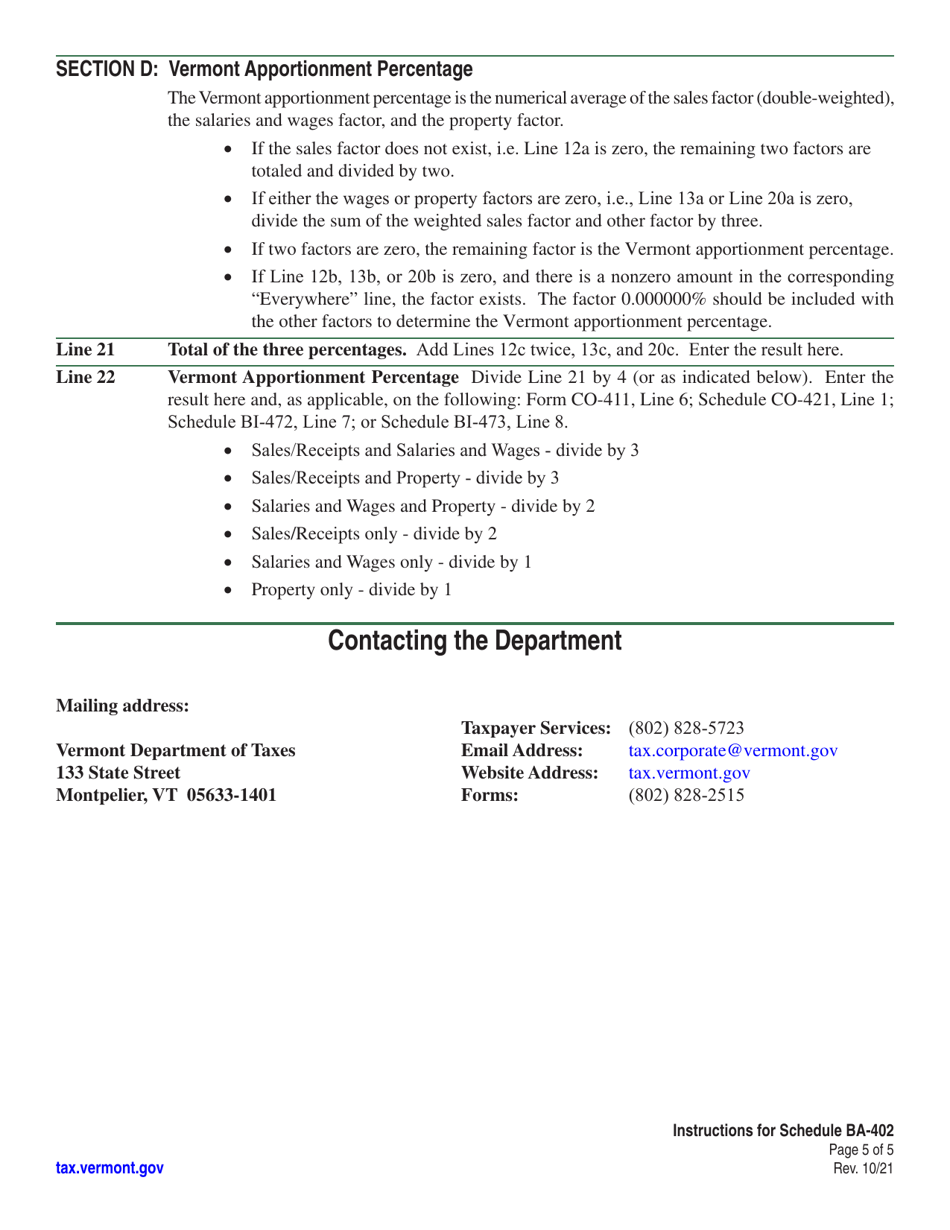

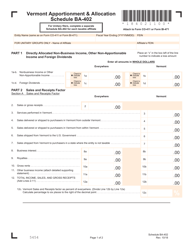

Instructions for Schedule BA-402 Vermont Apportionment & Allocation - Vermont

This document contains official instructions for Schedule BA-402 , Vermont Apportionment & Allocation - a form released and collected by the Vermont Department of Taxes.

FAQ

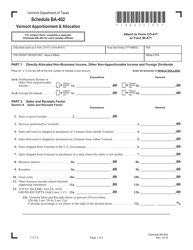

Q: What is Schedule BA-402?

A: Schedule BA-402 is a form used for Vermont Apportionment & Allocation.

Q: What is Vermont Apportionment & Allocation?

A: Vermont Apportionment & Allocation is the process of determining how much income is taxable in Vermont for businesses with activities in multiple states.

Q: Who needs to file Schedule BA-402?

A: Businesses with activities in multiple states that need to apportion and allocate their income for Vermont taxation purposes.

Q: What information is required on Schedule BA-402?

A: Schedule BA-402 requires details of the taxpayer's activities, income, and taxes paid in both Vermont and other states.

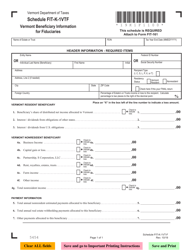

Q: Do businesses in Vermont need to file Schedule BA-402 every year?

A: Businesses with activities in multiple states need to file Schedule BA-402 annually with their Vermont tax return.

Q: Is there a deadline to file Schedule BA-402?

A: The deadline to file Schedule BA-402 is the same as the deadline for filing the Vermont tax return, which is usually April 15th.

Q: Are there any penalties for not filing Schedule BA-402?

A: Yes, failure to file Schedule BA-402 or providing incomplete or incorrect information may result in penalties and interest.

Q: Can I get help with filling out Schedule BA-402?

A: Yes, you can contact the Vermont Department of Taxes for assistance or consult a tax professional.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.