This version of the form is not currently in use and is provided for reference only. Download this version of

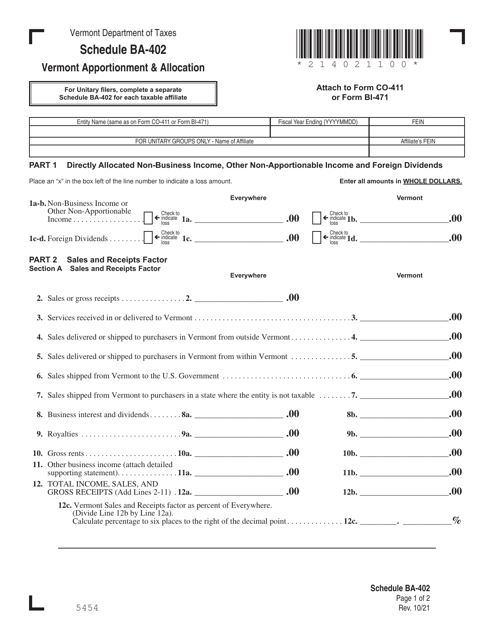

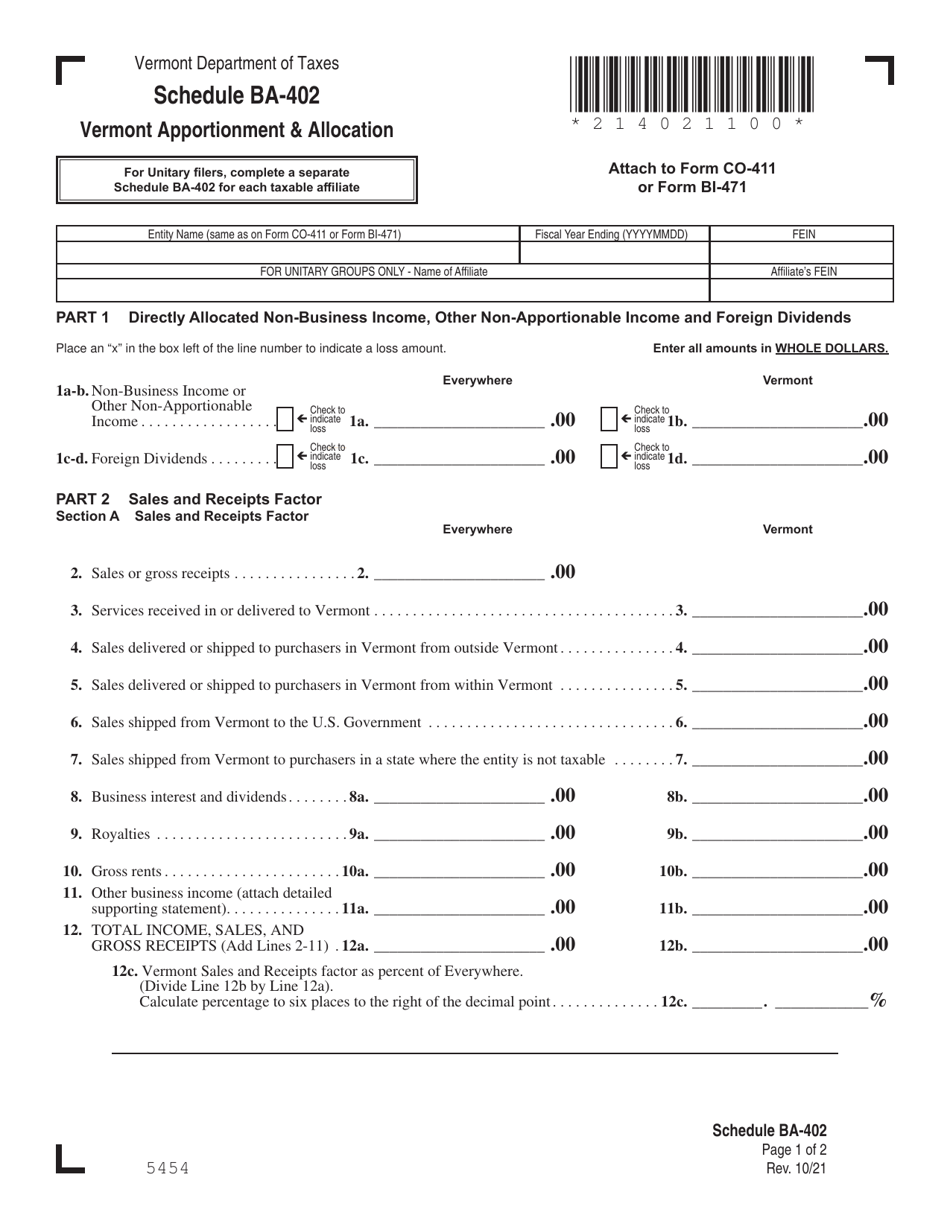

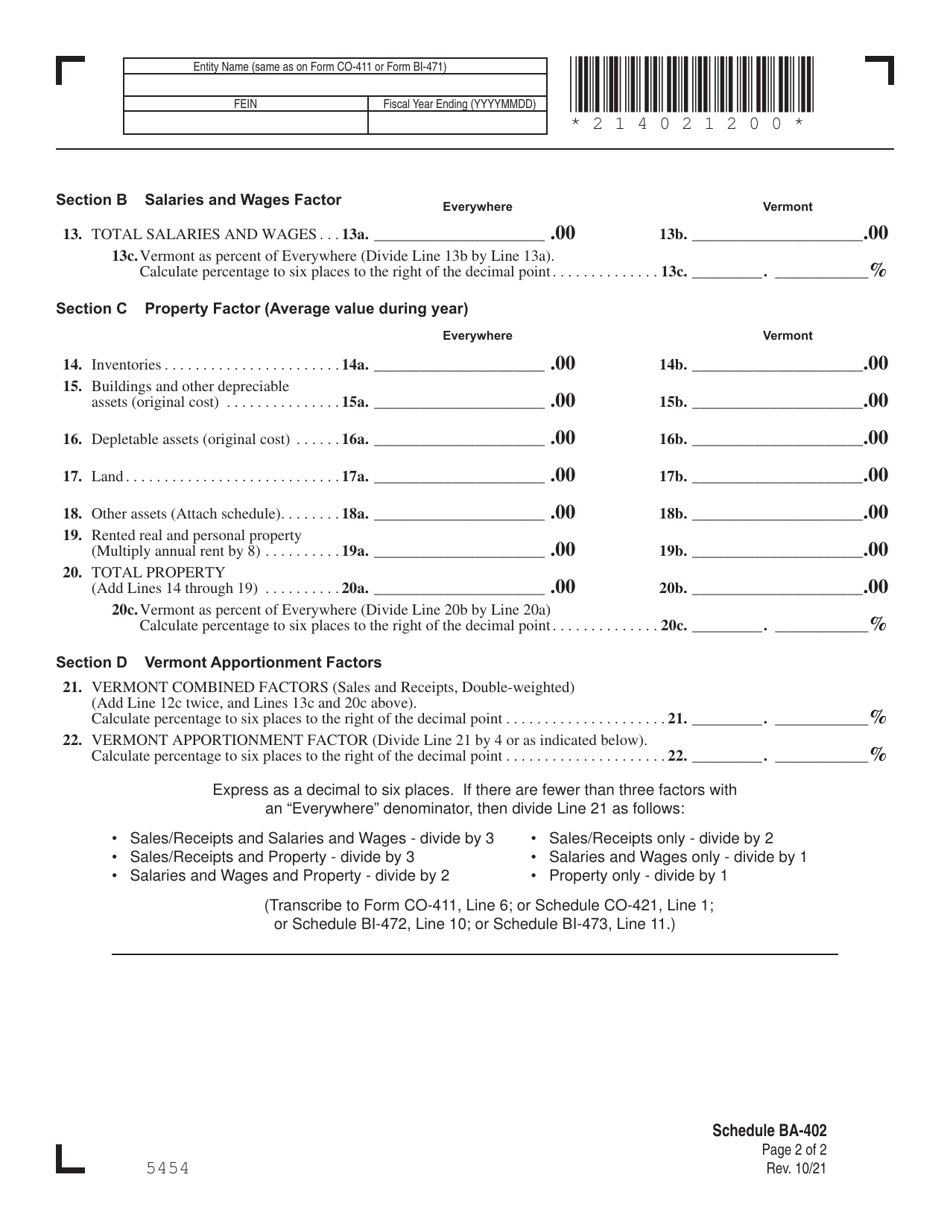

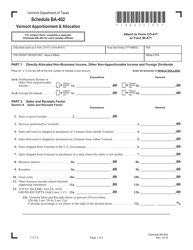

Schedule BA-402

for the current year.

Schedule BA-402 Vermont Apportionment & Allocation - Vermont

What Is Schedule BA-402?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule BA-402?

A: Schedule BA-402 is a form used in Vermont for apportionment and allocation purposes.

Q: What is the purpose of Schedule BA-402?

A: The purpose of Schedule BA-402 is to determine the portion of a corporation's income that is taxable in Vermont.

Q: Who needs to file Schedule BA-402?

A: Corporations that are doing business in Vermont and have income from both inside and outside the state must file Schedule BA-402.

Q: What information is required to complete Schedule BA-402?

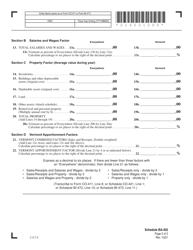

A: To complete Schedule BA-402, corporations need to provide details about their total income, the percentage attributable to Vermont, and the allocation factors used.

Q: What are allocation factors?

A: Allocation factors are ratios used to determine the portion of a corporation's income that is attributable to Vermont. The most common allocation factors include sales, payroll, and property.

Q: When is Schedule BA-402 due?

A: Schedule BA-402 is typically due with the corporation's annual tax return, which is generally due by the 15th day of the fourth month following the close of the tax year.

Q: Are there any penalties for not filing Schedule BA-402?

A: Yes, failure to file Schedule BA-402 or filing an incomplete or inaccurate form may result in penalties and interest.

Q: Can I amend Schedule BA-402?

A: Yes, if a corporation needs to make changes or corrections to a previously filed Schedule BA-402, they can file an amended form.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule BA-402 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.