This version of the form is not currently in use and is provided for reference only. Download this version of

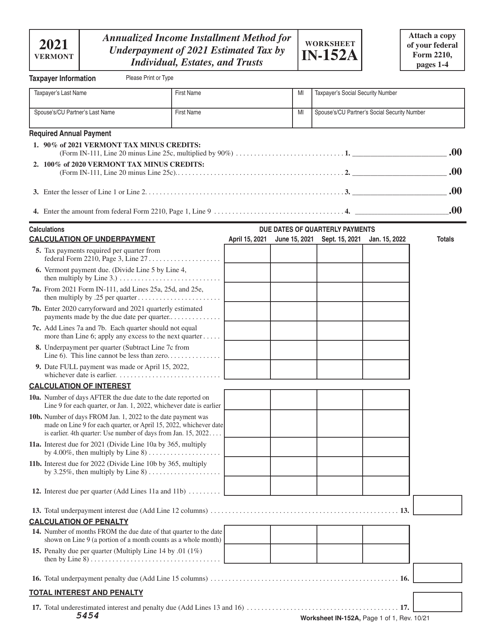

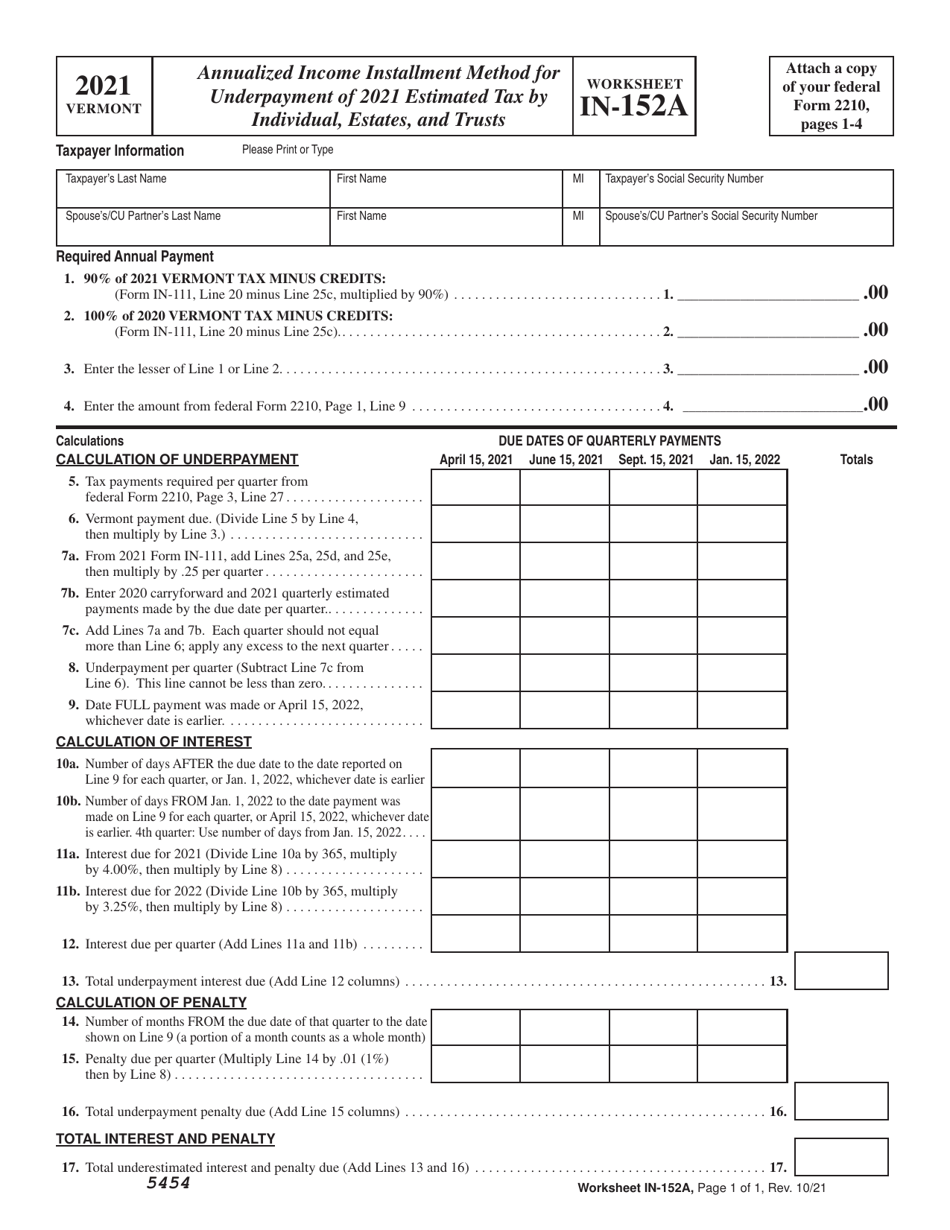

Worksheet IN-152A

for the current year.

Worksheet IN-152A Annualized Income Installment Method for Underpayment of Estimated Tax by Individual, Estates, and Trusts - Vermont

What Is Worksheet IN-152A?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Worksheet IN-152A?

A: Worksheet IN-152A is used to calculate the underpayment of estimated tax by individuals, estates, and trusts in Vermont.

Q: Who uses Worksheet IN-152A?

A: Individuals, estates, and trusts in Vermont use Worksheet IN-152A to calculate their underpayment of estimated tax.

Q: What does the Annualized Income Installment Method mean?

A: The Annualized Income Installment Method is a way to calculate the amount of estimated tax that should have been paid throughout the year based on the income earned in each quarter.

Q: Why do I need to use Worksheet IN-152A?

A: You need to use Worksheet IN-152A if you owe underpayment of estimated tax in Vermont.

Q: How do I use Worksheet IN-152A?

A: To use Worksheet IN-152A, you need to follow the instructions provided and input your income and estimated tax information for each quarter of the year.

Q: What happens if I don't use Worksheet IN-152A?

A: If you don't use Worksheet IN-152A when calculating your underpayment of estimated tax, you may not accurately determine the amount you owe and could be subject to penalties.

Q: Can I use Worksheet IN-152A for any other state?

A: No, Worksheet IN-152A is specific to Vermont and should not be used for calculating underpayment of estimated tax in any other state.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Worksheet IN-152A by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.