This version of the form is not currently in use and is provided for reference only. Download this version of

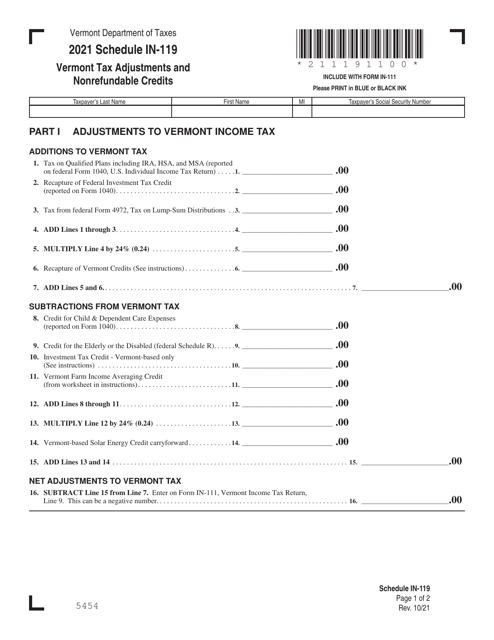

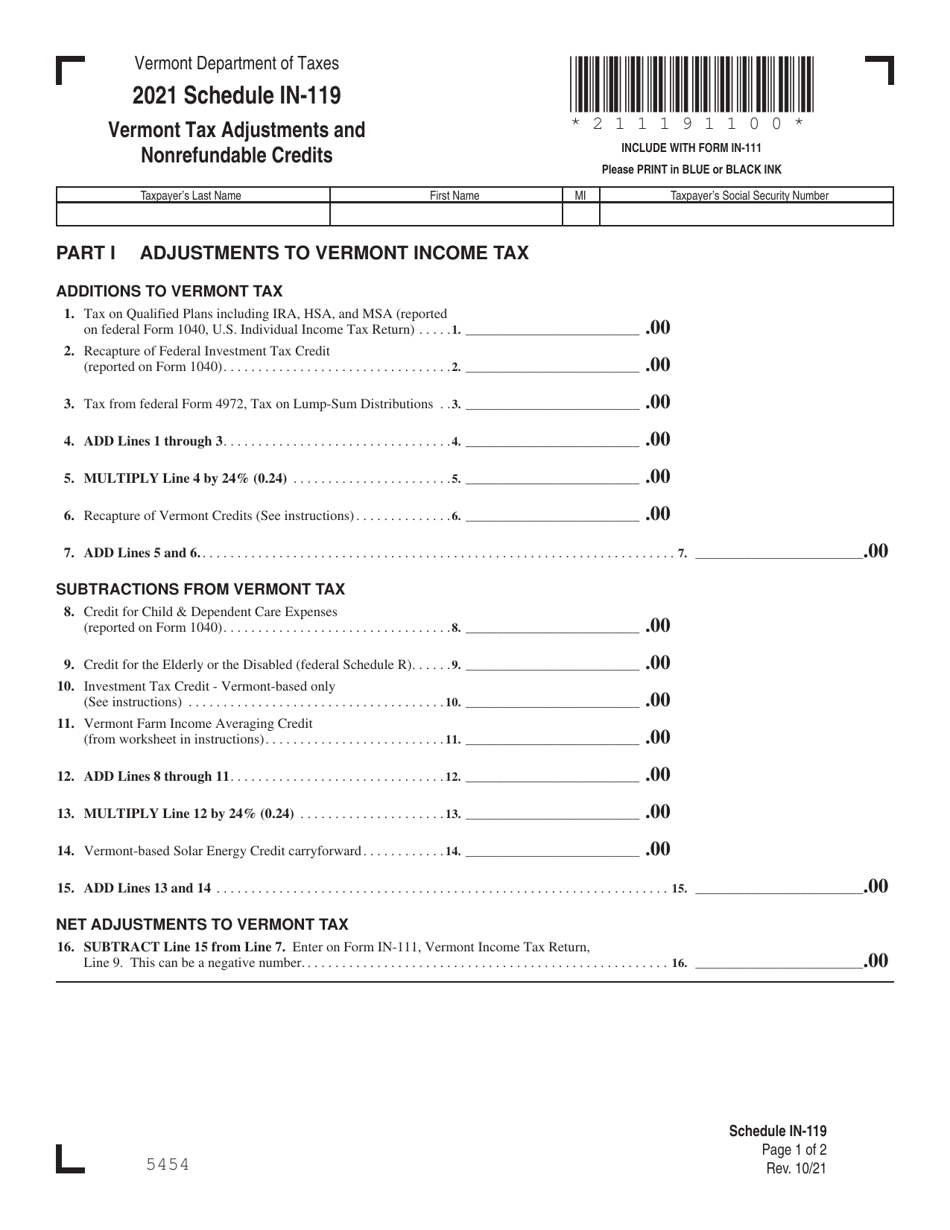

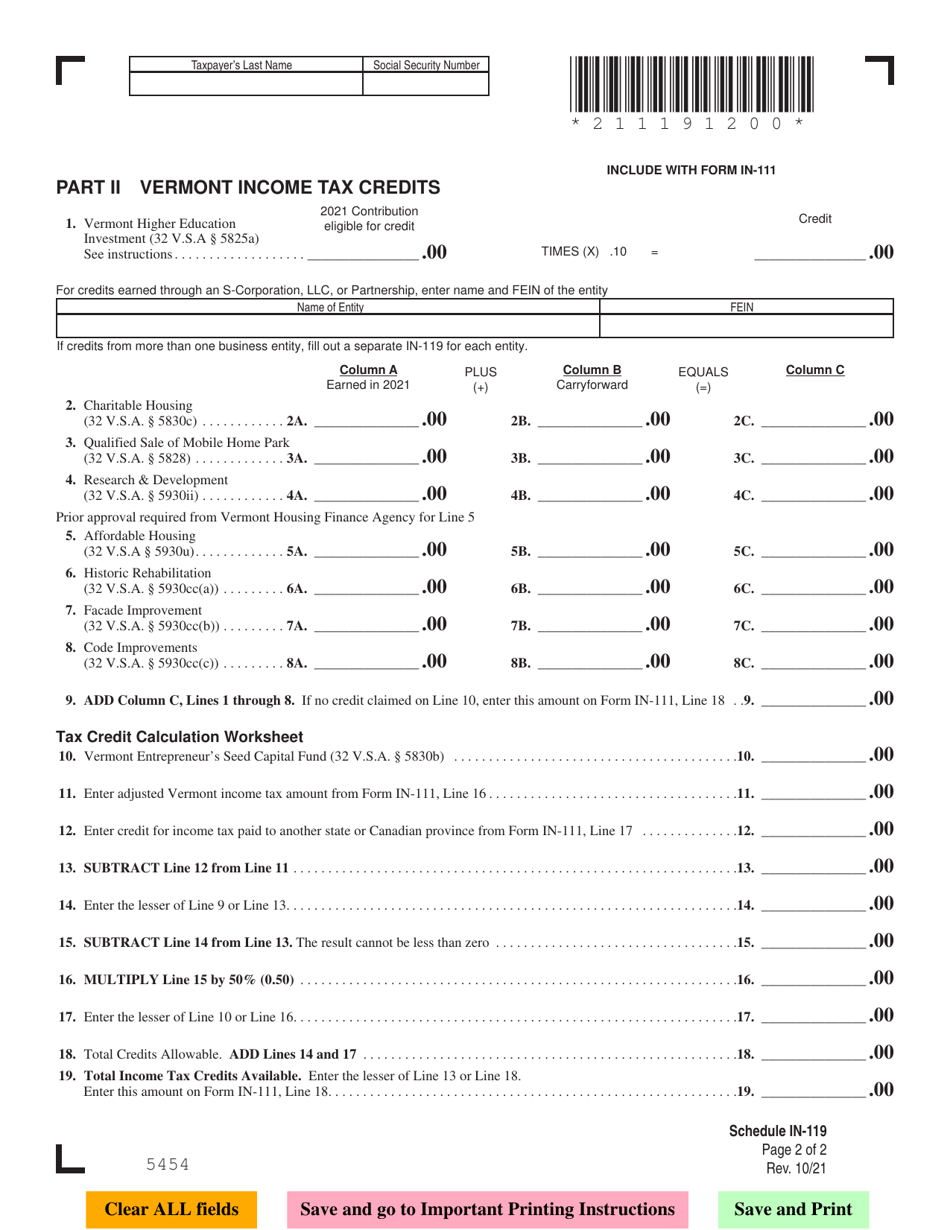

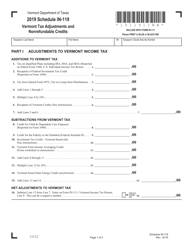

Schedule IN-119

for the current year.

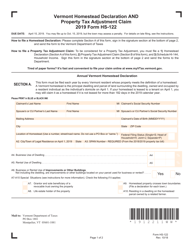

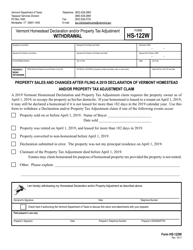

Schedule IN-119 Vermont Tax Adjustments and Nonrefundable Credits - Vermont

What Is Schedule IN-119?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule IN-119?

A: Schedule IN-119 is a form used for reporting Vermont tax adjustments and nonrefundable credits.

Q: What is a Vermont tax adjustment?

A: A Vermont tax adjustment is a modification made to your tax liability based on certain factors like income, deductions, or credits.

Q: What are nonrefundable credits?

A: Nonrefundable credits are tax credits that can reduce your tax liability but cannot result in a refund.

Q: Why do I need to file Schedule IN-119?

A: You need to file Schedule IN-119 to report any tax adjustments or nonrefundable credits that you are eligible for in the state of Vermont.

Q: Are there any specific eligibility criteria for tax adjustments and nonrefundable credits in Vermont?

A: Yes, there are specific eligibility criteria for different tax adjustments and nonrefundable credits in Vermont. You should refer to the instructions provided with Schedule IN-119 for more information.

Q: When is the deadline to file Schedule IN-119?

A: The deadline to file Schedule IN-119 is the same as the deadline for filing your Vermont state tax return, which is usually April 15th.

Q: Can I e-file Schedule IN-119?

A: Yes, you can e-file Schedule IN-119 if you are using tax software that supports Vermont state tax returns.

Q: Can I claim both tax adjustments and nonrefundable credits on Schedule IN-119?

A: Yes, you can claim both tax adjustments and nonrefundable credits on Schedule IN-119 if you are eligible for them.

Q: Is Schedule IN-119 only for Vermont residents?

A: No, Schedule IN-119 is also used by part-year residents and nonresidents of Vermont who have income from Vermont sources.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule IN-119 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.