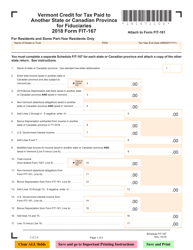

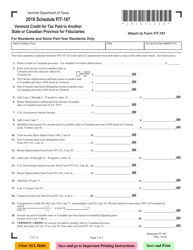

This version of the form is not currently in use and is provided for reference only. Download this version of

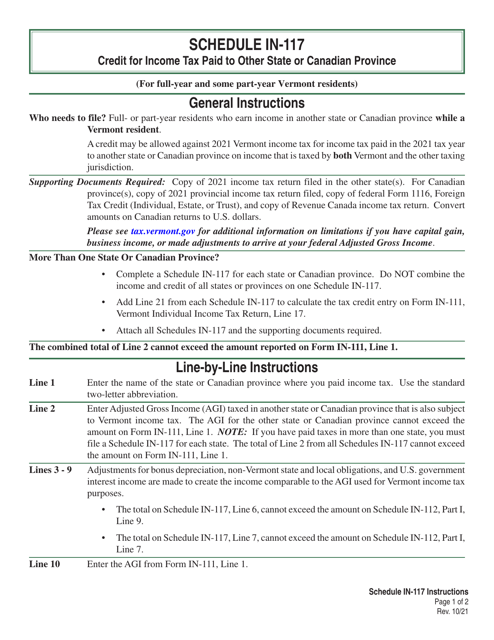

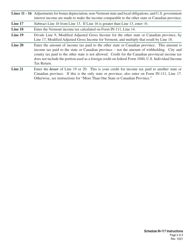

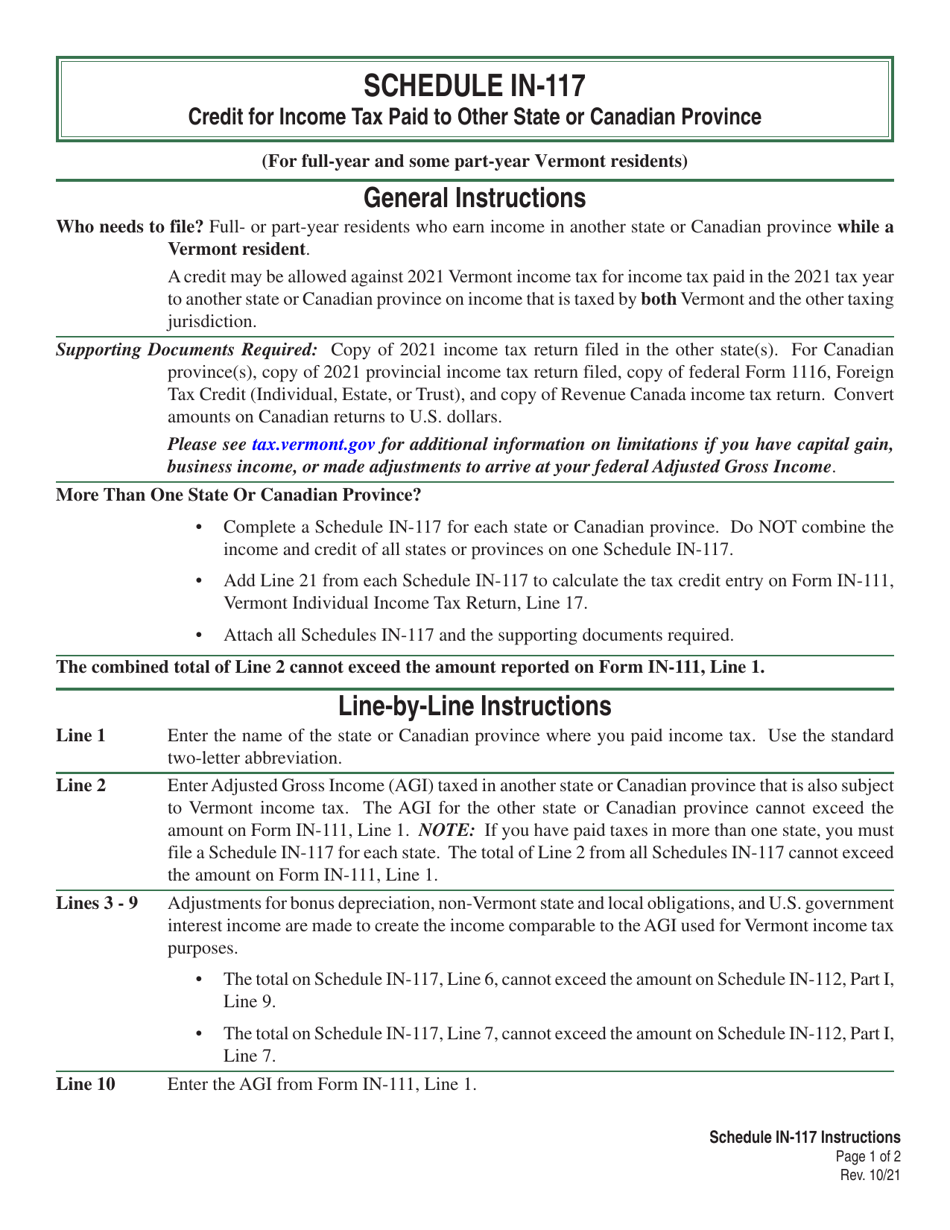

Instructions for Schedule IN-117

for the current year.

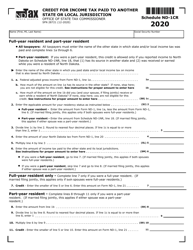

Instructions for Schedule IN-117 Vermont Credit for Income Tax Paid to Other State or Canadian Province - Vermont

This document contains official instructions for Schedule IN-117 , Vermont Credit for Income Other State or Canadian Province - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule IN-117?

A: Schedule IN-117 is a form used in Vermont to claim a credit for income tax paid to another state or Canadian province.

Q: Who is eligible to use Schedule IN-117?

A: Vermont residents who have paid income tax to another state or Canadian province may be eligible to use Schedule IN-117.

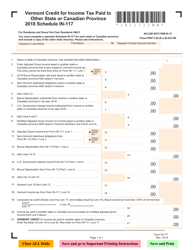

Q: What information do I need to complete Schedule IN-117?

A: You will need a copy of your tax return from the other state or Canadian province, as well as any supporting documents.

Q: How do I calculate the credit on Schedule IN-117?

A: The credit is calculated based on the tax you paid to the other state or Canadian province, up to the amount of Vermont tax on the same income.

Q: Can I claim the credit for taxes paid to multiple states or Canadian provinces?

A: Yes, you can claim the credit for taxes paid to multiple states or Canadian provinces, but the total credit cannot exceed your Vermont tax liability on the same income.

Q: Is there a deadline to file Schedule IN-117?

A: Yes, Schedule IN-117 must be filed by the same deadline as your Vermont income tax return, usually April 15th.

Q: Can I e-file Schedule IN-117?

A: Yes, you can e-file Schedule IN-117 if you are filing your Vermont income tax return electronically.

Q: What should I do if I have questions or need help with Schedule IN-117?

A: If you have questions or need help, you should contact the Vermont Department of Taxes or consult a tax professional.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.