This version of the form is not currently in use and is provided for reference only. Download this version of

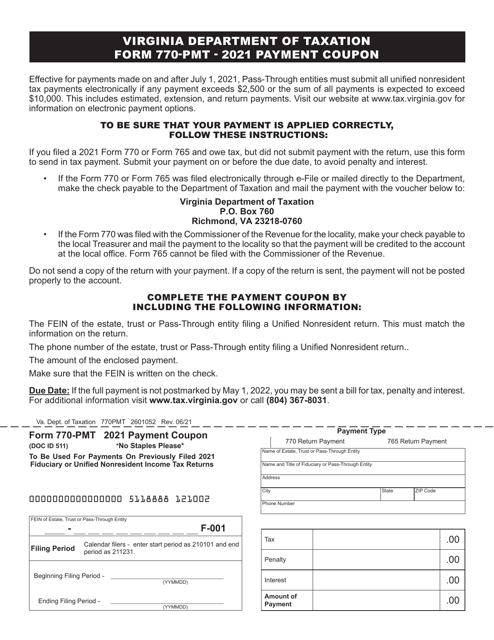

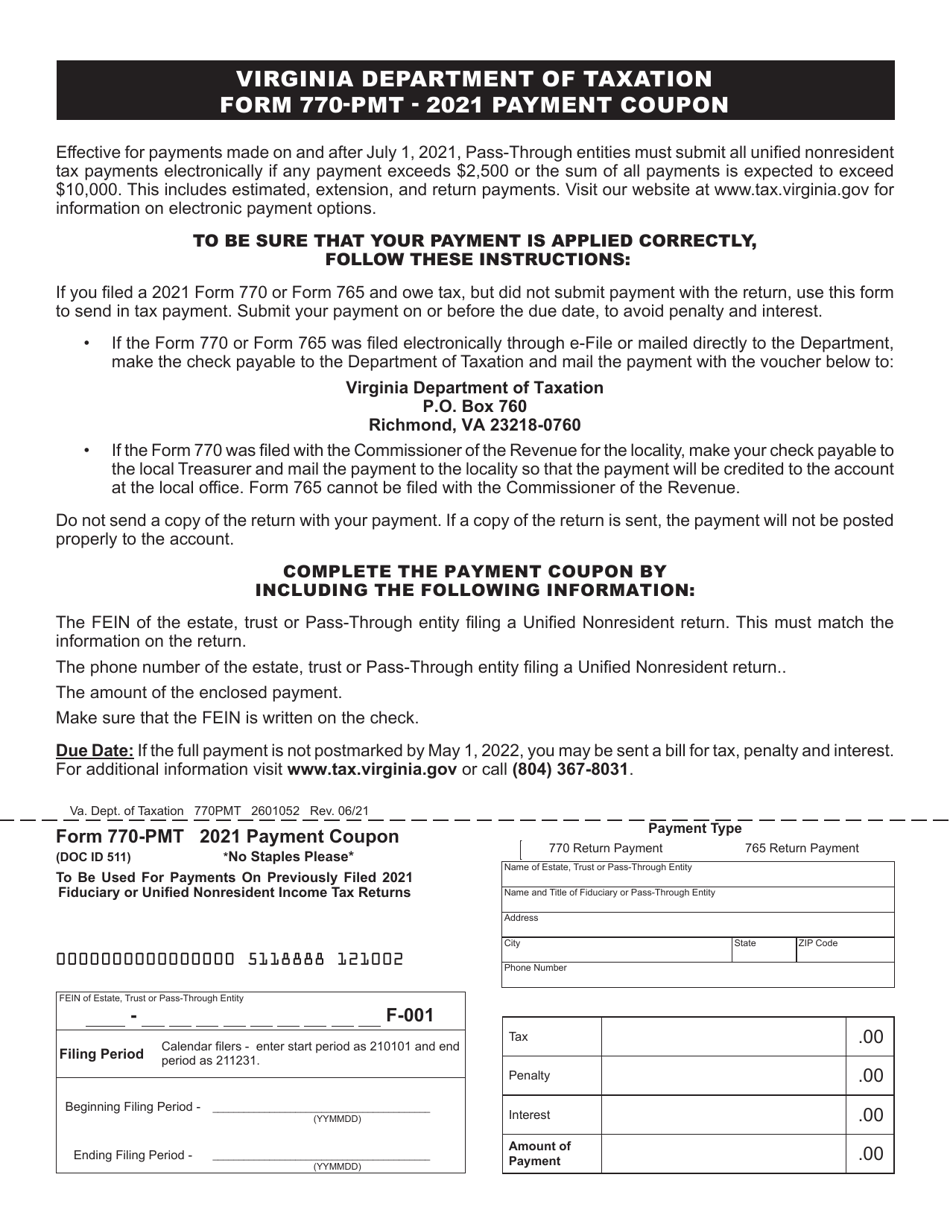

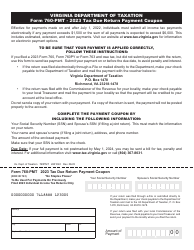

Form 770-PMT

for the current year.

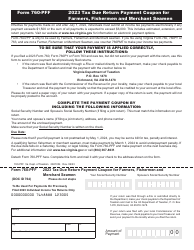

Form 770-PMT Payment Coupon for Previously Filed Fiduciary Income Tax Returns - Virginia

What Is Form 770-PMT?

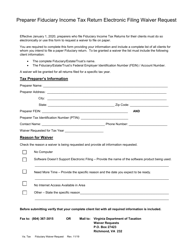

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 770-PMT?

A: Form 770-PMT is a payment coupon used for previously filed fiduciary income tax returns in Virginia.

Q: Who needs to use Form 770-PMT?

A: The form is used by fiduciaries who have previously filed their income tax returns in Virginia and need to make a payment.

Q: What is a fiduciary?

A: A fiduciary is a person or entity that is responsible for managing the financial affairs of another, such as an executor or trustee.

Q: When do I use Form 770-PMT?

A: You use Form 770-PMT when you have already filed your fiduciary income tax return in Virginia and need to make a payment.

Q: What information do I need to provide on Form 770-PMT?

A: You will need to provide your name, Social Security number or employer identification number, the tax year, and the amount of payment.

Q: Is there a deadline for filing Form 770-PMT?

A: The deadline for filing Form 770-PMT is the same as the deadline for filing your fiduciary income tax return in Virginia.

Q: What happens if I don't file Form 770-PMT?

A: If you don't file Form 770-PMT and make the required payment, you may be subject to penalties and interest.

Q: Can I file Form 770-PMT electronically?

A: No, Form 770-PMT cannot be filed electronically. It must be filed by mail or in person.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 770-PMT by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.