This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 765

for the current year.

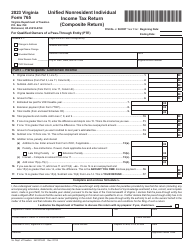

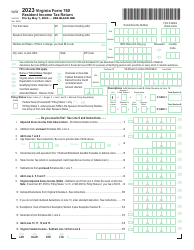

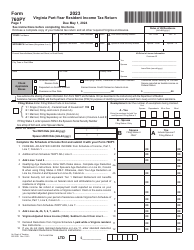

Instructions for Form 765 Unified Nonresident Individual Income Tax Return (Composite Return) - Virginia

This document contains official instructions for Form 765 , Unified Nonresident Individual Income Tax Return (Composite Return) - a form released and collected by the Virginia Department of Taxation. An up-to-date fillable Form 765 is available for download through this link.

FAQ

Q: What is Form 765?

A: Form 765 is the Unified Nonresident Individual Income Tax Return (Composite Return) for Virginia.

Q: Who should file Form 765?

A: Nonresident individuals who have income from Virginia sources and are members of a pass-through entity (such as a partnership or a limited liability company) that conducts business in Virginia should file Form 765.

Q: What is a composite return?

A: A composite return is a tax return filed by a pass-through entity on behalf of its nonresident owners.

Q: What is the purpose of Form 765?

A: The purpose of Form 765 is to report and pay income tax on behalf of nonresident owners of a pass-through entity.

Q: When is Form 765 due?

A: Form 765 is due on or before the 15th day of the fourth month following the close of the taxable year.

Instruction Details:

- This 12-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.