This version of the form is not currently in use and is provided for reference only. Download this version of

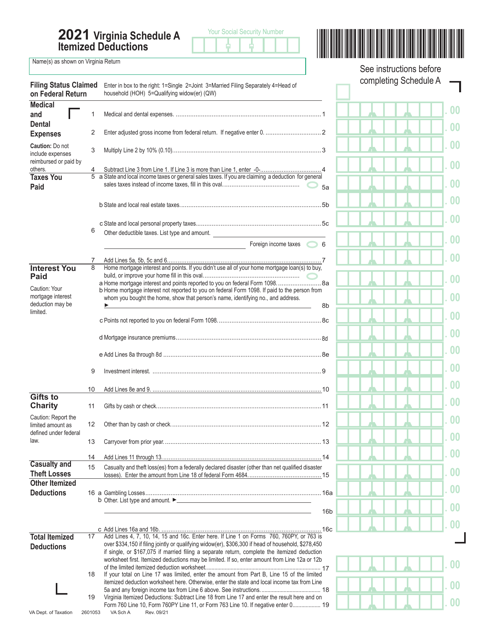

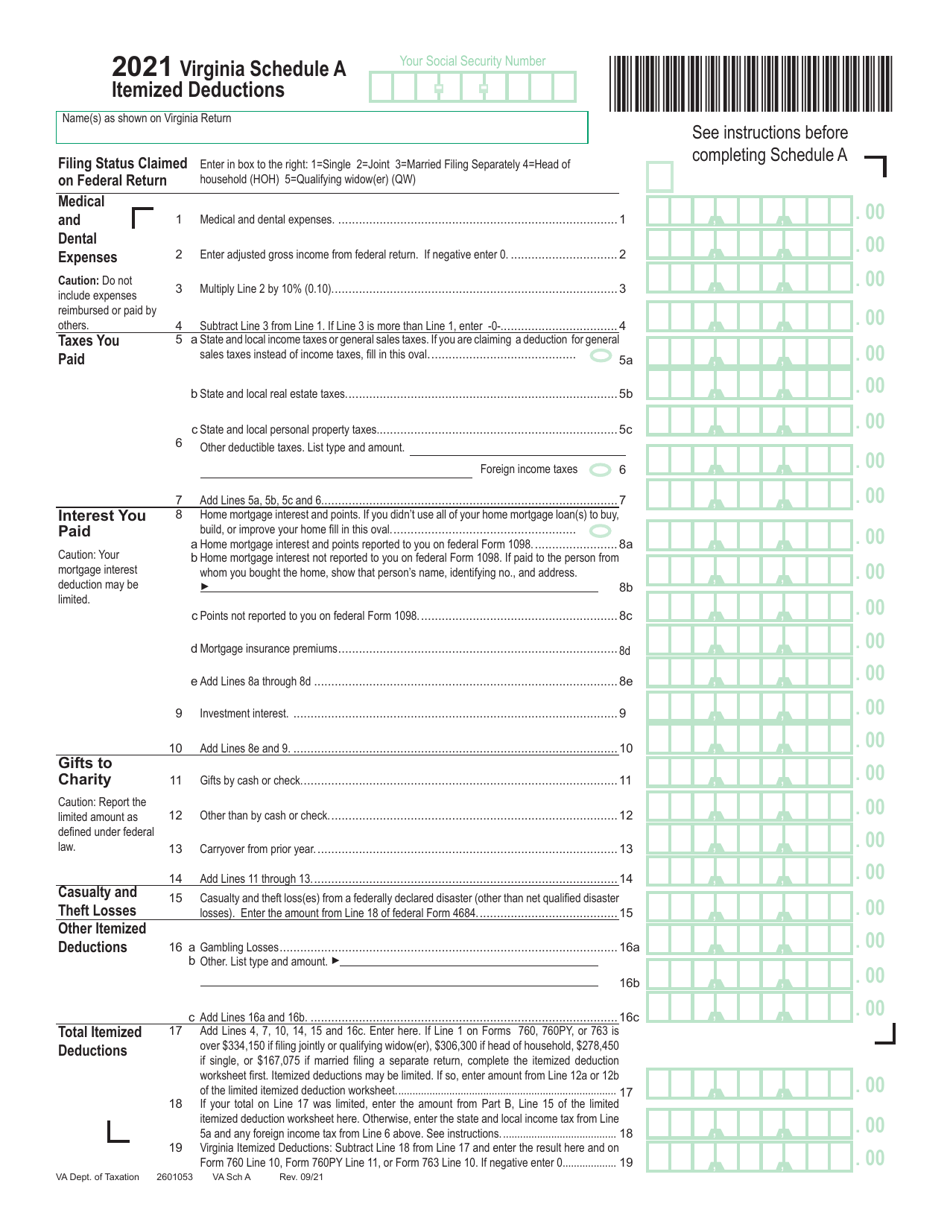

Schedule A

for the current year.

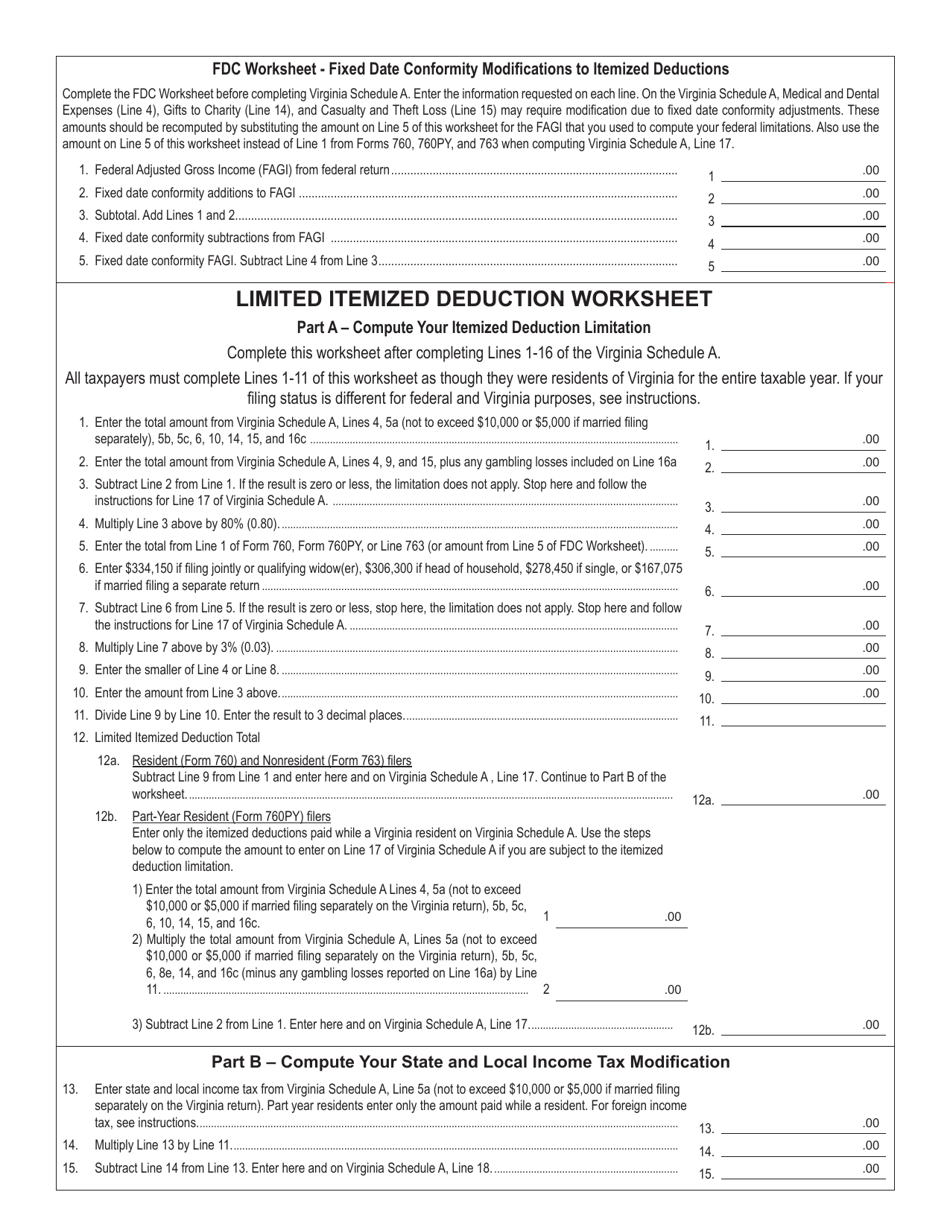

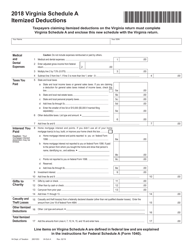

Schedule A Virginia Itemized Deductions - Virginia

What Is Schedule A?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule A Virginia Itemized Deductions?

A: Schedule A Virginia Itemized Deductions is a tax form used in the state of Virginia to report itemized deductions.

Q: What are itemized deductions?

A: Itemized deductions are specific expenses that can be subtracted from your taxable income to reduce your overall tax liability.

Q: What types of expenses can be included in Schedule A Virginia Itemized Deductions?

A: Some common expenses that can be included are medical expenses, mortgage interest, state and local taxes, charitable contributions, and certain unreimbursed job expenses.

Q: Are there any limitations or restrictions on itemized deductions in Virginia?

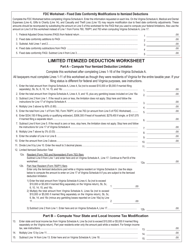

A: Yes, Virginia has certain limitations on itemized deductions such as the limitation on state and local tax deductions.

Q: When should I use Schedule A Virginia Itemized Deductions?

A: You should use Schedule A Virginia Itemized Deductions if your total itemized deductions exceed the standard deduction for your filing status.

Q: Do I need to attach Schedule A Virginia Itemized Deductions to my federal tax return?

A: No, Schedule A Virginia Itemized Deductions is used for state tax purposes only and should not be attached to your federal tax return.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule A by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.