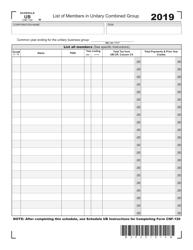

This version of the form is not currently in use and is provided for reference only. Download this version of

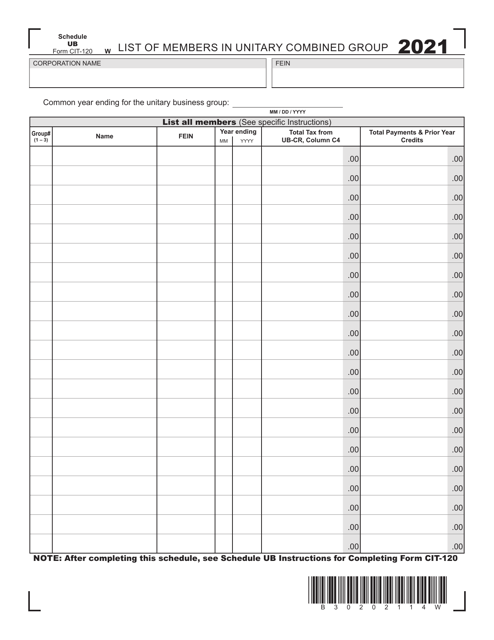

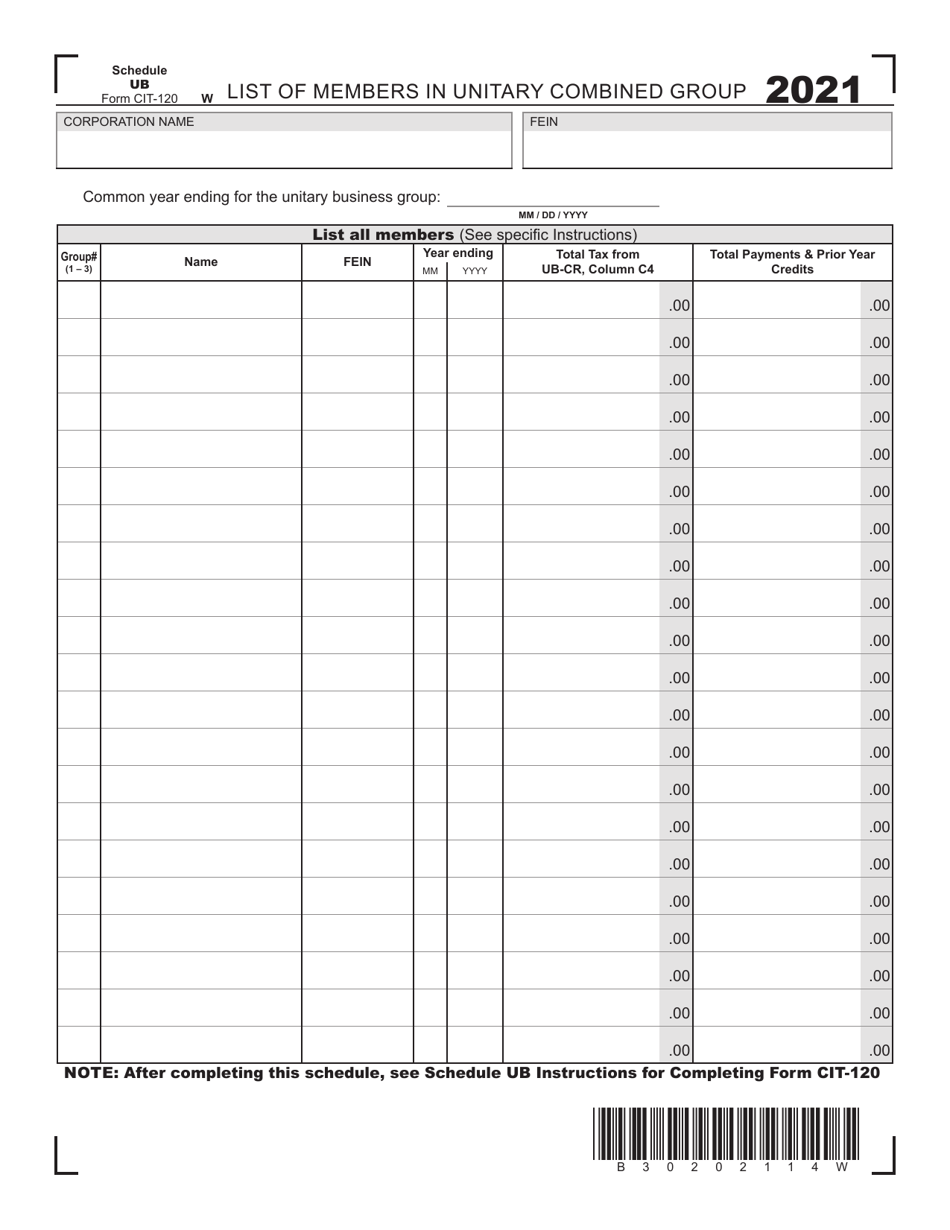

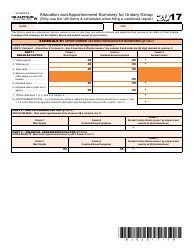

Form CIT-120 Schedule UB

for the current year.

Form CIT-120 Schedule UB List of Members in Unitary Combined Group - West Virginia

What Is Form CIT-120 Schedule UB?

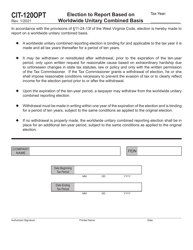

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form CIT-120, Corporation Net Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CIT-120 Schedule UB?

A: CIT-120 Schedule UB is a form that is used in West Virginia to list the members in a unitary combined group.

Q: What is a unitary combined group?

A: A unitary combined group is a group of corporations that are engaged in a unitary business and are required to file a combined tax return.

Q: Who needs to file CIT-120 Schedule UB?

A: Any unitary combined group that is required to file a combined tax return in West Virginia needs to file CIT-120 Schedule UB.

Q: What information is required in CIT-120 Schedule UB?

A: CIT-120 Schedule UB requires you to list the members of your unitary combined group, including their names, federal identification numbers, and percentage of ownership.

Q: Is there a deadline for filing CIT-120 Schedule UB?

A: Yes, the deadline for filing CIT-120 Schedule UB is the same as the deadline for filing your combined tax return in West Virginia.

Q: Is there a fee for filing CIT-120 Schedule UB?

A: No, there is no fee for filing CIT-120 Schedule UB in West Virginia.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIT-120 Schedule UB by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.