This version of the form is not currently in use and is provided for reference only. Download this version of

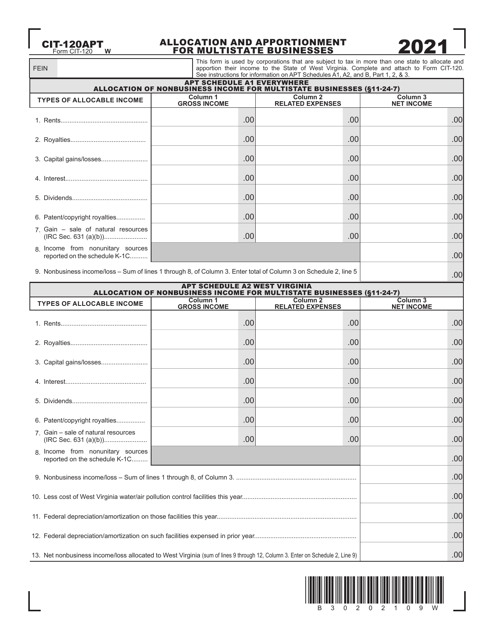

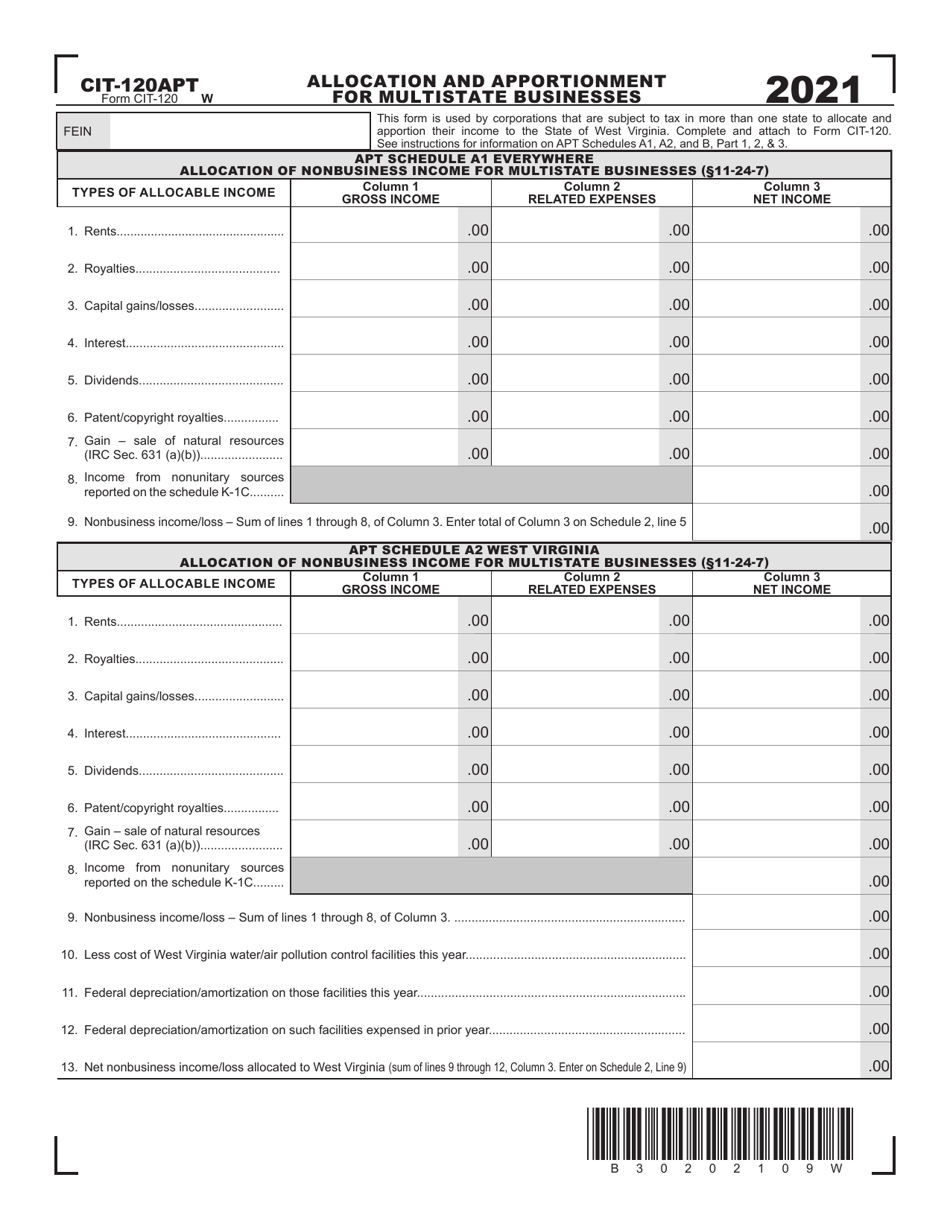

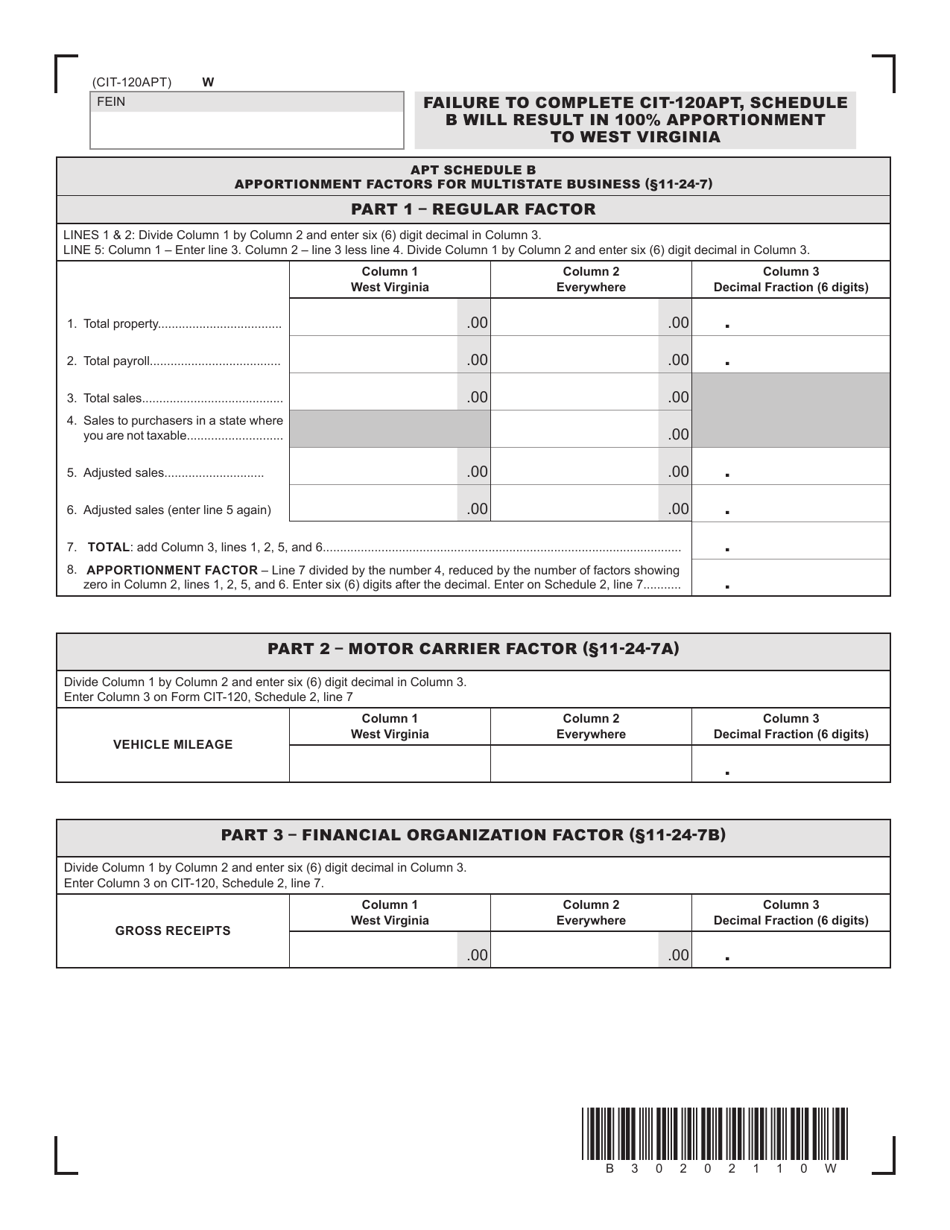

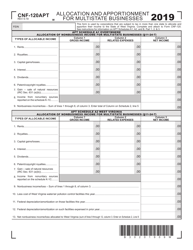

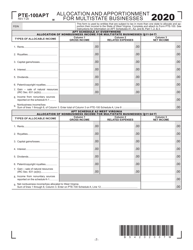

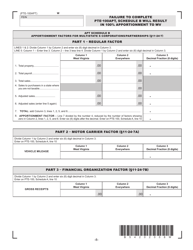

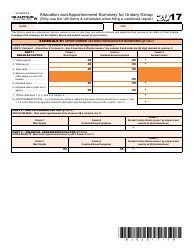

Form CIT-120APT

for the current year.

Form CIT-120APT Allocation and Apportionment for Multistate Businesses - West Virginia

What Is Form CIT-120APT?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CIT-120APT?

A: CIT-120APT is a form used for allocating and apportioning income for multistate businesses in West Virginia.

Q: Who needs to file CIT-120APT?

A: Multistate businesses operating in West Virginia need to file CIT-120APT.

Q: What is the purpose of CIT-120APT?

A: The purpose of CIT-120APT is to determine the portion of a multistate business's income that is taxable in West Virginia.

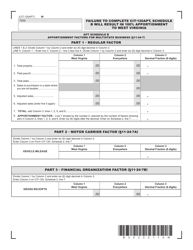

Q: What information is required to complete CIT-120APT?

A: To complete CIT-120APT, you will need information about the business's total income, property, and payroll both inside and outside of West Virginia.

Q: When is the deadline for filing CIT-120APT?

A: The deadline for filing CIT-120APT is the same as the deadline for filing the annual West Virginia Corporation Net Income Tax Return, which is generally April 15th.

Q: Is there a fee for filing CIT-120APT?

A: No, there is no fee for filing CIT-120APT.

Q: Are there any penalties for not filing CIT-120APT?

A: Yes, there are penalties for not filing CIT-120APT, including late filing penalties and interest on any unpaid taxes.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIT-120APT by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.