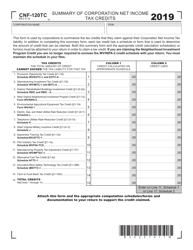

This version of the form is not currently in use and is provided for reference only. Download this version of

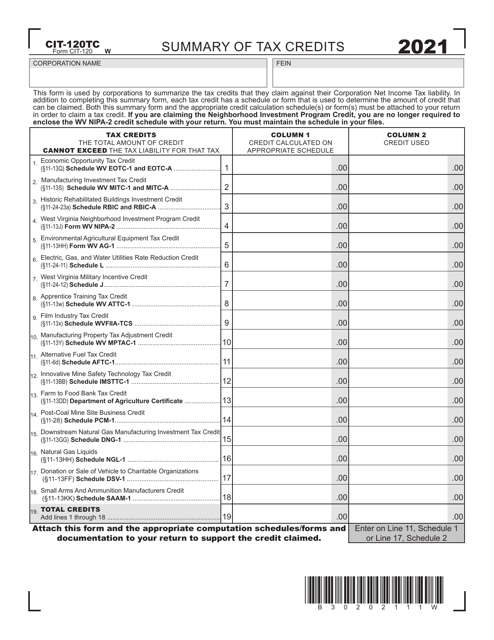

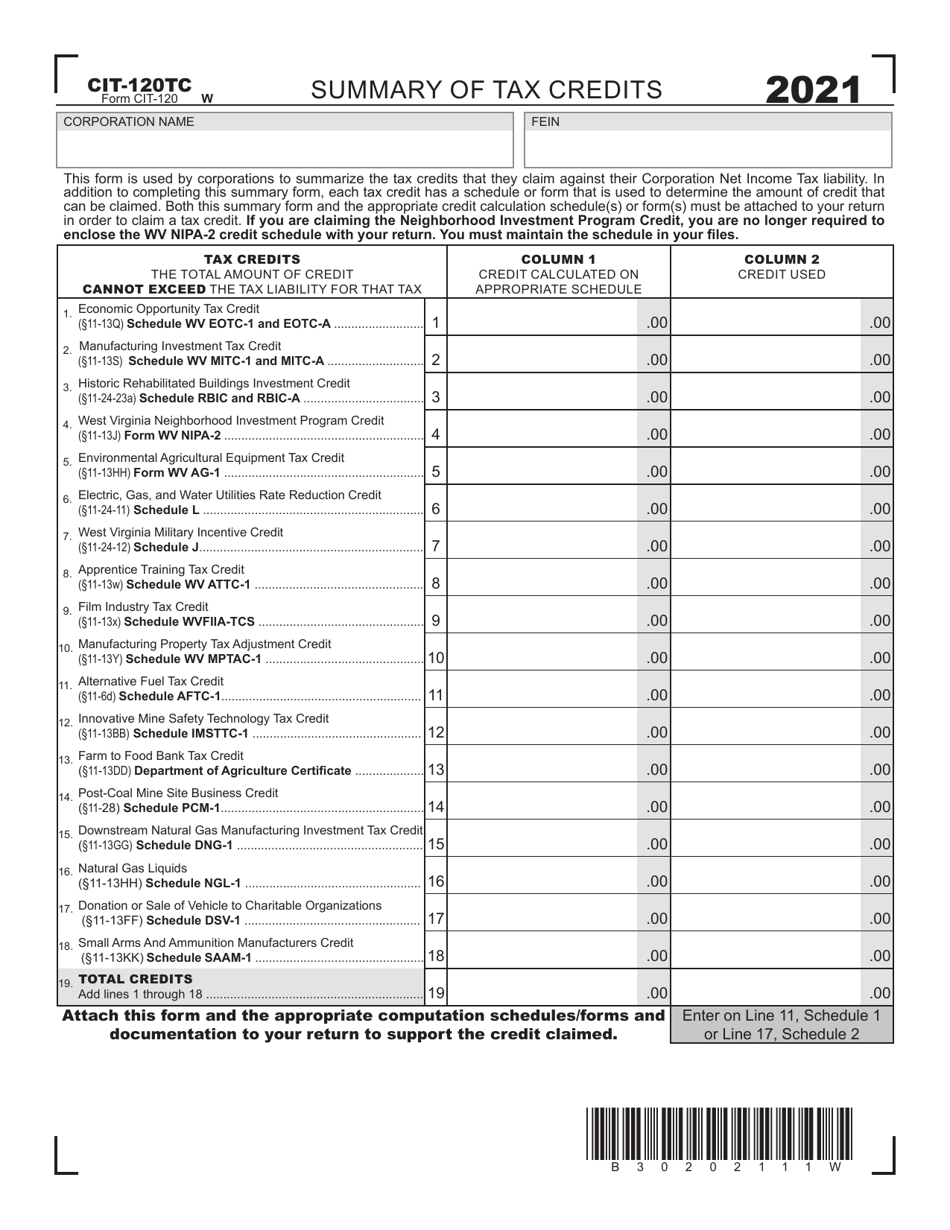

Form CIT-120TC

for the current year.

Form CIT-120TC Summary of Tax Credits - West Virginia

What Is Form CIT-120TC?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CIT-120TC form?

A: The CIT-120TC form is the Summary of Tax Credits form for the state of West Virginia.

Q: Who needs to file the CIT-120TC form?

A: Taxpayers in West Virginia who have tax credits to report need to file the CIT-120TC form.

Q: What is the purpose of the CIT-120TC form?

A: The purpose of the CIT-120TC form is to summarize and report any tax credits claimed by the taxpayer.

Q: When is the deadline for filing the CIT-120TC form?

A: The deadline for filing the CIT-120TC form is the same as the deadline for filing your West Virginia state tax return.

Q: Are there any specific instructions for filling out the CIT-120TC form?

A: Yes, the CIT-120TC form comes with detailed instructions that you should follow while filling it out.

Q: What should I do if I have questions about the CIT-120TC form?

A: If you have questions about the CIT-120TC form, you can contact the West Virginia Department of Revenue for assistance.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIT-120TC by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.