This version of the form is not currently in use and is provided for reference only. Download this version of

Form CIT-120U

for the current year.

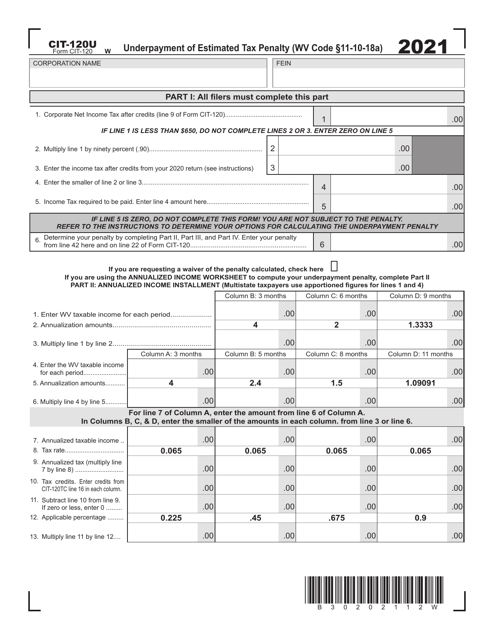

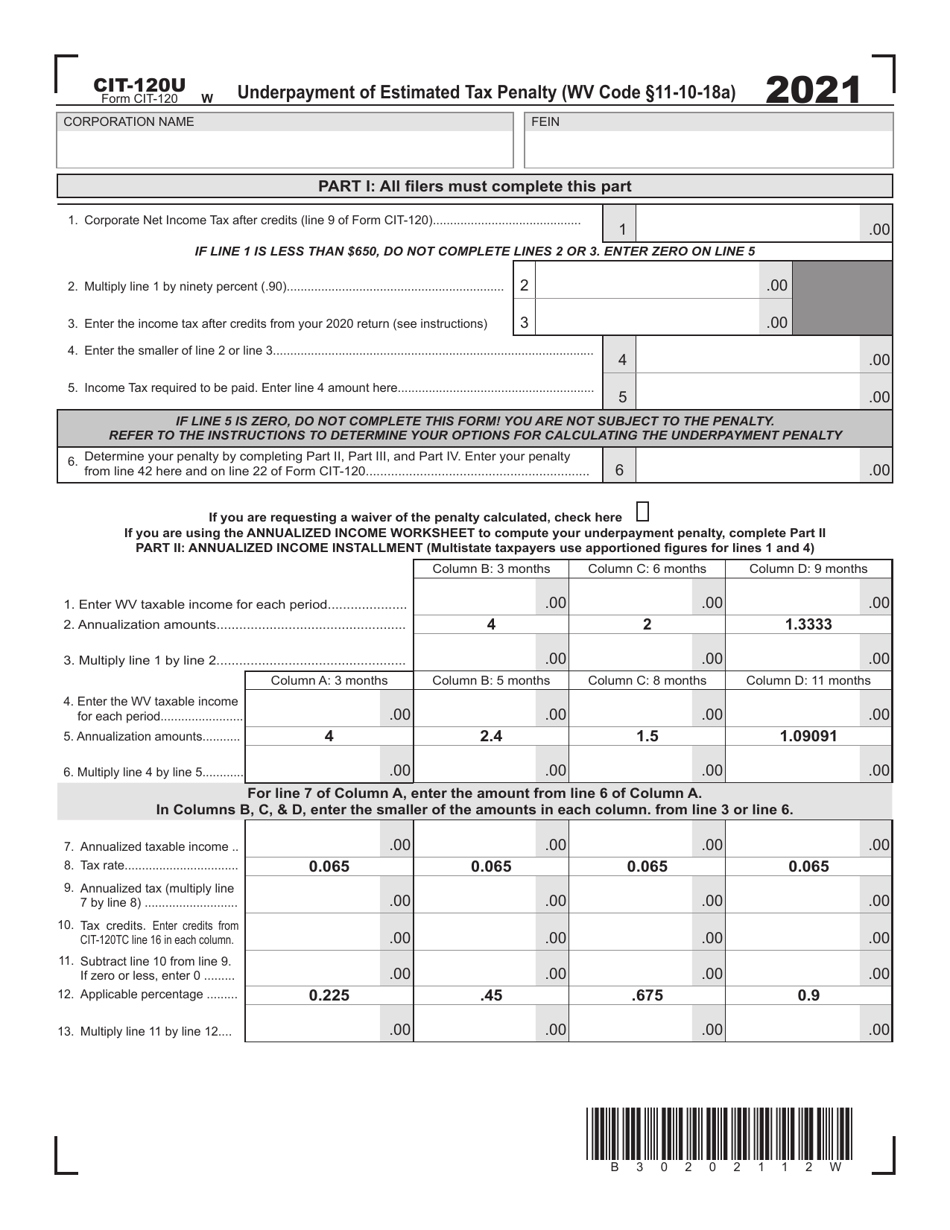

Form CIT-120U Underpayment of Estimated Tax Penalty - West Virginia

What Is Form CIT-120U?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form CIT-120U?

A: Form CIT-120U is a form used in West Virginia to calculate and pay the underpayment of estimated tax penalty.

Q: Who needs to file form CIT-120U?

A: Individuals, estates, and trusts who have underpaid their estimated taxes in West Virginia may need to file form CIT-120U.

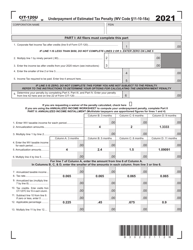

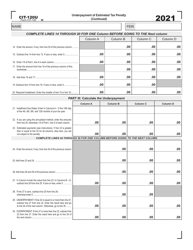

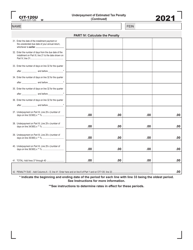

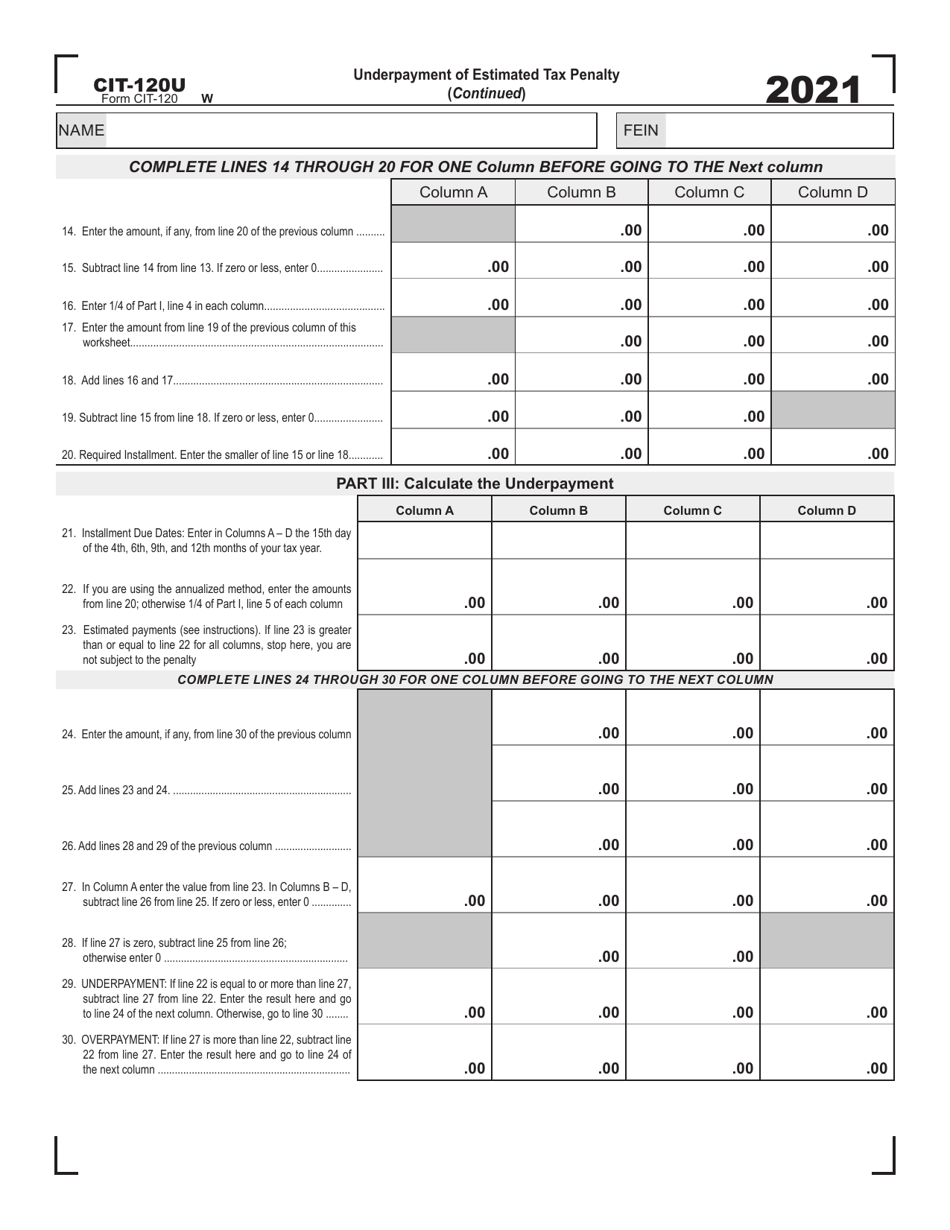

Q: How do I calculate the underpayment of estimated tax penalty?

A: The underpayment of estimated tax penalty is based on the amount of tax underpaid and the number of days the underpayment occurred. Form CIT-120U provides instructions for calculating the penalty.

Q: When is form CIT-120U due?

A: Form CIT-120U is generally due on the same date as your West Virginia income tax return, which is April 15th.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIT-120U by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.