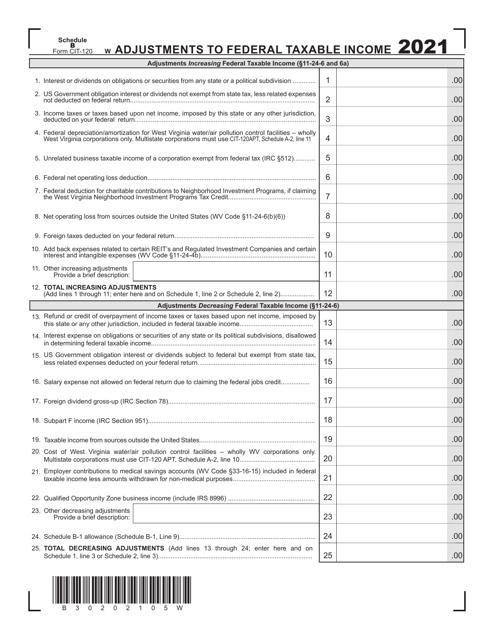

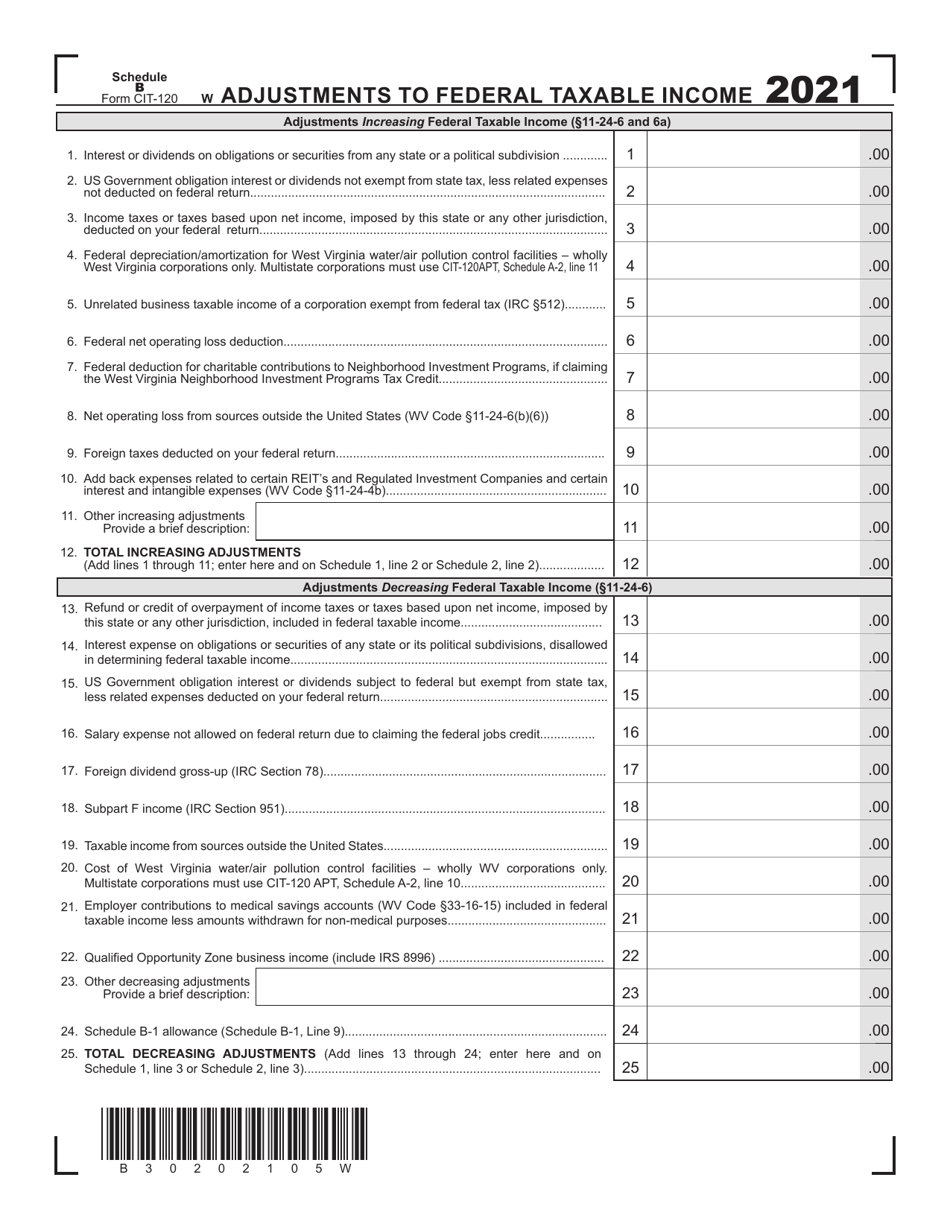

Form CIT-120 Schedule B Adjustments to Federal Taxable Income - West Virginia

What Is Form CIT-120 Schedule B?

This is a legal form that was released by the West Virginia Department of Revenue - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CIT-120 Schedule B?

A: CIT-120 Schedule B is a form used in West Virginia to report adjustments to federal taxable income.

Q: What are adjustments to federal taxable income?

A: Adjustments to federal taxable income are specific deductions or additions made to the income reported on your federal tax return.

Q: Why do I need to fill out CIT-120 Schedule B?

A: You need to fill out CIT-120 Schedule B to properly report and calculate your state income tax liability in West Virginia.

Q: Are there any specific requirements for filling out CIT-120 Schedule B?

A: Yes, you must follow the instructions provided with the form and provide accurate information regarding your federal taxable income adjustments.

Q: What types of adjustments can be reported on CIT-120 Schedule B?

A: Some common adjustments include additions for state income tax refunds, alimony received, and deductions for self-employment taxes.

Q: Do I need to include supporting documentation when submitting CIT-120 Schedule B?

A: You should keep any supporting documentation and be prepared to provide it if requested by the West Virginia State Tax Department.

Q: When is the deadline for filing CIT-120 Schedule B?

A: The deadline for filing CIT-120 Schedule B typically aligns with the deadline for filing your state income tax return in West Virginia.

Q: Can I file CIT-120 Schedule B electronically?

A: Yes, you can file CIT-120 Schedule B electronically through the West Virginia Taxpayer Access Point (TAP) system.

Form Details:

- The latest edition provided by the West Virginia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIT-120 Schedule B by clicking the link below or browse more documents and templates provided by the West Virginia Department of Revenue.