This version of the form is not currently in use and is provided for reference only. Download this version of

Form CIT-120 Schedule 1

for the current year.

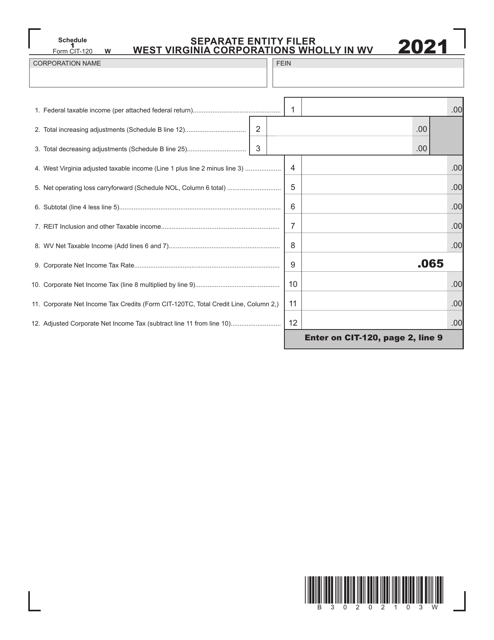

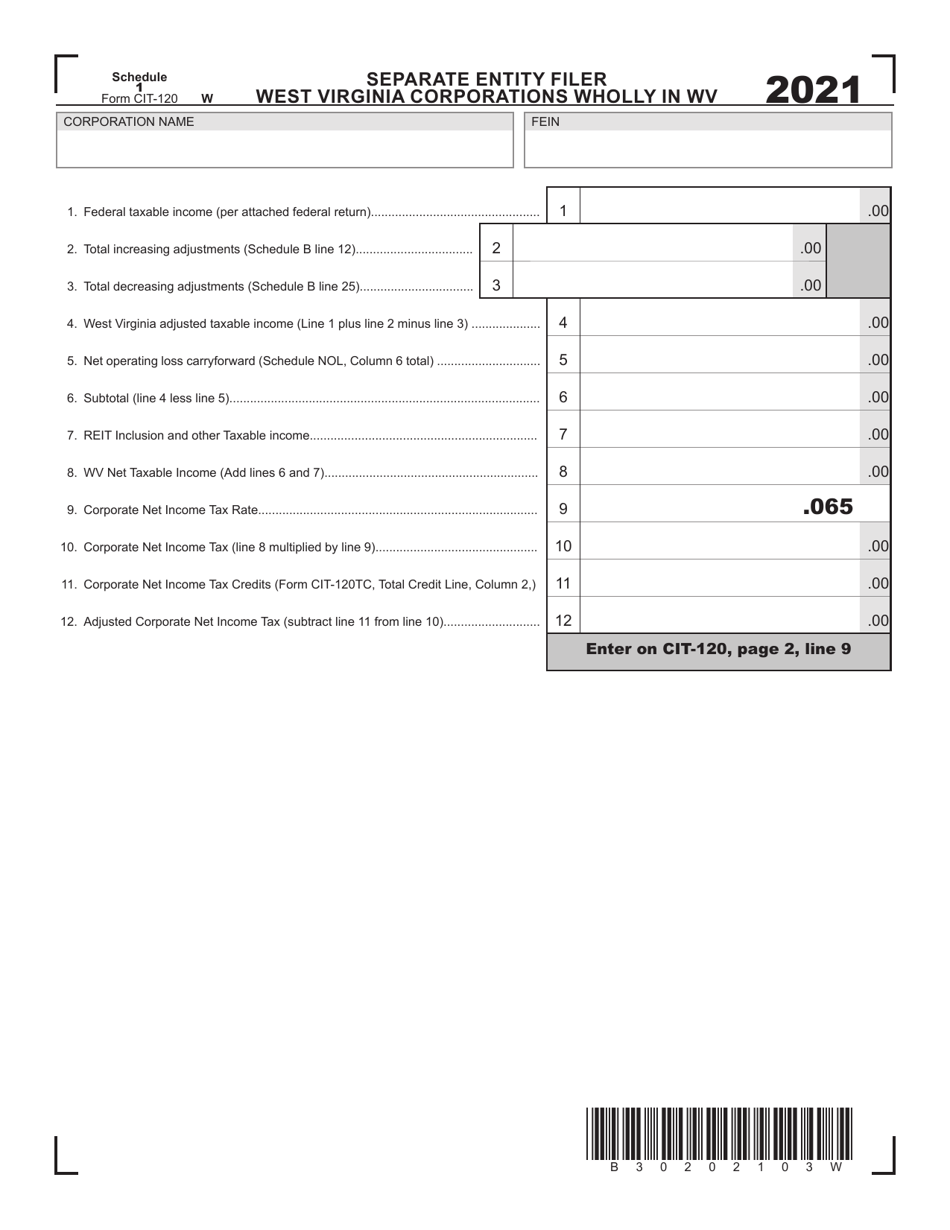

Form CIT-120 Schedule 1 Separate Entity Filer West Virginia Corporations Wholly in Wv - West Virginia

What Is Form CIT-120 Schedule 1?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form CIT-120, Corporation Net Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CIT-120 Schedule 1?

A: CIT-120 Schedule 1 is a form used for filing taxes by West Virginia Corporations.

Q: What does Separate Entity Filer mean?

A: Separate Entity Filer refers to a corporation that is filing its taxes separately from its owners or shareholders.

Q: What are West Virginia Corporations Wholly in Wv?

A: West Virginia Corporations Wholly in Wv are corporations that are registered and conducting business solely in West Virginia.

Q: What is the purpose of filing CIT-120 Schedule 1 for West Virginia Corporations Wholly in Wv?

A: The purpose of filing CIT-120 Schedule 1 is to report the corporation's income, deductions, and tax liability to the state of West Virginia.

Q: Is CIT-120 Schedule 1 only for corporations?

A: Yes, CIT-120 Schedule 1 is specifically designed for filing taxes for West Virginia Corporations Wholly in Wv.

Q: Are there any specific requirements for filing CIT-120 Schedule 1?

A: Yes, West Virginia Corporations Wholly in Wv must meet certain criteria and follow the instructions provided in the form to accurately complete the filing.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIT-120 Schedule 1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.