This version of the form is not currently in use and is provided for reference only. Download this version of

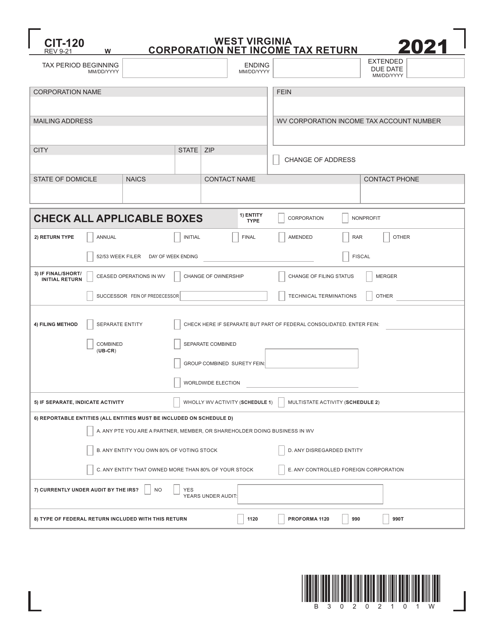

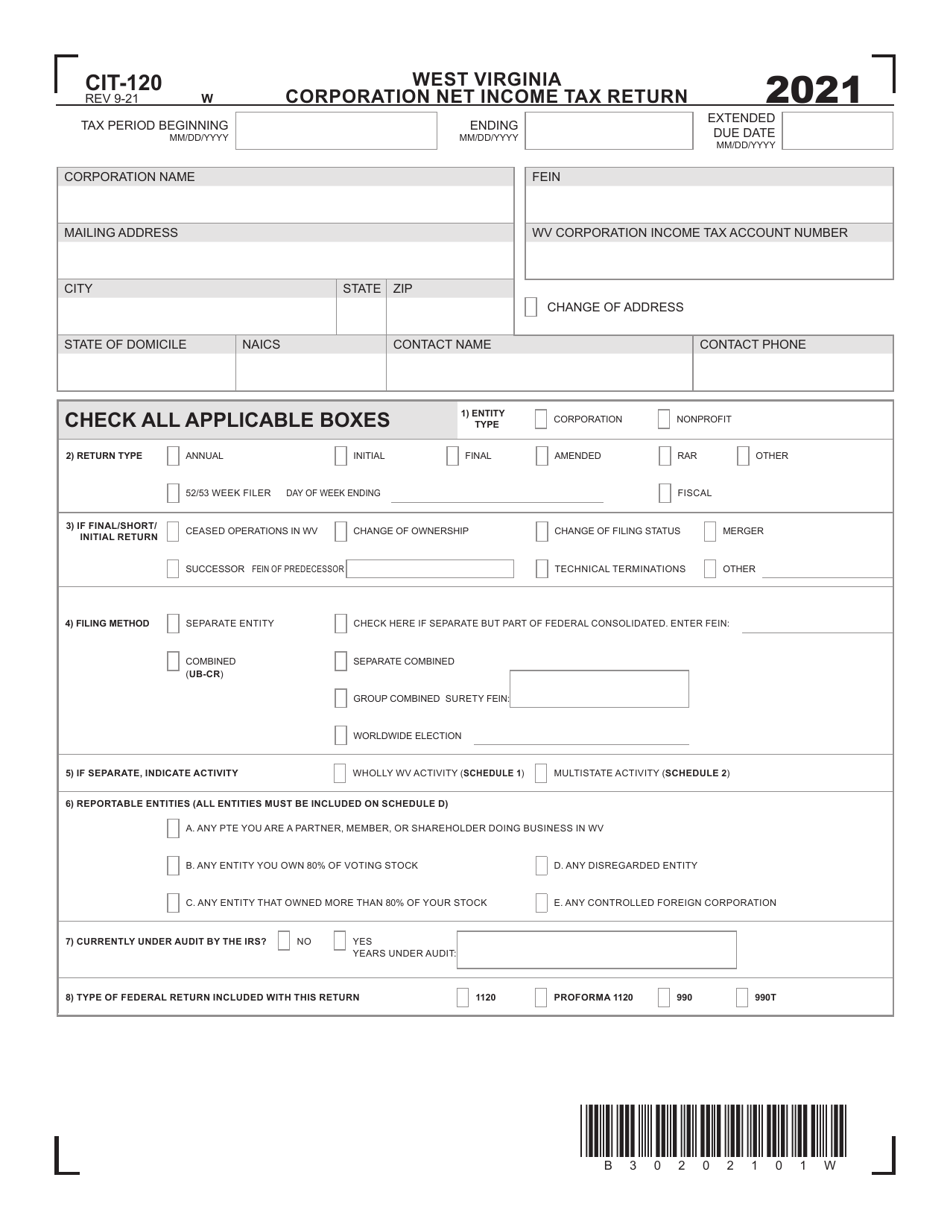

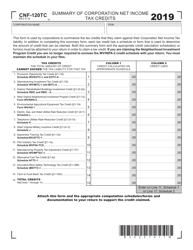

Form CIT-120

for the current year.

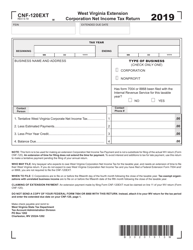

Form CIT-120 Corporation Net Income Tax Return - West Virginia

What Is Form CIT-120?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form CIT-120?

A: The Form CIT-120 is the Corporation Net Income Tax Return for West Virginia.

Q: What is the purpose of Form CIT-120?

A: The purpose of Form CIT-120 is to report the net income and calculate the tax liability of corporations in West Virginia.

Q: Who needs to file Form CIT-120?

A: Corporations operating in West Virginia are required to file Form CIT-120.

Q: What information is required in Form CIT-120?

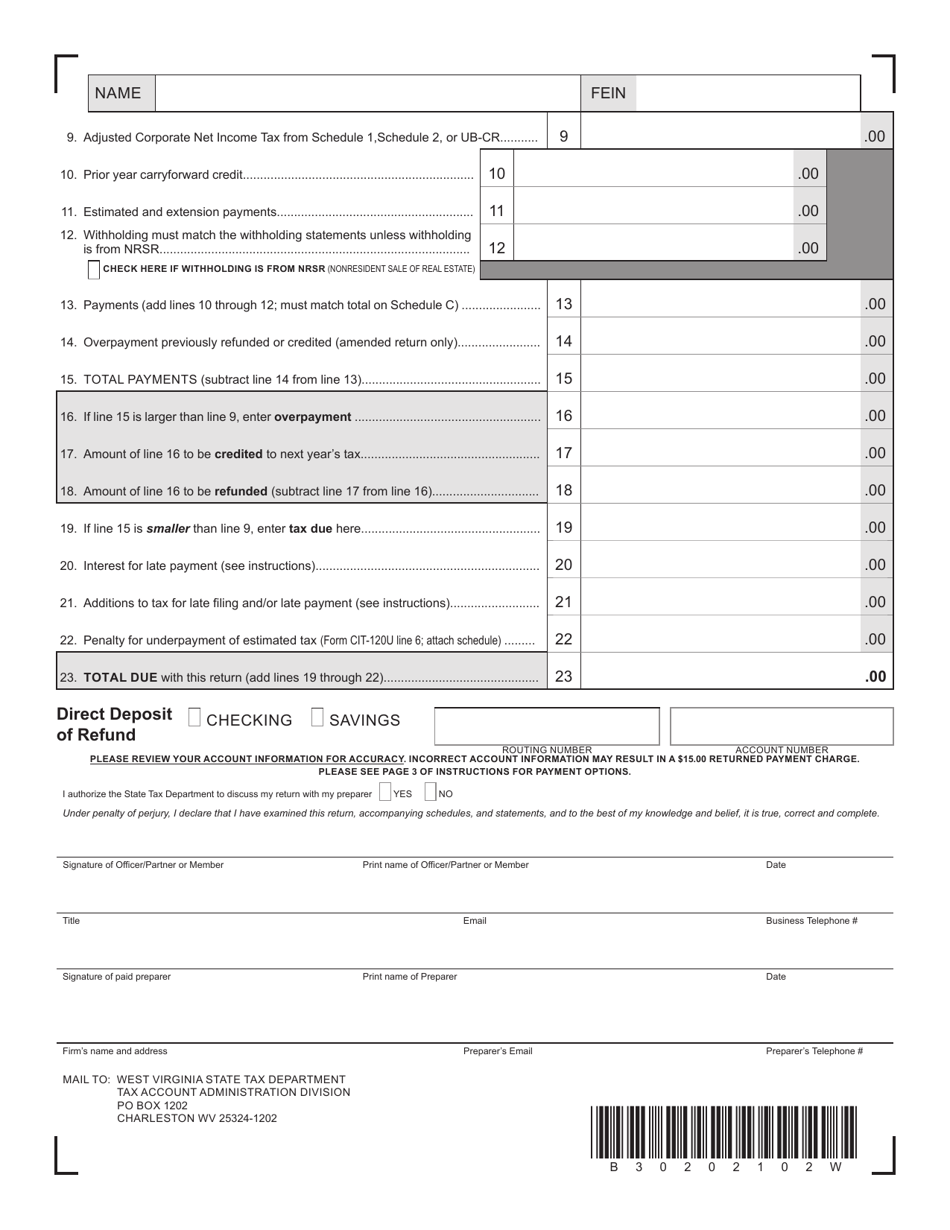

A: Form CIT-120 requires the corporation to provide detailed financial information, including income, deductions, and credits.

Q: What is the deadline for filing Form CIT-120?

A: The deadline for filing Form CIT-120 is the 15th day of the 4th month following the close of the corporation's tax year.

Q: Are there any penalties for late filing of Form CIT-120?

A: Yes, there are penalties for late filing or failure to file Form CIT-120, including interest charges and possible additional fees.

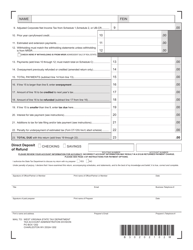

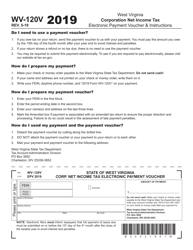

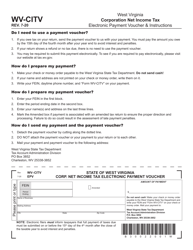

Q: Are there any payment requirements associated with Form CIT-120?

A: Yes, corporations must pay any tax liability owed at the time of filing Form CIT-120.

Q: Are there any additional forms or schedules that need to be attached to Form CIT-120?

A: Depending on the specific circumstances of the corporation, additional forms or schedules may need to be attached to Form CIT-120.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIT-120 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.