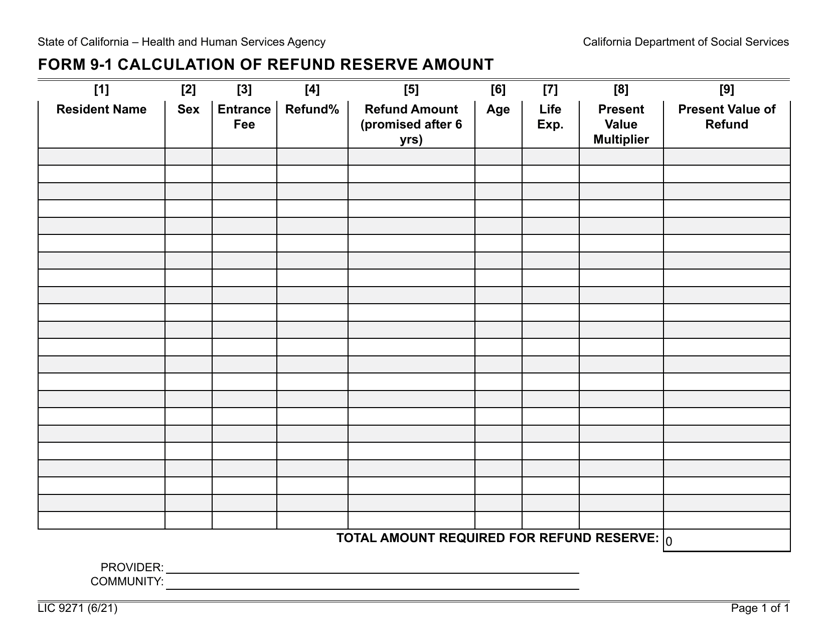

Form 9-1 (LIC9271) Calculation of Refund Reserve Amount - California

What Is Form 9-1 (LIC9271)?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 9-1 (LIC9271)?

A: Form 9-1 (LIC9271) is used for the Calculation of Refund Reserve Amount in California.

Q: What is the purpose of Form 9-1 (LIC9271)?

A: The purpose of Form 9-1 (LIC9271) is to calculate the refund reserve amount in California.

Q: Who uses Form 9-1 (LIC9271)?

A: Form 9-1 (LIC9271) is used by insurance companies in California.

Q: What is the refund reserve amount?

A: The refund reserve amount is the amount of money set aside by an insurance company to cover potential future refund obligations to policyholders.

Q: Why is the refund reserve amount calculated?

A: The refund reserve amount is calculated to ensure that insurance companies have sufficient funds to meet their refund obligations to policyholders.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 9-1 (LIC9271) by clicking the link below or browse more documents and templates provided by the California Department of Social Services.