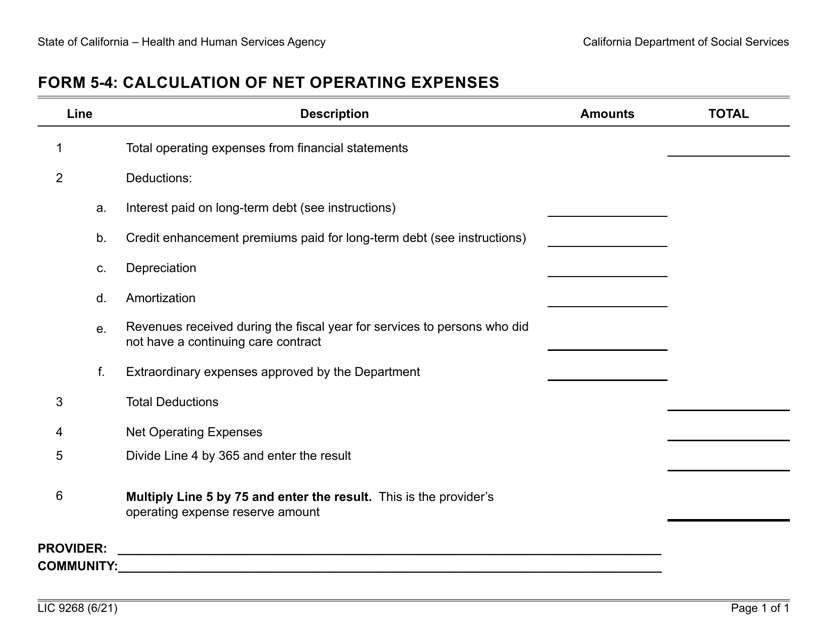

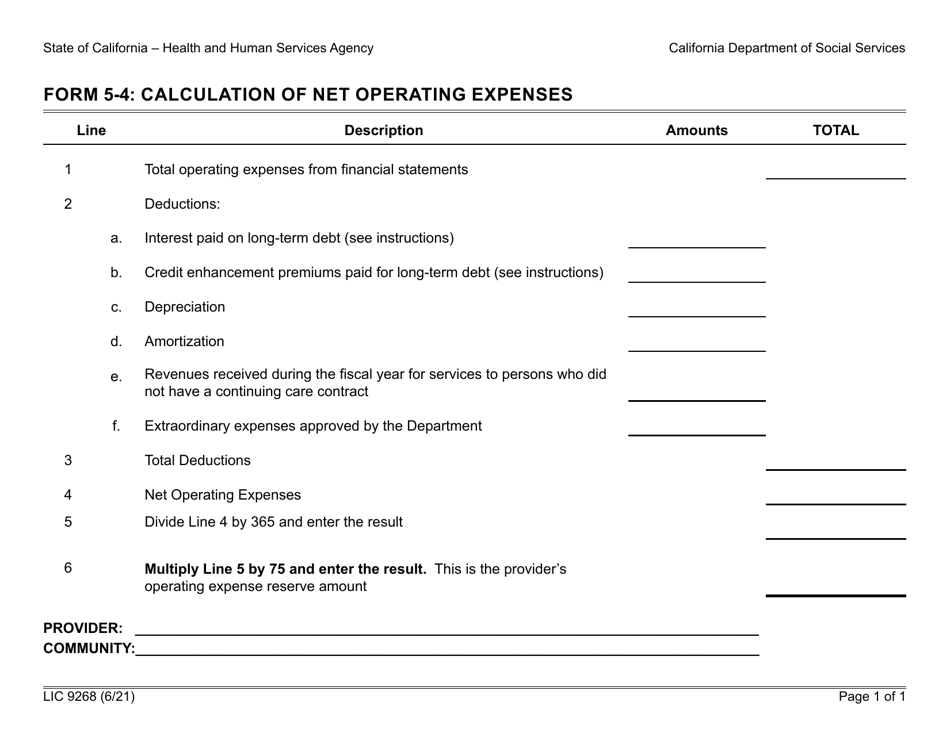

Form 5-4 (LIC9268) Calculation of Net Operating Expenses - California

What Is Form 5-4 (LIC9268)?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5-4 (LIC9268)?

A: Form 5-4 (LIC9268) is a document used to calculate the net operating expenses in California.

Q: What does the Form 5-4 (LIC9268) calculate?

A: The Form 5-4 (LIC9268) calculates the net operating expenses.

Q: Which state is the Form 5-4 (LIC9268) used in?

A: The Form 5-4 (LIC9268) is used in California.

Q: What is the purpose of calculating net operating expenses?

A: The purpose of calculating net operating expenses is to determine the total expenses incurred by a business or organization.

Q: Why is calculating net operating expenses important?

A: Calculating net operating expenses is important to evaluate the financial performance and profitability of a business or organization.

Q: What other information is required to complete Form 5-4 (LIC9268)?

A: Other information required to complete Form 5-4 (LIC9268) may include income sources, expenses, and any deductions or credits.

Q: Is Form 5-4 (LIC9268) mandatory?

A: The requirement to file Form 5-4 (LIC9268) may vary depending on the specific regulations and laws of California. It is recommended to consult with a tax professional or the California Department of Insurance for the most accurate information.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5-4 (LIC9268) by clicking the link below or browse more documents and templates provided by the California Department of Social Services.