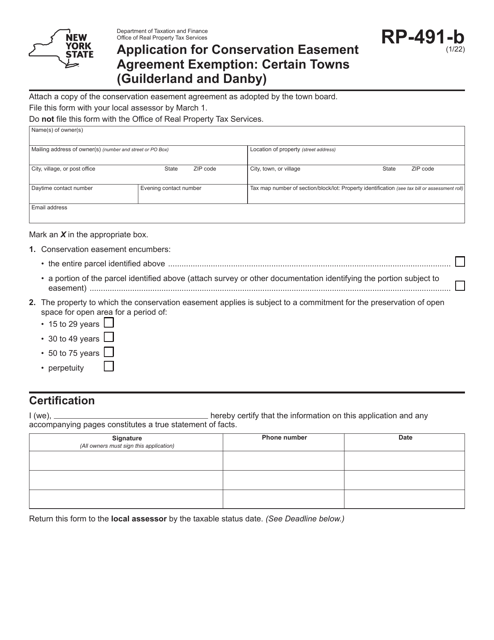

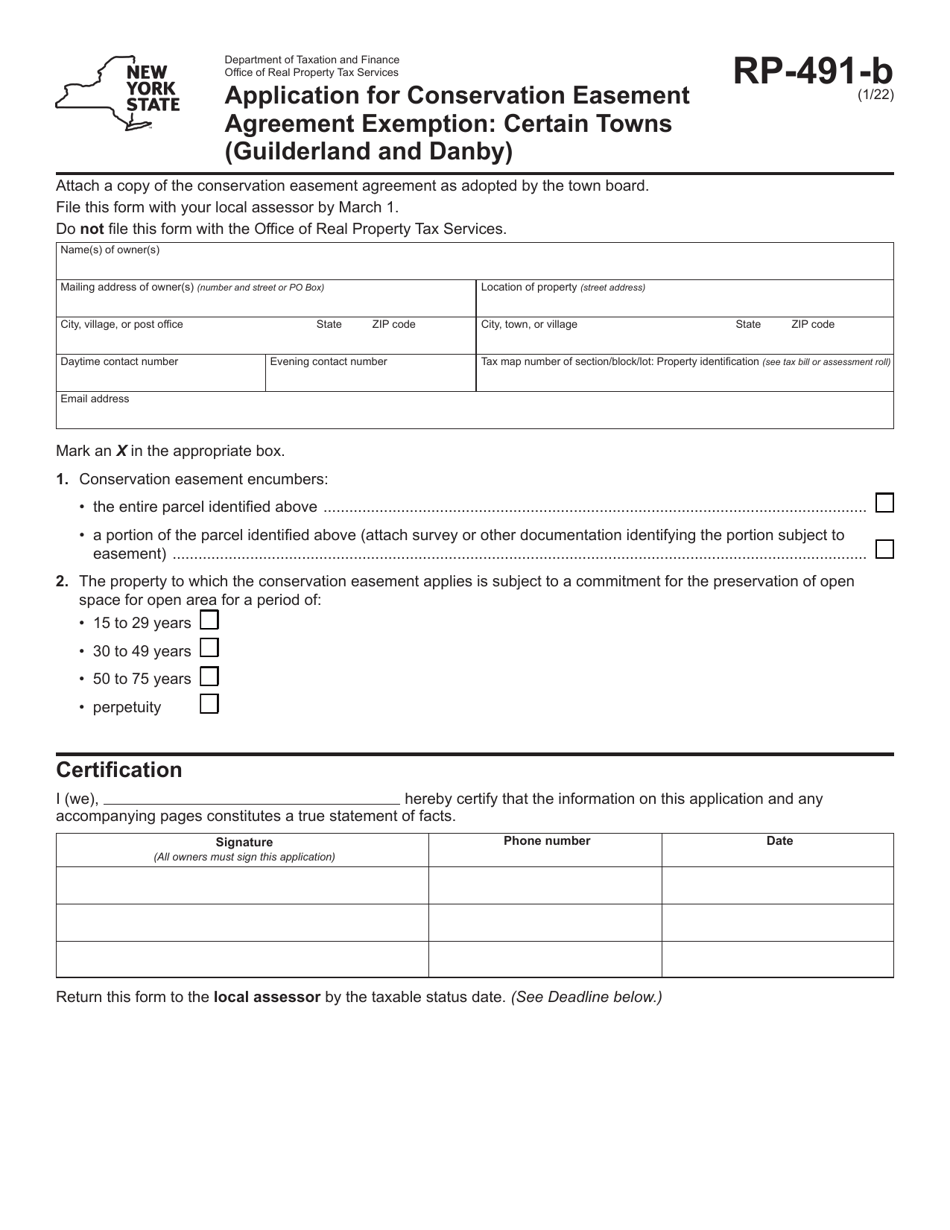

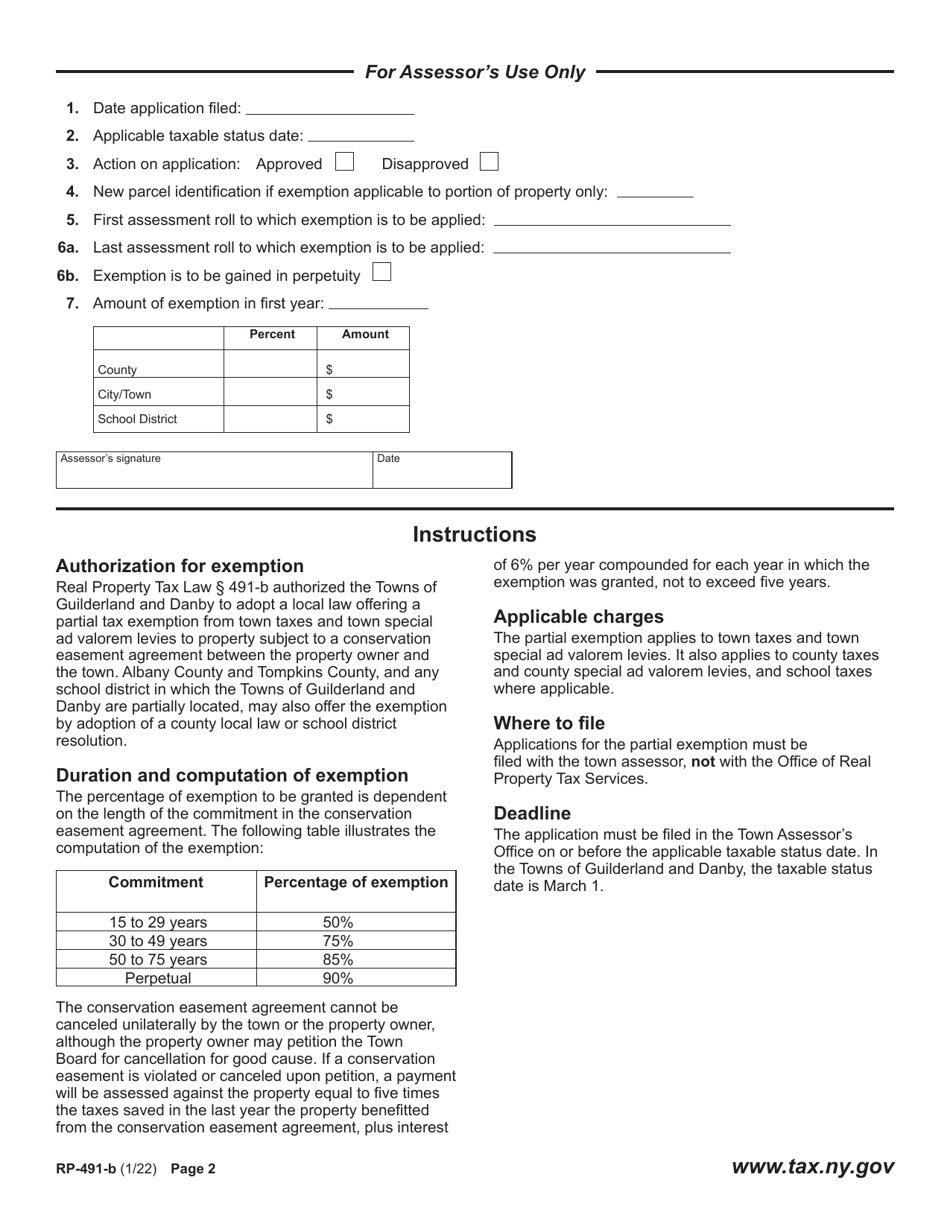

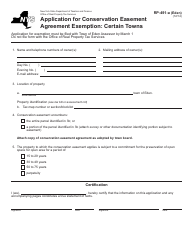

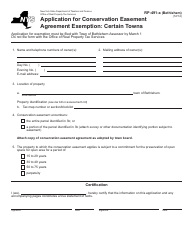

Form RP-491-B Application for Conservation Easement Agreement Exemption: Certain Towns (Guilderland and Danby) - New York

What Is Form RP-491-B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-491-B?

A: Form RP-491-B is the application for Conservation Easement Agreement Exemption for certain towns in New York (Guilderland and Danby).

Q: What is a conservation easement agreement?

A: A conservation easement agreement is a legal agreement that restricts the development or future use of a property in order to protect its natural, scenic, or agricultural value.

Q: Who is eligible to apply for the exemption?

A: Residents or landowners in Guilderland and Danby, New York, are eligible to apply for the exemption.

Q: What is the purpose of the exemption?

A: The exemption aims to encourage the preservation of open spaces, natural resources, and agricultural lands in Guilderland and Danby.

Q: Are there any fees associated with the application?

A: There may be filing fees associated with the application. It is best to check with the local tax assessor's office for the specific fee amount.

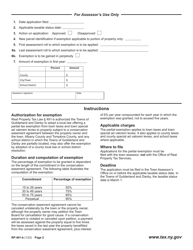

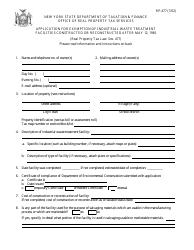

Q: What information and documents are required for the application?

A: The application typically requires information about the property, including its location, size, and current use. It may also require supporting documentation such as surveys, deeds, and maps.

Q: Are there any deadlines for submitting the application?

A: Yes, the application must be filed with the assessor on or before the taxable status date of the applicable assessment roll.

Q: What happens after the application is submitted?

A: After the application is submitted, it will be reviewed by the local tax assessor's office. If approved, the property may qualify for a partial exemption from property taxes.

Q: Can I appeal if my application is denied?

A: Yes, if your application is denied, you have the right to appeal the decision. The specific appeal process may vary depending on the local jurisdiction.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-491-B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

![Document preview: Form RP-491 [ELMA] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733932/form-rp-491-elma-application-conservation-easement-agreement-exemption-certain-towns-new-york.png)

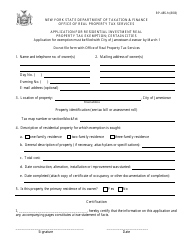

![Document preview: Form RP-485-I [ROME] Application for Residential Investment Real Property Tax Exemption; Certain Cities - New York](https://data.templateroller.com/pdf_docs_html/1733/17334/1733439/form-rp-485-i-rome-application-residential-investment-real-property-tax-exemption-certain-cities-new-york.png)

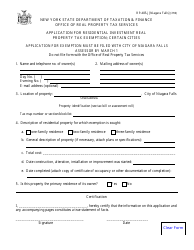

![Document preview: Form RP-485-M [ROME SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733929/form-rp-485-m-rome-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)

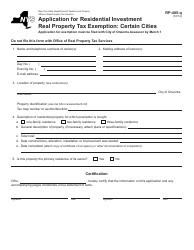

![Document preview: Form RP-485-K [UTICA SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - City of Utica, New York](https://data.templateroller.com/pdf_docs_html/1349/13498/1349829/form-rp-485-k-utica-sd-application-for-residential-investment-real-property-tax-exemption-certain-school-districts-city-of-utica-new-york.png)

![Document preview: Form RP-491 [ORCHARD PARK] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733934/form-rp-491-orchard-park-application-conservation-easement-agreement-exemption-certain-towns-new-york.png)

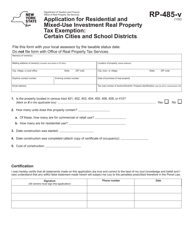

![Document preview: Form RP-485-I [JAMESTOWN SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/578/5786/578655/form-rp-485-i-jamestown-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york.png)