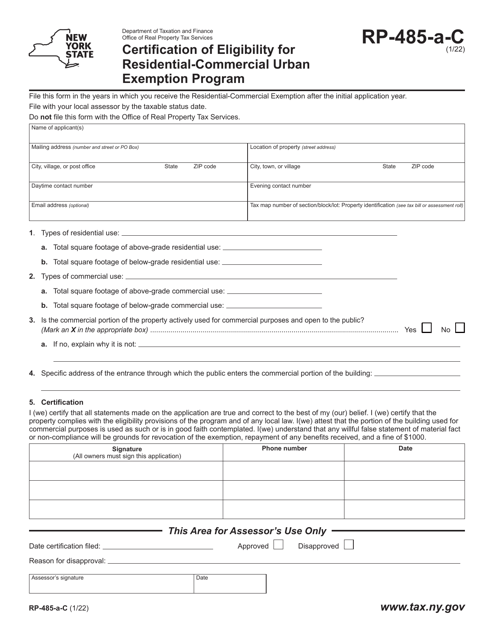

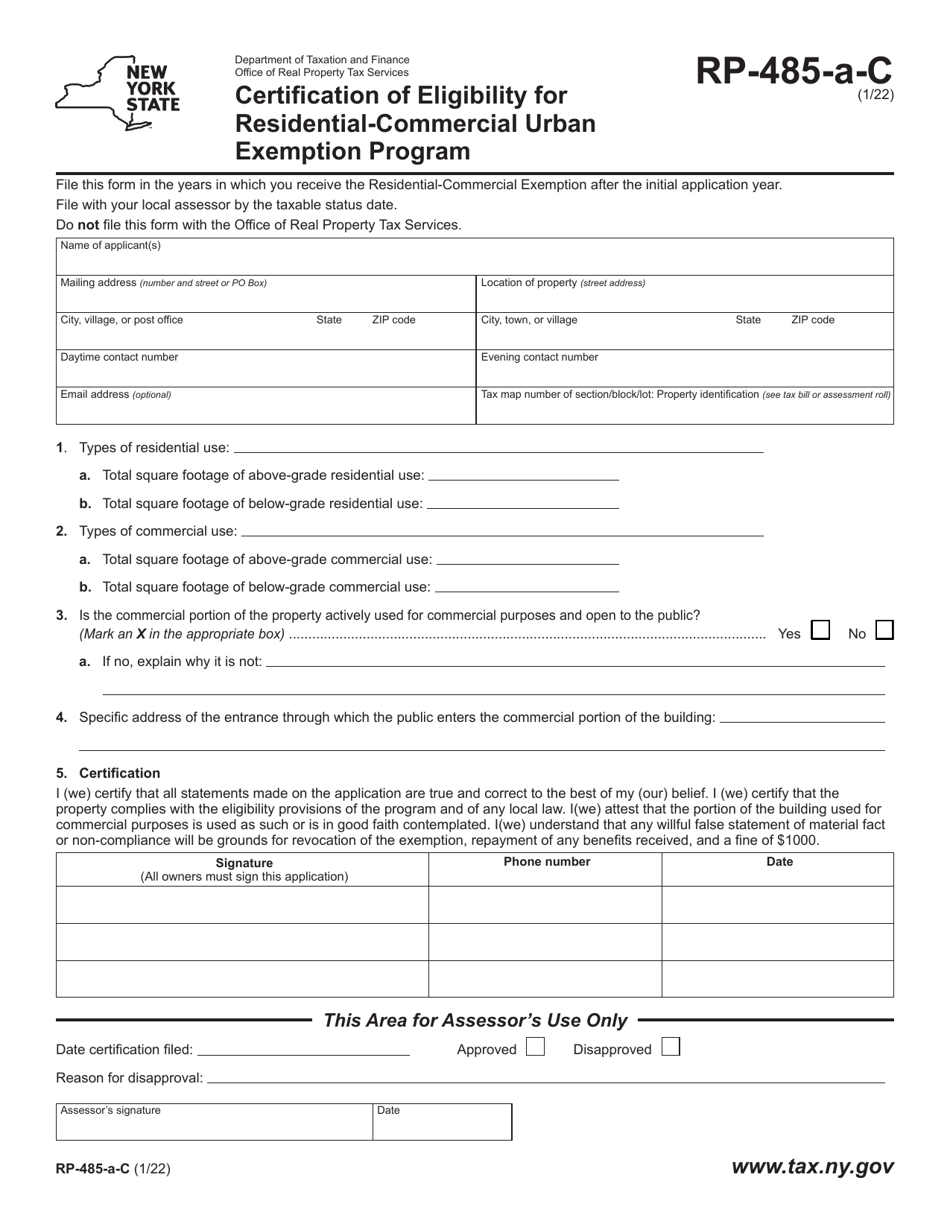

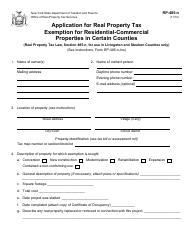

Form RP-485-A-C Certification of Eligibility for Residential-Commercial Urban Exemption Program - New York

What Is Form RP-485-A-C?

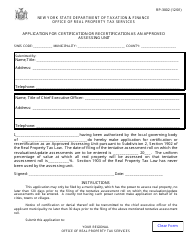

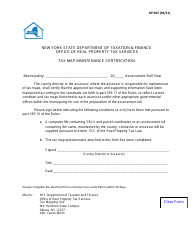

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-485-A-C?

A: Form RP-485-A-C is the Certification of Eligibility for the Residential-Commercial Urban Exemption Program in New York.

Q: What is the Residential-Commercial Urban Exemption Program?

A: The Residential-Commercial Urban Exemption Program is a program in New York that provides property tax exemptions to eligible residential and commercial property owners in designated urban areas.

Q: Who is eligible for the program?

A: Eligible property owners in designated urban areas are eligible for the Residential-Commercial Urban Exemption Program.

Q: Why would someone need to file Form RP-485-A-C?

A: Property owners who want to apply for the Residential-Commercial Urban Exemption Program need to file Form RP-485-A-C to certify their eligibility.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-485-A-C by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.