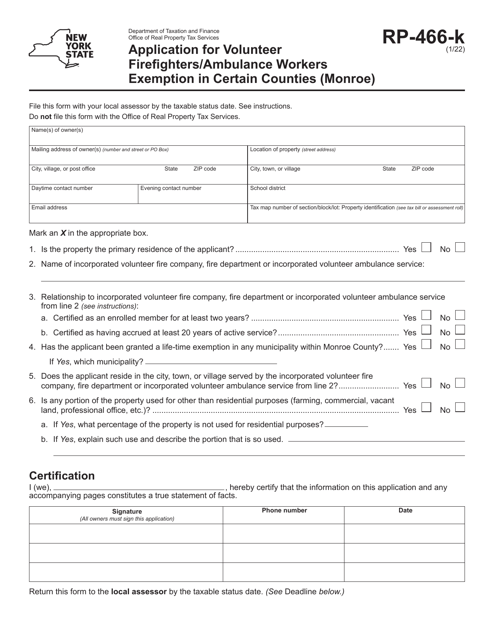

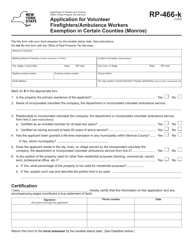

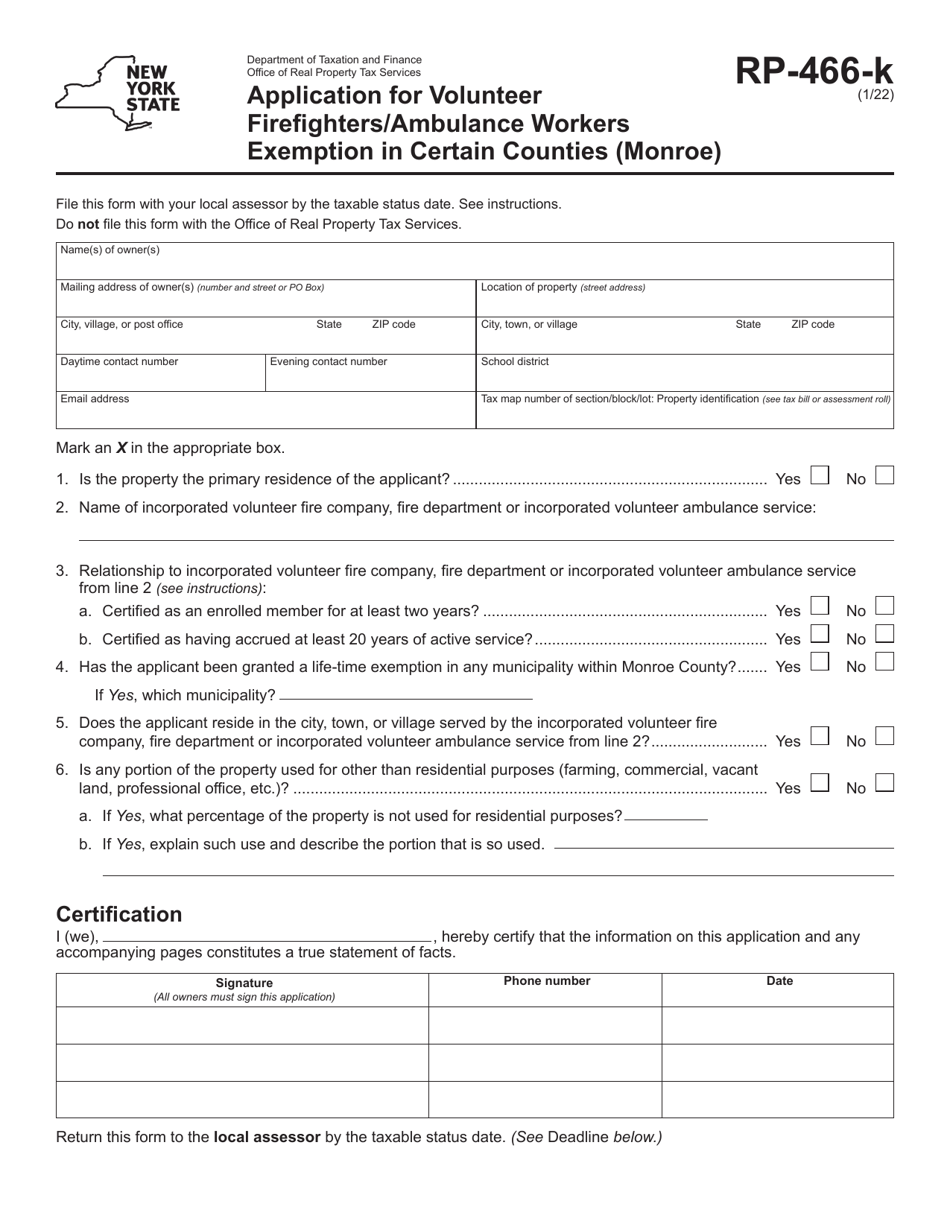

Form RP-466-K Application for Volunteer Firefighters / Ambulance Workers Exemption in Certain Counties (Monroe) - New York

What Is Form RP-466-K?

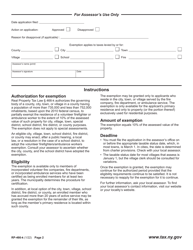

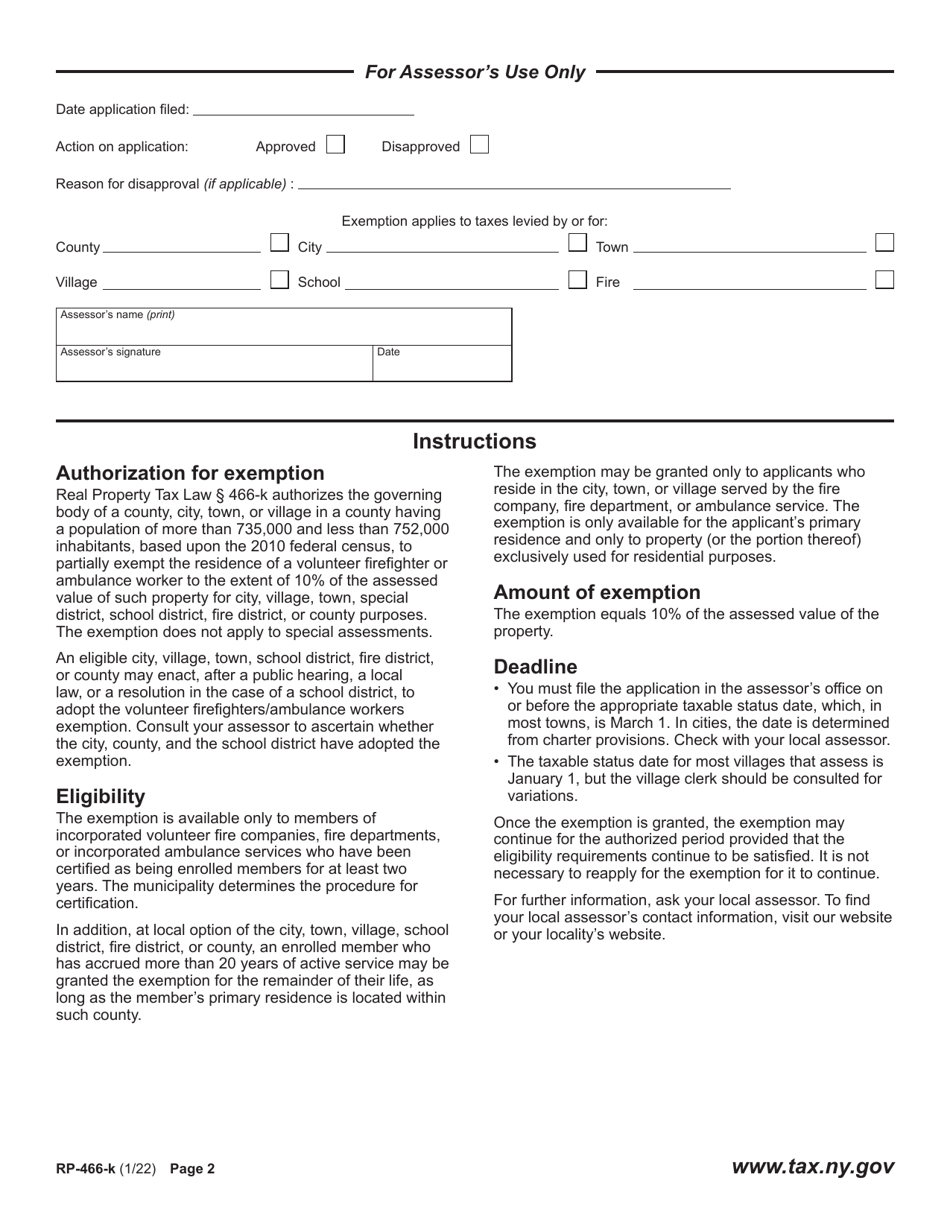

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-466-K?

A: Form RP-466-K is an application for Volunteer Firefighters/Ambulance Workers Exemption in Certain Counties in Monroe, New York.

Q: Who is eligible for the exemption?

A: Volunteer Firefighters and Ambulance Workers in certain counties, including Monroe, New York, are eligible for this exemption.

Q: What is the purpose of the exemption?

A: The exemption provides property tax relief to eligible Volunteer Firefighters and Ambulance Workers in certain counties.

Q: Are there any deadlines to submit the form?

A: The deadline to submit Form RP-466-K varies by county, so you should check with your local assessor's office for the specific deadline.

Q: What documentation is required with the application?

A: You will need to provide documentation such as proof of membership in a volunteer firefighting or ambulance service, as well as other supporting evidence of eligibility.

Q: Is the exemption renewable?

A: Yes, the exemption needs to be renewed annually. You will need to reapply each year to continue receiving the property tax relief.

Q: Will the exemption reduce my property taxes?

A: Yes, if you are eligible and approved for the exemption, it will reduce the amount of property taxes you owe.

Q: Can I apply for this exemption if I live outside Monroe County?

A: No, the Volunteer Firefighters/Ambulance Workers Exemption in Certain Counties (Monroe) is only applicable to eligible individuals residing in Monroe County, New York.

Q: Are there any income eligibility requirements for this exemption?

A: No, there are no income eligibility requirements for this exemption. It is based solely on your volunteer service as a firefighter or ambulance worker.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-466-K by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

![Document preview: Form RP-466-C [ERIE] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Erie County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733894/form-rp-466-c-erie-application-volunteer-firefighters-ambulance-workers-exemption-use-in-erie-county-only-new-york.png)

![Document preview: Form RP-466-E [LEWIS] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Lewis County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733901/form-rp-466-e-lewis-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-lewis-county-only-new-york.png)

![Document preview: Form RP-466-C [PUTNAM] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Putnam County Only) - New York](https://data.templateroller.com/pdf_docs_html/1731/17310/1731027/form-rp-466-c-putnam-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-putnam-county-only-new-york.png)

![Document preview: Form RP-466-F [ORANGE] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Orange County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733906/form-rp-466-f-orange-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-orange-county-only-new-york.png)

![Document preview: Form RP-466-H [ULSTER] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Ulster County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733907/form-rp-466-h-ulster-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-ulster-county-only-new-york.png)

![Document preview: Form RP-466-I [ALBANY] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Albany County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733909/form-rp-466-i-albany-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-albany-county-only-new-york.png)

![Document preview: Form RP-466-J [CLINTON] Application for Volunteer Firefighters/ Volunteer Ambulance Workers Exemption (For Use in Clinton County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733910/form-rp-466-j-clinton-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-clinton-county-only-new-york.png)

![Document preview: Form RP-466-C [SUFFOLK] Application for Volunteer Firefighters / Ambulance Workers Exemption(For Use in Suffolk County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17335/1733577/form-rp-466-c-suffolk-application-volunteer-firefighters-ambulance-workers-exemption-use-in-suffolk-county-only-new-york.png)

![Document preview: Form RP-466-C [WYOMING] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Wyoming County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733891/form-rp-466-c-wyoming-application-volunteer-firefighters-ambulance-workers-exemption-use-in-wyoming-county-only-new-york.png)

![Document preview: Form RP-466-F [SULLIVAN] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Sullivan County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17336/1733642/form-rp-466-f-sullivan-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-sullivan-county-only-new-york.png)

![Document preview: Form RP-466-G [ONONDAGA] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Onondaga County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733908/form-rp-466-g-onondaga-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-onondaga-county-only-new-york.png)

![Document preview: Form RP-466-C [DUTCHESS] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Dutchess County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733893/form-rp-466-c-dutchess-application-volunteer-firefighters-ambulance-workers-exemption-use-in-dutchess-county-only-new-york.png)

![Document preview: Form RP-466-E [SCHOHARIE] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Schoharie County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733903/form-rp-466-e-schoharie-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-schoharie-county-only-new-york.png)

![Document preview: Form RP-466-F [MONTGOMERY] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Montgomery County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733905/form-rp-466-f-montgomery-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-montgomery-county-only-new-york.png)

![Document preview: Form RP-466-E [SCHENECTADY] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Schenectady County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733899/form-rp-466-e-schenectady-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-schenectady-county-only-new-york.png)

![Document preview: Form RP-466-C [CATTARAUGUS] Application for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Cattaraugus County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733892/form-rp-466-c-cattaraugus-application-volunteer-firefighters-ambulance-workers-exemption-use-in-cattaraugus-county-only-new-york.png)

![Document preview: Form RP-466-D [WESTCHESTER] Application Form for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Westchester County Only) - New York](https://data.templateroller.com/pdf_docs_html/359/3598/359812/form-rp-466-d-westchester-application-form-volunteer-firefighters-ambulance-workers-exemption-use-in-westchester-county-only-new-york.png)

![Document preview: Form RP-466-A [ROCKLAND, STEUBEN] Application for Volunteer Firefighters / Ambulance Workers Exemption in Certain Counties (For Use in Rockland or Steuben County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733888/form-rp-466-a-rockland-steuben-application-volunteer-firefighters-ambulance-workers-exemption-in-certain-counties-use-in-rockland-or-steuben-county-only-new-york.png)

![Document preview: Form RP-466-B [CHAUTAUQUA, OSWEGO] Application for Volunteer Firefighters / Ambulance Workers Exemption in Certain Additional Counties (For Use in Chautauqua or Oswego County Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17338/1733890/form-rp-466-b-chautauqua-oswego-application-volunteer-firefighters-ambulance-workers-exemption-in-certain-additional-counties-use-in-chautauqua-or-oswego-county-only-new-york.png)

![Document preview: Form RP-466-F [JEFFERSON, ST. LAWRENCE] Application for Volunteer Firefighters / Volunteer Ambulance Workers Exemption (For Use in Jefferson and St. Lawrence Counties Only) - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733904/form-rp-466-f-jefferson-st-lawrence-application-volunteer-firefighters-volunteer-ambulance-workers-exemption-use-in-jefferson-and-st-lawrence-counties-only-new-york.png)