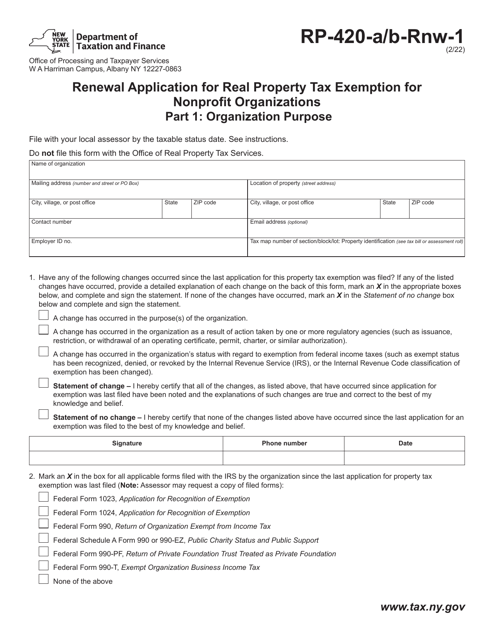

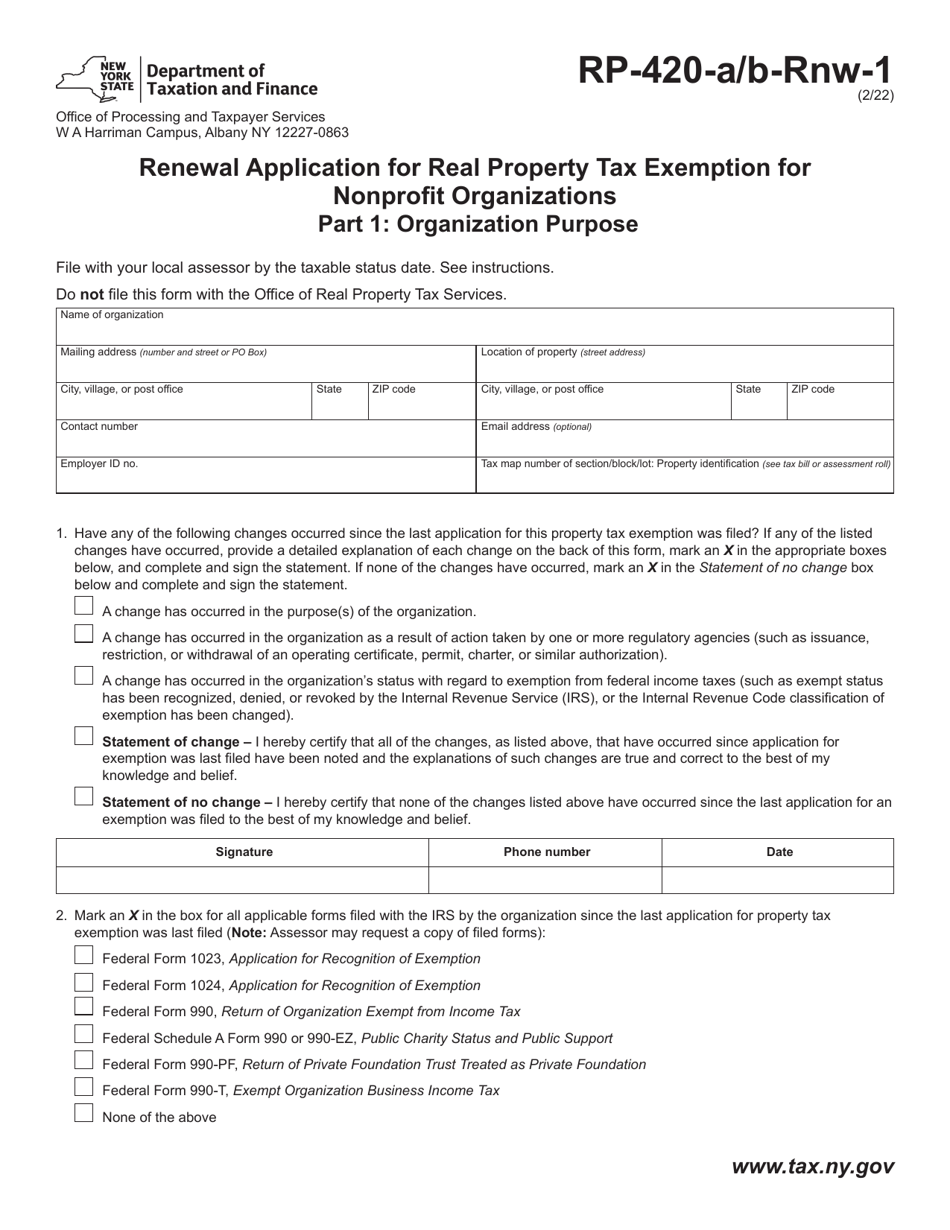

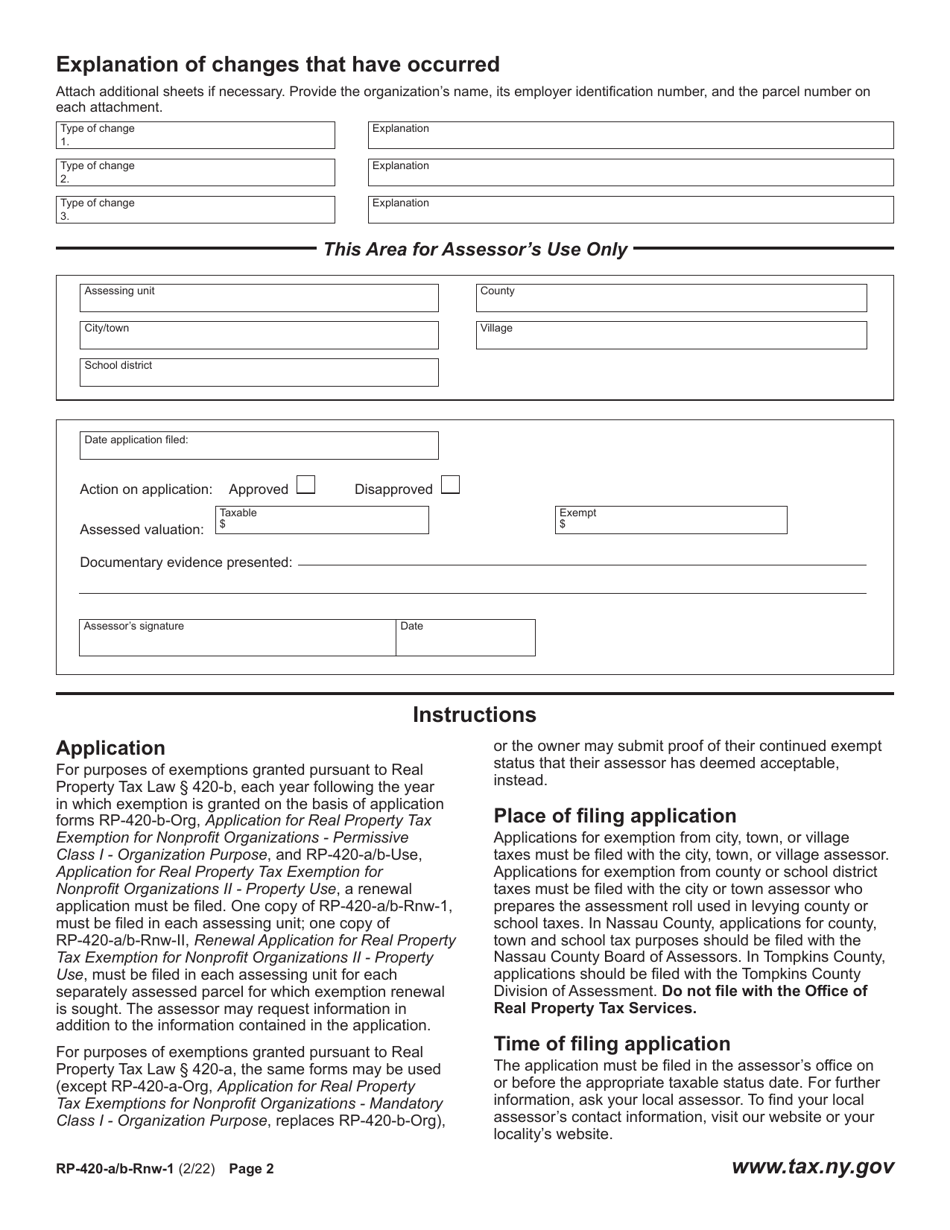

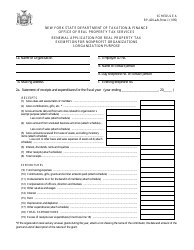

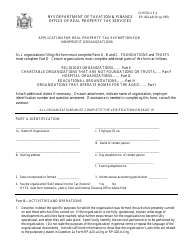

Form RP-420-A / B-RNW-1 Part 1 Renewal Application for Real Property Tax Exemption for Nonprofit Organizations - Organization Purpose - New York

What Is Form RP-420-A/B-RNW-1 Part 1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-420-A/B-RNW-1?

A: Form RP-420-A/B-RNW-1 is a Renewal Application for Real Property Tax Exemption for Nonprofit Organizations.

Q: What is the purpose of Form RP-420-A/B-RNW-1?

A: The purpose of Form RP-420-A/B-RNW-1 is to apply for a renewal of real property tax exemption for nonprofit organizations in New York.

Q: Who is eligible to use Form RP-420-A/B-RNW-1?

A: Nonprofit organizations in New York who already have a real property tax exemption can use Form RP-420-A/B-RNW-1 to apply for a renewal.

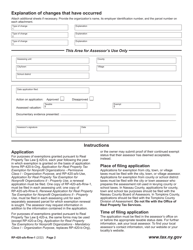

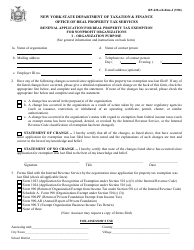

Q: What is the organization purpose section of Form RP-420-A/B-RNW-1?

A: The organization purpose section of Form RP-420-A/B-RNW-1 is where the nonprofit organization explains its purpose and mission.

Q: What information is required in the organization purpose section of Form RP-420-A/B-RNW-1?

A: The organization purpose section of Form RP-420-A/B-RNW-1 requires the nonprofit organization to provide a detailed description of its activities, programs, or services.

Q: Why is the organization purpose section important in Form RP-420-A/B-RNW-1?

A: The organization purpose section is important in Form RP-420-A/B-RNW-1 as it helps the tax authorities determine if the nonprofit organization meets the criteria for real property tax exemption.

Q: Is Form RP-420-A/B-RNW-1 only for nonprofit organizations in New York?

A: Yes, Form RP-420-A/B-RNW-1 is specifically for nonprofit organizations in New York seeking real property tax exemption.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-420-A/B-RNW-1 Part 1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.