This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

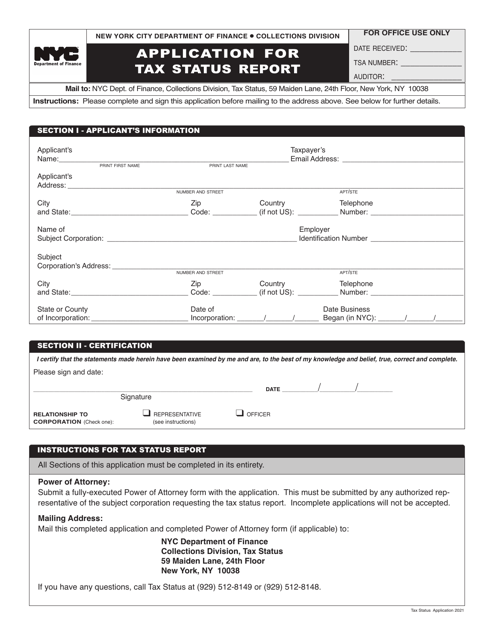

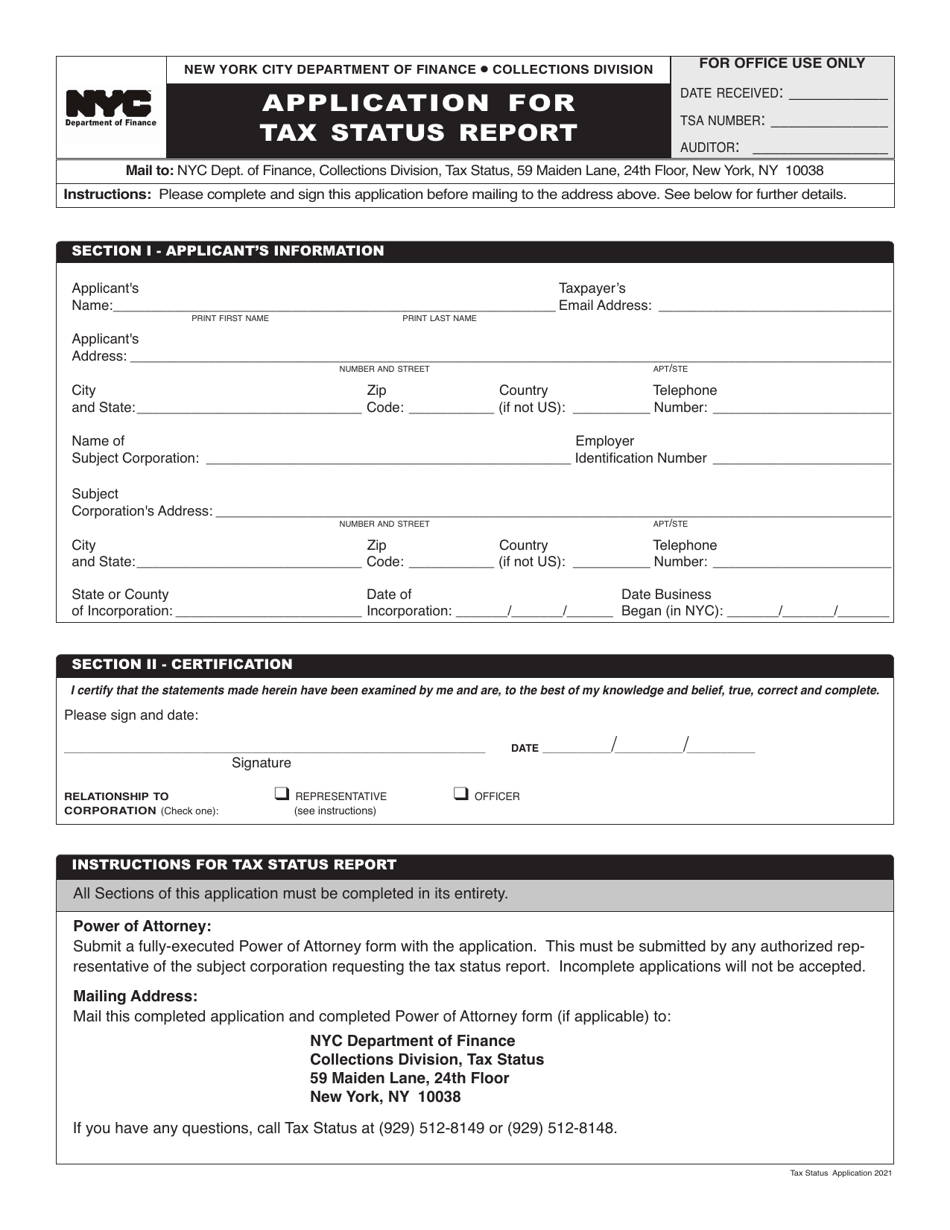

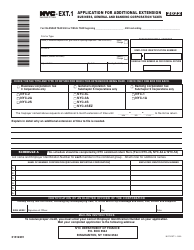

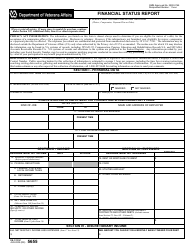

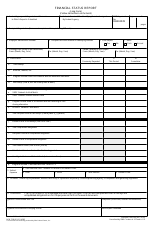

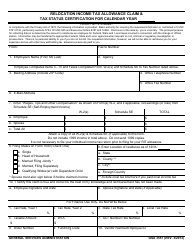

Application for Tax Status Report - New York City

Application for Tax Status Report is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

Q: What is a Tax Status Report?

A: A Tax Status Report is a document that provides information about an individual or business's tax status in New York City.

Q: How can I apply for a Tax Status Report in New York City?

A: You can apply for a Tax Status Report in New York City by submitting an application to the appropriate government agency.

Q: Why would I need a Tax Status Report?

A: You may need a Tax Status Report for various reasons, such as applying for a loan, proving compliance with tax obligations, or for business registration purposes.

Q: Which government agency should I contact to apply for a Tax Status Report in New York City?

A: You should contact the New York City Department of Finance to apply for a Tax Status Report.

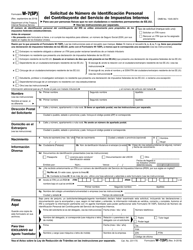

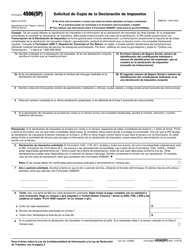

Q: What information do I need to provide in the application for a Tax Status Report?

A: The specific information required may vary, but generally, you will need to provide your personal or business details, such as your name, address, and taxpayer identification number.

Q: Is there a fee for obtaining a Tax Status Report in New York City?

A: Yes, there is usually a fee associated with obtaining a Tax Status Report. The exact fee amount may vary depending on the specific circumstances.

Q: How long does it take to receive a Tax Status Report in New York City?

A: The processing time for a Tax Status Report can vary. It is best to check with the New York City Department of Finance for the most up-to-date information on processing times.

Q: What should I do if there is an error or discrepancy in my Tax Status Report?

A: If you believe there is an error or discrepancy in your Tax Status Report, you should contact the New York City Department of Finance to resolve the issue.

Q: How long is a Tax Status Report valid for?

A: The validity period of a Tax Status Report can vary depending on the specific circumstances or requirements. It is best to check with the relevant agencies or organizations that require the report to determine the validity period.

Form Details:

- Released on January 1, 2021;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.