This version of the form is not currently in use and is provided for reference only. Download this version of

Form NYC-FP

for the current year.

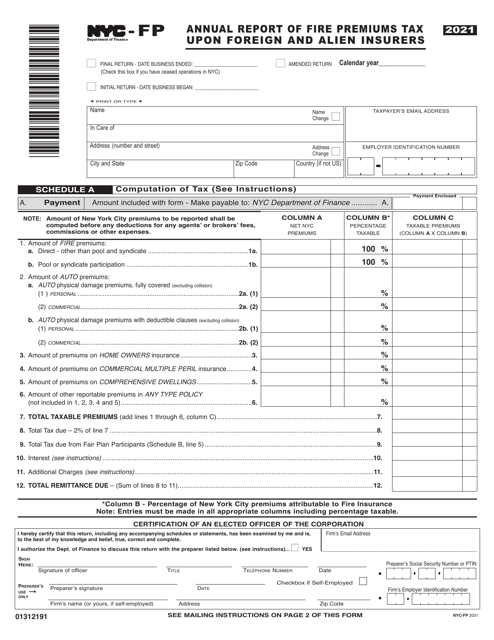

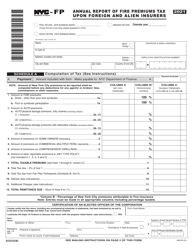

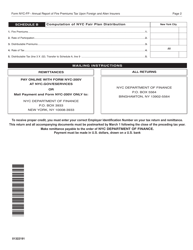

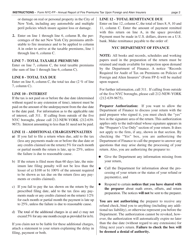

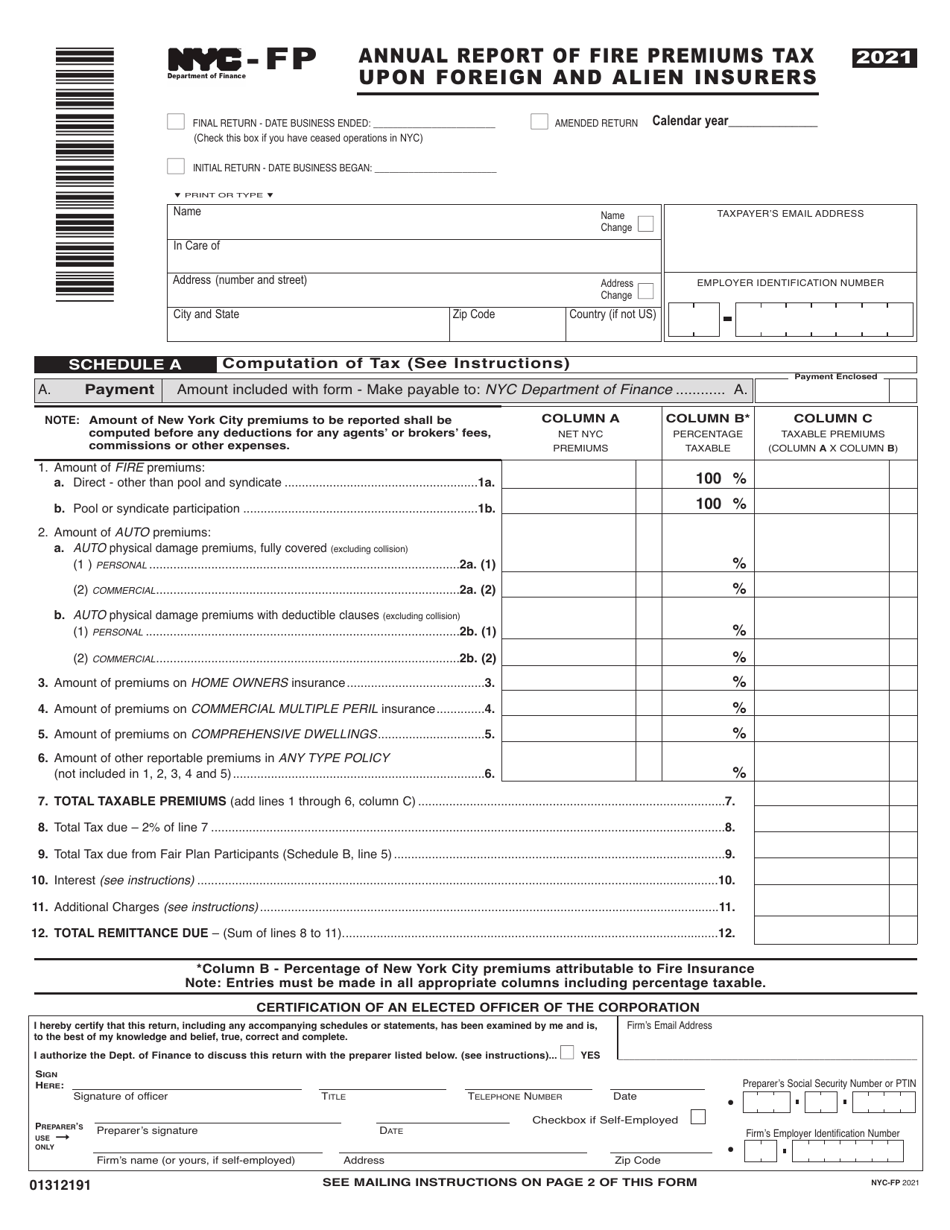

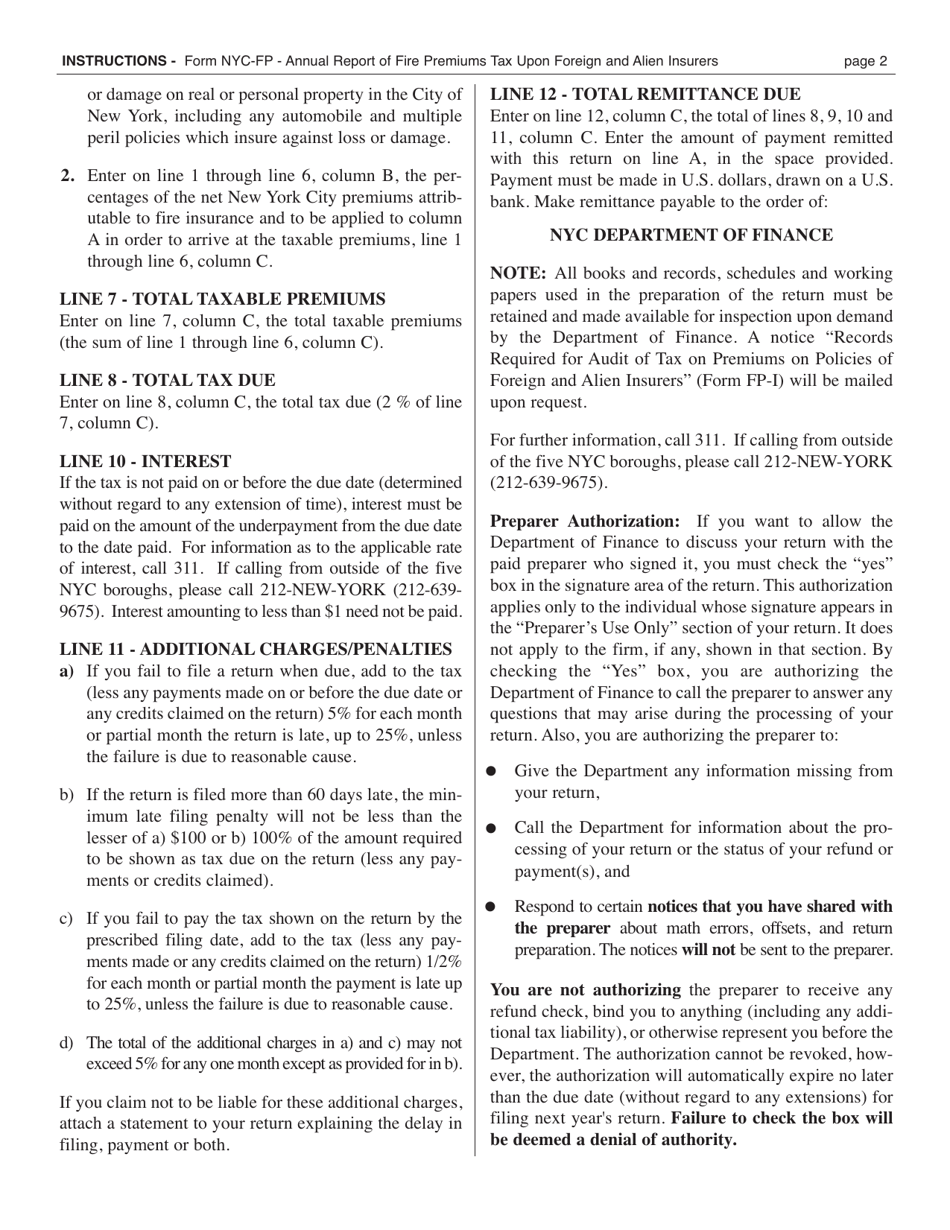

Form NYC-FP Annual Report of Fire Premiums Tax Upon Foreign and Alien Insurers - New York City

What Is Form NYC-FP?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-FP Annual Report of Fire Premiums Tax?

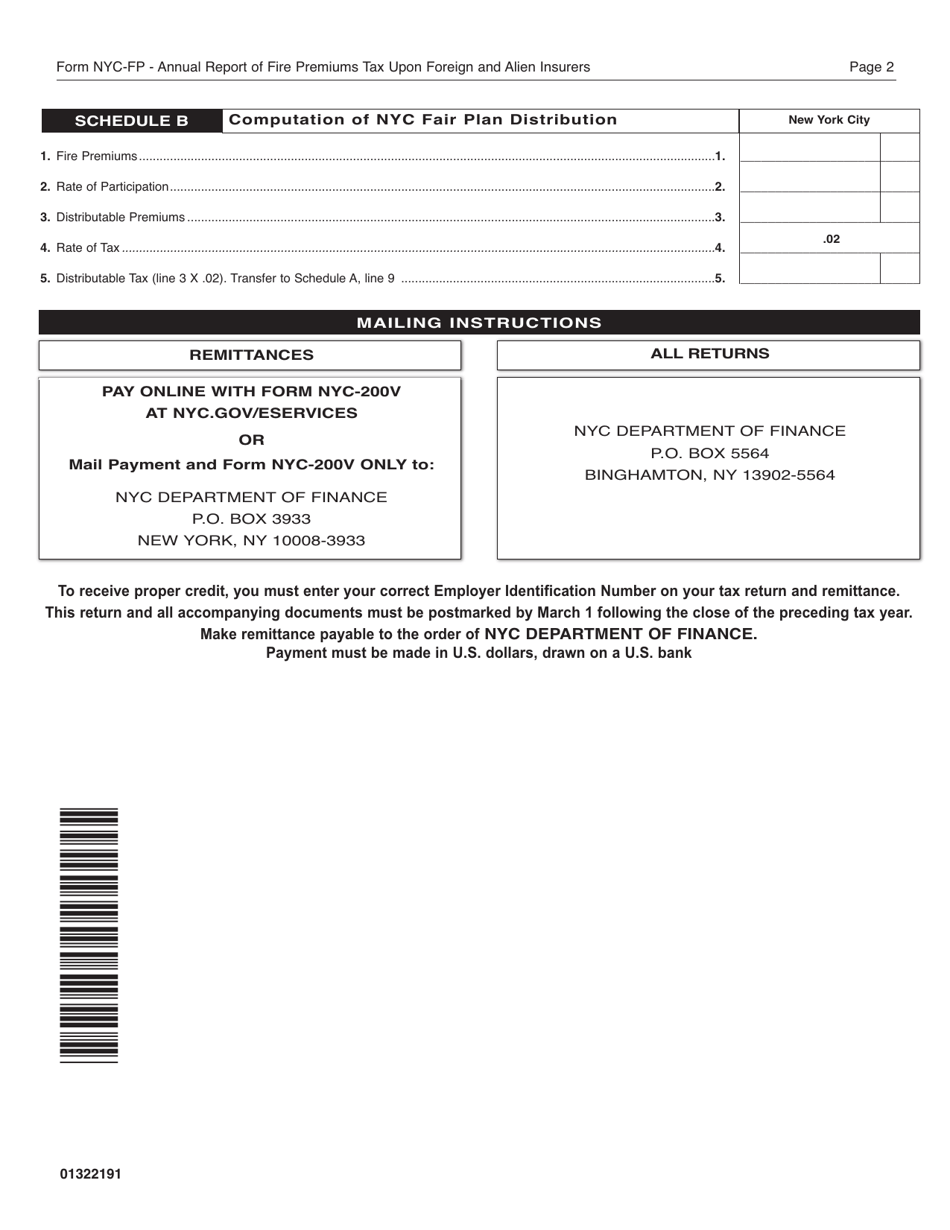

A: The NYC-FP Annual Report of Fire Premiums Tax is a tax report that foreign and alien insurers operating in New York City are required to file annually.

Q: Who needs to file the NYC-FP Annual Report of Fire Premiums Tax?

A: Foreign and alien insurers operating in New York City need to file the NYC-FP Annual Report of Fire Premiums Tax.

Q: What is the purpose of the NYC-FP Annual Report of Fire Premiums Tax?

A: The purpose of the NYC-FP Annual Report of Fire Premiums Tax is to collect taxes on fire insurance premiums from foreign and alien insurers.

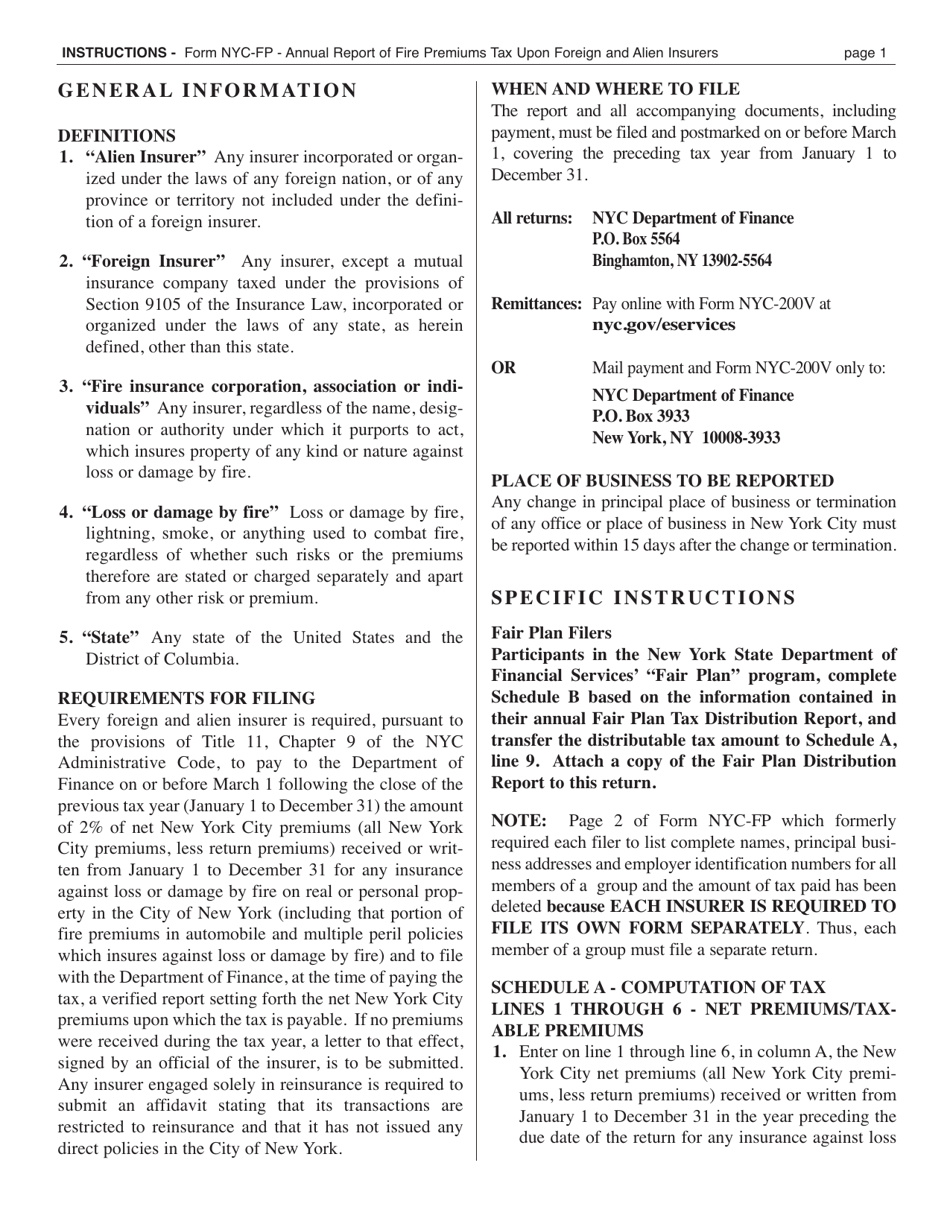

Q: What information needs to be included in the NYC-FP Annual Report of Fire Premiums Tax?

A: The NYC-FP Annual Report of Fire Premiums Tax requires insurers to provide information about their fire insurance premiums, policies, and losses in New York City.

Q: When is the deadline for filing the NYC-FP Annual Report of Fire Premiums Tax?

A: The deadline for filing the NYC-FP Annual Report of Fire Premiums Tax is typically April 1st of each year.

Q: Are there any penalties for late filing of the NYC-FP Annual Report of Fire Premiums Tax?

A: Yes, there are penalties for late filing of the NYC-FP Annual Report of Fire Premiums Tax. Insurers may be subject to fines and interest on unpaid taxes.

Q: Is there any assistance available for completing the NYC-FP Annual Report of Fire Premiums Tax?

A: Yes, the New York City Department of Finance provides assistance and resources for insurers to help them complete the NYC-FP Annual Report of Fire Premiums Tax.

Q: What happens if an insurer fails to file the NYC-FP Annual Report of Fire Premiums Tax?

A: If an insurer fails to file the NYC-FP Annual Report of Fire Premiums Tax, they may face additional penalties and consequences, such as suspension of their ability to do business in New York City.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-FP by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.