This version of the form is not currently in use and is provided for reference only. Download this version of

Form NYC-UXS

for the current year.

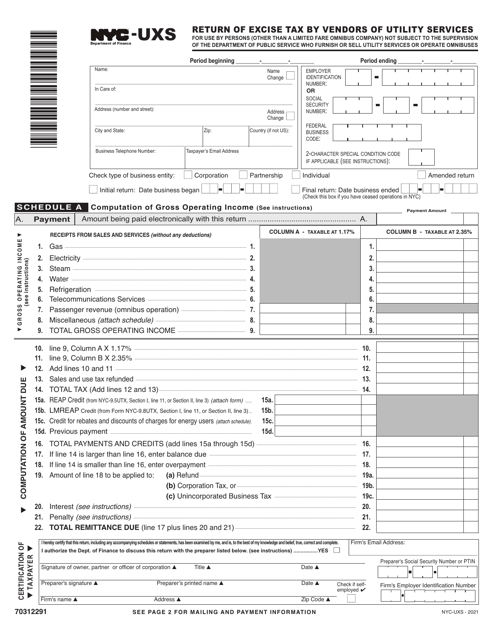

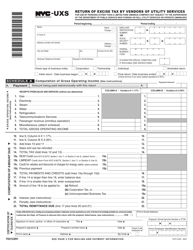

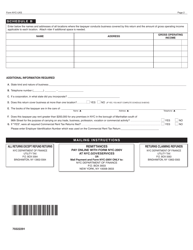

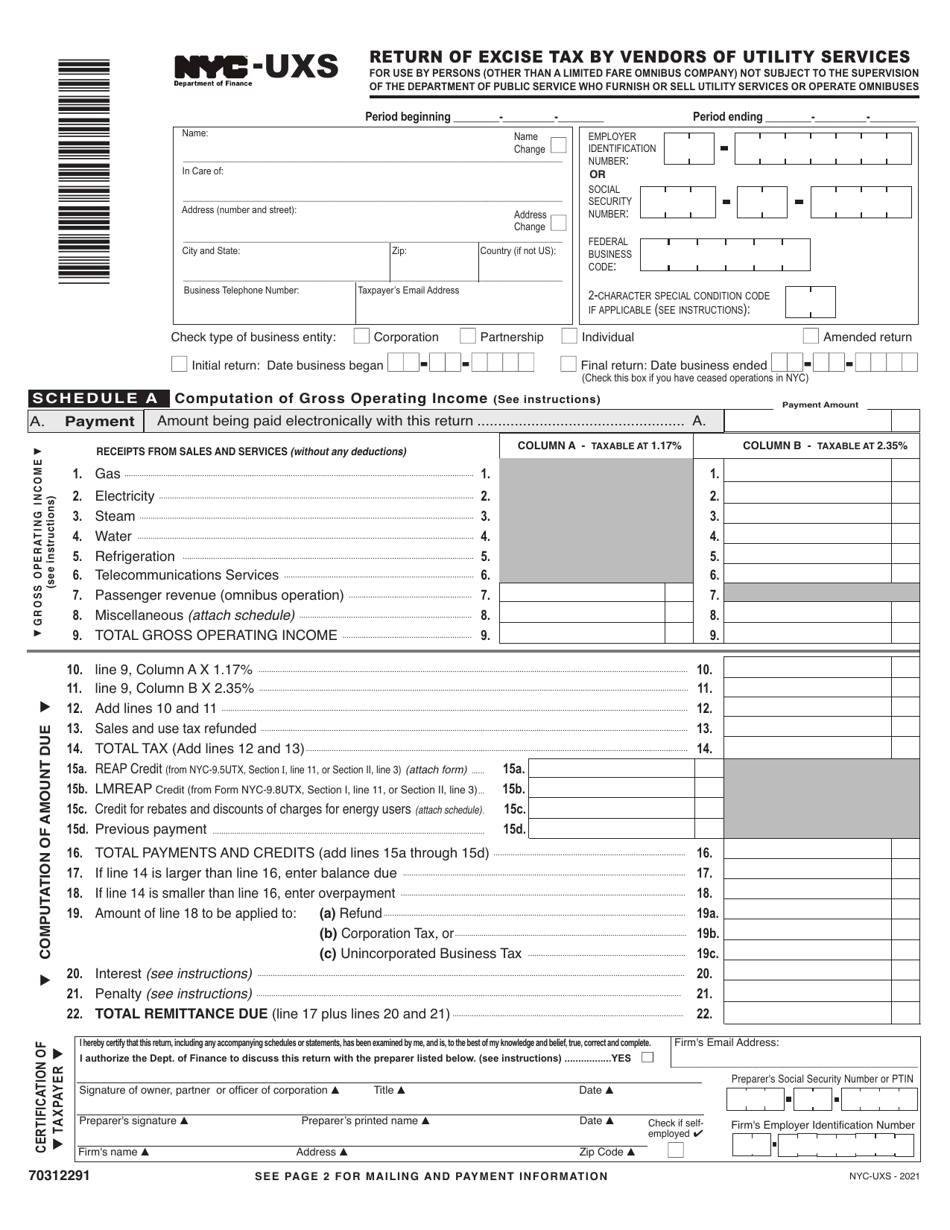

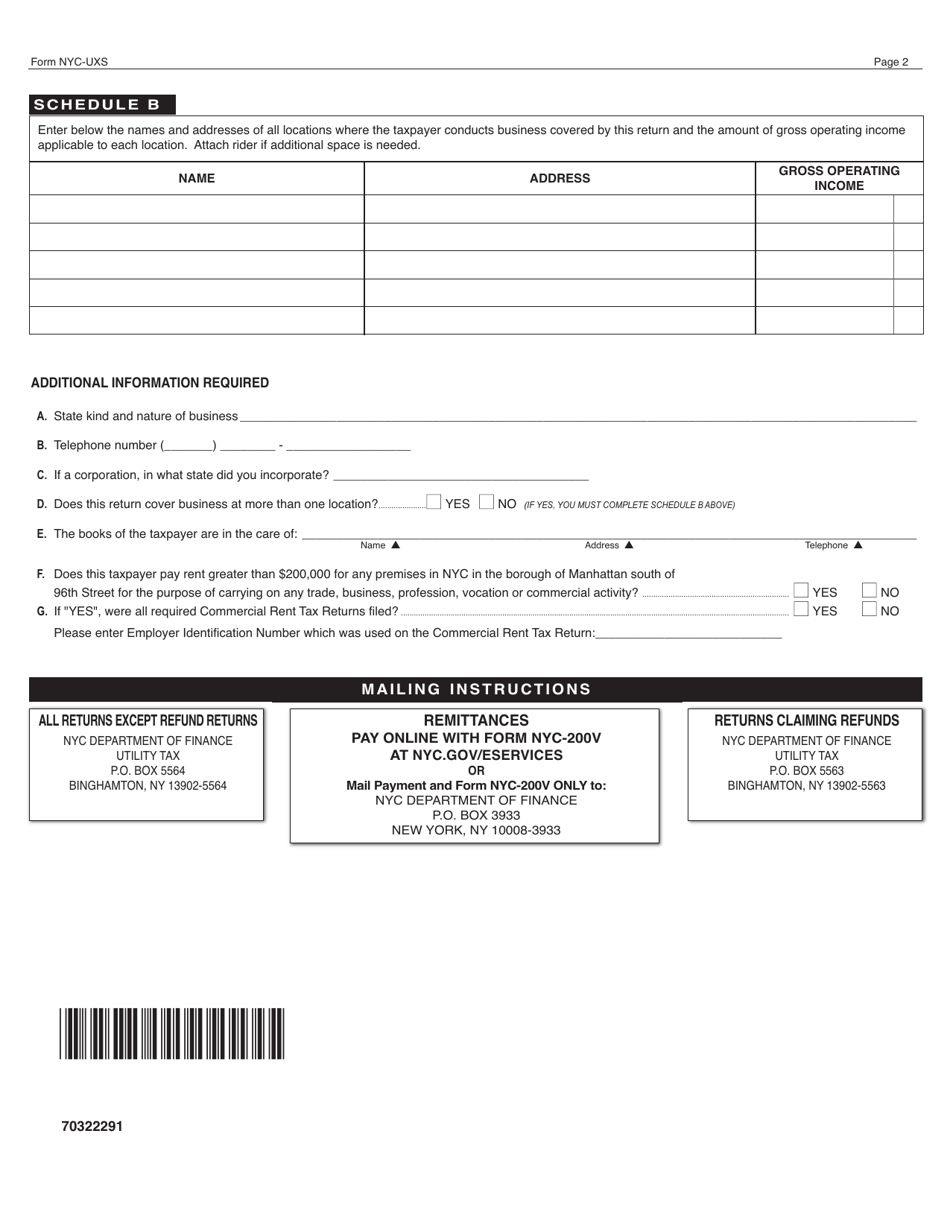

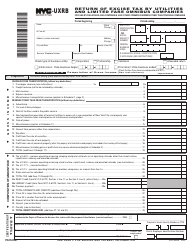

Form NYC-UXS Return of Excise Tax by Vendors of Utility Services - New York City

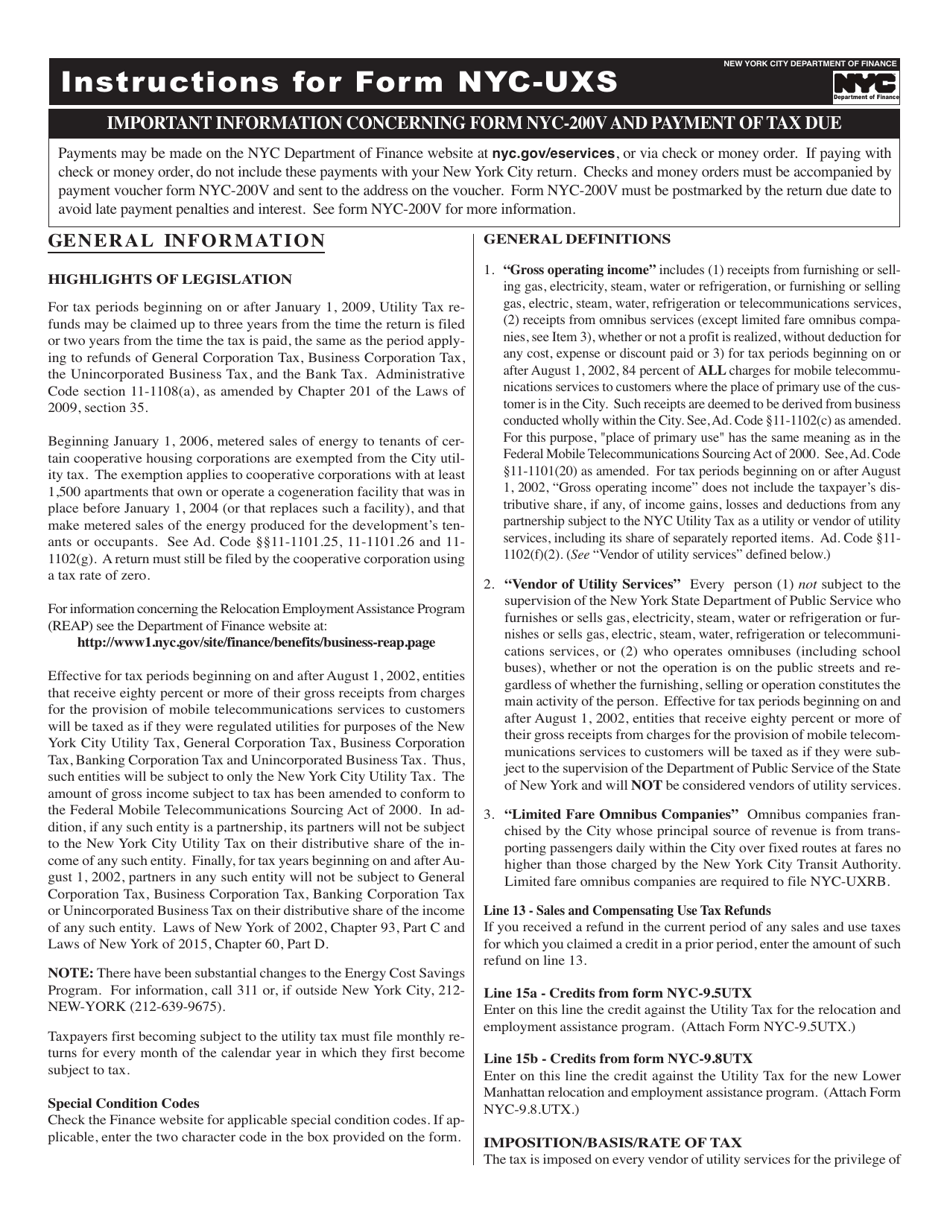

What Is Form NYC-UXS?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-UXS Return of Excise Tax?

A: The NYC-UXS Return of Excise Tax is a tax return form that vendors of utility services in New York City must file.

Q: Who needs to file the NYC-UXS Return of Excise Tax?

A: Vendors of utility services in New York City need to file the NYC-UXS Return of Excise Tax.

Q: What are utility services?

A: Utility services are services related to electricity, gas, steam, water, and telecommunications provided to consumers.

Q: What is the purpose of the NYC-UXS Return of Excise Tax?

A: The purpose of the NYC-UXS Return of Excise Tax is to report and remit excise tax on utility services provided in New York City.

Q: How often do vendors need to file the NYC-UXS Return of Excise Tax?

A: Vendors need to file the NYC-UXS Return of Excise Tax on a quarterly basis.

Q: What is the due date for filing the NYC-UXS Return of Excise Tax?

A: The due date for filing the NYC-UXS Return of Excise Tax is the last day of the month following the end of each quarter.

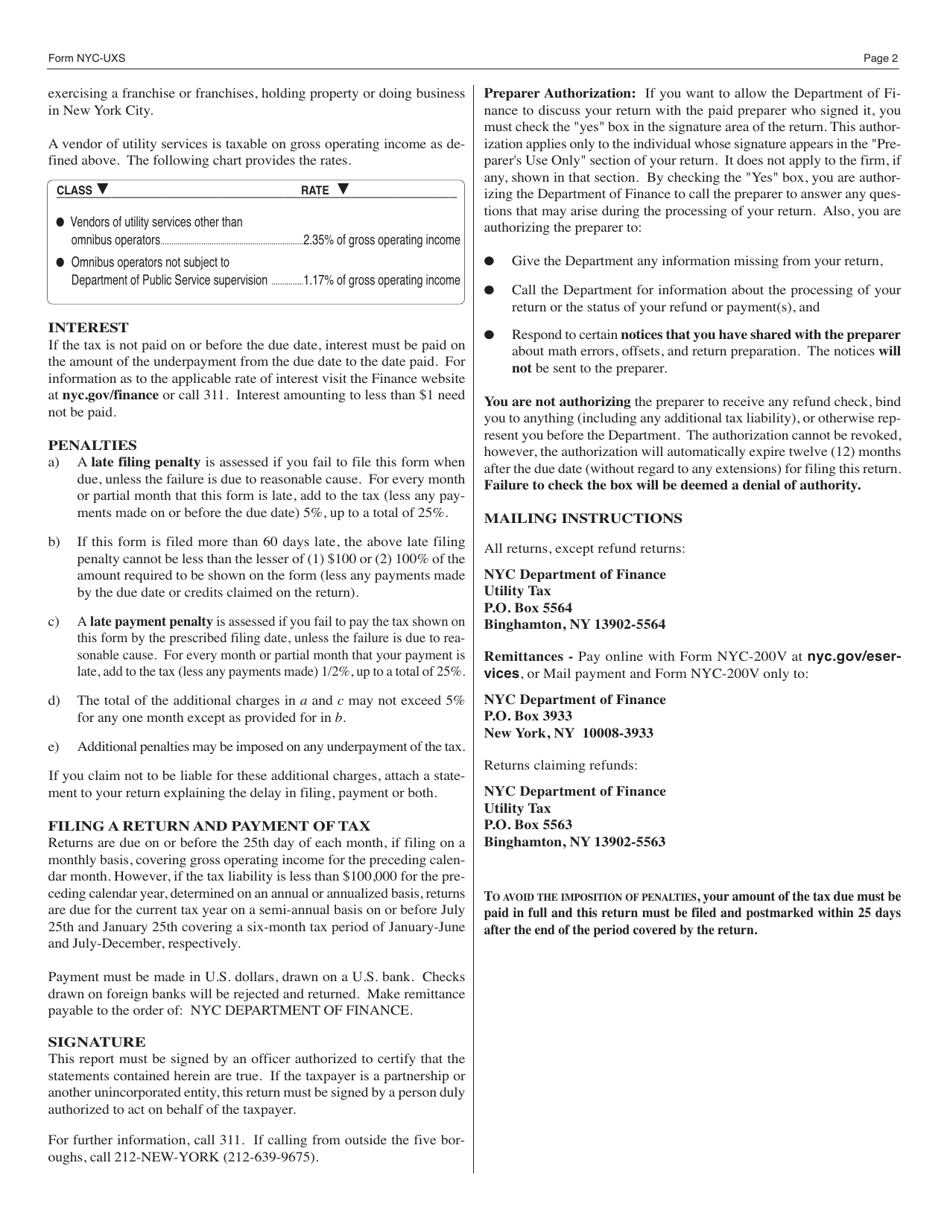

Q: Are there any penalties for late filing or non-filing of the NYC-UXS Return of Excise Tax?

A: Yes, there are penalties for late filing or non-filing of the NYC-UXS Return of Excise Tax. Vendors may be subject to interest charges and penalties.

Q: Are there any exemptions or deductions available for the NYC-UXS excise tax?

A: Yes, there are certain exemptions and deductions available for the NYC-UXS excise tax. Vendors should consult the instructions and guidelines provided by the New York City Department of Finance.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-UXS by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.