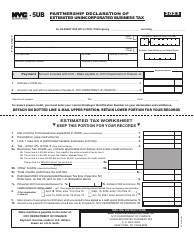

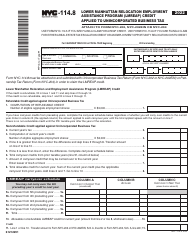

This version of the form is not currently in use and is provided for reference only. Download this version of

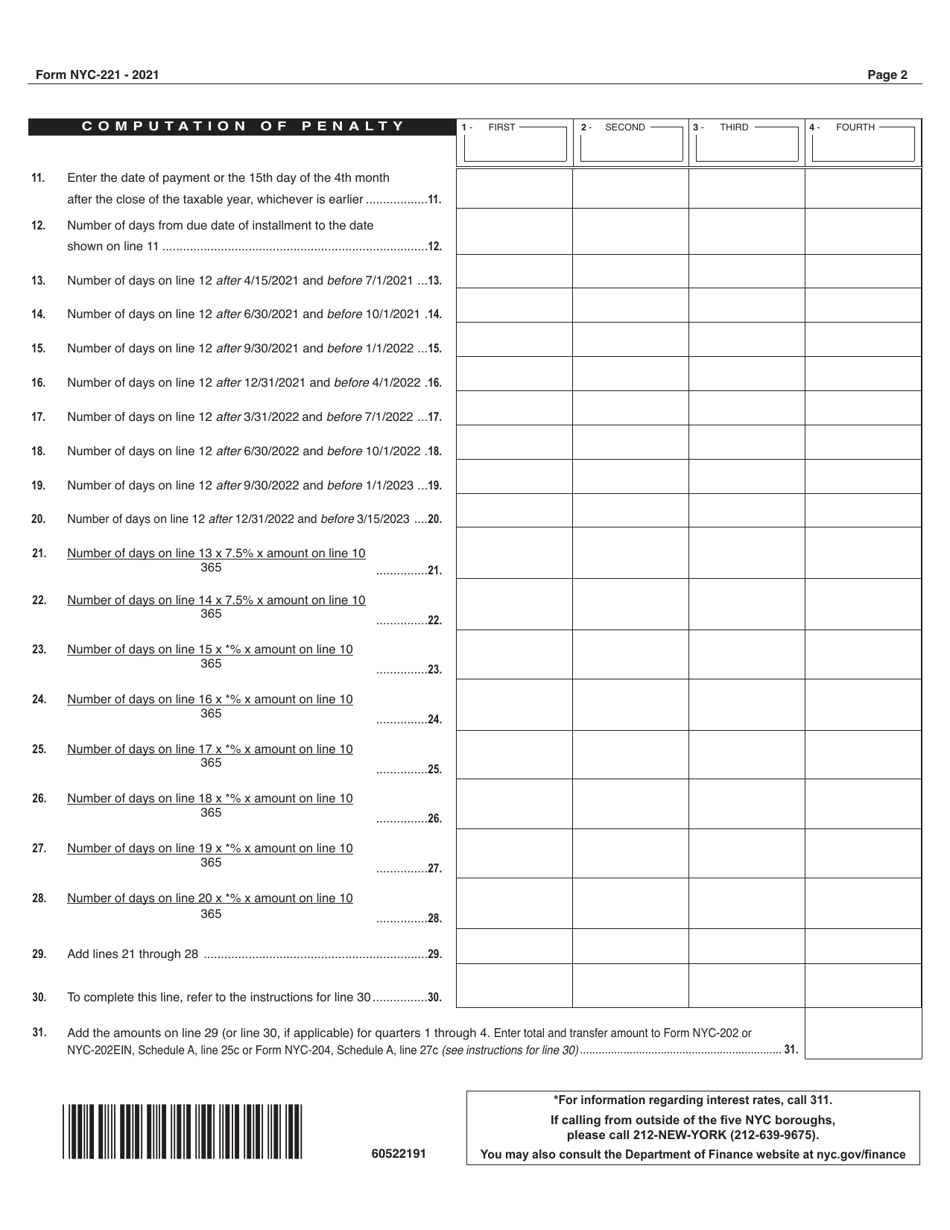

Form NYC-221

for the current year.

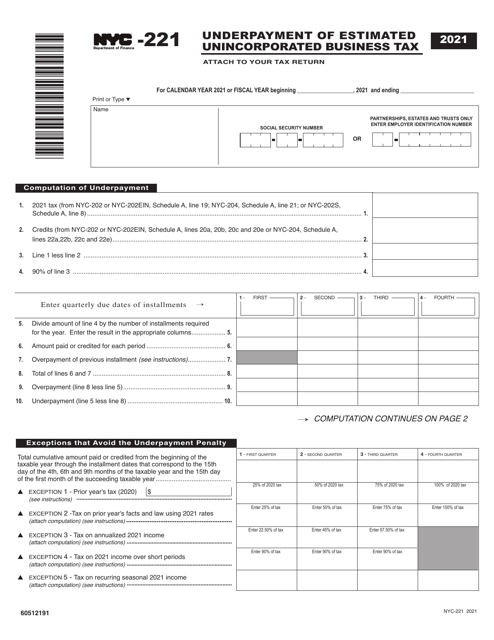

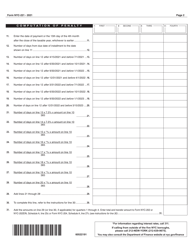

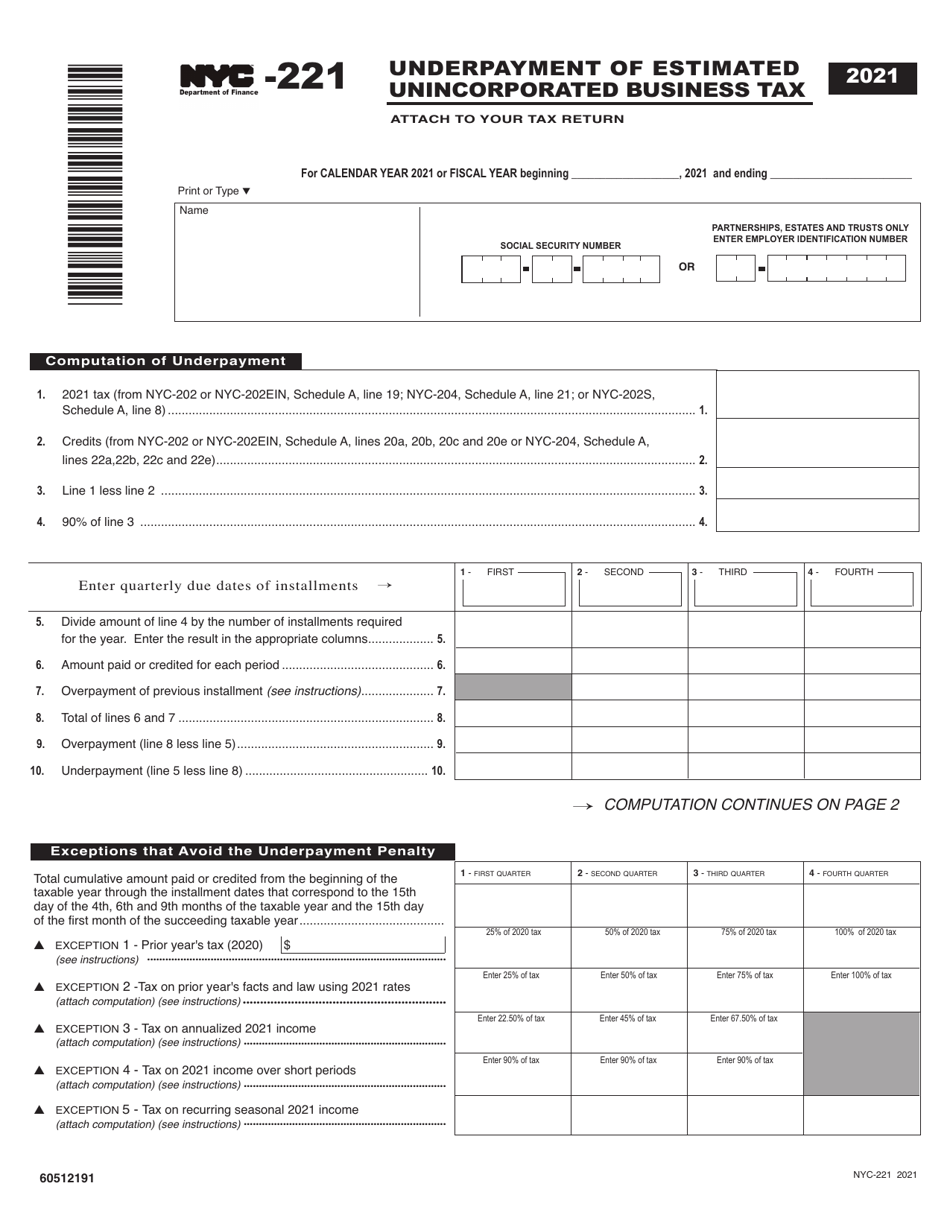

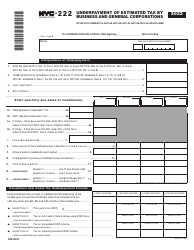

Form NYC-221 Underpayment of Estimated Unincorporated Business Tax - New York City

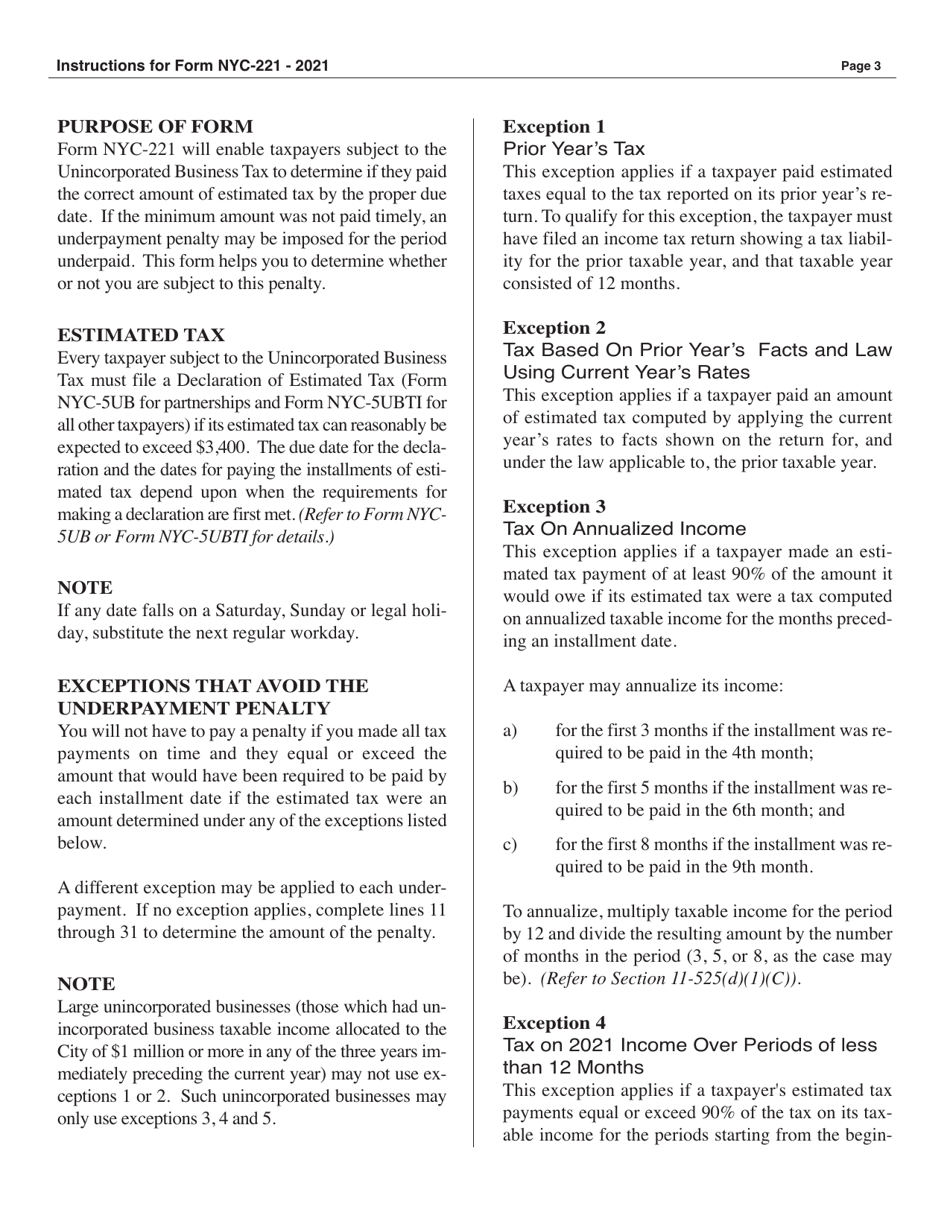

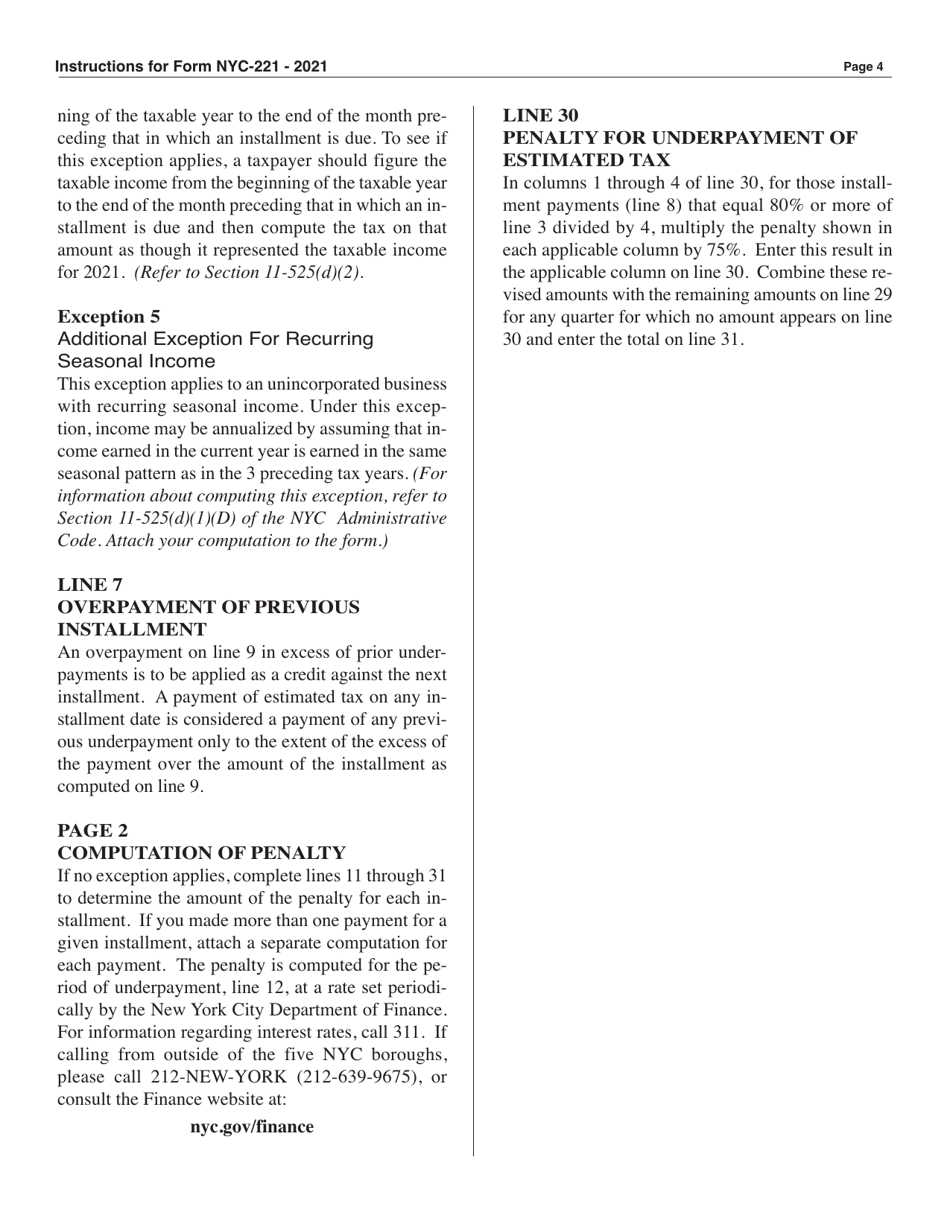

What Is Form NYC-221?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form NYC-221?

A: Form NYC-221 is a tax form used to report and pay the underpayment of estimated unincorporated business tax in New York City.

Q: Who needs to file form NYC-221?

A: Individuals or businesses that have underpaid their estimated unincorporated business tax in New York City need to file form NYC-221.

Q: When is form NYC-221 due?

A: Form NYC-221 is generally due on April 15th of the year following the tax year in which the underpayment occurred.

Q: What happens if I don't file form NYC-221?

A: Failure to file form NYC-221 and pay the underpayment of estimated unincorporated business tax may result in penalties and interest being assessed by the New York City Department of Finance.

Q: Can I e-file form NYC-221?

A: Currently, the New York City Department of Finance does not offer e-filing options for form NYC-221. It must be filed by mail.

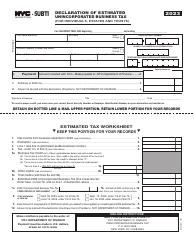

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-221 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.