This version of the form is not currently in use and is provided for reference only. Download this version of

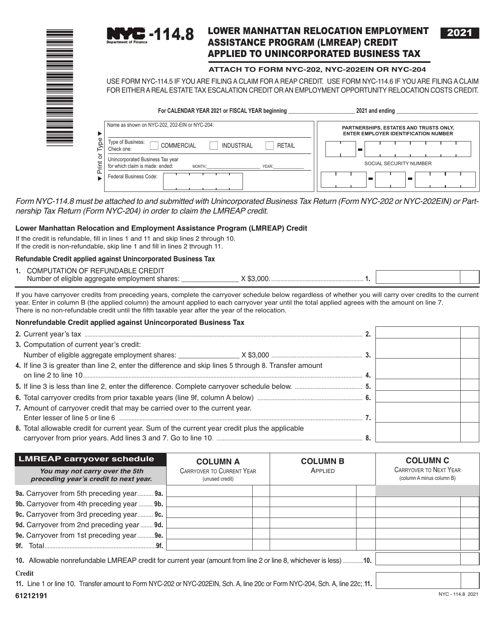

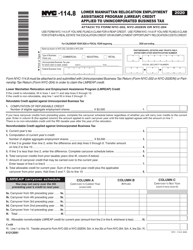

Form NYC-114.8

for the current year.

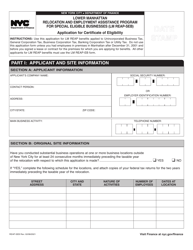

Form NYC-114.8 Lower Manhattan Relocation Employment Assistance Program (Lmreap) Credit Applied to Unincorporated Business Tax - New York City

What Is Form NYC-114.8?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-114.8?

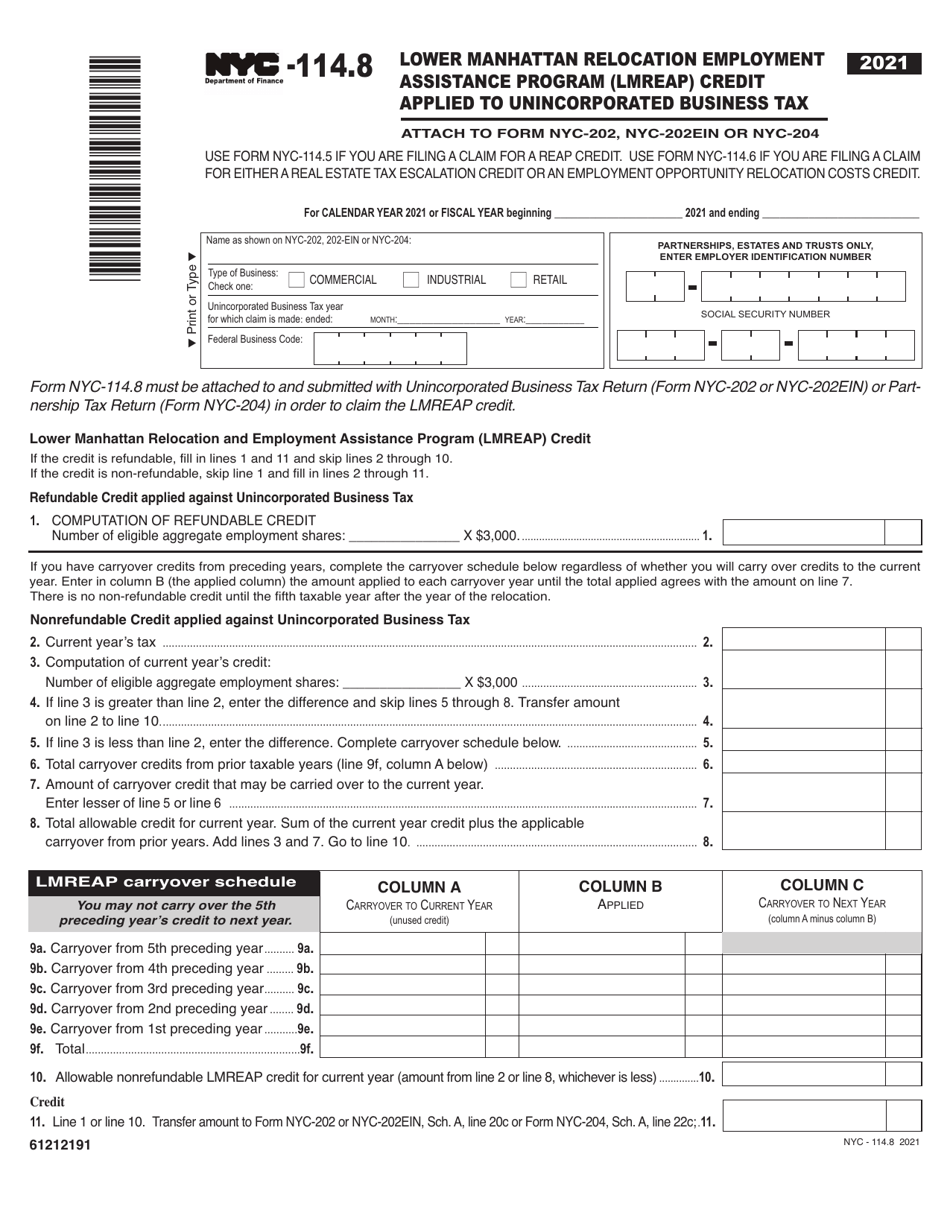

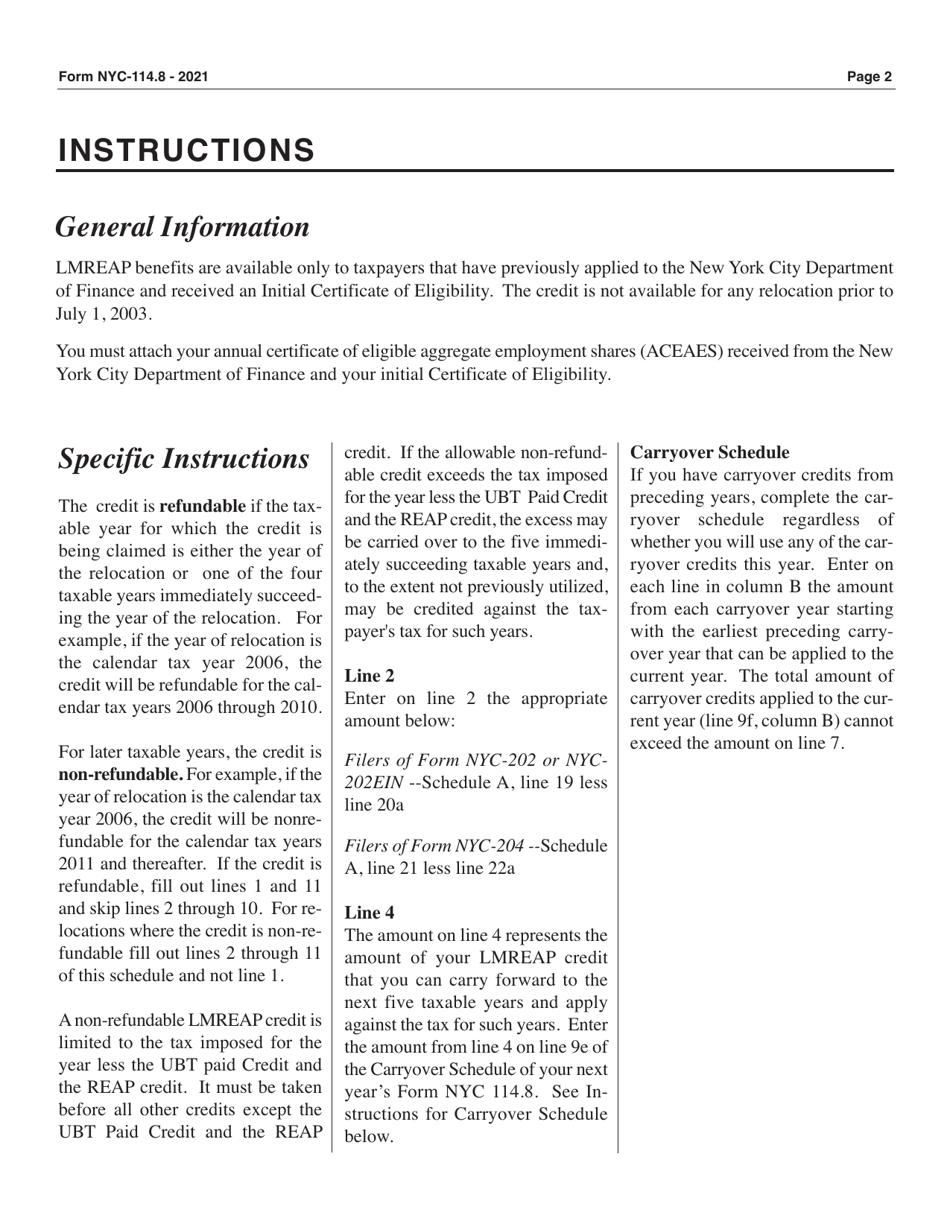

A: NYC-114.8 is a form for the Lower Manhattan Relocation Employment Assistance Program (LMREAP) Credit applied to the Unincorporated Business Tax in New York City.

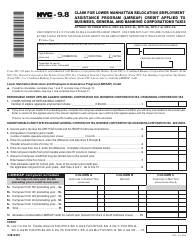

Q: What is the Lower Manhattan Relocation Employment Assistance Program (LMREAP) Credit?

A: The LMREAP Credit is a program in New York City that provides tax incentives to businesses that have relocated or expanded in Lower Manhattan.

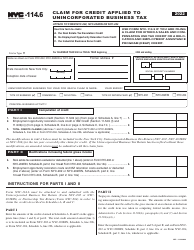

Q: What is the Unincorporated Business Tax?

A: The Unincorporated Business Tax is a tax imposed by the New York City on certain types of businesses that are not incorporated.

Q: How does the LMREAP Credit apply to the Unincorporated Business Tax?

A: The LMREAP Credit can be applied to reduce the amount of Unincorporated Business Tax owed by eligible businesses in Lower Manhattan.

Q: Who is eligible for the LMREAP Credit?

A: Businesses that have relocated or expanded in Lower Manhattan and meet certain criteria are eligible for the LMREAP Credit.

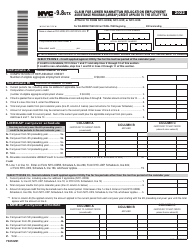

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-114.8 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.