This version of the form is not currently in use and is provided for reference only. Download this version of

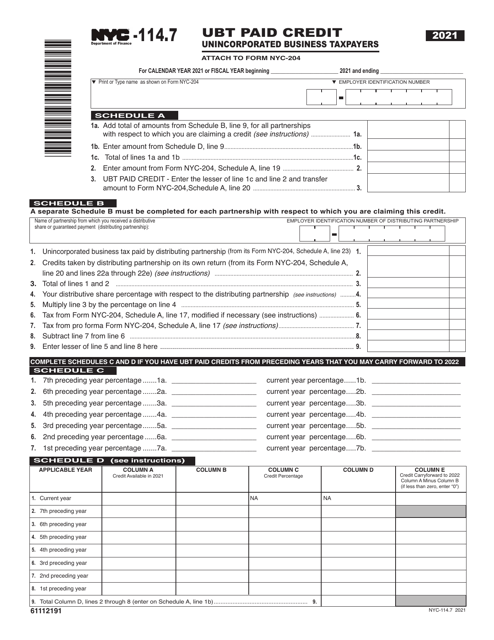

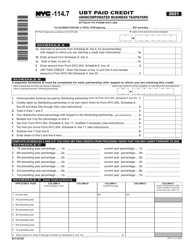

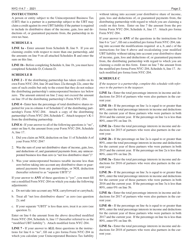

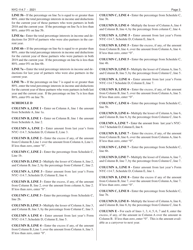

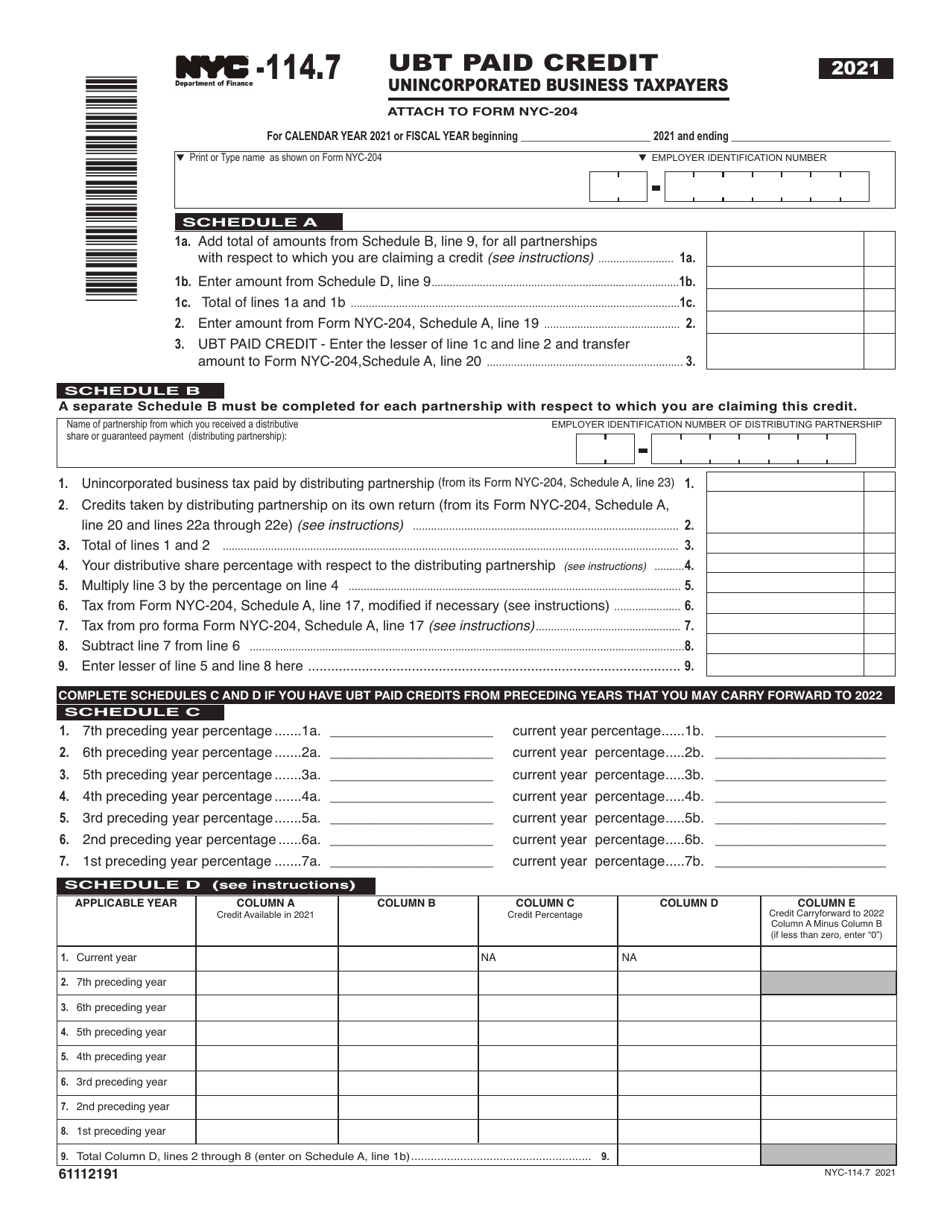

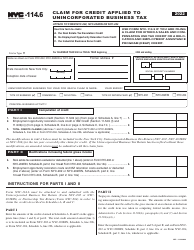

Form NYC-114.7

for the current year.

Form NYC-114.7 Ubt Paid Credit for Unincorporated Business Taxpayers - New York City

What Is Form NYC-114.7?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

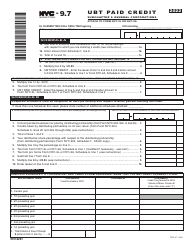

Q: What is NYC-114.7?

A: NYC-114.7 is a form used by unincorporated business taxpayers in New York City.

Q: What is the purpose of NYC-114.7?

A: NYC-114.7 is used to claim the UBT (Unincorporated Business Tax) Paid Credit.

Q: Who needs to fill out NYC-114.7?

A: Unincorporated business taxpayers in New York City who are eligible for the UBT Paid Credit need to fill out this form.

Q: What is the UBT Paid Credit?

A: The UBT Paid Credit is a credit that allows eligible taxpayers to reduce their Unincorporated Business Tax liability.

Q: Is NYC-114.7 only for businesses in New York City?

A: Yes, NYC-114.7 is specifically for unincorporated businesses operating in New York City.

Q: What are the eligibility requirements for the UBT Paid Credit?

A: To be eligible for the UBT Paid Credit, the taxpayer must have paid UBT in the current tax year and have a base income that does not exceed the specified threshold.

Q: Can I claim the UBT Paid Credit on my personal tax return?

A: No, the UBT Paid Credit should be claimed on the appropriate business tax return for unincorporated businesses.

Q: Are there any deadlines for filing NYC-114.7?

A: Yes, the deadline for filing NYC-114.7 is typically the same as the deadline for filing the relevant business tax return.

Q: What should I do if I need assistance with NYC-114.7?

A: If you need assistance with NYC-114.7, you can contact the New York City Department of Finance or consult a tax professional.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-114.7 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.