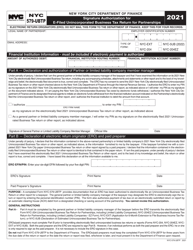

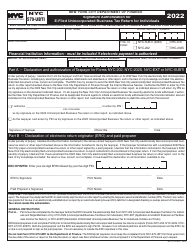

This version of the form is not currently in use and is provided for reference only. Download this version of

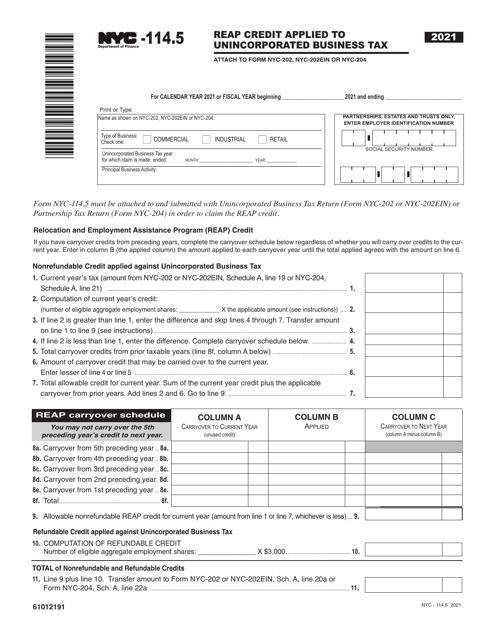

Form NYC-114.5

for the current year.

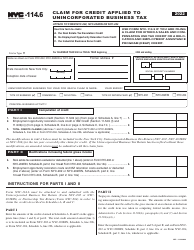

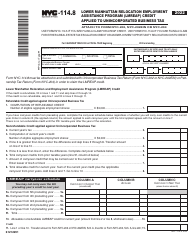

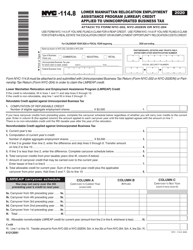

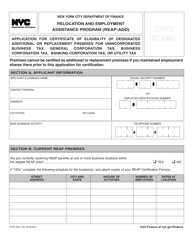

Form NYC-114.5 Reap Credit Applied to Unincorporated Business Tax - New York City

What Is Form NYC-114.5?

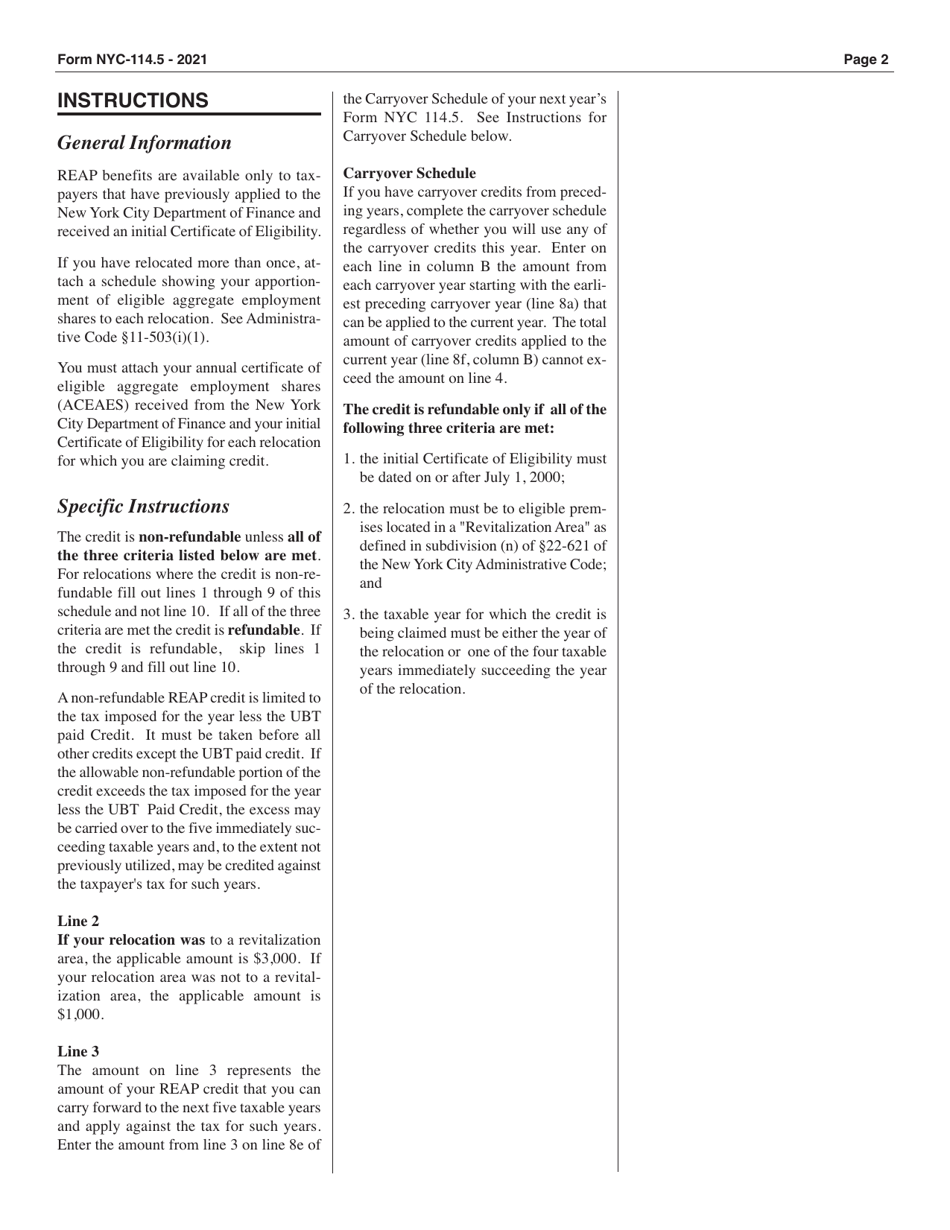

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

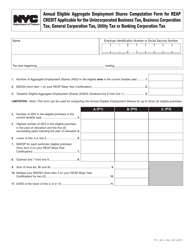

Q: What is NYC-114.5?

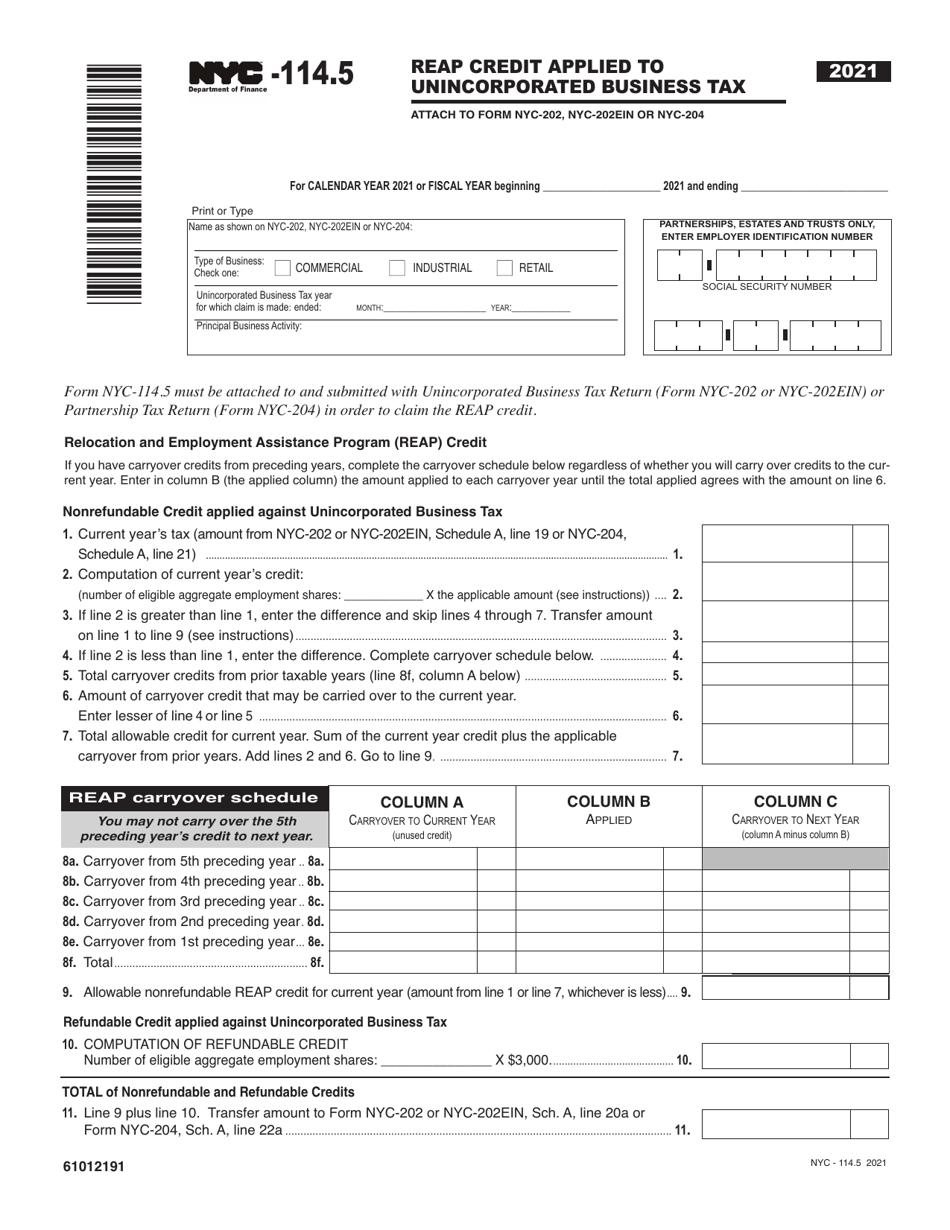

A: NYC-114.5 is a form used to apply for the Reap Credit on the Unincorporated Business Tax in New York City.

Q: What is the Reap Credit?

A: The Reap Credit is a tax credit available to certain businesses in New York City to offset their Unincorporated Business Tax liabilities.

Q: Who can apply for the Reap Credit?

A: Businesses eligible for the Reap Credit include sole proprietorships, partnerships, and limited liability companies (LLCs).

Q: What information is required to complete Form NYC-114.5?

A: To complete Form NYC-114.5, you will need to provide information about your business, including income, expenses, and any other relevant financial data.

Q: When is the deadline to file Form NYC-114.5?

A: The deadline to file Form NYC-114.5 is usually April 15th of each year, unless it falls on a weekend or holiday, in which case it is extended to the next business day.

Q: Is there a fee to file Form NYC-114.5?

A: No, there is no fee to file Form NYC-114.5.

Q: What should I do if I have questions or need assistance with Form NYC-114.5?

A: If you have questions or need assistance with Form NYC-114.5, you can contact the New York City Department of Finance for guidance.

Q: Can I claim the Reap Credit if I have an incorporated business?

A: No, the Reap Credit is only available to businesses that are not incorporated.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-114.5 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.