This version of the form is not currently in use and is provided for reference only. Download this version of

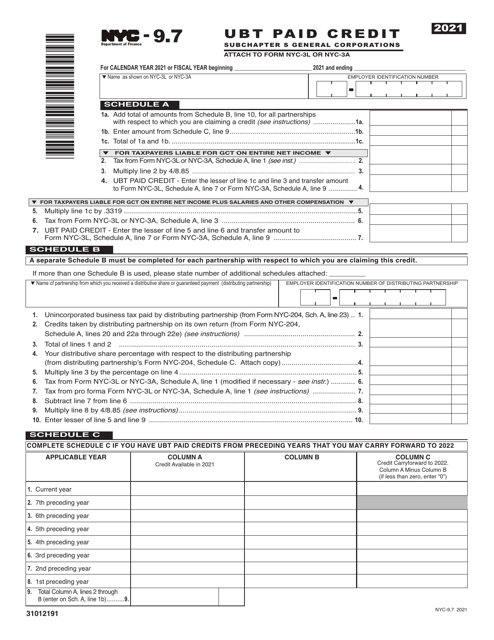

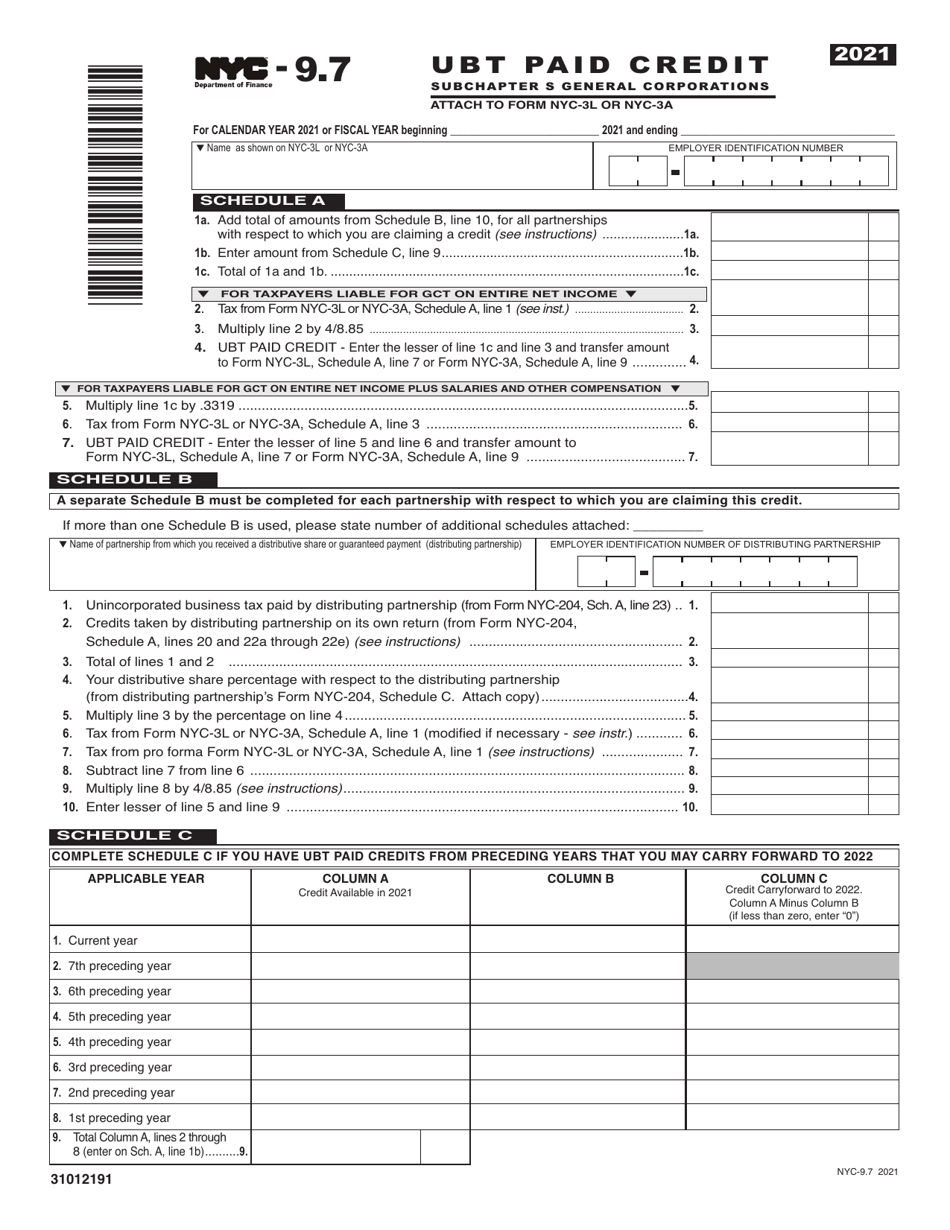

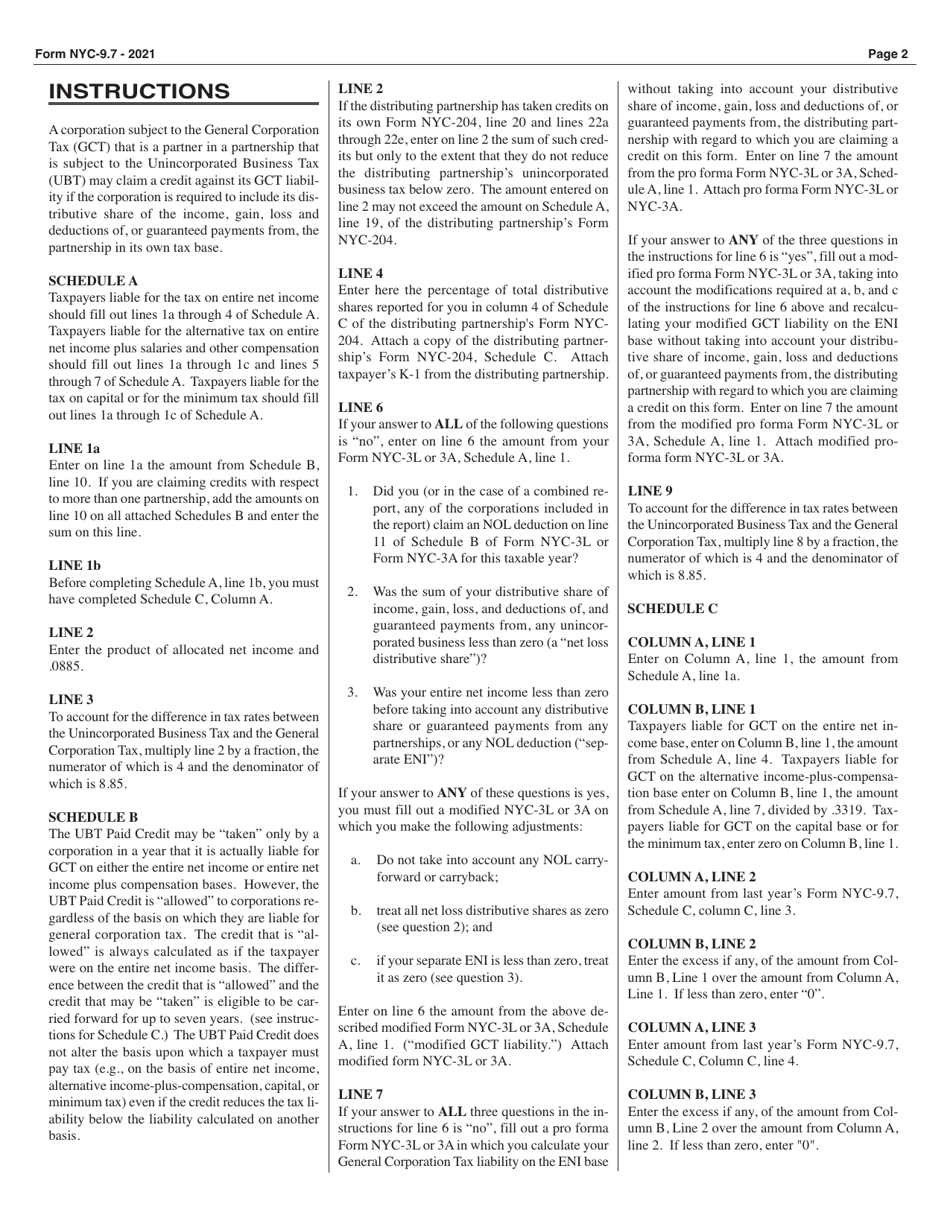

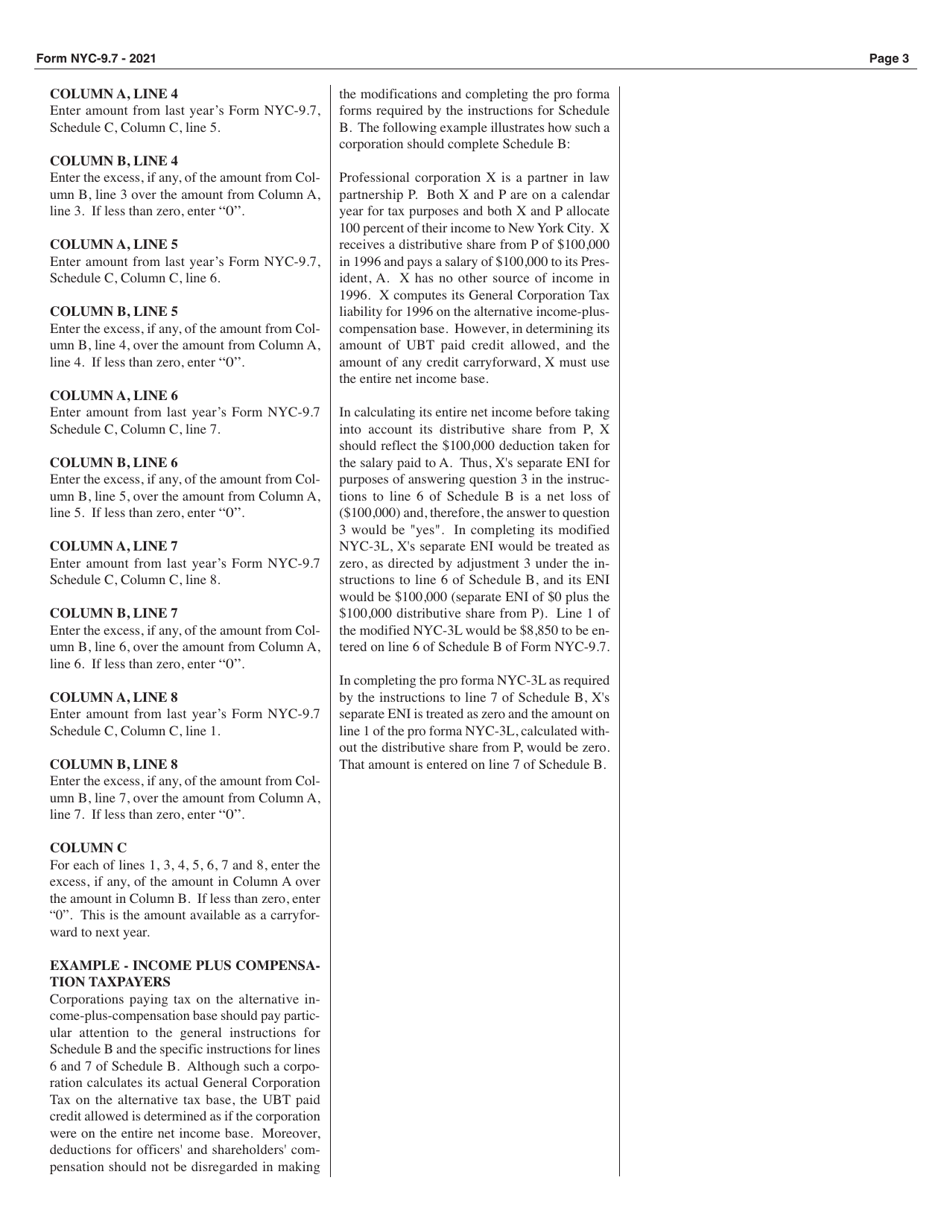

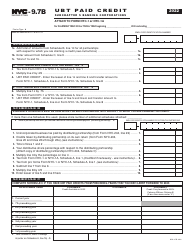

Form NYC-9.7

for the current year.

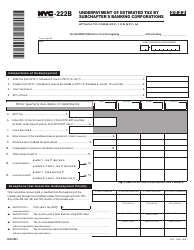

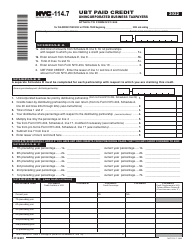

Form NYC-9.7 Ubt Paid Credit for Subchapter S General Corporations - New York City

What Is Form NYC-9.7?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-9.7?

A: NYC-9.7 is a form for claiming the UBT Paid Credit for Subchapter S General Corporations in New York City.

Q: What is the UBT Paid Credit?

A: The UBT Paid Credit is a credit that can be claimed by Subchapter S General Corporations in New York City against their Unincorporated Business Tax (UBT) liability.

Q: Who can claim the UBT Paid Credit?

A: Subchapter S General Corporations in New York City can claim the UBT Paid Credit.

Q: What is a Subchapter S General Corporation?

A: A Subchapter S General Corporation is a type of corporation that elects to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.

Q: How can I claim the UBT Paid Credit?

A: You can claim the UBT Paid Credit by filling out and submitting Form NYC-9.7 to the New York City Department of Finance.

Q: Are there any filing deadlines for Form NYC-9.7?

A: Yes, there are specific filing deadlines for Form NYC-9.7. You should refer to the instructions on the form or consult with the New York City Department of Finance for the current deadlines.

Q: Is the UBT Paid Credit refundable?

A: No, the UBT Paid Credit is not refundable. It can only be used to offset your UBT liability.

Q: What if I have more questions about Form NYC-9.7 or the UBT Paid Credit?

A: If you have more questions, you should reach out to the New York City Department of Finance for assistance.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-9.7 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.