This version of the form is not currently in use and is provided for reference only. Download this version of

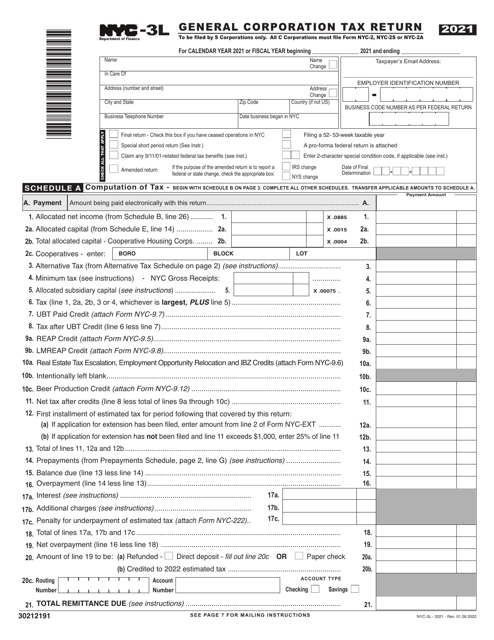

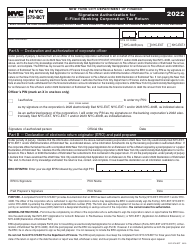

Form NYC-3L

for the current year.

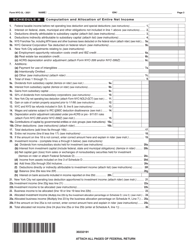

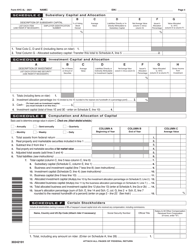

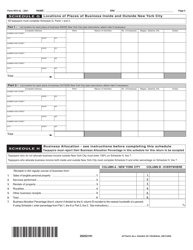

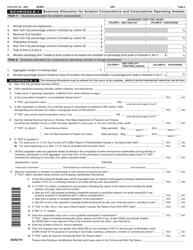

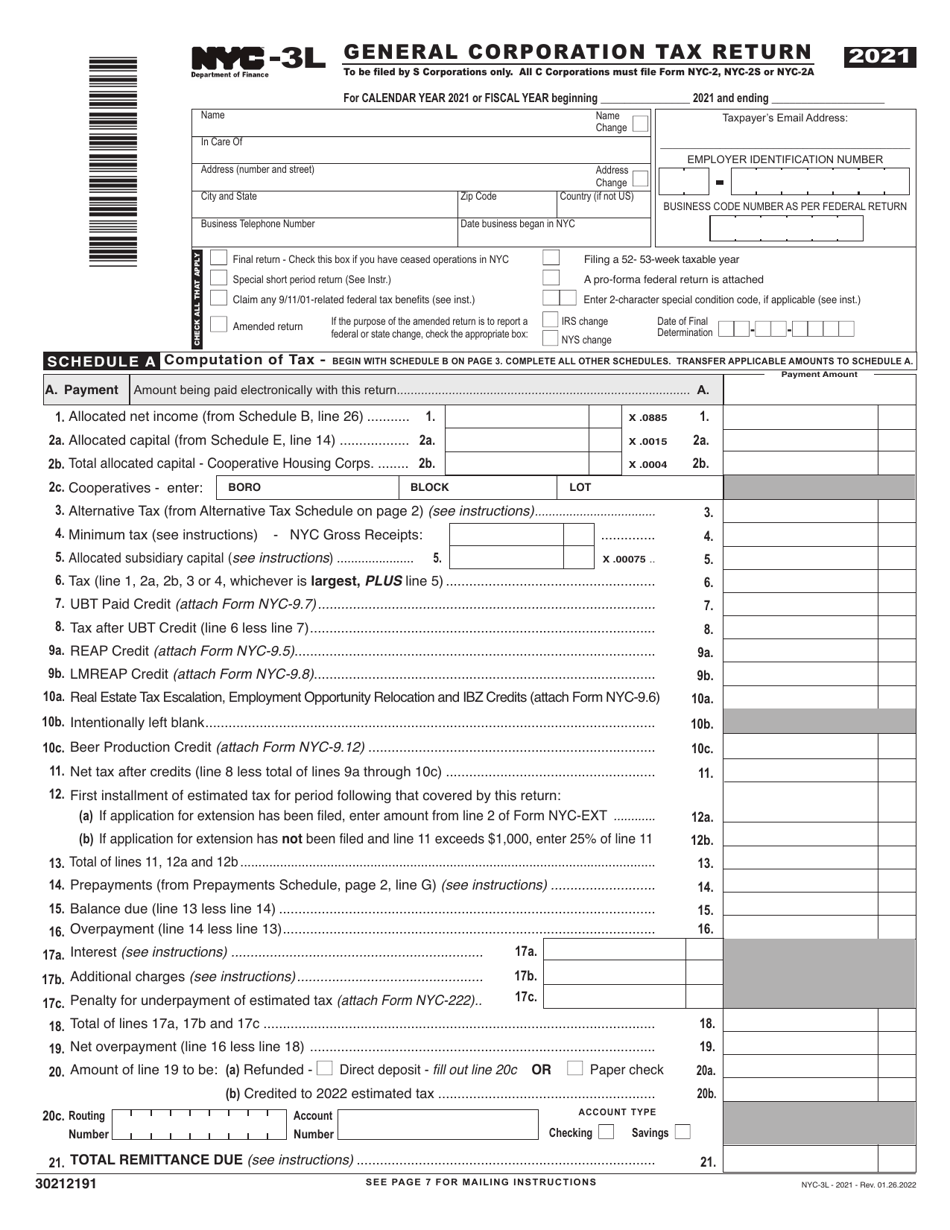

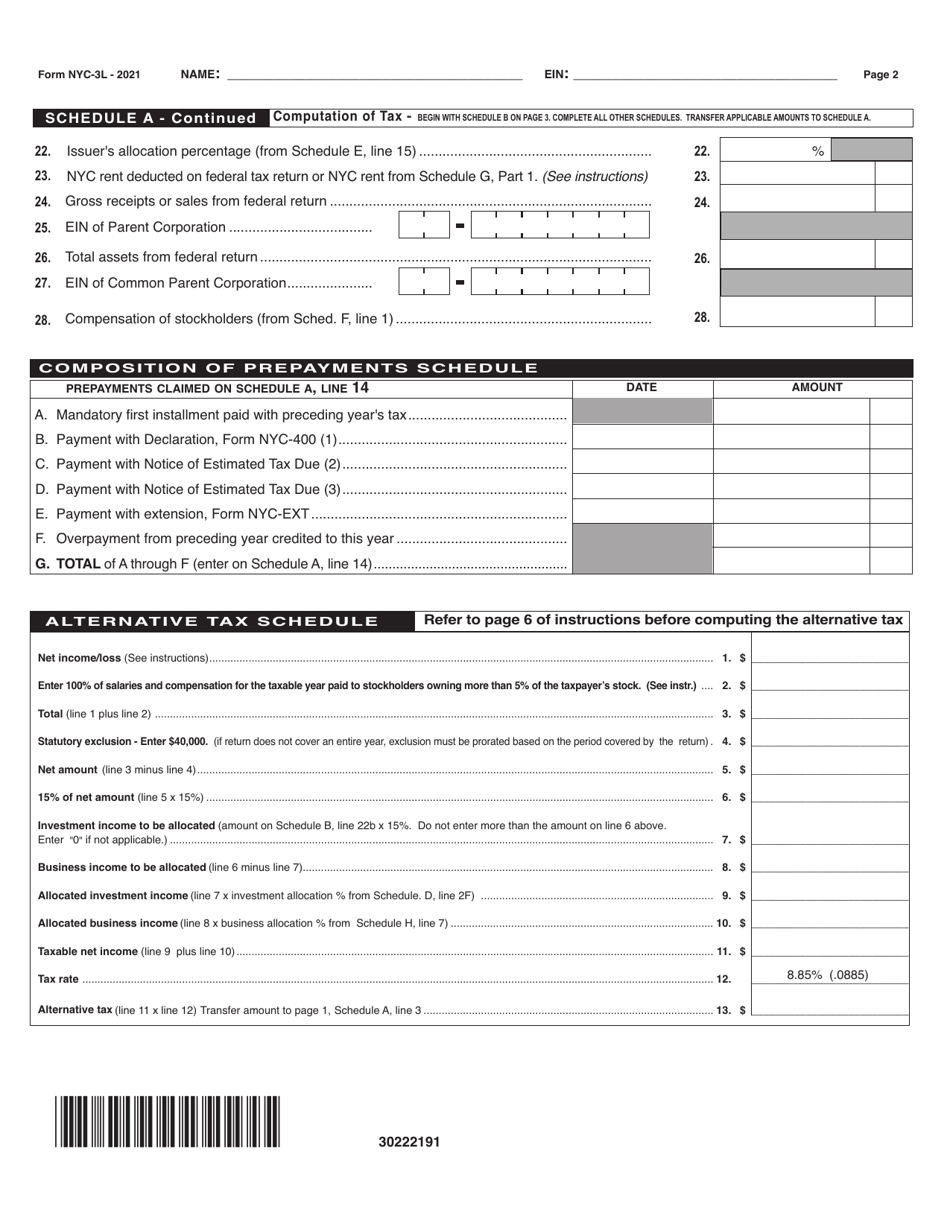

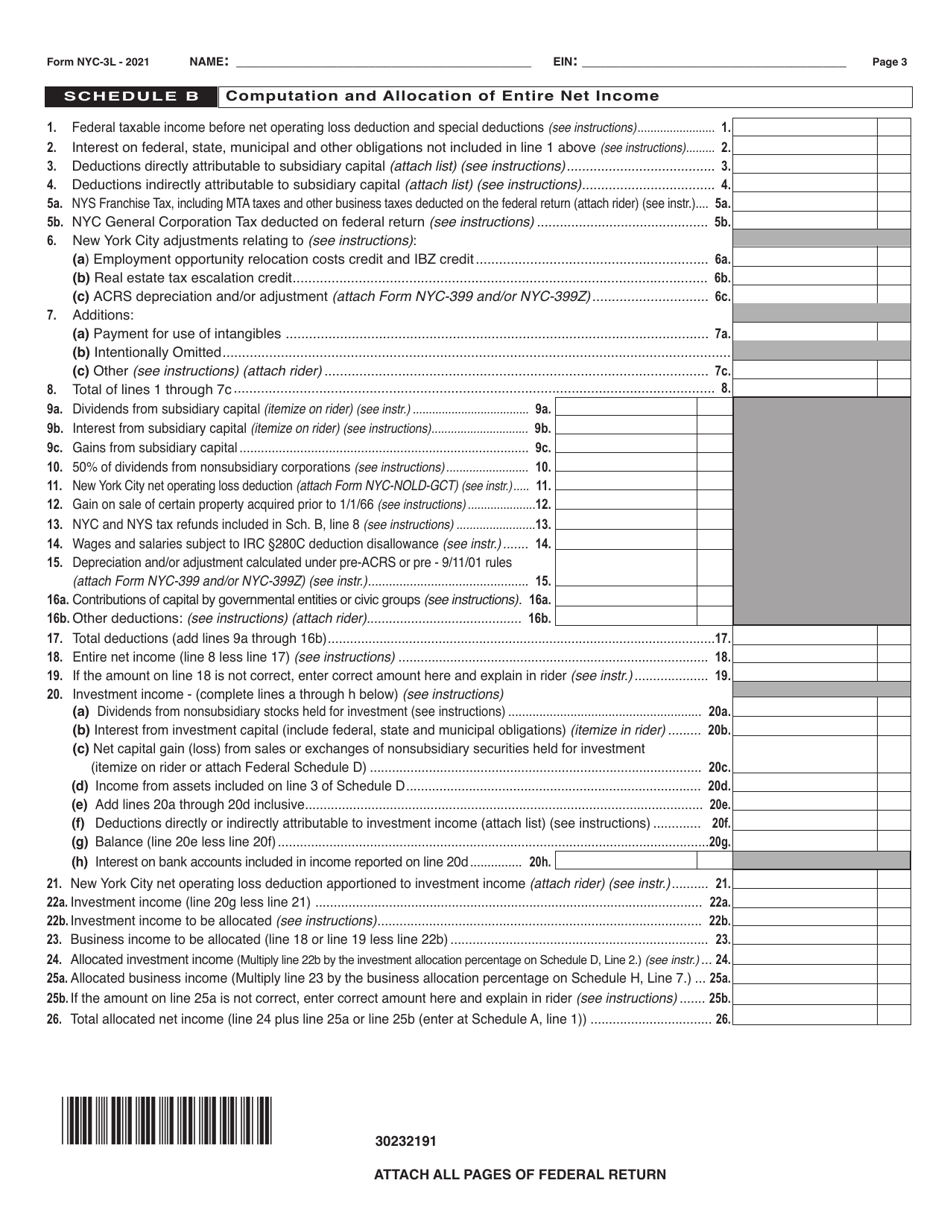

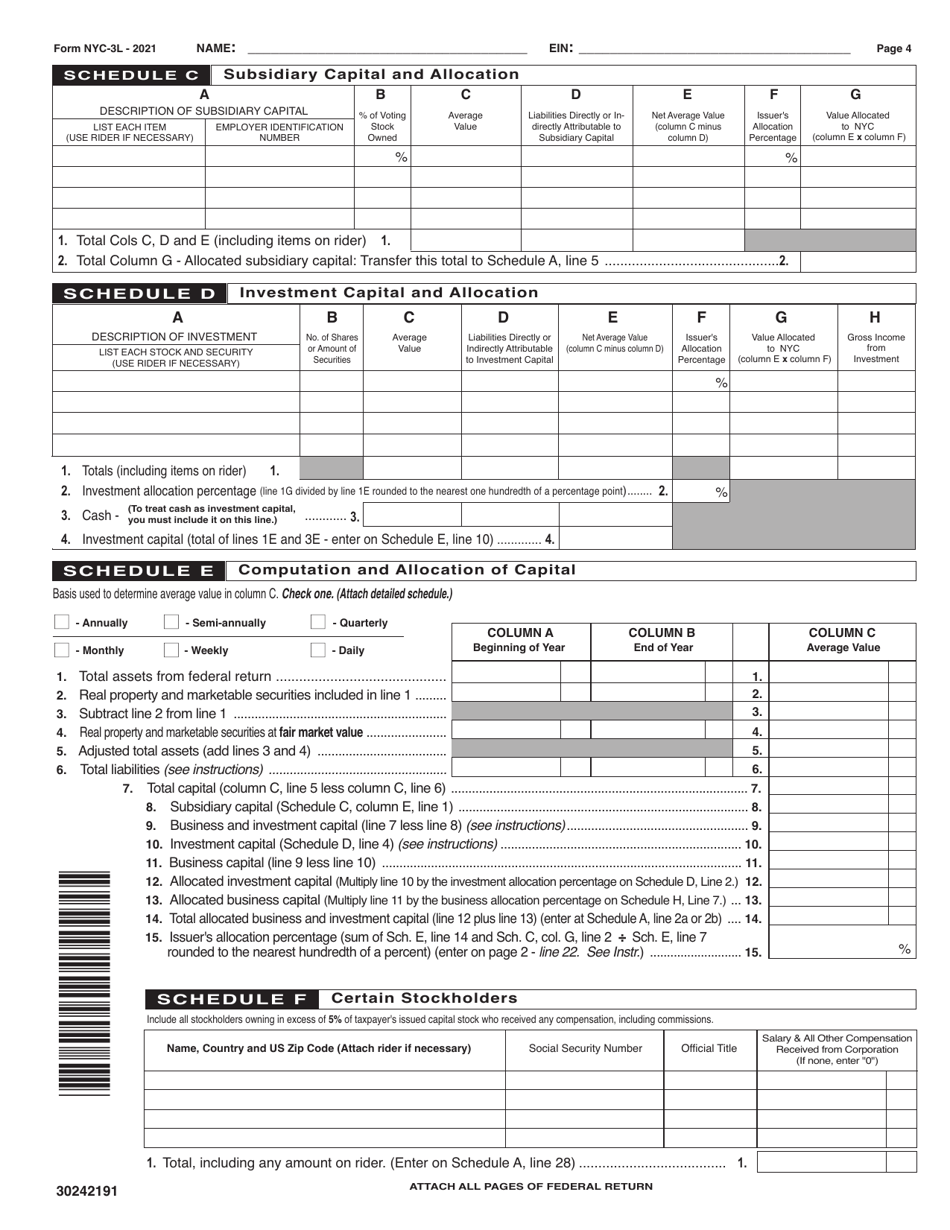

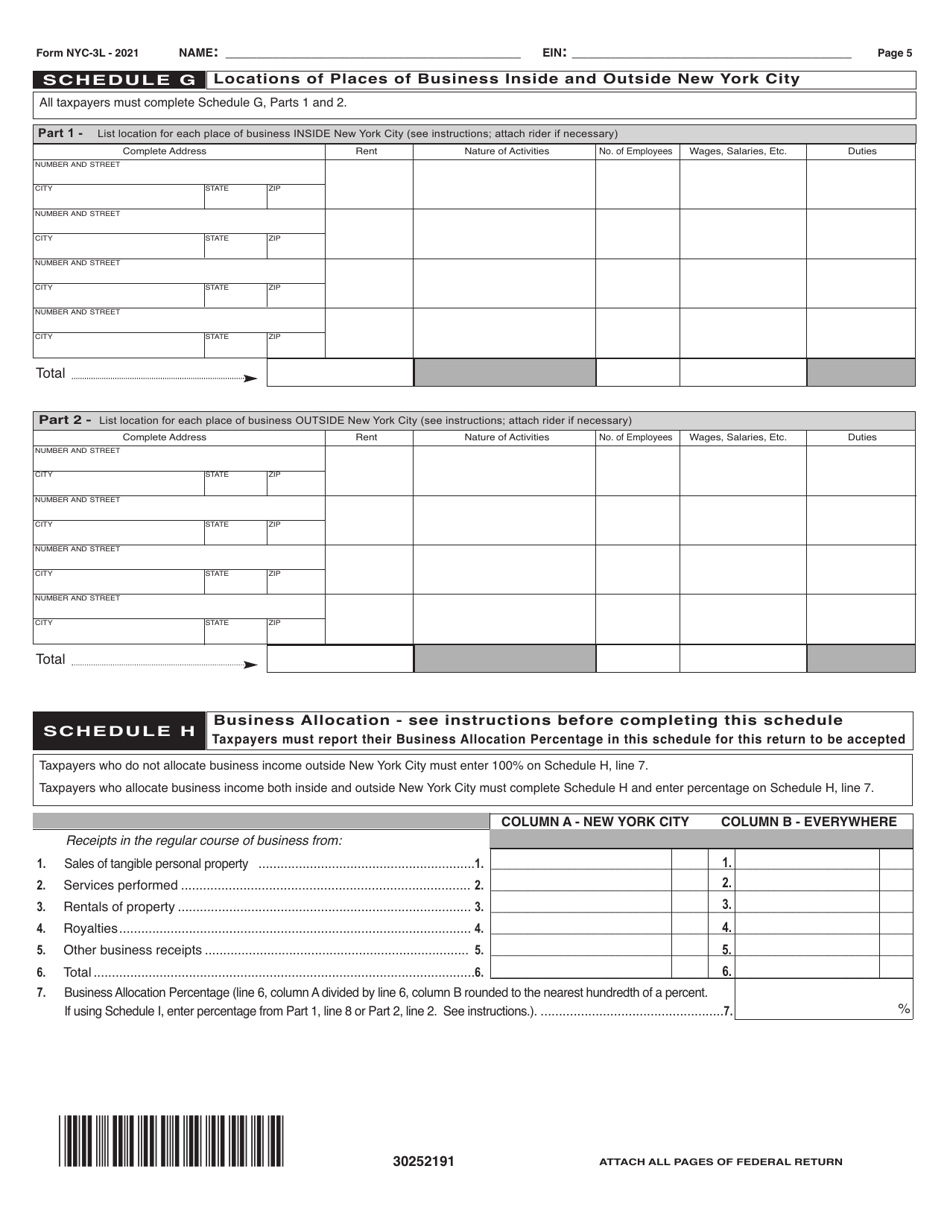

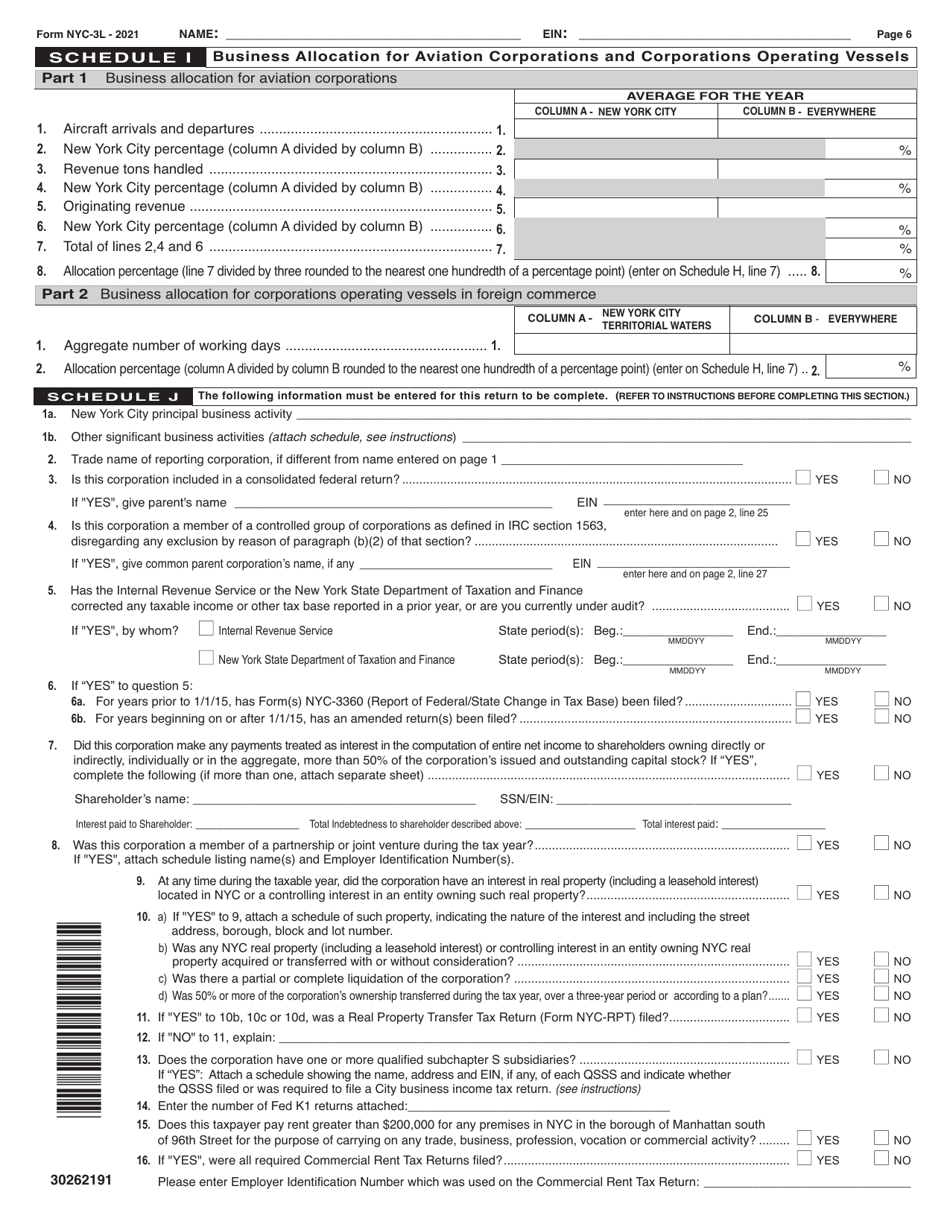

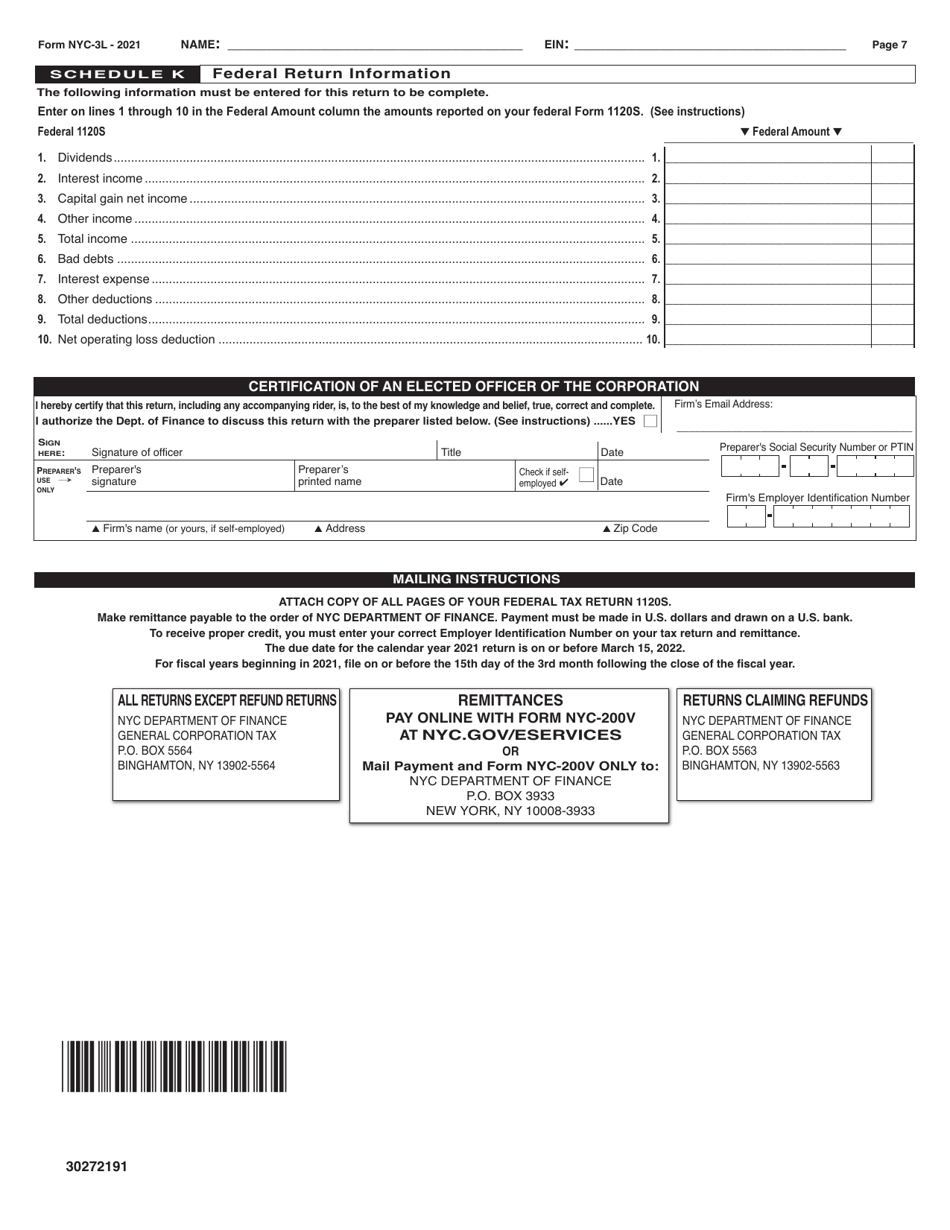

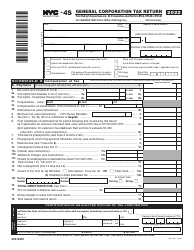

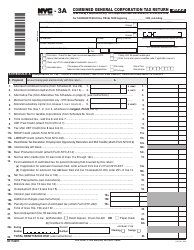

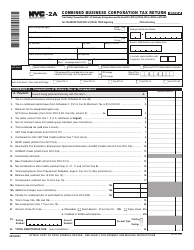

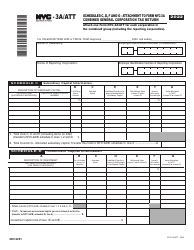

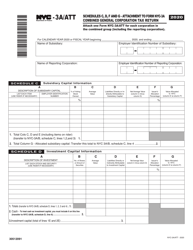

Form NYC-3L General Corporation Tax Return - New York City

What Is Form NYC-3L?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. Check the official instructions before completing and submitting the form.

FAQ

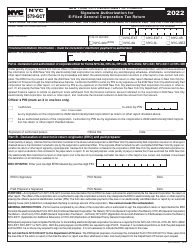

Q: What is the NYC-3L General Corporation Tax Return?

A: The NYC-3L is a tax return form for General Corporation Tax in New York City.

Q: Who needs to file the NYC-3L General Corporation Tax Return?

A: Corporations operating in New York City are required to file the NYC-3L.

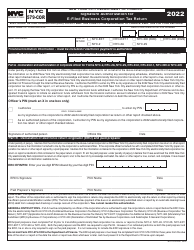

Q: How often is the NYC-3L General Corporation Tax Return filed?

A: The NYC-3L is filed annually.

Q: What information is required on the NYC-3L General Corporation Tax Return?

A: The form requires information about the corporation's income, deductions, and credits.

Q: Is there a deadline for filing the NYC-3L General Corporation Tax Return?

A: Yes, the deadline for filing the NYC-3L is generally April 15th.

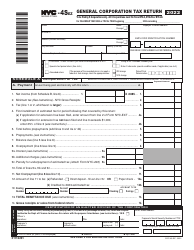

Form Details:

- Released on January 26, 2022;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-3L by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.