This version of the form is not currently in use and is provided for reference only. Download this version of

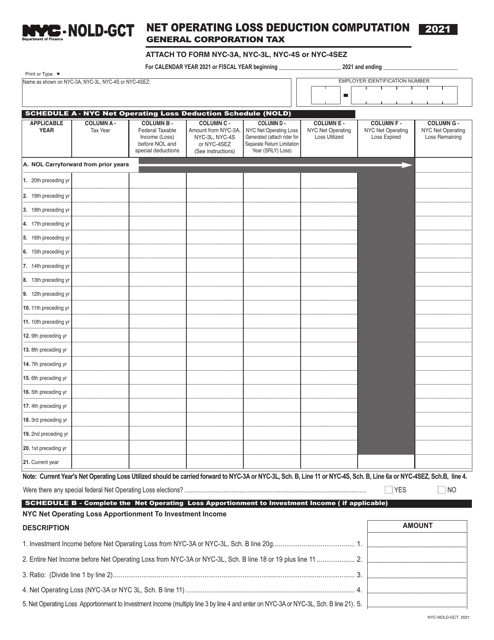

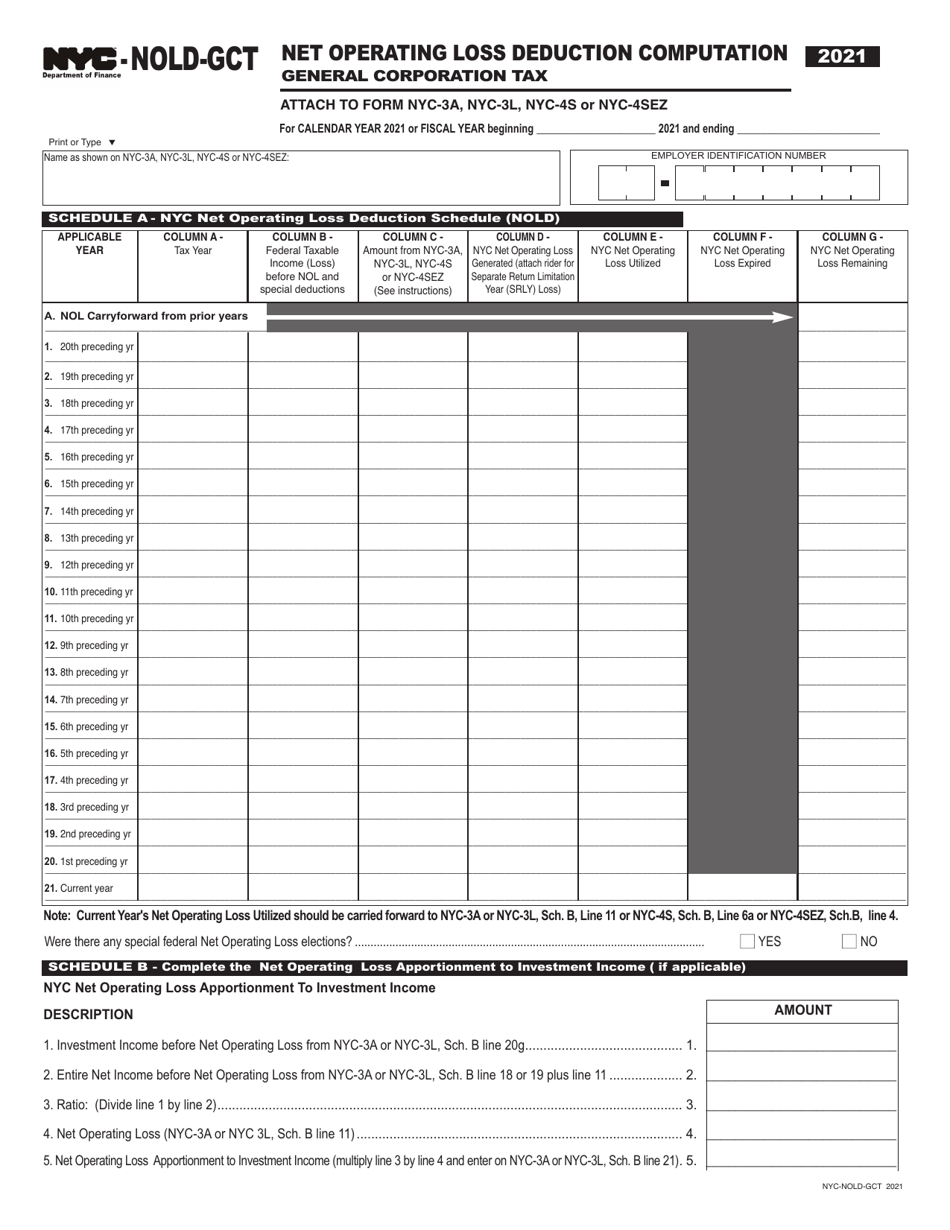

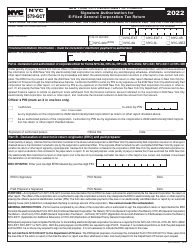

Form NYC-NOLD-GCT

for the current year.

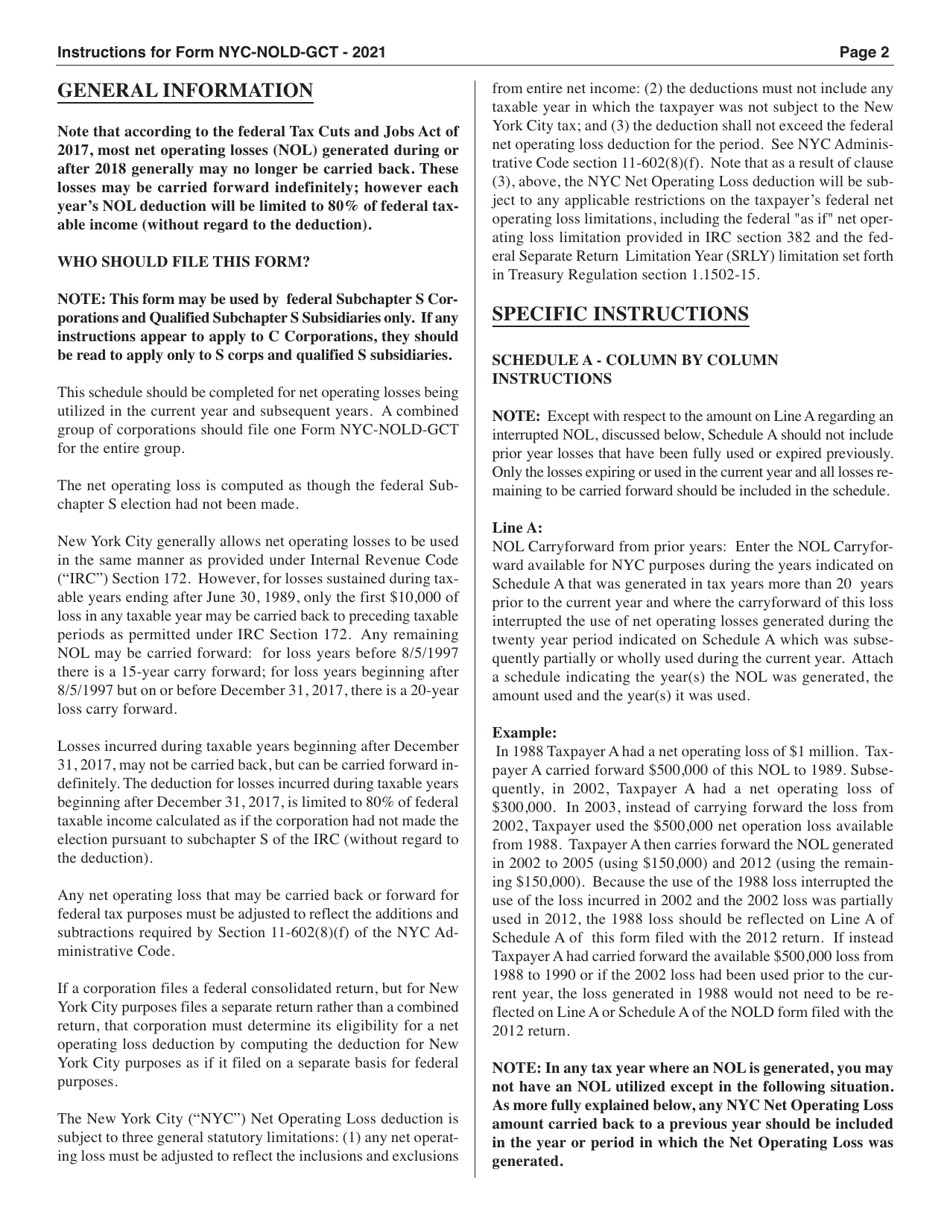

Form NYC-NOLD-GCT Net Operating Loss Deduction Computation - General Corporation Tax - New York City

What Is Form NYC-NOLD-GCT?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-NOLD-GCT Net Operating Loss Deduction Computation?

A: The NYC-NOLD-GCT Net Operating Loss Deduction Computation is a calculation used for the General Corporation Tax in New York City.

Q: Who is eligible for the NYC-NOLD-GCT Net Operating Loss Deduction?

A: Corporations that operate in New York City and have incurred net operating losses can be eligible for this deduction.

Q: What is the purpose of the NYC-NOLD-GCT Net Operating Loss Deduction?

A: The purpose of this deduction is to allow corporations to offset their taxable income with any net operating losses from previous years.

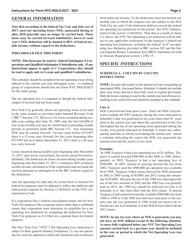

Q: How is the NYC-NOLD-GCT Net Operating Loss Deduction calculated?

A: The calculation involves subtracting the available net operating loss carryforward from the current year's taxable income, subject to certain limitations.

Q: Are there any limitations on the NYC-NOLD-GCT Net Operating Loss Deduction?

A: Yes, there are limitations based on the corporation's income and the number of tax years the loss can be carried forward.

Q: Is the NYC-NOLD-GCT Net Operating Loss Deduction specific to New York City?

A: Yes, this deduction is specific to the General Corporation Tax in New York City.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-NOLD-GCT by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.