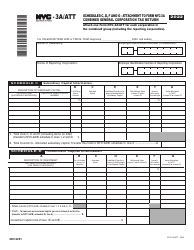

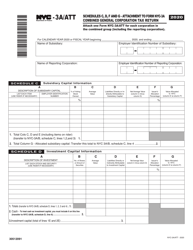

This version of the form is not currently in use and is provided for reference only. Download this version of

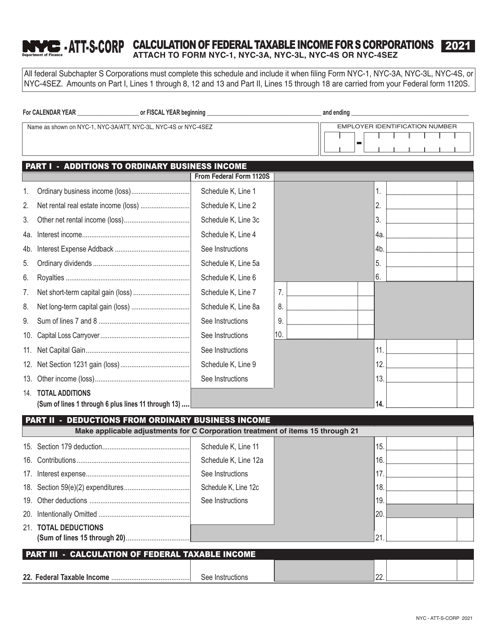

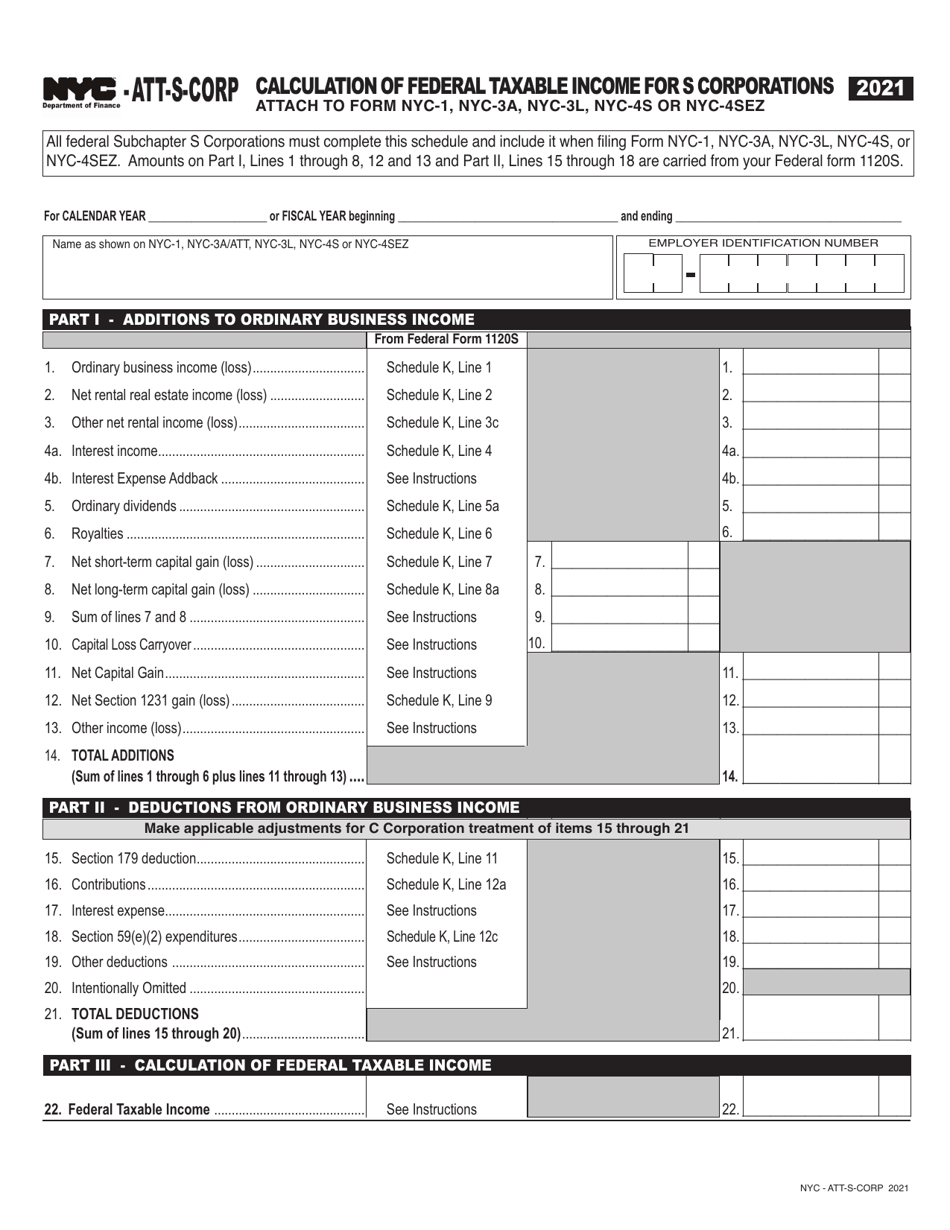

Form NYC-ATT-S-CORP

for the current year.

Form NYC-ATT-S-CORP Calculation of Federal Taxable Income for S Corporations - New York City

What Is Form NYC-ATT-S-CORP?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an S Corporation?

A: An S Corporation is a type of corporation that is eligible for special tax treatment.

Q: What is Federal Taxable Income?

A: Federal Taxable Income is the amount of income that is subject to federal income tax.

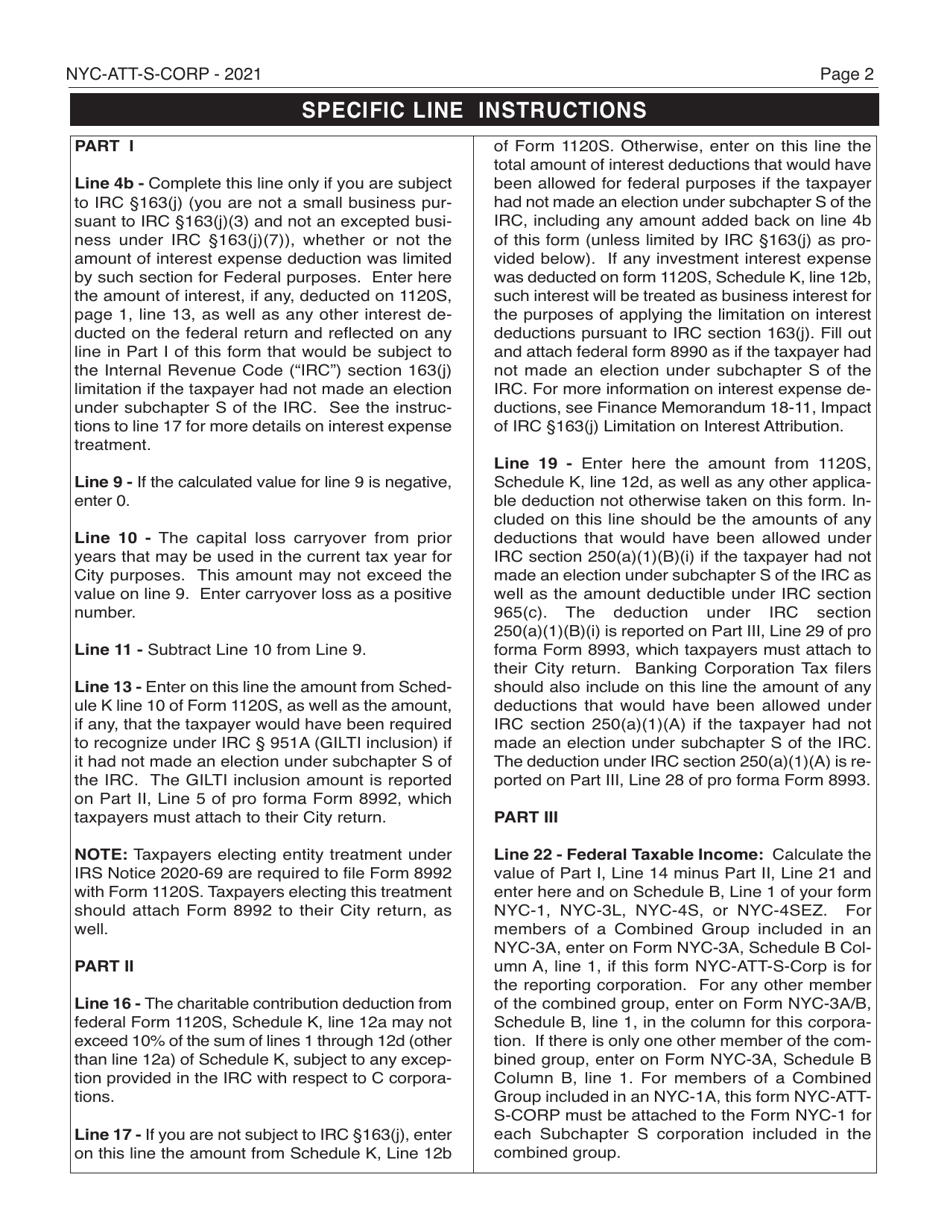

Q: How do you calculate Federal Taxable Income for S Corporations in New York City?

A: The calculation of Federal Taxable Income for S Corporations in New York City involves several steps, including determining the corporation's net income, making certain adjustments and deductions, and applying the applicable tax rates.

Q: What are the special tax treatments for S Corporations?

A: S Corporations enjoy certain tax advantages, such as the avoidance of double taxation on corporate income, as the income is passed through to the shareholders and taxed at their individual tax rates.

Q: Are there any specific rules or regulations for S Corporations in New York City?

A: Yes, there are specific rules and regulations that apply to S Corporations in New York City, including the calculation of Federal Taxable Income and the payment of taxes.

Q: Do S Corporations in New York City pay federal income tax?

A: No, S Corporations themselves do not pay federal income tax, but their shareholders are responsible for reporting and paying taxes on their share of the corporation's income.

Q: Can S Corporations in New York City deduct business expenses?

A: Yes, S Corporations in New York City can deduct business expenses, such as salaries, rent, and office supplies, from their taxable income.

Q: What is the tax rate for S Corporations in New York City?

A: The tax rate for S Corporations in New York City varies depending on their taxable income. The current rates range from 4% to 8.85%.

Q: Are there any tax credits or incentives available for S Corporations in New York City?

A: Yes, there are various tax credits and incentives available for S Corporations in New York City, such as the New York City Investment Tax Credit and the Industrial and Commercial Incentive Program.

Q: Do S Corporations in New York City have to file separate federal and state tax returns?

A: Yes, S Corporations in New York City are required to file separate federal and state tax returns.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-ATT-S-CORP by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.