This version of the form is not currently in use and is provided for reference only. Download this version of

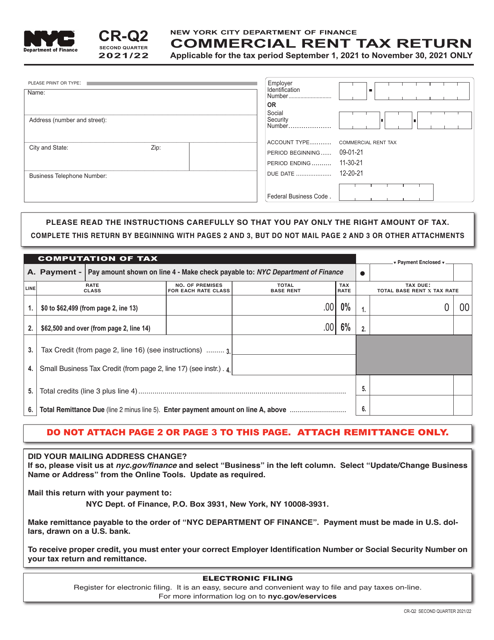

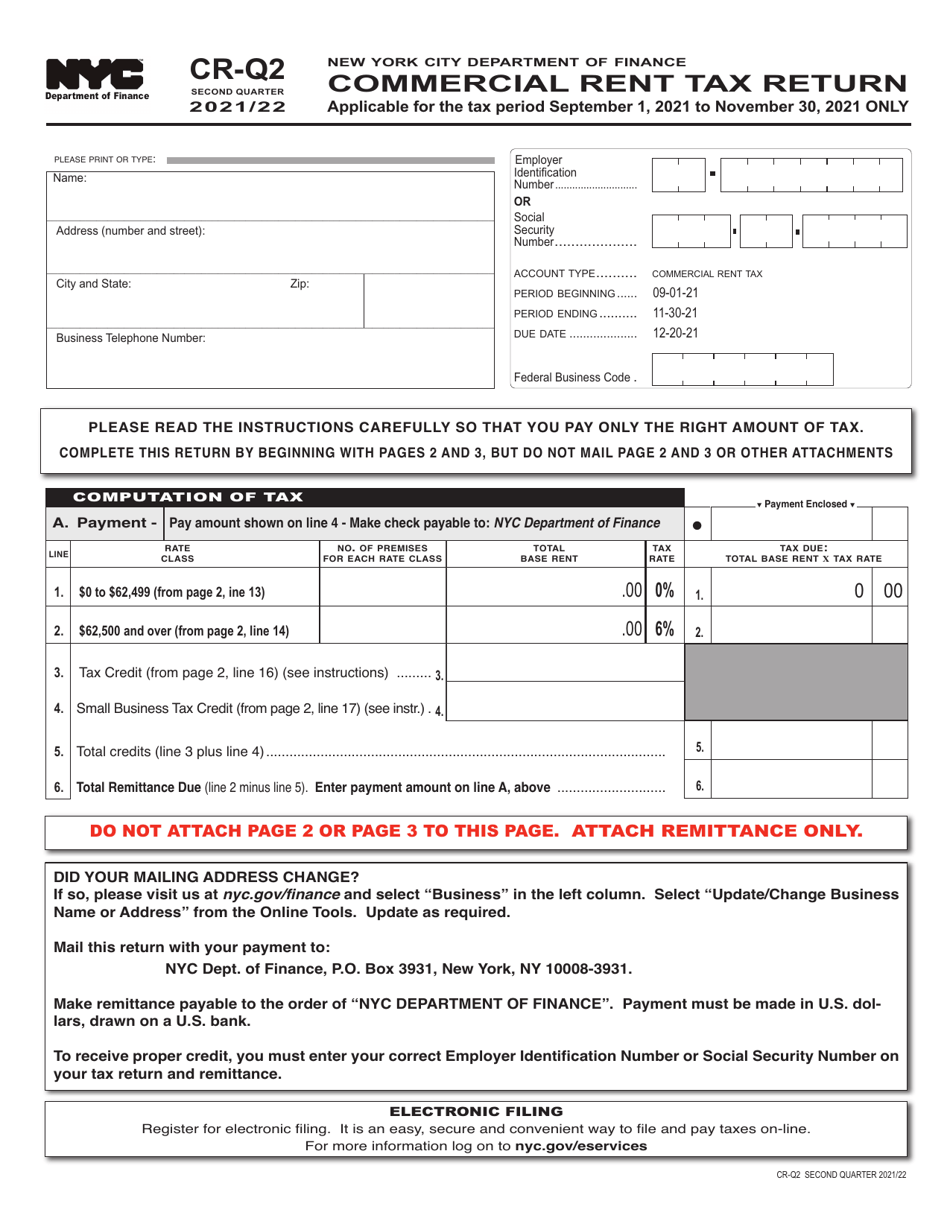

Form CR-Q2

for the current year.

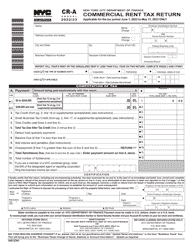

Form CR-Q2 Commercial Rent Tax Return - New York City

What Is Form CR-Q2?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form CR-Q2?

A: Form CR-Q2 is the Commercial Rent Tax Return for businesses in New York City.

Q: Who needs to file Form CR-Q2?

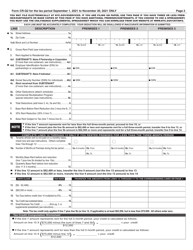

A: Businesses that are subject to the Commercial Rent Tax in New York City need to file Form CR-Q2.

Q: What is the Commercial Rent Tax in New York City?

A: The Commercial Rent Tax is a tax on commercial rents paid for certain business premises in specific parts of New York City.

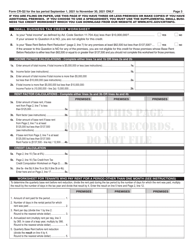

Q: When is Form CR-Q2 due?

A: Form CR-Q2 is typically due on the 20th day of the month following the end of the tax quarter.

Q: Are there any penalties for not filing Form CR-Q2?

A: Yes, there are penalties for not filing Form CR-Q2 or filing it late, including interest charges and additional penalties.

Q: What if I no longer qualify for the Commercial Rent Tax?

A: If you no longer qualify for the Commercial Rent Tax, you must notify the NYC Department of Finance and stop filing Form CR-Q2.

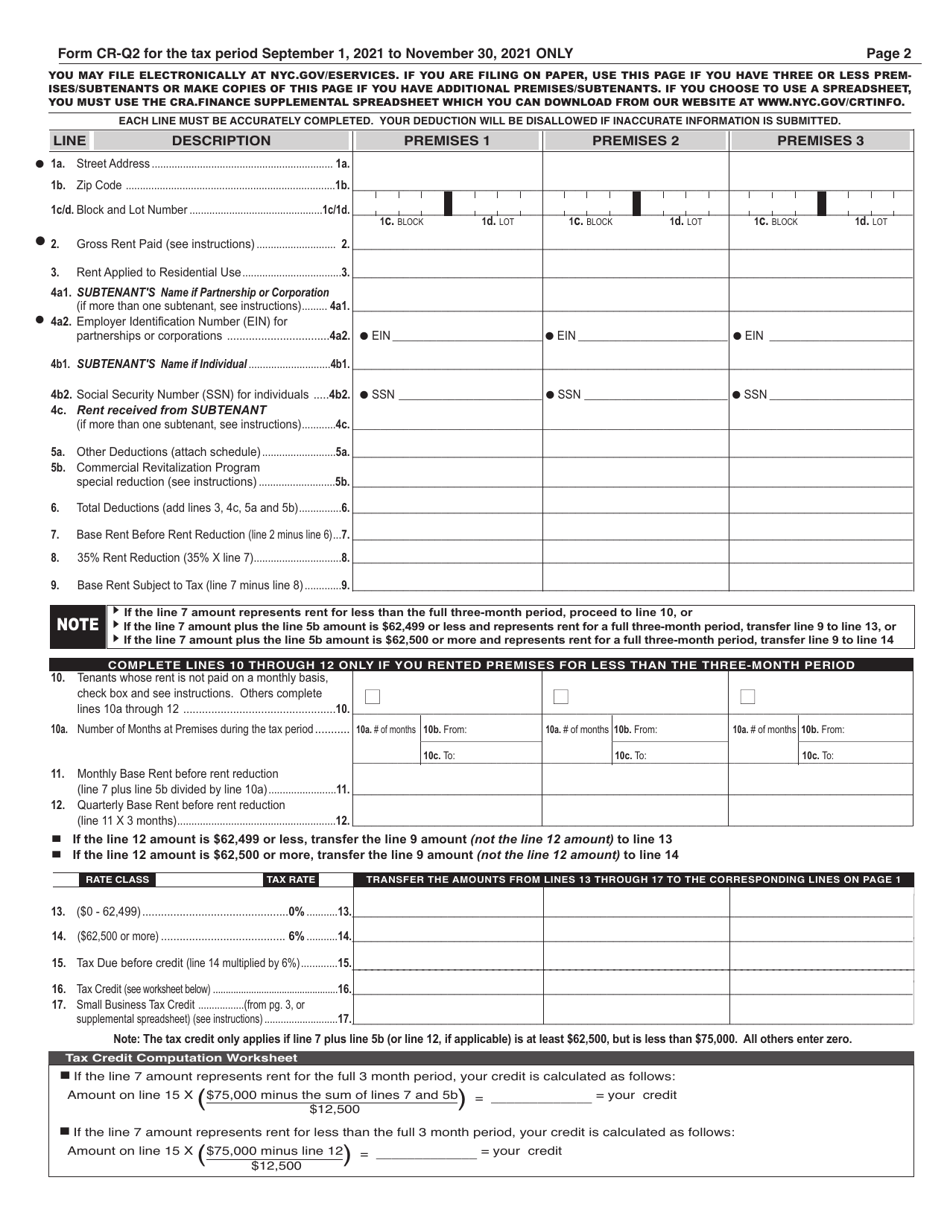

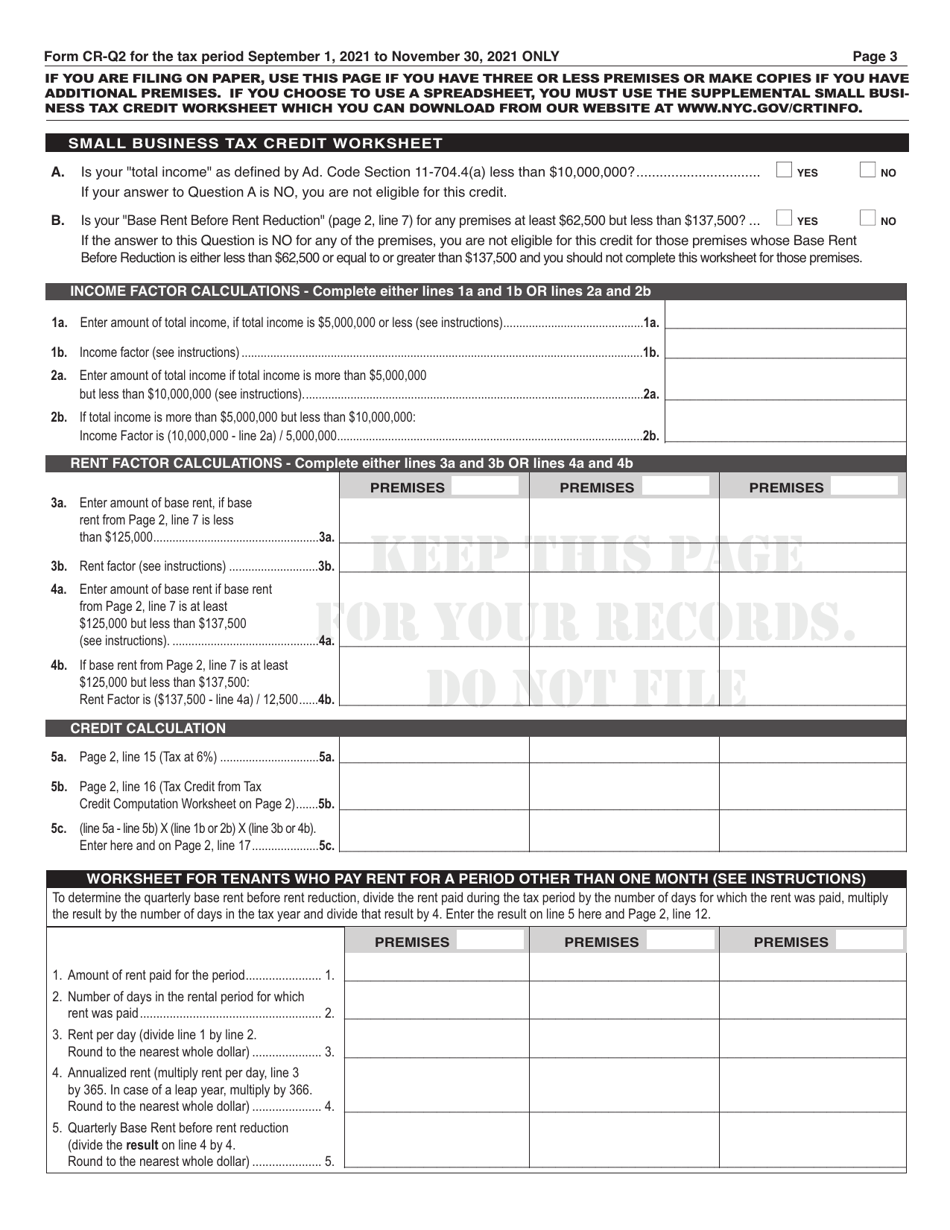

Q: Do I need to attach any supporting documents with Form CR-Q2?

A: Depending on your specific circumstances, you may need to attach supporting documents such as rent receipts or lease agreements.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CR-Q2 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.