This version of the form is not currently in use and is provided for reference only. Download this version of

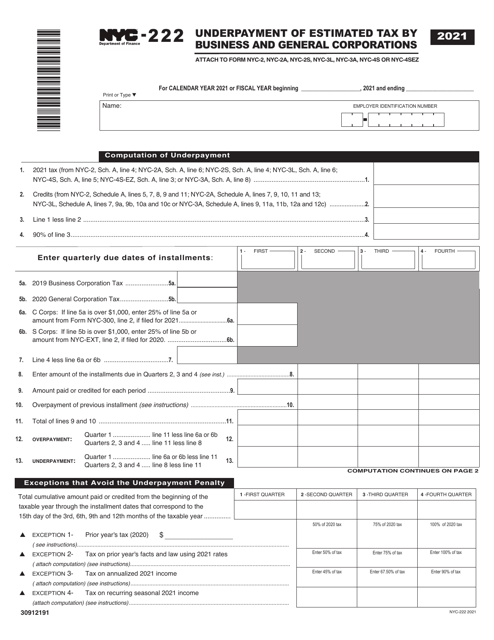

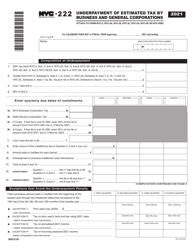

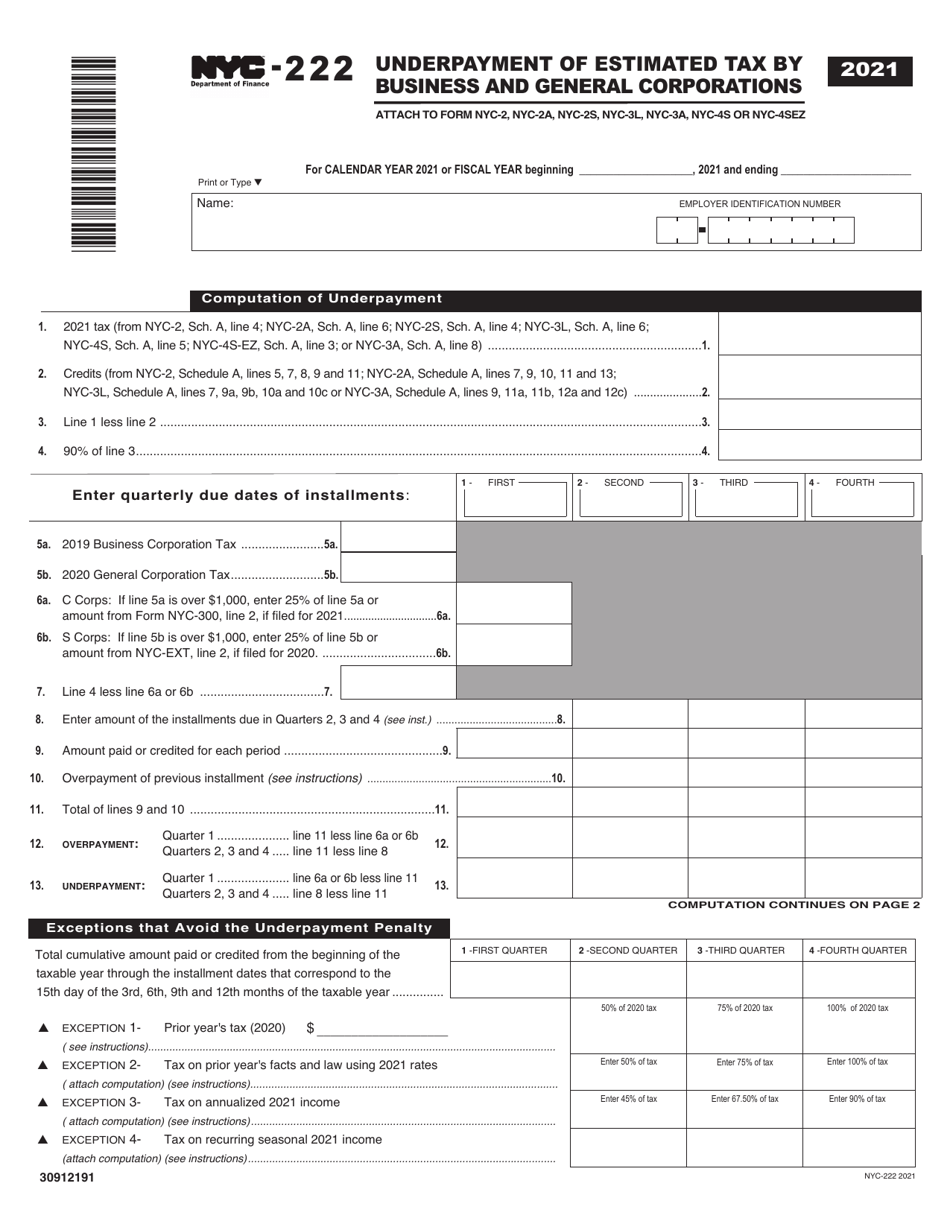

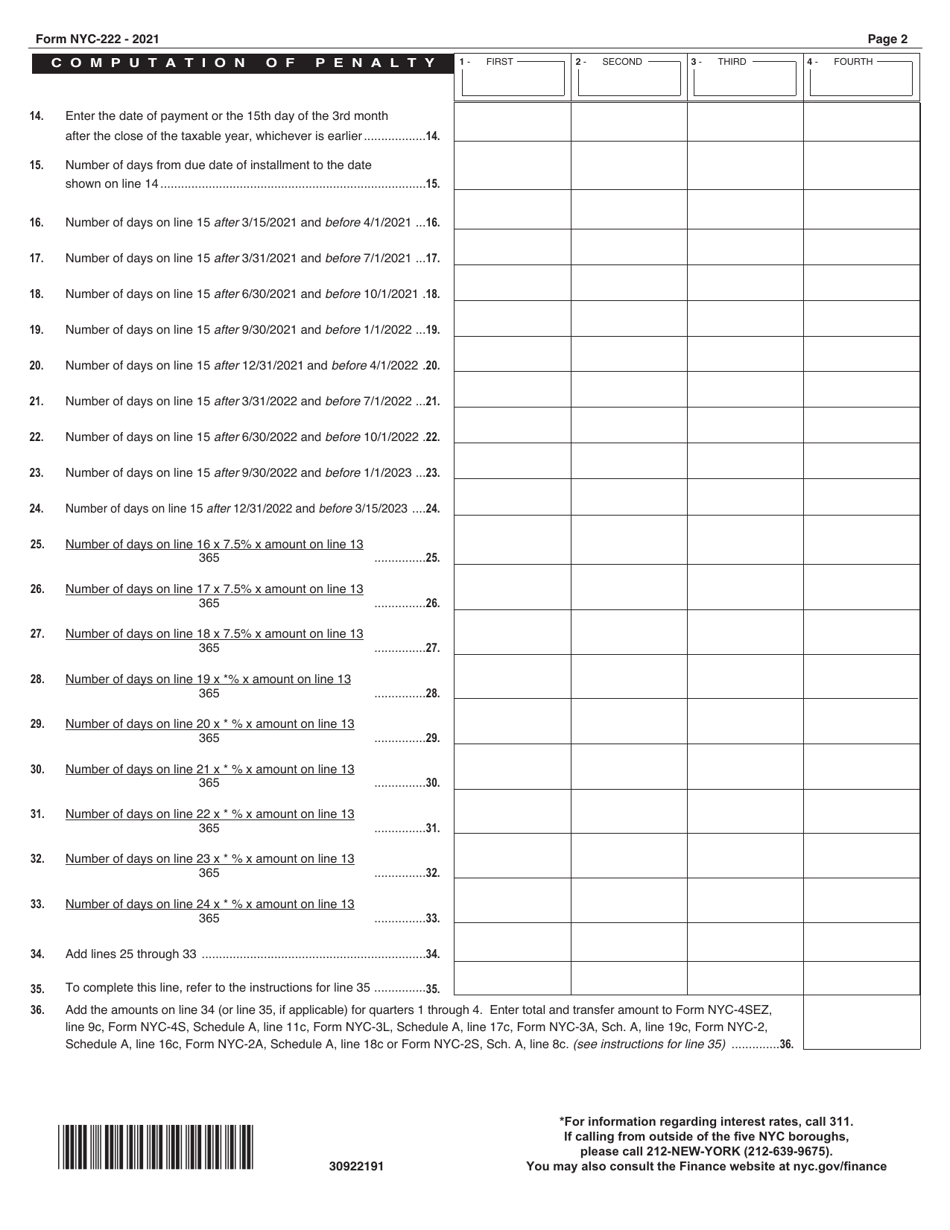

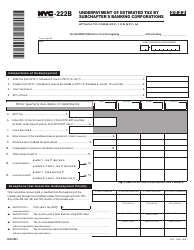

Form NYC-222

for the current year.

Form NYC-222 Underpayment of Estimated Tax by Business and General Corporations - New York City

What Is Form NYC-222?

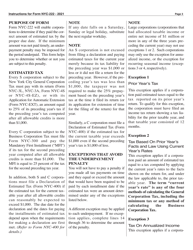

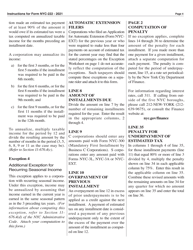

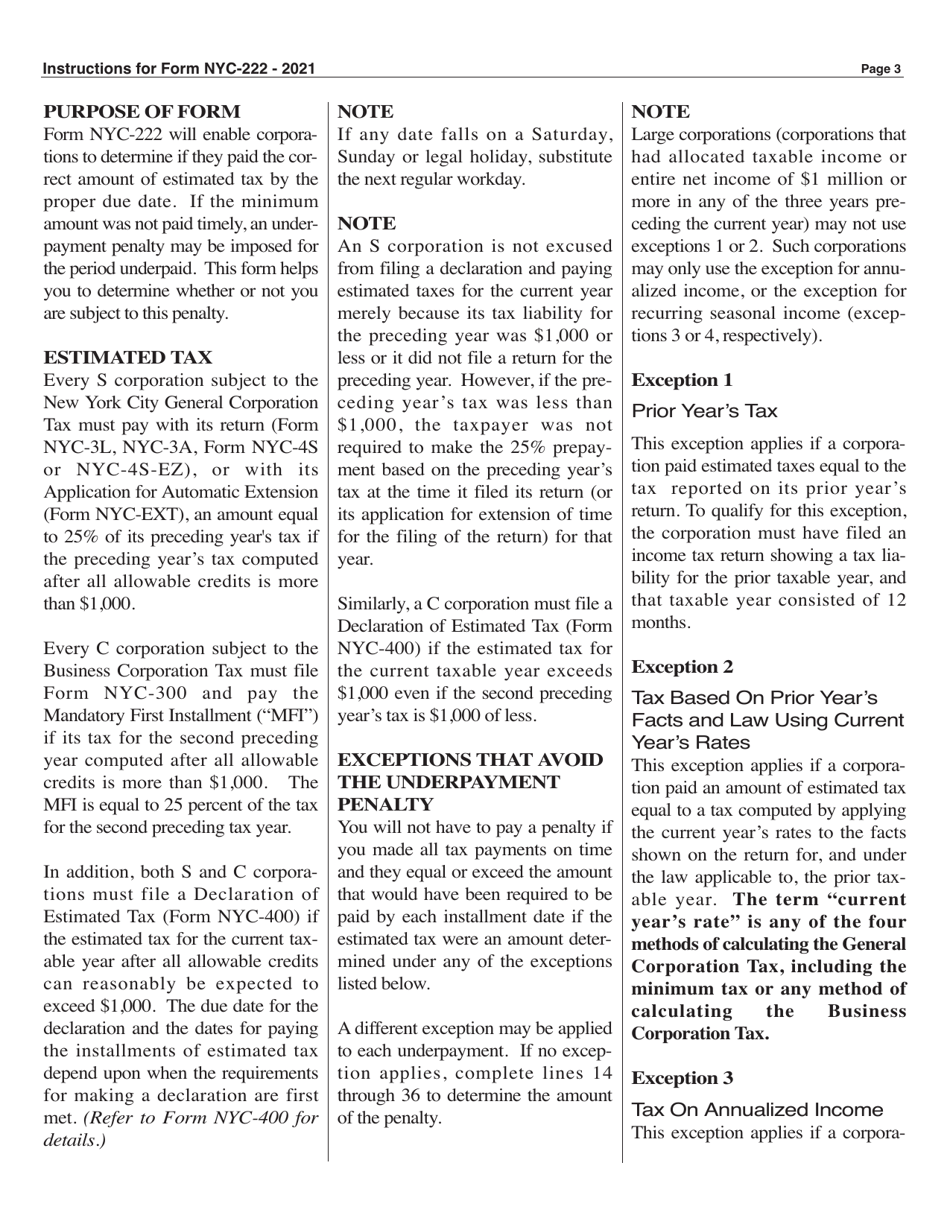

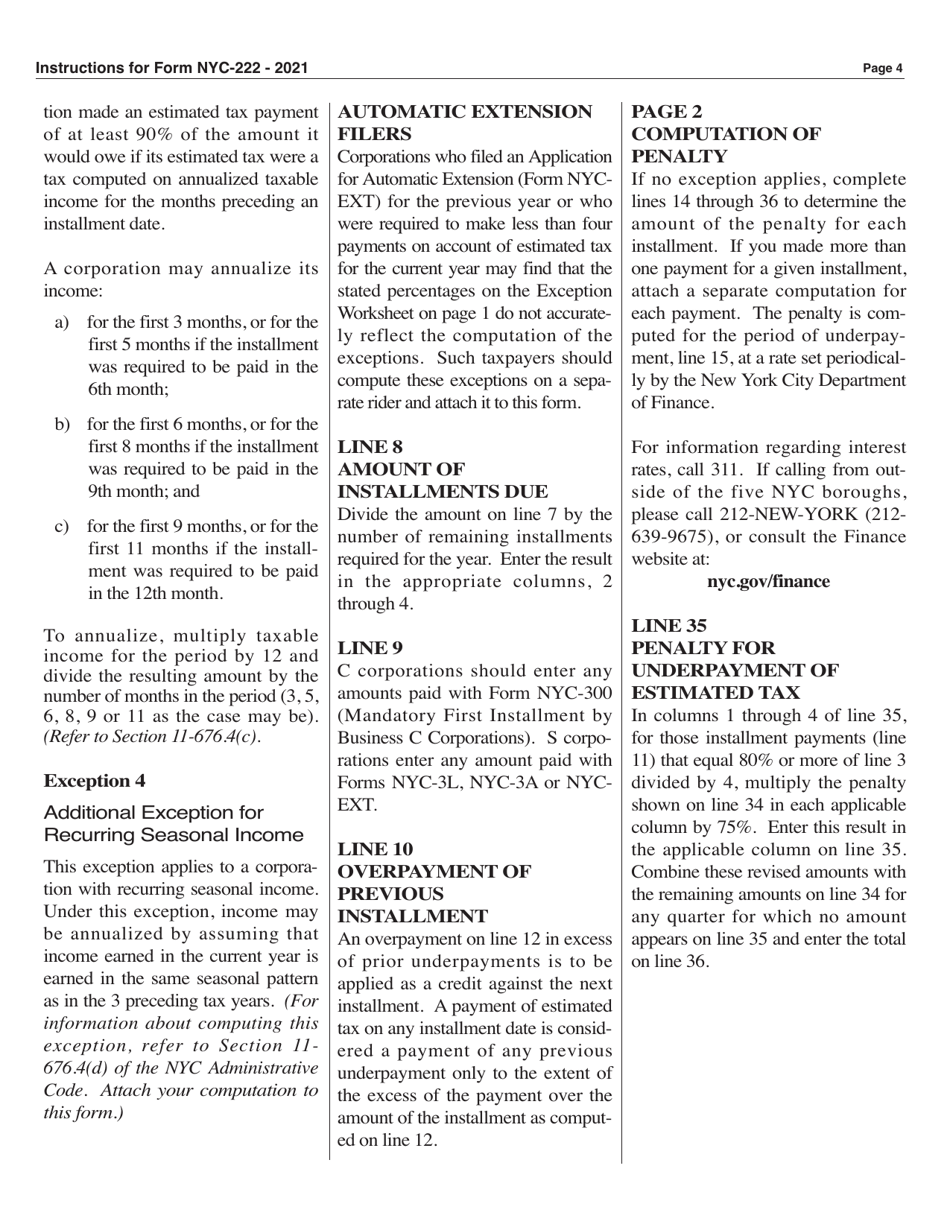

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

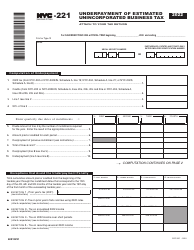

Q: What is NYC-222?

A: NYC-222 is a form used to report underpayment of estimated tax by business and general corporations in New York City.

Q: Who needs to file NYC-222?

A: Business and general corporations in New York City who have underpaid their estimated tax are required to file NYC-222.

Q: What is the purpose of filing NYC-222?

A: The purpose of filing NYC-222 is to report and pay the underpaid estimated tax by business and general corporations in New York City.

Q: When is the deadline to file NYC-222?

A: The deadline to file NYC-222 is generally the same as the deadline for filing the annual business tax return, which is March 15th for most corporations.

Q: What happens if I don't file NYC-222?

A: Failure to file NYC-222 or underpaying the estimated tax may result in penalties and interest being imposed by the New York City Department of Finance.

Q: Are there any exemptions or deductions available for underpaid estimated tax?

A: There are no specific exemptions or deductions available for underpaid estimated tax. However, it is always recommended to consult with a tax professional to determine if any special circumstances apply.

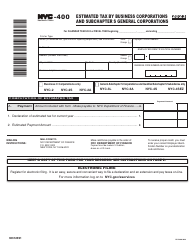

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-222 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.