This version of the form is not currently in use and is provided for reference only. Download this version of

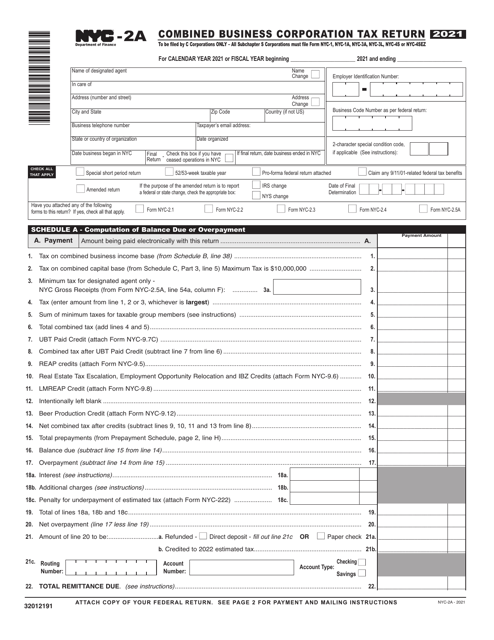

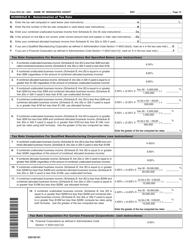

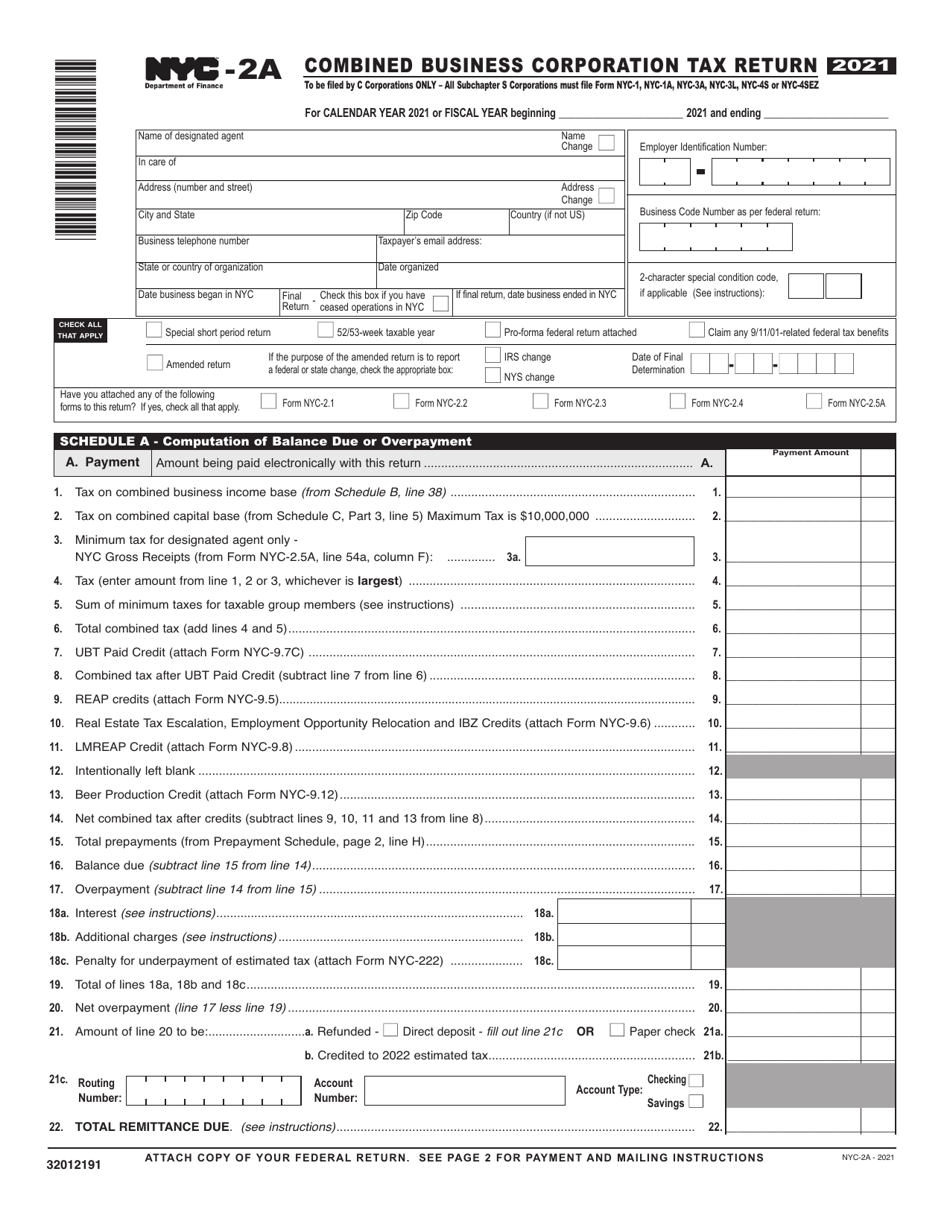

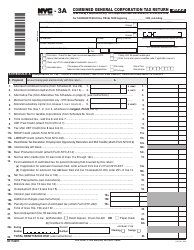

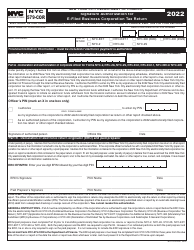

Form NYC-2A

for the current year.

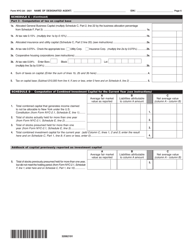

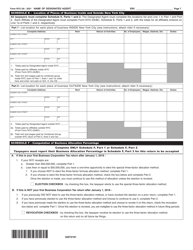

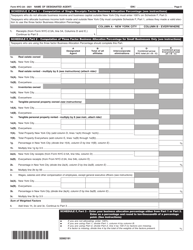

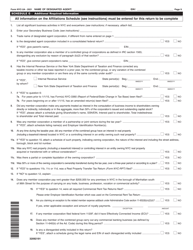

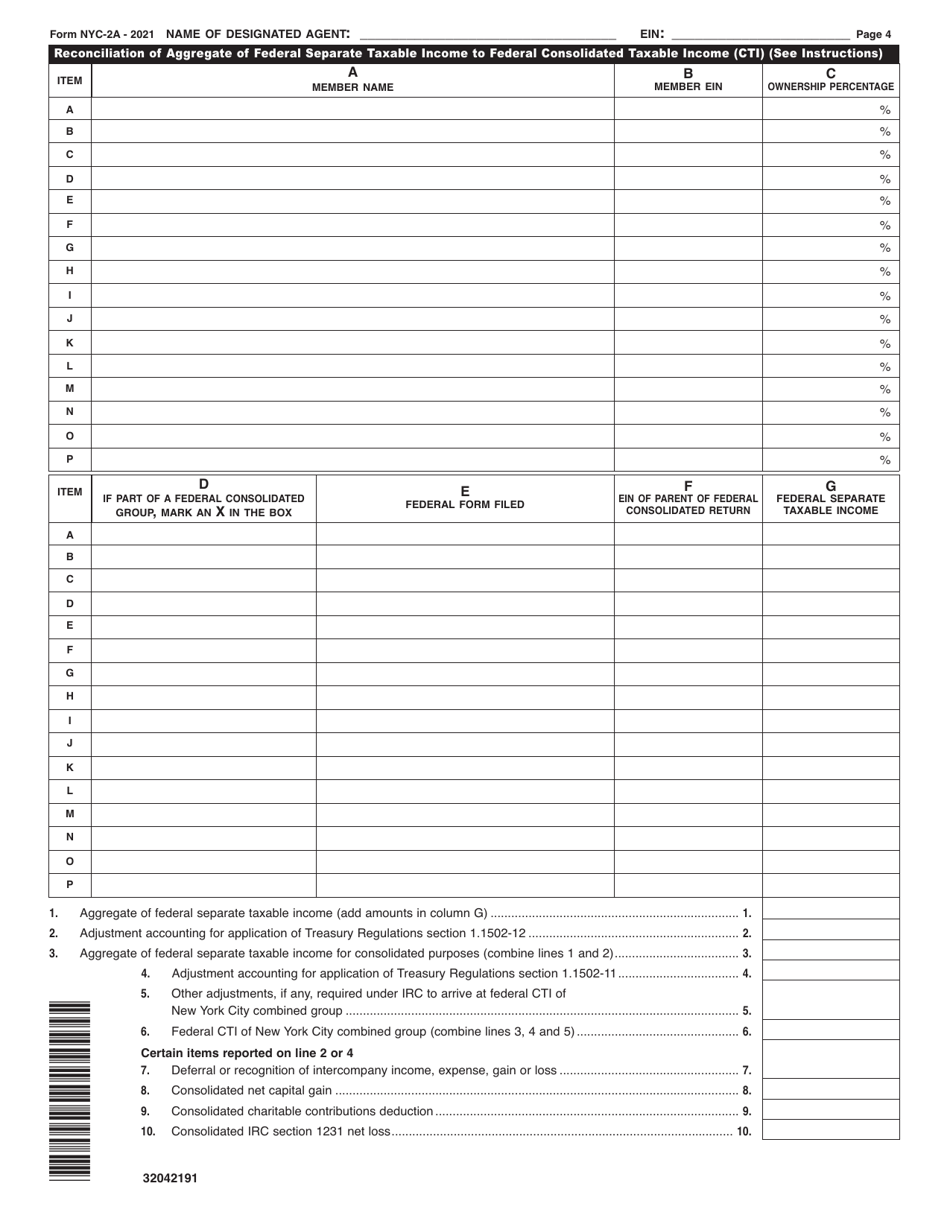

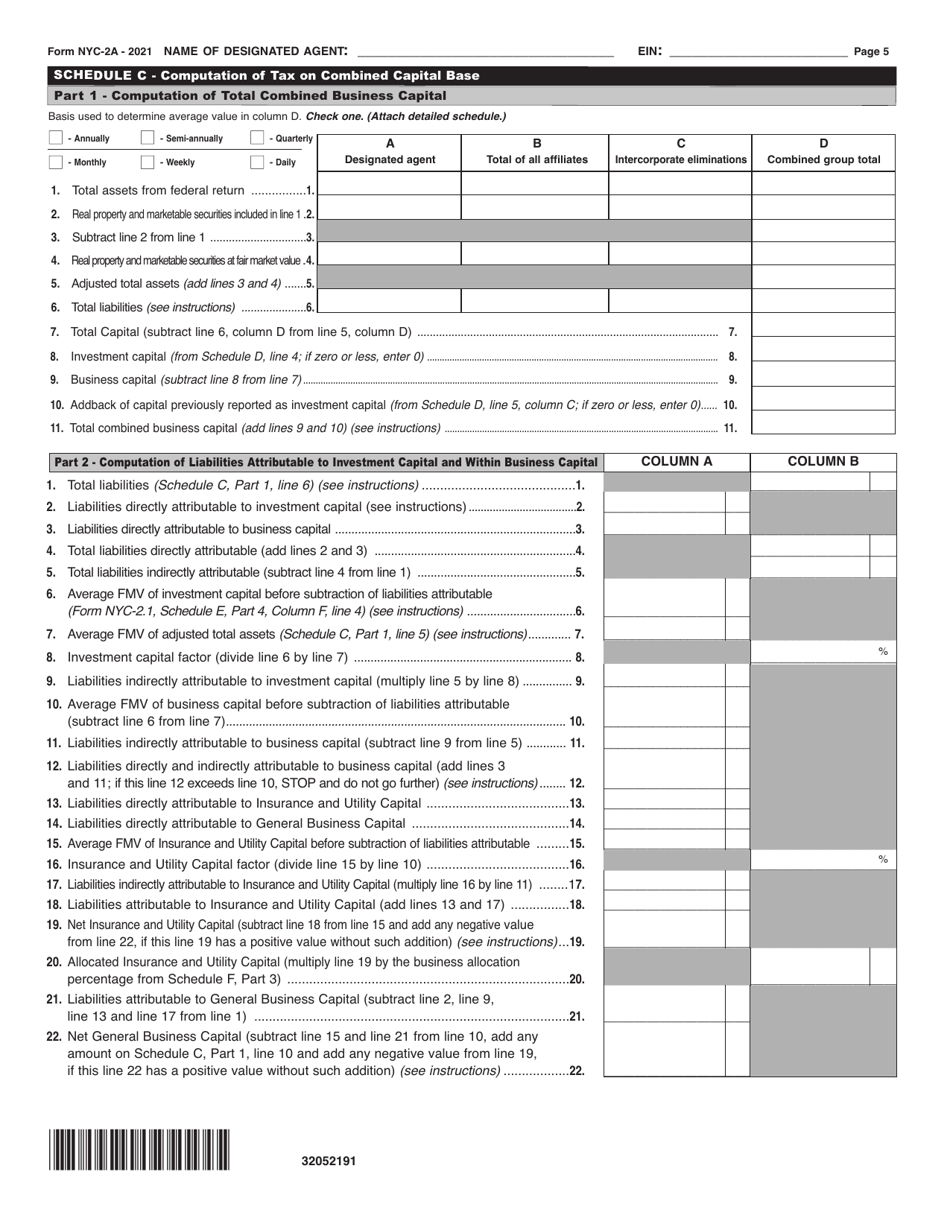

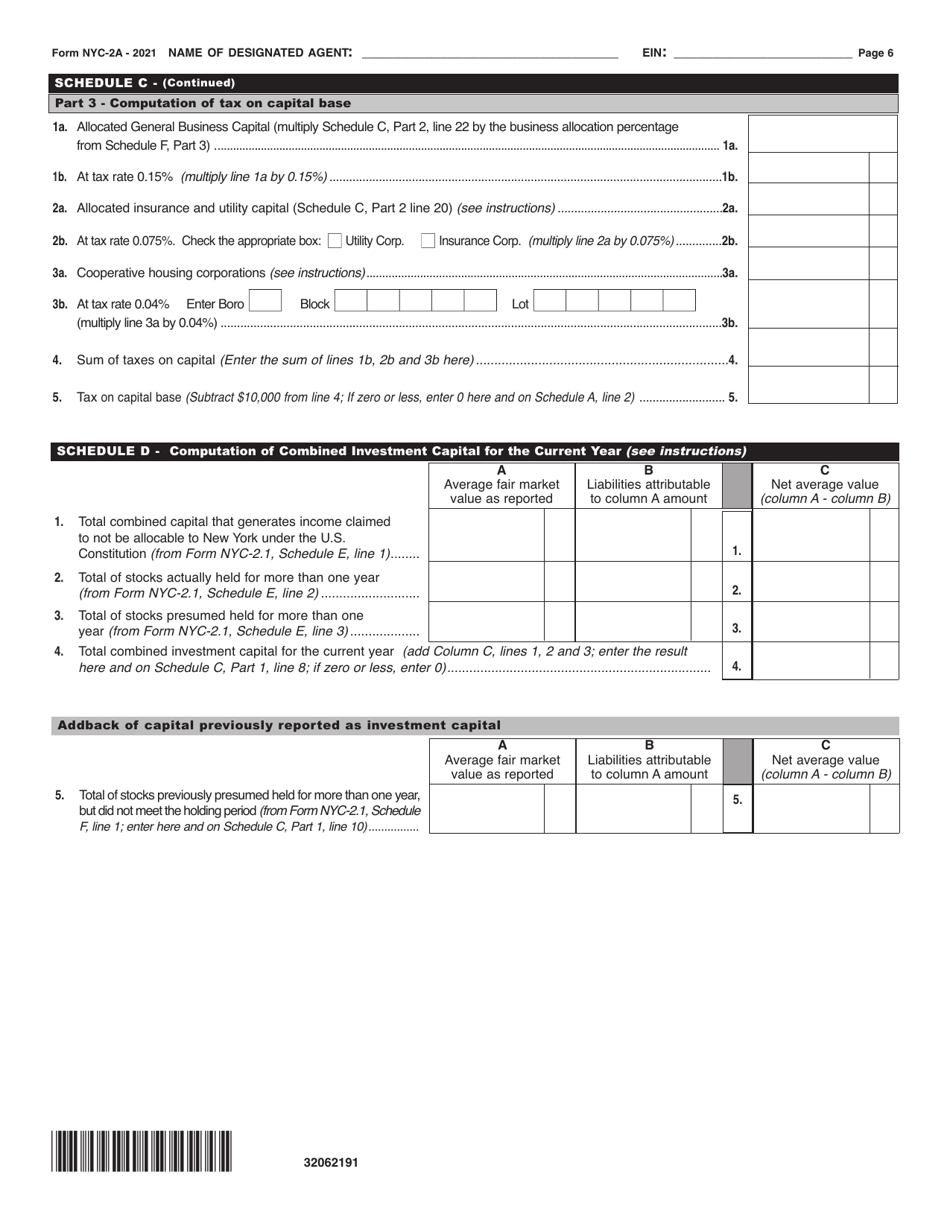

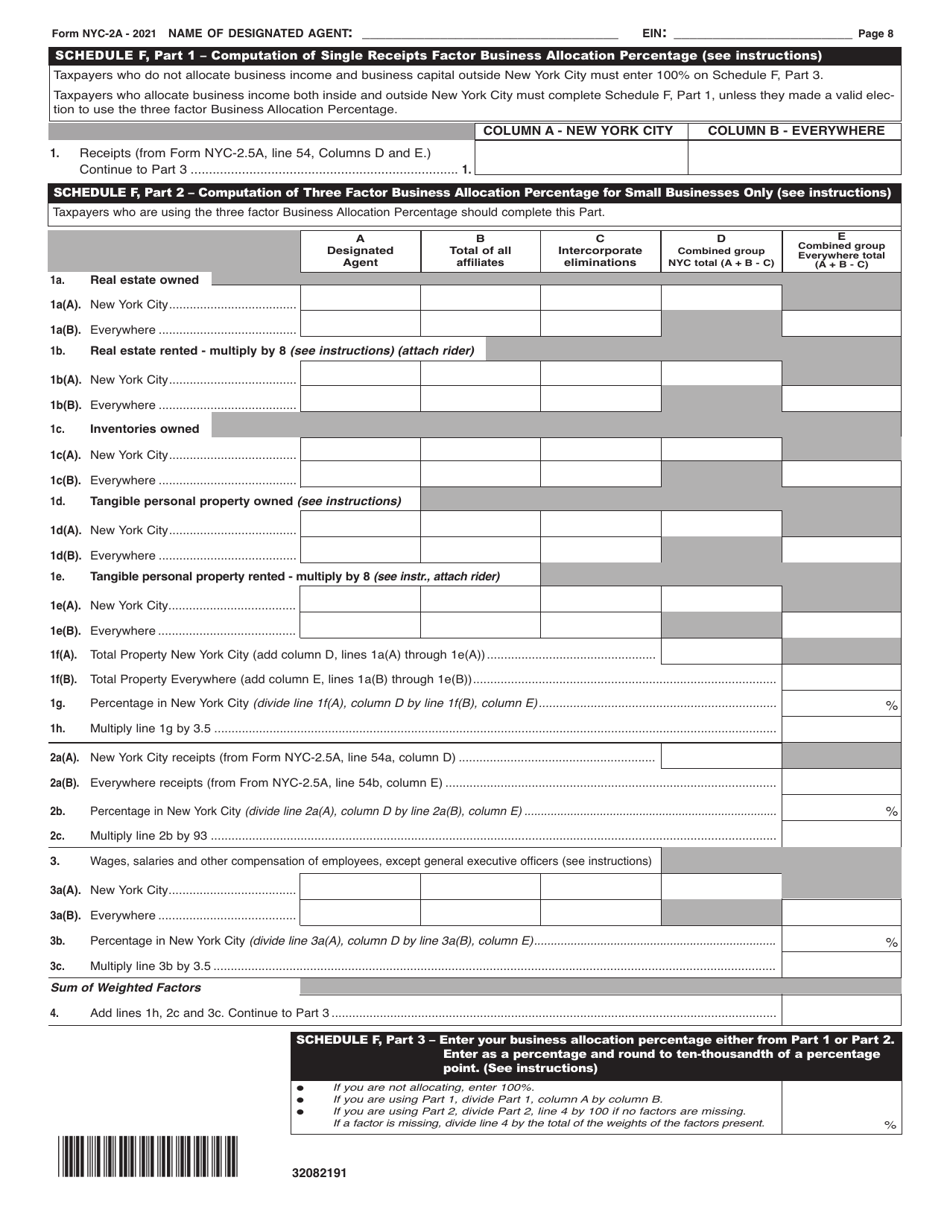

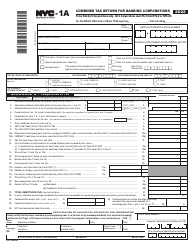

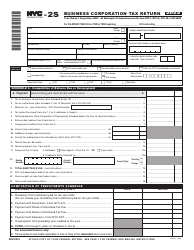

Form NYC-2A Combined Business Corporation Tax Return - New York City

What Is Form NYC-2A?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NYC-2A?

A: Form NYC-2A is the Combined Business Corporation Tax return for businesses operating in New York City.

Q: Who needs to file Form NYC-2A?

A: Businesses that are subject to the New York City Business Corporation Tax and have a nexus with the city.

Q: What is the purpose of Form NYC-2A?

A: Form NYC-2A is used to report and calculate the tax liability for businesses operating in New York City.

Q: When is Form NYC-2A due?

A: Form NYC-2A is due on the 15th day of the fourth month following the end of the tax year for calendar year filers.

Q: Are there any penalties for not filing Form NYC-2A?

A: Yes, failure to file Form NYC-2A or filing it late can result in penalties and interest being assessed on the tax owed.

Q: Can I file Form NYC-2A electronically?

A: Yes, electronic filing is available for Form NYC-2A through the New York State Tax Department's e-file system.

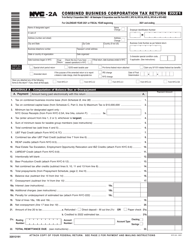

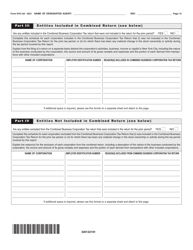

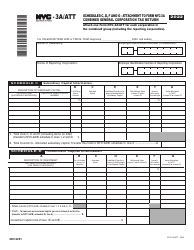

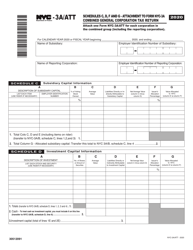

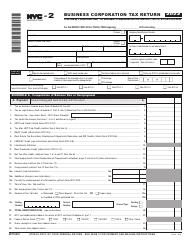

Q: What other forms may need to be filed along with Form NYC-2A?

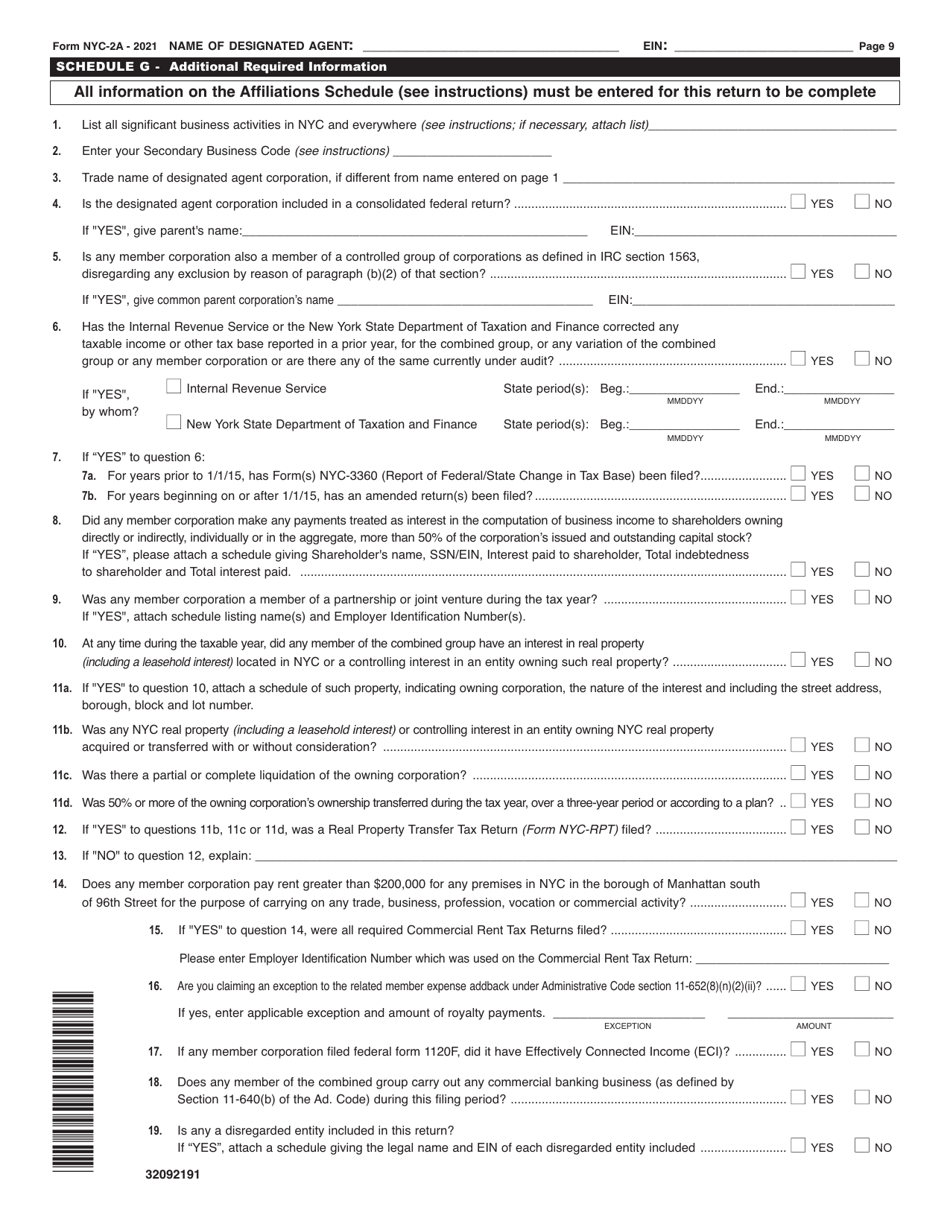

A: Depending on the specific situation, businesses may also need to file additional schedules and forms, such as Schedule G and Form NYC-3L.

Q: Is Form NYC-2A only for corporations?

A: No, Form NYC-2A is also used by other entities subject to the New York City Business Corporation Tax, such as limited liability companies (LLCs).

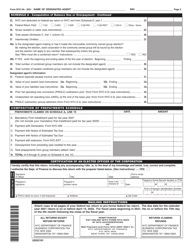

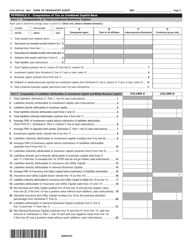

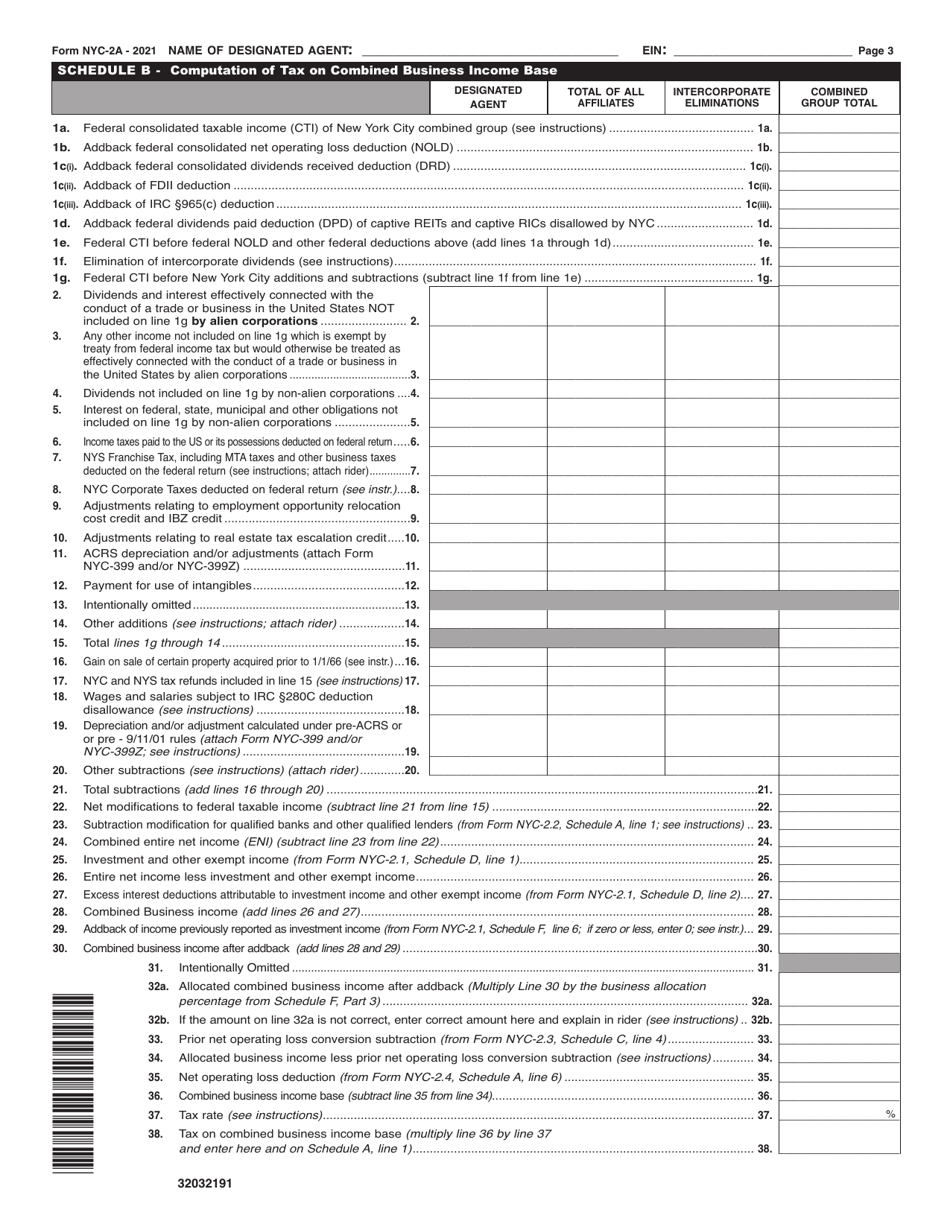

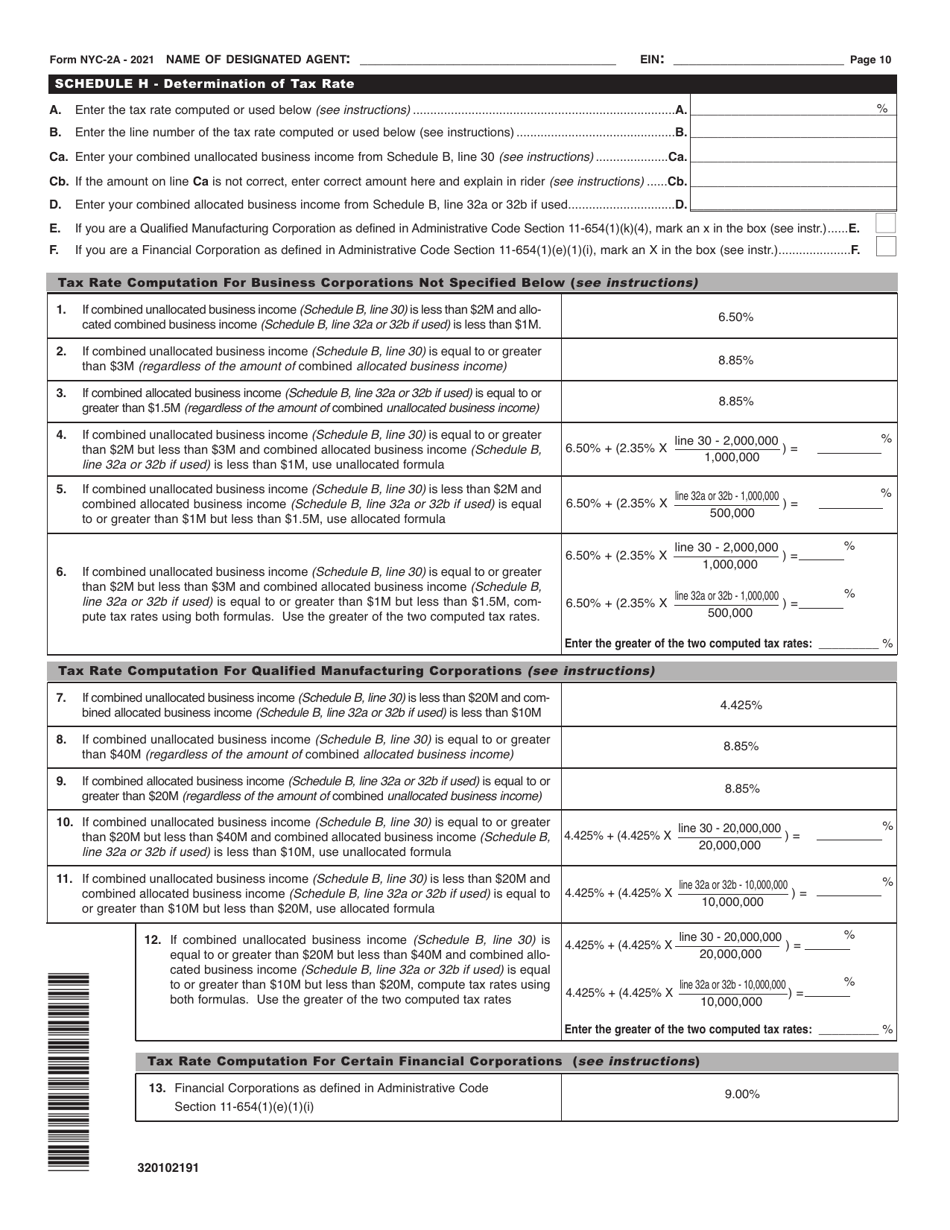

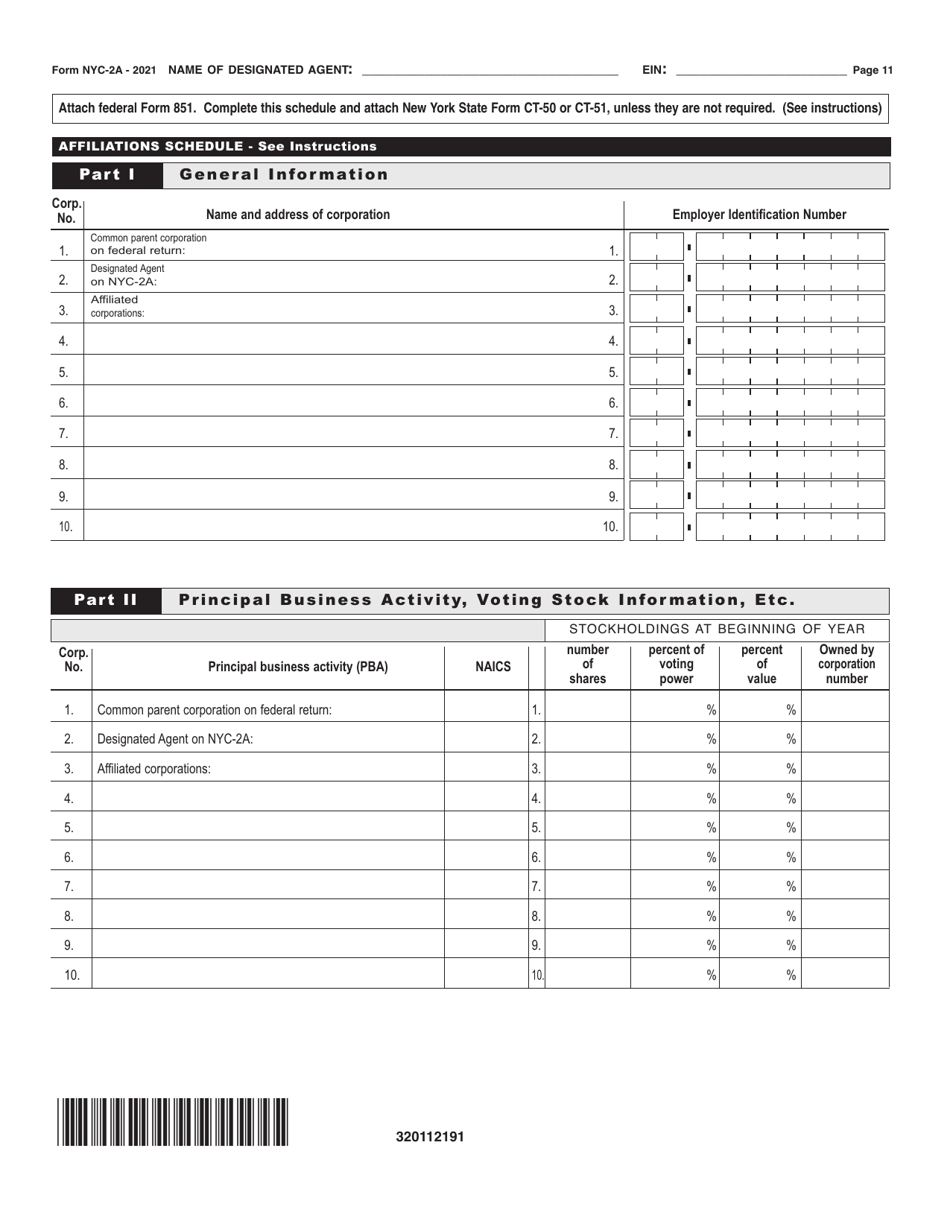

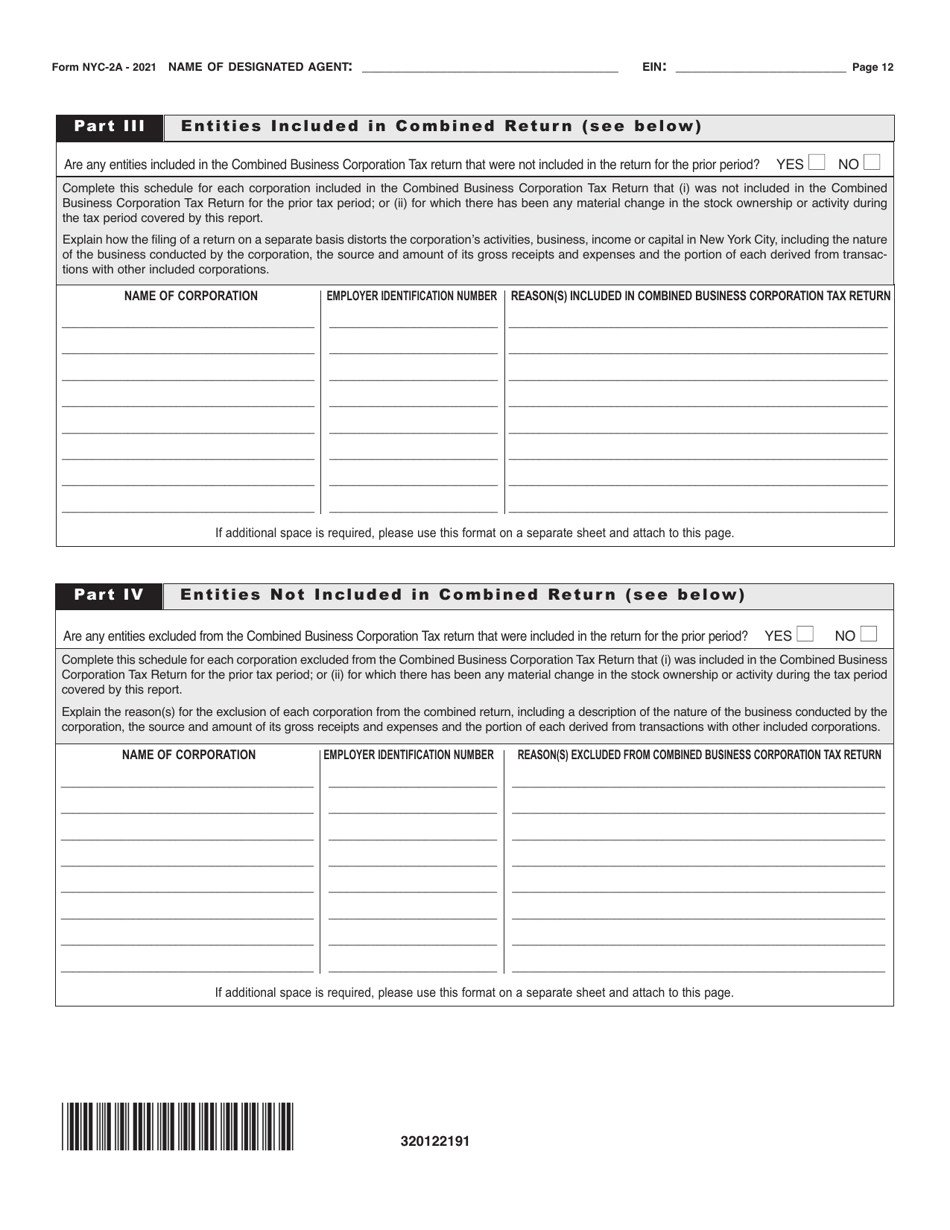

Q: What information is needed to complete Form NYC-2A?

A: Businesses will need to provide information about their income, deductions, credits, and other relevant financial data for the tax year.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2A by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.